Global risk assets faced their darkest hour on the morning of February 6, with Bitcoin plummeting over 12% in a single day, nearing the $60,000 mark, and more than 570,000 people being liquidated in the cryptocurrency market within a day.

Bitcoin touched $60,000 during the day, which is a halving compared to the historical high of $126,000 set last October, with a market cap evaporating by over $1.2 trillion.

This sell-off storm swept across the globe, affecting everything from U.S. stocks and precious metals to Asian stock markets, with spot silver crashing over 19% in a single day, and all three major U.S. stock indices falling by more than 1%, while the Nikkei 225 and South Korea's KOSPI indices also declined simultaneously.

1. Market Catastrophe

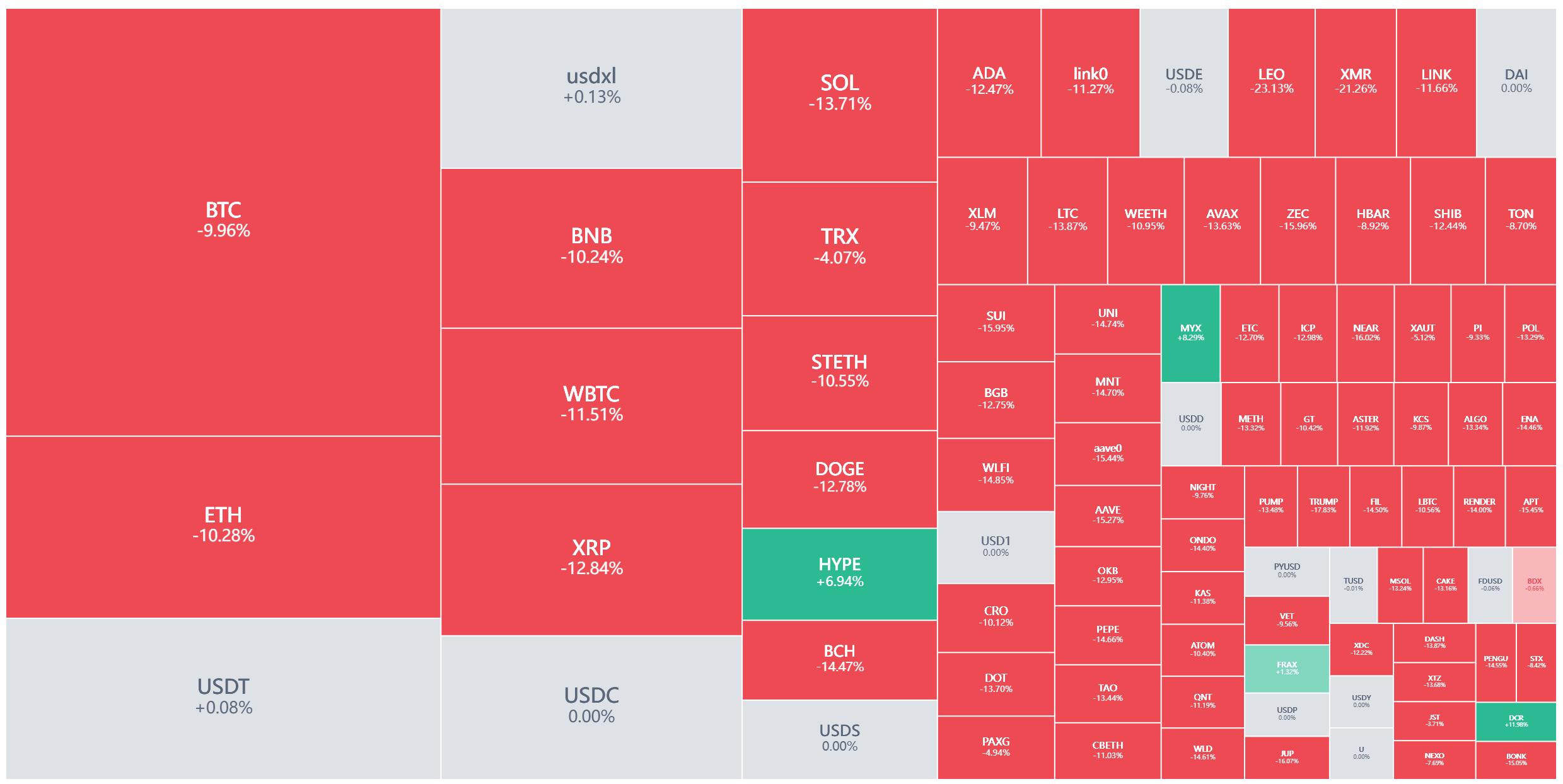

● The cryptocurrency market experienced a "crash-like" drop. Bitcoin's price fell sharply from above $70,000 to around $63,000 within just a few hours, dropping over 12% in a single day.

● Ethereum saw an even larger decline, over 13%; XRP plummeted over 22%; other major cryptocurrencies like SOL, Dogecoin, and BNB also fell by more than 14%.

