The aftermath of the Dow Jones Industrial Average breaking the historic 50,000-point mark is still unfolding, and an even more outrageous prediction has stirred the global market—Trump claims that during his term, the Dow will reach 100,000 points.

On February 9, Trump reiterated his astonishing prediction, stating, “The U.S. stock market is at record highs, and national security is also guaranteed, thanks to our great tariff policy. I expect the Dow to rise to 100,000 points before my term ends.”

Before he made this statement, the U.S. stock market had just experienced a retaliatory rebound, with the Dow Jones Index closing above 50,000 points for the first time in history on February 6.

1. Market Volatility

● The U.S. stock market has just gone through a dramatic emotional rollercoaster. After three consecutive days of oppressive selling, bottom-fishing funds erupted, driving a strong rebound in U.S. stocks on Friday.

● All three major indices surged, with the Dow Jones Industrial Average crossing 50,000 points for the first time in history, closing up 1,206.95 points, a gain of 2.47%, at 50,115.67 points. The S&P 500 also recorded its largest single-day gain since last May, closing at 6,932.30 points. Market sentiment seems to have quickly shifted from panic-driven deleveraging to “bottom-fishing recovery.”

2. Policy Insights

● Trump's optimistic prediction for the stock market is not without basis; the policy logic behind it is worth exploring. The market generally believes that his nomination for the next Federal Reserve Chair is a direct trigger for the current market turbulence.

