Authors: Yu Jianing, Wang Ping, Wang Hongbin

Table of Contents:

Introduction ABST The Future Is Here, Shaping the New Landscape of Financial Services

The convergence inflection point of future industrial finance and the reconstruction of global regulatory rules

The United States accelerates the advancement of digital asset regulation and market infrastructure reconstruction driven by a national agenda

Institutional willingness to allocate digital assets rises and resonates with the expansion of tokenized assets

Part One Development of Asset-Backed Securities Tokens (ABST) in 2026: Six Key Trends

Key Trend One: Domestic assets are issued overseas, with ABST entering a predictable compliance channel, marking the transition from exploratory to institutionalized advancement of cross-border asset digitization.

Key Trend Two: The global regulatory framework and licensing for stablecoins are fully implemented, and ABST is linked to stablecoins to build a new foundation for digital finance

Key Trend Three: AI Agents Fi are set to become an important part of the financial system, enabling seamless connectivity of traditional asset digitization with AI trading via ABST

Key Trend Four: The tokenization of U.S. stocks reconstructs a new generation of capital markets, as mainstream financial systems and on-chain asset systems deeply integrate

Key Trend Five: Tokenization digitizes gold and returns its use from reserve assets to the payment battlefield, becoming an important component of global cross-border settlement

Key Trend Six: DAT 2.0 further deepens the fusion of stocks and tokens, while the Web3.0 public company index and financial tools expand the innovation area of ABST

- Create a new highland of digital finance under the dual circulation

Domestic Path: Solidify the compliance and data governance infrastructure in the first kilometer and promote ABST to drive the development and prosperity of new productive forces.

Hong Kong Path: Leverage the dual hubs of finance and technology innovation, and the advantages of "stock-token integration," to strengthen the new ecosystem of ABST issuance and liquidity.

International Path: Align with the characteristics of multi-jurisdictional regulation and the broader trend of compliance, establishing a global network for compliant ABST issuance and circulation overseas.

Conclusion: Welcoming a New Era of Asset and Currency Internet

Introduction ABST The Future Is Here, Shaping the New Landscape of Financial Services

The global financial market's understanding of digital assets is completing a critical shift in focus. From the native digital assets represented by Bitcoin to the exploration surrounding stablecoins and asset digitization, technology provides new paradigms for expressing and circulating assets and currencies, as well as proposing feasible pathways for the financial system's more granular, higher-frequency, and lower-friction operation. Consequently, the market's focus has shifted from early-stage technical feasibility and conceptual validation to substantial transformation of financial system operational efficiency, particularly emphasizing enhancements in payment and settlement, registration and clearing, custody, and information disclosure among market infrastructure elements.

For a long time, the market and research institutions have used multiple terms in the concurrent use of asset-backed tokens, such as "Real World Asset (RWA) tokens," "Securities Tokens (ST)," and "Tokenized Securities," reflecting both technical path differences and compliance boundary variations.

On February 6, 2026, the People's Bank of China, the National Development and Reform Commission, the Securities Regulatory Commission, and other eight departments released the "Notice on Further Preventing and Handling Risks Related to Virtual Currency" (Yin Fa [2026] No. 42), which defines the tokenization of real-world assets. It states that using cryptographic and distributed ledger technologies or similar technologies to convert ownership and revenue rights of assets into tokens (certificates) or other rights with token characteristics, and to carry out issuance and trading activities. This description aligns with international definitions, covering a broad scope, and has general characteristics of digital expression of rights. The notice also establishes strict policies for the domestic development of real-world asset tokenization and for addressing risks associated with cross-border expansion.

On the same day, the China Securities Regulatory Commission issued the "Supervisory Guidelines on the Offshore Issuance of Asset-Backed Security Tokens" (CSRC Announcement [2026] No. 1), which defines the offshore issuance of asset-backed securities tokens as activities that utilize the cash flow produced by domestic assets or relevant asset rights as repayment support, employing cryptographic technology and distributed ledgers or similar technologies to issue tokenized rights certificates overseas.

This report focuses on "Asset-Backed Securities Tokens (ABST)" as the core analytical object, concentrating on key trends related to its cross-border issuance, compliance governance, and market development.

