This report is written by Tiger Research, as the cryptocurrency market continues to be in a long-term decline. In this environment, projects that can continue to survive are those that demonstrate pragmatic and realistic visions.

Core Points

- Projects that address real, specific problems can maintain resilience even during market downturns.

- Hyperliquid, Canton, and Kite target different problem areas, but they share a common characteristic: providing practical and realistic solutions rather than abstract narratives.

- To assess this realism, the analysis should focus on three factors: the problem the project aims to solve, the structure of the solution, and the team's execution capability in practice.

1. Survival Conditions in a Bear Market: Does It Work in Practice?

Source: Tiger Research

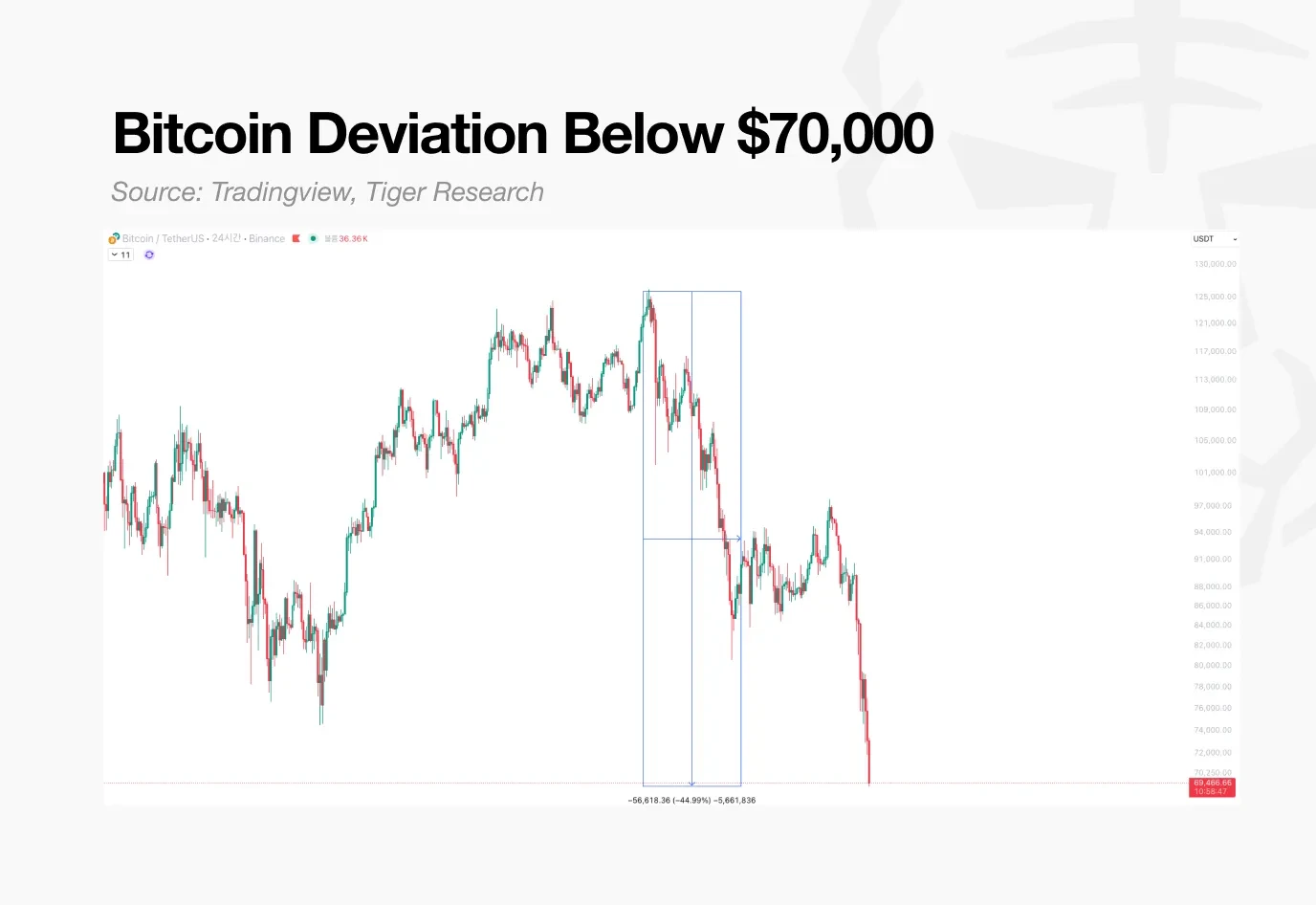

Bitcoin has fallen below $70,000. Among the top 100 cryptocurrencies by market capitalization, only 7 remain above the 200-day moving average. In contrast, 53 stocks in the Nasdaq 100 index are still trading above that threshold.

