One interesting point is that I remember @timzz_sleep told me that Spark is not trying to create a safer Aave or Morpho, but rather to build a commercial bank + on-chain money market fund.

It sounded a bit abstract at the time, but now I feel it aligns very well with the structure mentioned in Messari's research report—

1⃣ Upstream obtaining the policy interest rate: Sky acts as the central bank, determining the SSR (deposit benchmark) and Base Rate (institutional borrowing benchmark); the Base Rate is always 0.3% higher than the SSR, of which 0.2% is directly rewarded to the execution layer protocols that utilize the funds, and the remaining 0.1% is Sky's profit.

2⃣ Downstream selling the financing certainty that institutions want: Spark lends out stablecoins through SLL and then exchanges them 1:1 with the hard currency stablecoins that institutions prefer using PSM.

3⃣ Earning structural interest rate spreads in the middle: Deploying these resources into SparkLend or external RWA/DeFi to earn returns.

This essentially provides a long-term funding ticket to execution layers like @sparkdotfi. As long as you can deploy funds to places that yield above the Base Rate, the interest rate spread is sustainable, leading to stable profitability.

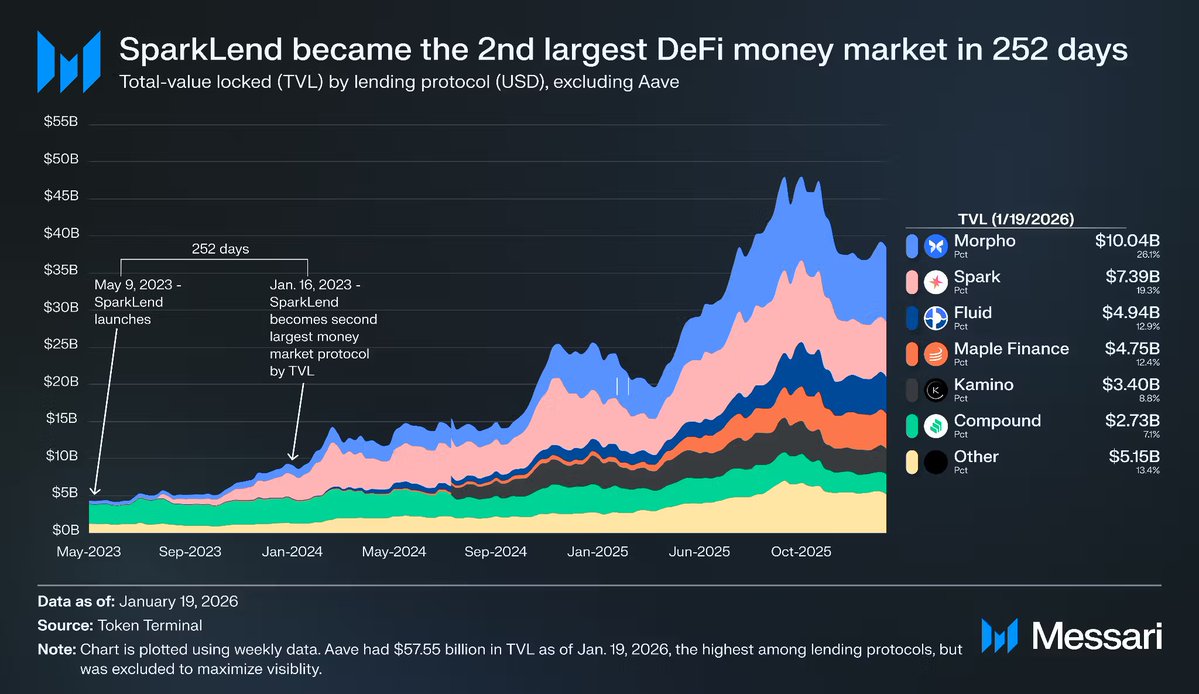

Based on this goal, Spark could never take the route of maximizing short-term efficiency; what it aims for is definitely scalability and predictability.

Therefore, the report repeatedly mentions several seemingly conservative designs of Spark: blue-chip collateral limits, fixed prices for stablecoins, and predictable lending parameters.

Take blue-chip collateral as an example—

The growth methods of peers generally involve increasing assets, long tails, yield tokens, and wrapped tokens, mostly focusing on scaling first and then supplementing with isolated risk control.

The advantage of this diversified collateral is that the overall TVL looks impressive, but the downside is that each type of collateral can only provide relatively loose parameters because you cannot perform detailed risk modeling for dozens of assets.

The result is that everything seems safe on the surface, but when a problem arises, it becomes a systemic issue.

In contrast, Spark directly abandons the most common growth method in DeFi, only accepting blue-chip asset collateral, which essentially increases the underlying security.

This may not be important for retail investors, but for institutions and funds that need to be deployed long-term, the value is far beyond imagination!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。