The positioning of Asset-Backed Securities Tokens (ABST) emphasizes "strong regulation, strong transparency, and strong constraints." Its definition encompasses three layers of constraints. First, the repayment support is anchored to cash flows, emphasizing that measurable and verifiable cash flow assets are core; second, activities occur in offshore issuance scenarios, inherently requiring compliance with both the securities regulations of the token issuance location and the cross-border compliance requirements of the asset source country; third, being subject to registration and negative situation constraints as preconditions, incorporating compliance of the principal, asset ownership, negative lists, and national security reviews into access conditions.

It can be seen that the concepts of tokenization of real-world assets (RWA) and asset-backed securities tokens (ABST) intersect, as both involve the blockchain expression of rights, converting ownership, revenue, or other economic rights related to physical assets into digital certificates that are registrable, transferable, and traceable, while using on-chain records to facilitate higher-frequency information disclosure and status synchronization; on the transaction organization level, they both attempt to streamline the traditionally fragmented registration, clearing, custody, and reconciliation processes in finance with lower friction, thereby enhancing asset transfer efficiency and cross-border distribution efficiency. Differences primarily manifest in compliance and asset dimensions. In compliance, ABST emphasizes dual regulatory constraints, with supervision from both the asset source country's regulation and the issuance jurisdiction's regulation relying on upon the issuance environment; in terms of assets, ABST emphasizes a close alignment with cash flows from physical economy assets, utilizing securitization logic to complete rights structuring and risk isolation, while the concept of tokenization of real-world assets is broader in scope.

There have also been various representations of securities tokens in different markets, with the core focus being whether the rights represented by the tokens constitute securities within the regulatory definition. For instance, in Hong Kong, the Securities and Futures Commission pointed out in its "Statement on the Issuance of Securities Tokens" that issuing securities tokens usually involves using blockchain technology to express ownership or economic rights in digital form, which may qualify as "securities" under the Securities and Futures Ordinance, thus subjecting them to existing securities regulations and intermediary licensing requirements, while also alerting investors to relevant risks. As the market transitions from single issuance to full chain business, the Hong Kong SFC's 2023 circular further defines tokenized securities as traditional financial tools using distributed ledger or similar technologies during the securities life cycle, such as bonds or funds, clearly stating that the regulatory principle is "same business, same risks, same rules," with existing prospectus regulations, investment offering rules, and ethics requirements for intermediaries continuing to apply.

The Hong Kong SFC also noted in the same circular that some "digital securities" not classified as tokenized securities may exist in more customized, complex forms, and may even lack links to underlying assets or external rights. Such forms are inherently weaker than ABST in terms of asset backing, cash flow constraints, and ownership transparency. Thus, ST has a broader scope, while ABST falls into a clearer subset of asset-backed and structured securities, indicating not all STs are ABST.

Further, a narrower and broader understanding can be formed around ABST itself, providing a more conducive expression system for international communication. In a narrow sense, ABST can be understood as "ABS+T," corresponding to tokenized ABS, with a core anchored in cash flow assets and a securitized structure. The U.S. securities regulation definition emphasizes that asset-backed securities mainly rely on cash flows generated by a pool of discrete assets for payments, where such assets convert to cash within a limited duration according to their terms, including related rights arrangements set for ensuring services or timely distributions. This highlights the distinction between ABS and equity securities, or general corporate bonds in the aspects of repayment sources, risk isolation, and structural governance, providing a clear international reference framework for narrow ABST.

In a broader sense, ABST can be understood as "AB+ST," where AB stands for asset-backed, and ST represents securities tokens, with its boundaries premised on "securitizable, compliant rights confirmation, and auditable disclosure" of the underlying assets. In addition to cash flow assets, debt rights, equity rights, their revenue rights, fund shares, etc., might also serve as the foundation for issuing securities tokens when they meet the requirements of securitization and risk isolation, forming connections within the traditional financial instruments covered by tokenized securities in Hong Kong. From a trend perspective, as future regulatory rules and market infrastructure continue to improve, ABST is likely to evolve from the narrow "cash flow-oriented tokenized ABS" into a wider range of compliant securitizable asset-supported token forms, thus promoting the migration of asset digitization from isolated product innovations to a re-engineering of traditional financial processes.