Market conditions are unforgiving. Nevertheless, some crypto assets manage to survive even in the harshest environments.

Their resilience cannot simply be attributed to artificial market making or random rebounds. A closer examination of their development trajectories reveals different explanations.

These projects no longer rely solely on vague visions or technical complexities. Instead, they share a common feature: addressing core market issues with solutions rooted in practical realities. Their approaches typically align with three directions:

- Do they address the current problems facing the market?

- Are they prepared for practical applications in the near term?

- Are they building the infrastructure that the industry will rely on in the long term?

Ultimately, the ability to solve real problems in practice remains the strongest fundamental.

2. Three Directions of Market Selection

Projects that can answer the above questions have successfully survived. Their approach is: 1) clearly identifying market problems; 2) proposing practical solutions that match specific timing.

2.1. Hyperliquid: Addressing Instant Trading Friction

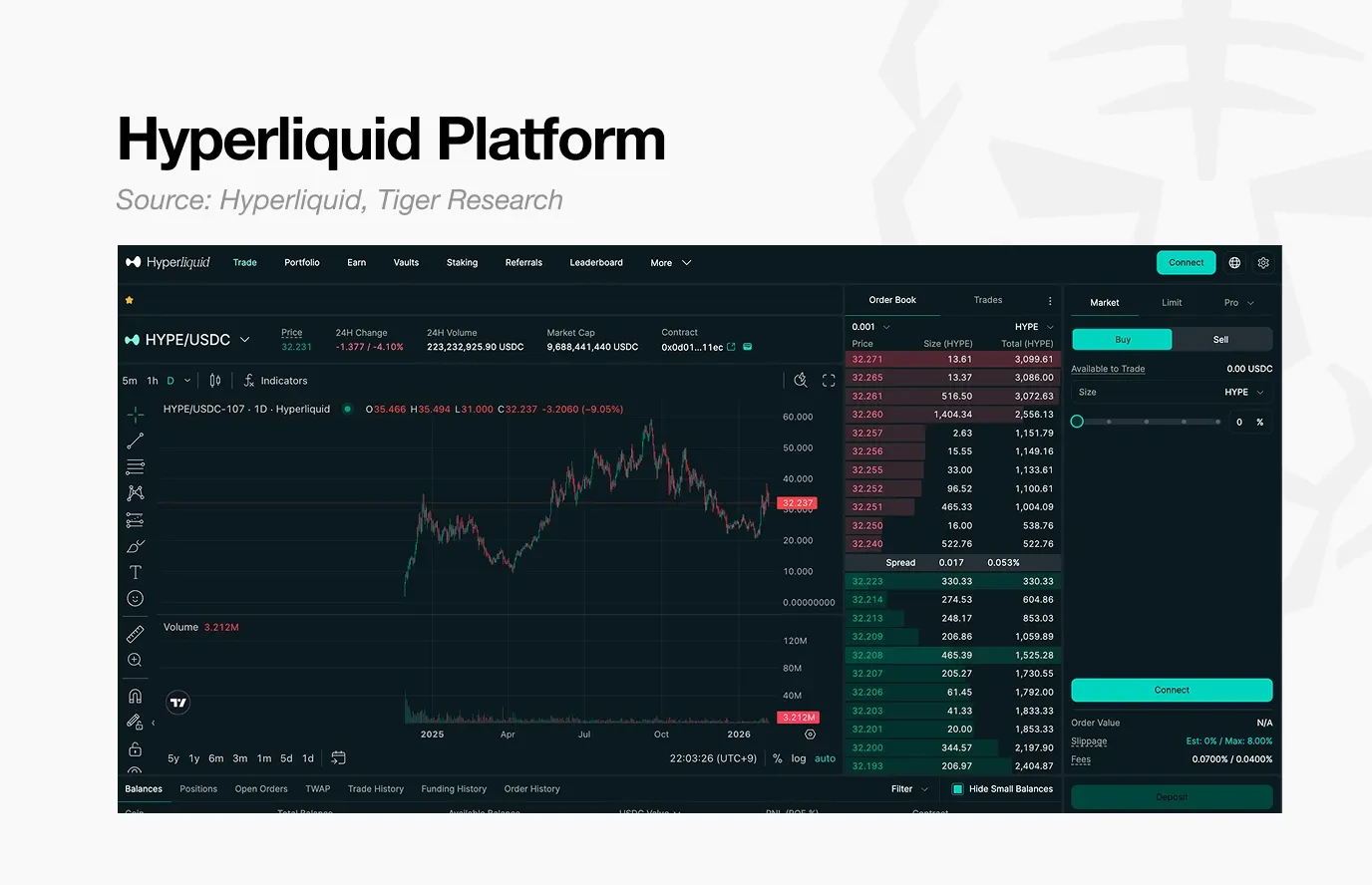

Centralized exchanges have traditionally been seen as responsible intermediaries. However, in practice, when problems arise, they often fail to align with investors' interests. Decentralized exchanges emerged as an alternative, but poor user experiences and performance led many investors to steer clear.

In this context, Hyperliquid introduces the concept of a perpetual contract decentralized exchange (perp DEX). It brings features valued by investors in centralized exchanges—such as high leverage, fast execution, and stable liquidity—into an on-chain environment through the HLP mechanism.

The early usage was partly driven by demand for the $HYPE token airdrop. However, continued participation after the airdrop reflects user satisfaction with the platform's performance.

Ultimately, Hyperliquid's resilience stems from addressing a persistent real issue: dissatisfaction with centralized exchanges.