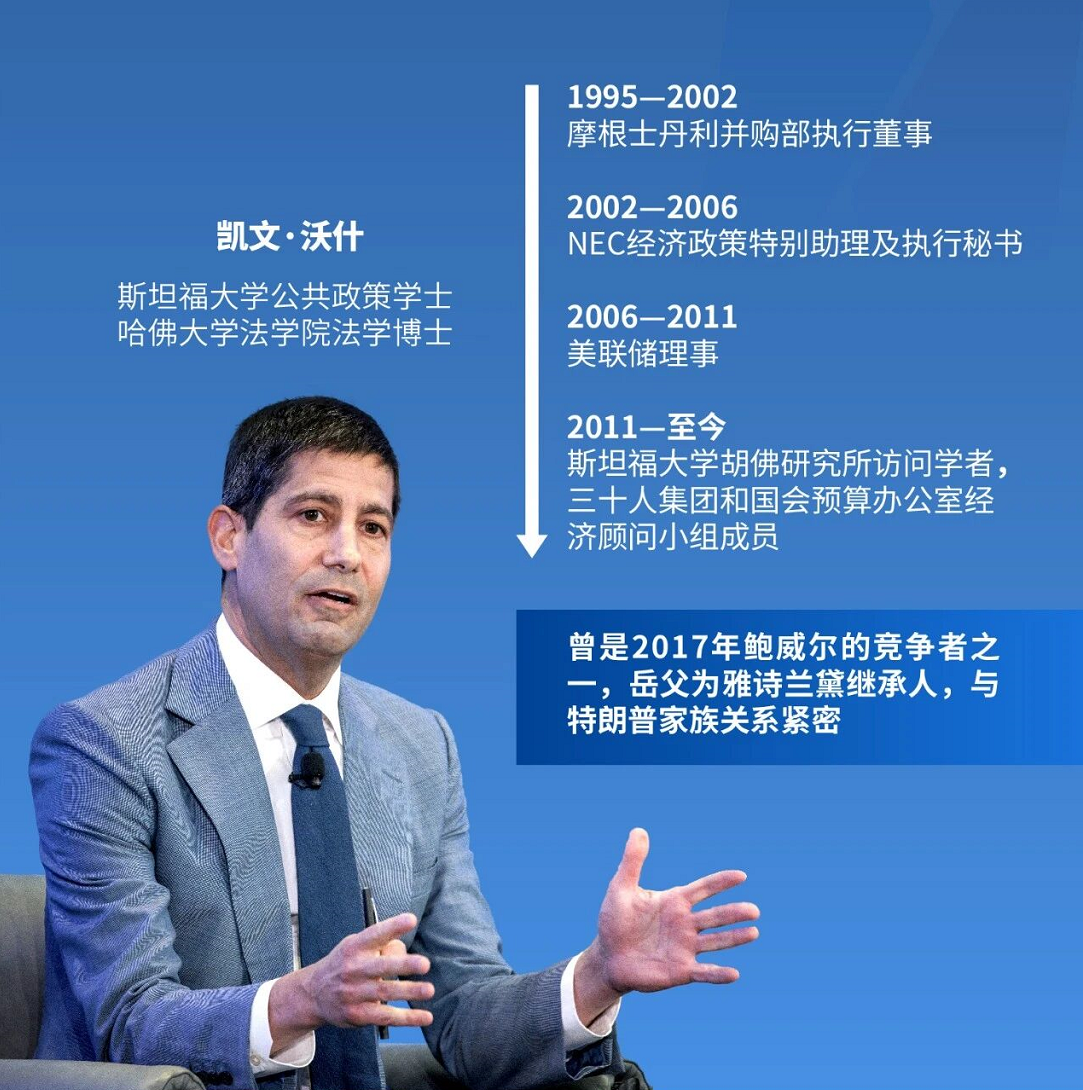

● Trump nominated Kevin Warsh to be the next Federal Reserve Chair. Following this announcement, the dollar strengthened, long-term Treasury yields remained strong, and precious metal prices saw increased pullbacks.

● Warsh is not an ordinary candidate. His billionaire father-in-law, Ronald Lauder, was a classmate of Trump at the Wharton School of the University of Pennsylvania and donated $5 million to Trump’s super PAC in March 2025.

3. Historical Echoes

Trump's "calls" are not unprecedented; historically, his statements have often been closely related to market trends. He has publicly predicted market movements multiple times, followed by subsequent market increases.

● In April 2025, when the market plummeted due to tariff fears, Trump posted on Truth Social: “Now is a great time to buy.” A few hours later, he announced a suspension of most tariffs, and the stock market surged, with the S&P rising 9.5% in a single day.

● When the U.S.-U.K. trade agreement was reached in May of the same year, Trump said at a press conference: “You better buy stocks now.” On that day, U.S. stocks soared, and Bitcoin broke through $100,000.

4. Crypto Movements

● Just as U.S. stocks hit historic highs, the crypto market also saw a notable synchronized rebound. Bitcoin rebounded strongly after a significant drop the previous day, rising about 11% in a single day, returning to around $70,000. Market analysts pointed out that the high correlation between crypto assets and tech stocks amplified the downward volatility. Trump's previous statements seem to have a correlated effect on the crypto market.

● According to market observations, long-term Bitcoin holders have stopped selling for the first time in six months. This may indicate reduced selling pressure, creating conditions for a market rebound.

5. Tech Divergence

● Despite the overall market rebound, there is a clear divergence among sectors, with a complex picture emerging within tech stocks. The Dow has significantly outperformed the Nasdaq and S&P 500 this year, while several software companies have been hit by negative impacts. The market is concerned that the application of artificial intelligence technology will intensify industry competition and squeeze corporate profits, while investors are also anxious about the high valuations of AI-related stocks.

● Nvidia CEO Jensen Huang attempted to reassure the market, stating that demand for artificial intelligence is “extremely strong,” and that AI infrastructure development will continue for seven to eight years. The integration of traditional finance and the crypto market is accelerating, which could be an important turning point for the future market. The New York Stock Exchange is developing a platform for tokenized securities trading and on-chain settlement.

● This platform could enable 24/7 trading, instant settlement of stablecoins, fractional trading, and native digital securities. This initiative could fundamentally change market structure, narrowing the gap between traditional finance and the crypto world.

● Meanwhile, global central banks continue to increase their gold holdings. The People's Bank of China has increased its gold reserves for 15 consecutive months, purchasing 40,000 ounces (approximately $200 million) in January. This trend reflects a preference for traditional safe-haven assets, but the crypto market may benefit from it.

6. Interwoven Risks

Looking ahead, the market faces a confluence of multiple risks. Voices within the Federal Reserve remain divided, with inflation pressures coexisting with the fragility of the job market. The trade, immigration, and even foreign policies promoted by the Trump administration are overall pushing up U.S. price levels, while the promotion of artificial intelligence technology applications brings employment pressures.

This puts the Federal Reserve in a dilemma of balancing its dual goals of inflation and employment. The uncertainty in the market may create opportunities for alternative investments such as crypto assets.

In the trading hall of the New York Stock Exchange, the clock ticks during trading hours, but soon, this global financial center may welcome 24/7 uninterrupted trading.

The New York Stock Exchange is developing a platform for tokenized securities trading and on-chain settlement, which not only means that stocks can be traded around the clock like cryptocurrencies but also that fractional trading and instant settlement will become possible.

Amid the dual narratives of U.S. stocks hitting new highs and the crypto market rebounding, the boundaries between traditional finance and digital assets are dissolving, with the safe-haven glow of gold and the digital revolution of Bitcoin reshaping the logic of global asset allocation.

Global central banks have continuously increased their gold holdings, with the People's Bank of China joining this trend for the 15th month, purchasing 40,000 ounces in a single month.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。