Fusion Inflection Point under Future Industrial Finance and Global Regulatory Rules Reconstruction

On January 30, 2026, the Political Bureau of the Central Committee of the Communist Party of China conducted its twenty-fourth collective study on the forward-looking layout and development of future industries, emphasizing the forward-looking, strategic, and disruptive characteristics of future industries. It proposed scientifically demonstrating the technological routes for key areas during the "14th Five-Year Plan" period and enhancing strategic predictive capabilities for cutting-edge technologies, while balancing vitality release and risk prevention at the policy and regulatory levels. The significance of this top-level arrangement lies in aligning the technological routes, industry organization, financial supply, and governance framework on the same map for coordinated advancement, providing policy coordinates for long-term capital formation, risk pricing mechanism transformation, and financial infrastructure upgrades.

Further, the concept of future finance necessitates an understanding of the implications for the asset and liability sides of future industries. The value of future industries is increasingly concentrated in non-traditional collateral such as data, algorithms, intellectual property, engineering capabilities, supply chain networks, and rights to carbon emission reduction, while traditional financial systems depend on offline confirmation and centralized registration and clearance that can quickly escalate friction costs under scenarios involving high-frequency trading, cross-border allocations, granular disaggregation, automated compliance, and real-time risk control.

The asset digitization migration ushered in by ABST can be seen as an evolutionary path aimed at the next-generation capital market infrastructure, where the key premise is to establish a trustworthy rights confirmation and compliance framework. By mapping asset rights into programmable digital certificates, registration, clearance, custody, information disclosure, risk control, and compliance checks can achieve higher degrees of data integration and automation, thus synchronously enhancing the accessibility, divisibility, tradability, and regulatory oversight capabilities of the financial system.

In addition, nurturing future industries requires long-cycle patient capital, more precise risk pricing, and clearer exit arrangements, as well as more efficient asset organization methods under digital conditions. The "Implementation Opinions on Promoting the Innovative Development of Future Industries," issued by the Ministry of Industry and Information Technology and six other departments, proposes systematic deployments around future manufacturing, future information, future materials, future energy, future space, and future health, emphasizing the need to be based on the manufacturing sector, grasp the opportunities of a new round of technological revolution and industrial transformation, and accelerate the development of future industries to support new industrialization. The practical value of ABST often manifests in the matching efficiency of capital and assets and the simultaneous enhancement of risk governance capabilities, particularly in cross-entity, cross-regional, and cross-cycling capital organization, providing a more operational infrastructure for the formation and circulation of "patient capital."

The United States Accelerates Digital Asset Regulation and Reconstruction of Digital Financial Infrastructure through National Agenda

In the global landscape of new industrial and financial competition, ABST and its related institutional arrangements are becoming crucial mechanisms for major economies to contest financial rules and market infrastructure discourse. Taking the United States as an example, its policy path displays evident characteristics of a national agenda, accelerating spillovers into various layers of executive orders, legislation, and regulatory practices post-2025.

In an executive order issued in January 2025, the U.S. leadership on digital assets and fintech was highlighted, stressing the need to shape the institutional environment under frameworks that promote innovation while protecting economic freedom. In July, Trump signed the GENIUS Act (full title: "Guidance and Establishment of the National Innovation Act for U.S. Stablecoins"), issuing explanations by the White House that proposed a coordinated stablecoin regulatory framework across state and federal levels. Meanwhile, the U.S. Congress is accelerating the advancement of market structure legislation, including the CLARITY Act (digital asset market structure and regulation of "digital commodities"), which will clarify the regulatory responsibilities between the SEC and CFTC.

Within the securities regulatory framework, the U.S. policy focus on digital assets is shifting from high-intensity individual enforcement cases to a more rule-based approach focusing on regulatory provision and market structure compatibility. In January 2025, the acting chair of the SEC announced the establishment of a digital asset working group led by commissioners to promote framework construction. Subsequently, in terms of accounting regulations, the removal of accounting guidance for custodial practices under SAB 121 has lowered compliance friction for custodial compliance and financial institution involvement in digital asset businesses. Following the swearing-in of Paul S. Atkins as SEC chairman in April 2025, the regulatory narrative shifted further towards rule modernization, and in July 2025, he proposed and initiated Project Crypto, including key topics such as classifying digital assets, trading venue rules, issuance, and ongoing information disclosure under a comprehensive institutional reconstruction framework. Meanwhile, the SEC has commenced arrangements to end or withdraw some legacy cases and investigations, including the dismissal of a lawsuit against Coinbase in February 2025 and the closing of investigations into Robinhood's digital asset business, shifting market expectations of regulatory boundaries from high uncertainty to more discussable rule paths. From the product and market structure dimension, the SEC is advancing universal listing standards for commodity-based ETPs, including digital asset ETPs into a more predictable rule-based access framework, indicating that the compliance provision of digital asset financial products is beginning to shift from individual case approvals to generic standard logic.