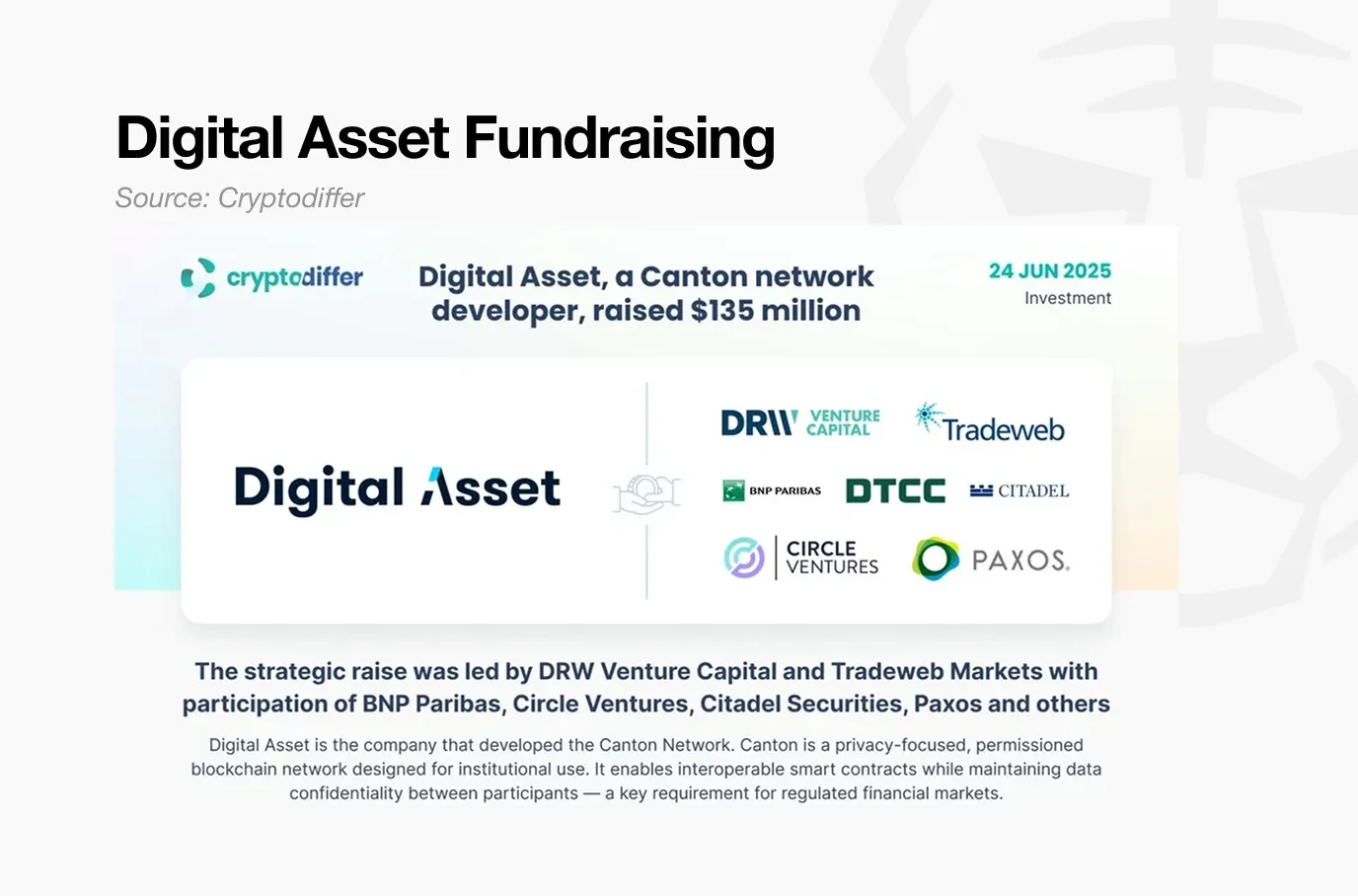

2.2. Canton Network: Preparing for the Era of Institutional Finance

Canton presents a solution aimed at the near future. With the ongoing rise in interest in real-world assets (RWA), institutions are beginning to view blockchain as financial infrastructure rather than a public network. In this context, what institutions need is not complete data transparency, but a selective privacy model that supports regulatory compliance and confidentiality.

Canton Network was born. Through DAML, Canton can provide configurable data disclosures for each participant.

This allows institutions to share information only to the necessary extent while maintaining transaction confidentiality. Canton is not imposing a provider-driven design but is building infrastructure that meets institutional needs.

Another key factor is that Canton has focused on real deployments from the start to expand its ecosystem, supported by early collaborations with financial institutions.

Notably, its partnership with DTCC establishes a channel for assets managed by the traditional financial system to expand into a Canton-based environment. DTCC processes approximately $37 trillion in transactions annually, highlighting the practical feasibility of the Canton Network approach.

Ultimately, Canton Network provides a structural solution designed to meet three institutional requirements simultaneously: privacy protection, regulatory compliance, and integration with existing financial systems.

2.3. Kite AI: Building the Yet-to-Come AI Economy

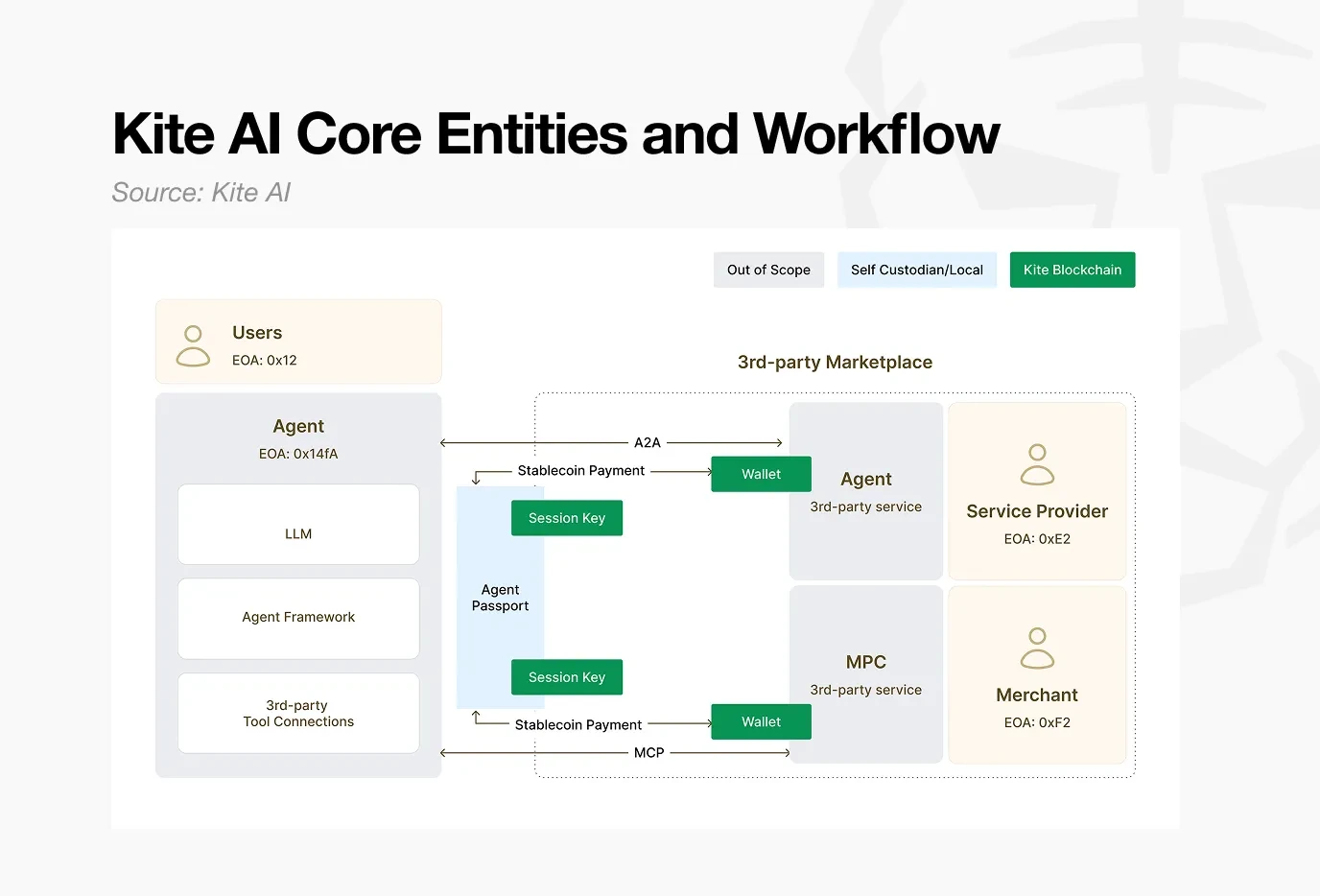

Unlike the previous two examples, Kite AI currently has limited practical applications. However, from the perspective of the future where AI agents operate as economic entities, its structural logic remains compelling.

In both Web2 and Web3 domains, there is broad consensus on an agent-driven future. Few question the scenarios where AI agents handle tasks like booking hotels or purchasing everyday items on behalf of users.

However, such a future requires infrastructure that allows AI agents to independently initiate and execute payments. Existing trading systems are designed around transfers between people and the efficiency of human participants.

Therefore, for AI agents to operate as autonomous economic entities, new mechanisms are needed, including authentication and automated payment frameworks.

Kite AI is building payment infrastructure for this environment. Its core components include an "agent passport" for authentication and x402 protocol functionality for enabling automated payments.

The vision proposed by Kite AI cannot currently be deployed on a large scale simply because the future it targets has not yet materialized.

Nevertheless, the project's realism stems from a broader premise: when this widely anticipated future arrives, the underlying technology it is developing will be essential. This alignment with a widely accepted development trajectory gives the project structural credibility, even though its current usage is limited.

3. Three Key Questions for Assessing Practical Feasibility

Despite the differing timelines of these three projects, they share a common feature: feasibility in the real world.