Within the non-securities regulatory framework, the Commodity Futures Trading Commission (CFTC) is promoting institutional implementation through the Crypto Sprint initiative, covering everything from spot contract listing mechanisms to tokenized collateral entering derivatives clearing systems, and encompassing a series of technical revisions and compliance guidelines regarding margin, clearing, settlement, and reporting.

At the market infrastructure level, adaptation of tokenized securities systems and the transformation of trading and settlement mechanisms are also underway. Nasdaq has submitted rule change documents to the SEC, clearly discussing the feasibility and compliance arrangements for trading tokenized versions of stocks and ETPs on exchanges. The parent company of the New York Stock Exchange, ICE, has disclosed that it is developing a tokenized securities platform, embedding it into a broader digital strategy alongside preparations for 24/7 trading and clearing infrastructure.

Institutional Willingness to Allocate Digital Assets Rises, Resonating with the Expansion of Tokenized Assets

Besides the regulatory aspect, demand-side institutional investors' willingness to allocate digital assets and tokenized instruments is on the rise. State Street Corporation's 2025 study reveals that nearly 60% of institutional investors plan to increase allocations to digital assets within the next year, expecting the average allocation ratio to double within three years. It anticipates that by 2030, 10% to 24% of institutional investments will be completed through tokenized instruments. 40% of institutional investors have dedicated digital asset teams or business units, and nearly one-third indicate that digital operations (such as blockchain) have become an indispensable part of their organization's broader digital transformation strategy. Some respondents believe that generative artificial intelligence and quantum computing will have a more significant impact on investment operations than tokenization or blockchain, while many maintain that these technologies complement digital asset plans.

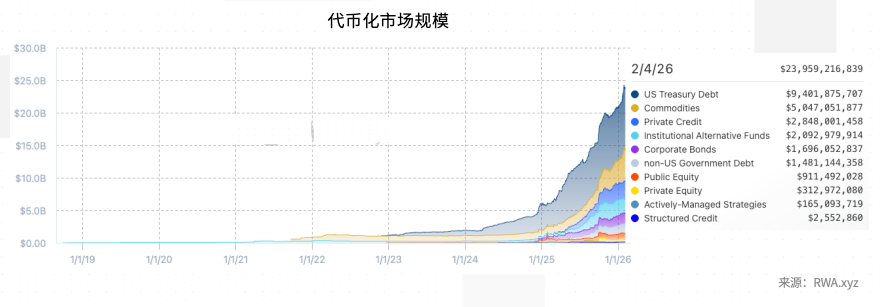

As of February 2026, the global scale of tokenized assets has surpassed $24.4 billion, with the highest proportions in tokenized U.S. Treasury bonds and private credit, where the scale of tokenized U.S. Treasury bonds has reached $9.4 billion and tokenized private credit totals over $5 billion.

The Boston Consulting Group (BCG) forecasts that by 2030, the global scale of tokenized assets will reach $16 trillion. Citibank has released a substantial 162-page report titled "Money, Tokens, and Games: Blockchain's Next Billion Users and Trillions of Value," predicting that by 2030, $4 trillion to $5 trillion of real-world assets will be tokenized, with the trade finance volume based on blockchain technology reaching $1 trillion, as almost everything of value could be tokenized, imagining digital finance and tokenization as the "killer applications" for blockchain breakthroughs.

The migration towards asset digitalization led by asset-backed securities tokens is advancing innovation in finance from isolated products to infrastructure-level upgrades, triggering the reconstruction of capital market transaction systems, clearing positions, collateral management, and cross-border allocation methods. This reconstruction will initially lead with high-frequency cash management tools, sovereign bonds, and fund shares, then extend to a broader array of yield-based assets and industrial side assets.

Moreover, we observe two more specific driving forces. First, global liquidity is dispersed across different markets and settlement systems, and friction in cross-border capital remains relatively high, leading to a real demand for higher frequency and lower friction settlement methods. Second, the explosive growth of artificial intelligence (AI) productivity, rapid infiltration of AI Agents (Artificial Intelligence Agents) into trading, market making, risk control, and operational elements, has engendered a demand for new asset forms that adapt to machine trading (M2M Economy).

Based on these changes, we lean towards believing that the past five years have served as the exploratory period for blockchain technology seeking grounded applications, while 2026 constitutes the year of genuine bilateral convergence between the traditional financial system (TradFi) and decentralized finance (DeFi), initiating further systematic analysis of the six trends surrounding ABST.

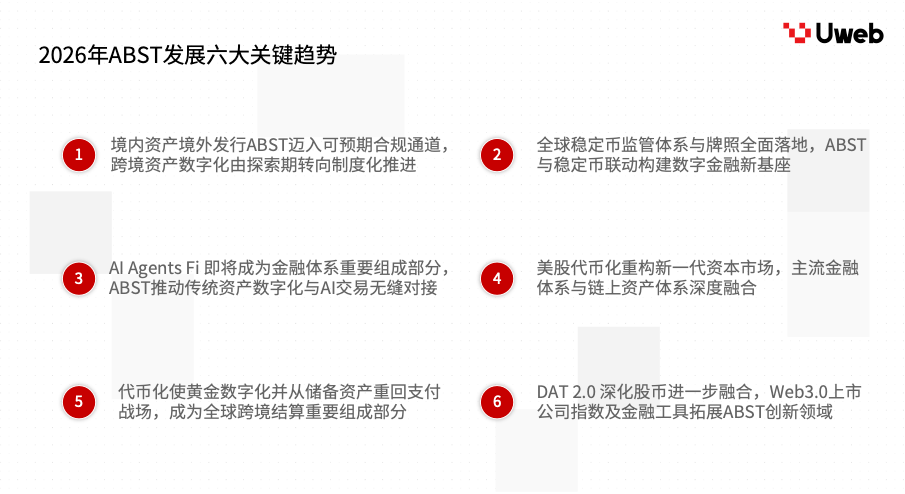

Six Key Trends in the Development of ABST in 2026

The focus of discussions surrounding ABST tokenization is shifting from feasibility to scalability replication. In recent times, the market's pilot explorations have preliminarily validated the potential advantages of tokenization in the areas of rights expression, information disclosure, and settlement efficiency; key forthcoming variables will center around three main lines: whether funds can stably enter, whether product forms can achieve standardized supply, and whether infrastructure for trading and clearing can realize institutional adaptation. This report thus proposes the six key trends regarding ABST development in 2026, summarizing the core factors that are likely to influence fund entry, product form, and trading activity in the coming year, while providing analytical grounds for subsequent policy recommendations:

Key Trend One: Offshore Issuance of ABST based on Domestic Assets Enters Predictable Compliance Channels, Marking the Transition from Exploratory to Institutional Advancement of Cross-Border Asset Digitization. The guidelines issued by the Securities Regulatory Commission on February 6, 2026, and effective immediately clarify the definition of ABST as businesses utilizing cash flows generated by domestic assets for repayment support, issuing tokenized rights certificates overseas. This shifts the market focus from conceptual narratives to verifiable asset quality, rights arrangements, and disclosure responsibilities. For the industry, clarifying compliance pathways will accelerate resource concentration towards quality assets and professional institutions, driving ABST from exploratory to institutional advancement based on standardized processes and cross-border regulatory cooperation.

Key Trend Two: The Global Regulatory Framework for Stablecoins and Licensing are Fully Implemented, Linking ABST with Stablecoins to Build a New Foundation for Digital Finance. The ongoing applicability of the EU's MiCA and stablecoin regulatory implementations in places like Hong Kong, combined with U.S. legislative progress on stablecoins, has clarified compliance boundaries and reserve requirements for stablecoins. Following enhancing regulatory certainty, stablecoins can be utilized as on-chain settlement mediums to enhance funding efficiency, while ABST can serve as a higher quality asset supply to increase asset-side availability, with both projected to accelerate penetration in cash management and industrial finance scenarios.

Key Trend Three: AI Agents Fi Are Set to Become a Vital Component of the Financial System, Paving Seamless Connectivity for Traditional Asset Digitization and AI Trading via ABST. The role of AI Agents is evolving from tool-like assistants to business entities capable of executing continuous tasks. The demand for verifiable, reconcilable, and regulatory-compliant asset forms in the financial system is increasing. The significance of ABST lies in representing rights as programmable certificates, providing a format for underlying assets that enables better integration with automation and risk control, thus advancing transaction organization towards higher frequencies and lower friction.