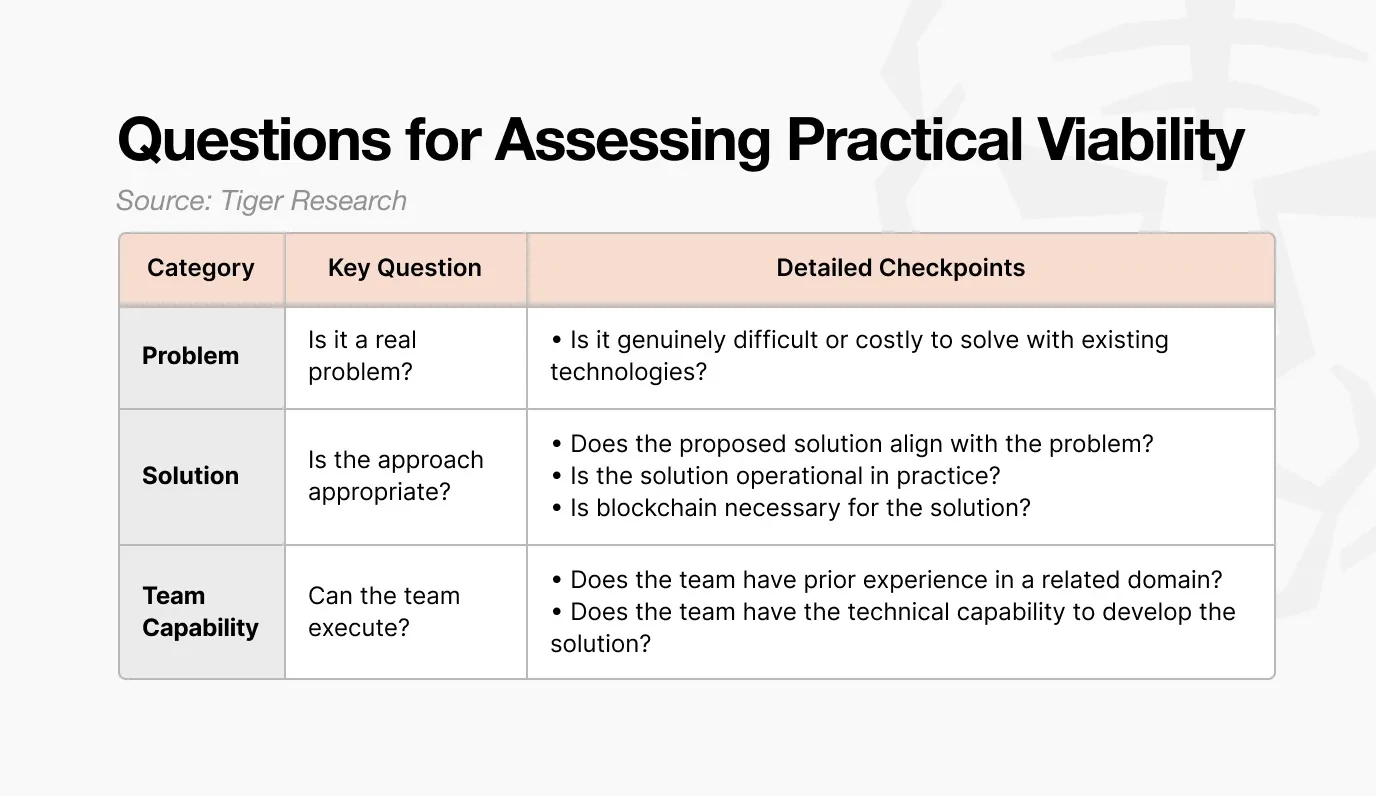

Evaluations of the same project often diverge. Some believe it addresses real problems, while others think it is overhyped. To narrow this interpretive gap, at least three core questions must be posed:

Source: Tiger Research

- What problem does it solve? Is the problem the project targets real and in demand in the market?

- How does it solve it? Is the proposed solution structurally sound and executable?

- Who is executing it? Does the team have the capability and resources to turn the vision into reality?

Since most projects promote optimistic future narratives, answering these questions correctly requires time and effort. Filtering out misleading or incomplete information is not easy. Projects that cannot confidently answer these three questions may experience short-term price surges, but when the next downturn arrives, they are likely to disappear.

The current state of the cryptocurrency market is clearly unfavorable. But that does not mean it is all over. New experiments will continue, and the task is to assess what these efforts truly represent.

What matters most now is realism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。