Key Trend Four: The Tokenization of U.S. Stocks Reconstructs a New Generation of Capital Markets, Deeply Integrating Mainstream Financial Systems and On-Chain Asset Systems. The tokenization of U.S. stocks has fully entered a critical phase of substantive advances in exchange rules revisions and clearing arrangements. Once standards for registration confirmation, custody arrangements, on-chain clearing, and delivery processes are executable, tokenization will serve as a critical infrastructure link between traditional account systems and on-chain systems, resulting in structural impacts on transaction periods, delivery efficiency, and cross-border allocation methods.

Key Trend Five: Tokenization Digitalizes Gold, Returning from Reserve Assets to the Payment Battlefield, Becoming an Important Component of Global Cross-Border Settlement. Against the backdrop of global monetary system adjustments and rising geopolitical uncertainties, gold's monetary attributes are being reactivated in the digital environment. Tokenization facilitates the digitalization and fragmentation of ownership, supplemented by higher-frequency settlement capabilities, allowing gold to more readily enter the application chains of cross-border payments and trade settlements, providing more neutral value anchoring options in some bilateral trades.

Key Trend Six: DAT 2.0 Deepens the Fusion of Stocks and Tokens, While Web3.0 Public Company Index and Financial Instruments Expand the Innovative Domain of ABST. The digital asset treasury model is transitioning from passive holdings to a phase that emphasizes strategy management and cash flow logic, coupled with rising market demand for Web3.0 public company indices and related ETFs and structured financial instruments that support Web3 to gain compliant exposure within traditional account systems. This drives the innovative boundaries of ABST from the foundational asset layer to product and risk management tool layers.

These trends collectively depict the key clues from 2026 as ABST shifts from pilot projects to replicable paths. Subsequent chapters will delve deeper into detailed analyses of each trend.

Key Trend One: Offshore Issuance of ABST based on Domestic Assets Enters Predictable Compliance Channels, Marking the Transition from Exploratory to Institutional Advancement of Cross-Border Asset Digitization.

On February 6, 2026, the People's Bank of China, along with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the Financial Regulatory Bureau, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange, jointly issued the "Notice on Further Preventing and Handling Risks Related to Virtual Currency," reaffirming that activities related to virtual currency are illegal financial activities and are strictly prohibited. Meanwhile, it defined the tokenization of real-world assets (RWA) as the activity of converting asset rights into tokens using cryptographic technology, emphasizing strict regulation of domestic entities conducting related business overseas. Without relevant departmental consent, domestic entities and their controlled overseas parties are prohibited from issuing virtual currencies overseas.

The notice further emphasizes that domestic entities engaging directly or indirectly in RWA tokenization overseas as foreign debt or conducting quasi-asset securitization of real-world assets based on domestic asset ownership and revenue rights must be strictly regulated by relevant departments, including the National Development and Reform Commission, China Securities Regulatory Commission, and State Administration of Foreign Exchange, based on principles of "same business, same risk, same rules." For other forms of RWA tokenization by domestic entities based on domestic rights conducted overseas, the China Securities Regulatory Commission places it under their joint supervision in collaboration with other relevant departments. Without proper consent, filing, etc., no unit or individual may conduct the aforementioned activities.

Offshore subsidiaries and branches of domestic financial institutions providing related services must adhere to laws and regulations, equip specialized personnel and systems, effectively manage business risks, strictly enforce client onboarding, suitability management, anti-money laundering, and bring their services within the domestic financial institutions' compliance and risk control frameworks. Intermediaries and IT service organizations providing services for domestic entities to conduct RWA tokenization overseas must strictly comply with legal requirements, establish solid compliance internal control systems according to relevant standards, and enhance business and risk management, reporting their activity status to relevant management departments for approval or filing.

Two particular aspects of the policy are worth noting. First, without legal consent, domestic entities and their controlled overseas parties are prohibited from issuing virtual currencies overseas, including stablecoins linked to the RMB; second, if domestic assets are to be tokenized for offshore financing, they must follow the compliance channels for approval and filing. Activities such as fundraising, distribution, and trading should, in principle, be conducted legally offshore, and no fundraising or trading arrangement directed at the public can be organized domestically.

Subsequently, the China Securities Regulatory Commission released "Supervisory Guidelines on Offshore Issuance of Asset-Backed Securities Tokens," defining such activities in terms of both cash flow and technology: using cash flows generated by domestic assets or related asset rights as payment support, utilizing cryptographic technology and distributed ledgers or similar technologies to issue tokenized rights certificates overseas. This definition anchors ABST within the financial logic of asset securitization, emphasizing that the source of repayment remains verifiable base asset cash flows, while tokenization increasingly reflects on digital reconstruction of the processes of issuance, registration, possession, transfer, and information disclosure. ABST enhances asset expression and cross-border distribution efficiency, maintaining existing securitization logic, rights arrangements, and information disclosure responsibilities.

The guidelines explicitly list circumstances where related activities are prohibited, covering cases where laws prohibit financing through capital markets, national security reviews determine that activities may threaten national security, criminal activities like corruption exist among controlling shareholders or actual controllers in the past three years, subjects are under investigation for suspected crimes or significant violations without clear conclusions, fundamental assets face significant ownership disputes or are legally untransferable, or hit with prohibitions under the negative list of domestic asset securitization. By bringing asset quality, clarity of ownership, governance of subjects, and compliance records to the forefront, ABST is set to embark on an institutionalized and standardized path right from the outset, preventing market structures from succumbing to subpar entities beneath conceptual enthusiasm.

Before engaging in related activities, the actual controllers of foundational assets must file with the China Securities Regulatory Commission, submitting filing reports and complete foreign issuance materials, covering subject information, foundational asset information, and token issuance proposals, among others. If the filing materials are incomplete, they must be corrected; if the materials meet the specified criteria, the filing procedures must be followed and information publicly disclosed, with non-compliant filings being rejected, and depending on circumstances, opinions may be sought from relevant governmental departments and industry regulators. Simultaneously, the guidelines emphasize that domestic filing subjects and their controlling shareholders, actual controllers, directors, supervisors, and intermediaries bear explicit responsibilities for the material's authenticity, accuracy, and completeness, prohibiting false records, misleading statements, or significant omissions. After filing completion, substantial risks or other significant matters occurring post-issuance overseas must also be reported promptly, with emphasis placed on enhancing cross-border regulatory cooperation and information sharing with overseas securities regulatory bodies. The core of this system arrangement enables a closed-loop governance model that ensures pre-emptive checks, monitoring during operation, and accountability afterward, aiming for sustainable space for cross-border innovation.

The landing of the regulatory framework for ABST is expected to first establish a restructured price anchor on the expectation level. Previously, market discussions leaned heavily towards the efficiency narrative brought by blockchain registration; however, in a landscape of unclear rules, non-transparent rights arrangements, and difficult self-verification for cross-border compliance pathways, technical narratives often devolve into conceptual premiums, impacted by speculative hype. Now, through official definitions, negative lists, filing and public disclosure mechanisms, ongoing reporting, and cross-border collaboration, regulation re-anchors ABST within verifiable cash flows, traceable rights chains, accountable information disclosures, and compliance responsibilities, thereby allowing market pricing to conditionally return to flowing from conceptual drivers to cash flow and risk premium drivers. This presents structural benefits for institutions holding quality assets backed by capable governance and risk control; for entities that seek to penetrate regulations through packaging and speculation, it implies narrowing pathways, increasing costs, and quicker risk exposure.

Secondly, the compliant offshore issuance of ABST will accelerate the process of significant asset digitization migration; however, this migration does not imply a short-term explosion of scale, but rather a cautious advancement within the boundaries recognized by regulators, with demonstrative projects driving standardized diffusion following this. Following the notice, domestic RWA tokenization activities should be restricted; correspondingly, the issuance of ABST from domestic assets overseas must follow structured regulatory pathways managed through the China Securities Regulatory Commission. This reinforced domestic compliance along with orderly cross-border structuring suggests that a significant portion of future innovations will manifest as the compliant issuance and trading of domestic assets overseas, complementing collaborative cross-regulatory efforts instead of creating a high-frequency speculative market directed at the public within domestic realms. For the industry, this will facilitate a shift from marketing-driven resource fluidity and concept packaging towards more tangible capability enhancement, comprising asset selection and due diligence, legal structures and rights arrangements, data compliance and cybersecurity, smart contract auditing and risk control, anti-money laundering and suitability management, as well as connecting with offshore securities market rules.

Lastly, pre-emptive engagement with "specialized" assets before compliance issuance. The goal is to enhance both shared pitches and unique advantages of Hainan's procedural frameworks regarding ABST issuance offshore. The previously established "multifunctional free trade account" is particularly poised to serve capital fluidity and international connections, thereby approaching similar functionalities within international markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。