● This crash led to over 570,000 people being forcibly liquidated in the global cryptocurrency market within 24 hours, with a total liquidation amount reaching $2.601 billion. The largest single liquidation occurred on Binance, with a Bitcoin contract worth $12.02 million being forcibly closed.

2. Global Resonance

The sell-off storm quickly spread to global financial markets. The three major U.S. stock indices opened lower and continued to decline, with the Nasdaq Composite Index closing down 1.59%, marking the most severe three-day decline since April of last year.

● Tech stocks were hit hard, with Amazon and Microsoft shares dropping over 4%, Tesla falling over 2%, and Nvidia down over 1%. Software stocks performed particularly poorly, with FactSet Research Systems' stock plunging over 10% at one point.

● The precious metals market also did not escape unscathed. Spot silver fell over 19% in a single day, and spot gold dropped over 3%, with both commodities still searching for a price bottom after experiencing historic sell-offs last Friday.

● International oil prices also saw significant declines, with WTI crude oil futures closing down 2.84% and Brent crude oil futures down 2.75%.

3. Multiple Triggers

Market analysis suggests that multiple factors are behind this round of declines. A significant turning point was the breach of the $70,000 psychological barrier for Bitcoin, which holds critical political and psychological significance.

● Andrew Tu, head of business development at cryptocurrency market maker Efficient Frontier, stated: “If Bitcoin cannot hold above $72,000, it is very likely to drop to $68,000, and it may even fall back to the lows after the initial rebound in early 2024.”

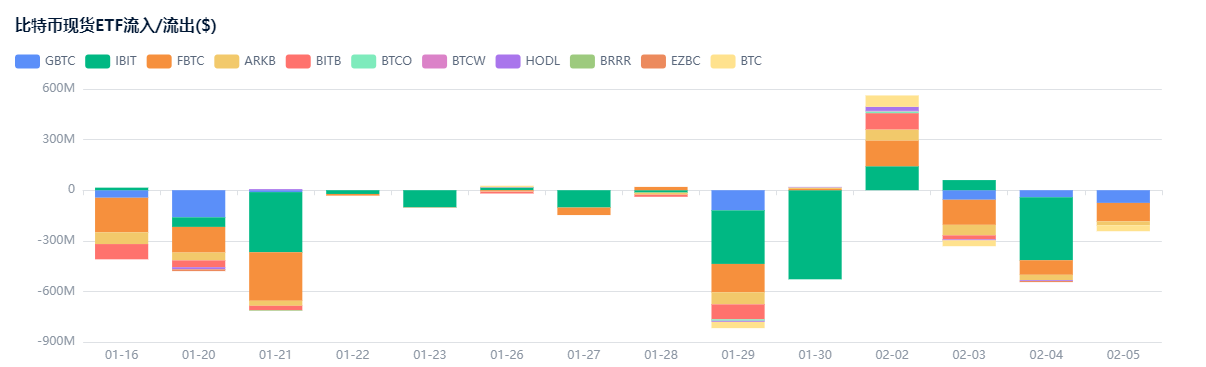

● Changes in institutional fund flows have also intensified the selling pressure. After recording a net inflow of about $562 million into Bitcoin exchange-traded funds on Monday, over $800 million flowed out in the following two trading days.

● Additionally, the news of Trump nominating Waller as the next Federal Reserve Chair on January 29 caused market turbulence. Waller is known as an "inflation fighter," advocating for aggressive balance sheet reduction to tighten liquidity, which has brought greater uncertainty to the market.

4. Shift in Sentiment

● Market sentiment has fundamentally shifted. Wenny Cai, COO of trading platform SynFutures, pointed out: “The scale of liquidations is massive, and market sentiment has shifted to risk aversion; price movements are now driven more by balance sheet mechanisms rather than narrative logic.”

● Ilan Solot, senior global market strategist at Marex Solutions, noted that Bitcoin has recently failed to act as a safe-haven asset, which is one of the reasons for the intensified sell-off. Confidence in Bitcoin is eroding. Shiliang Tang, managing partner at Monarq Asset Management, bluntly stated that the cryptocurrency market is experiencing a "crisis of confidence."

● Contracts on the prediction platform Polymarket indicate that there is an 82% probability that Bitcoin will fall below $65,000 within the year. Some traders are even betting on worse outcomes, with the probability of Bitcoin dropping below $55,000 rising to about 60%.

5. Chain Reaction

The collapse of the crypto market has prompted urgent responses from regulators and exchanges. The Chicago Mercantile Exchange announced an increase in margin requirements for certain gold, silver, and aluminum futures contracts.

● The new margin requirement for gold has been raised to 9%, while the margin level for silver has been significantly increased to 18%. This adjustment will take effect after the market closes on February 6 local time.

● The Asian markets quickly reacted after opening. The KOSPI 200 index futures in South Korea fell by 5%, triggering a 5-minute pause in program trading. Japan's Nikkei 225 index fell below 53,000 points, with a daily decline of 1.57%.

● A report from the employment placement agency Challenger, Gray & Christmas revealed that U.S. employers announced layoffs of 108,435 people in January, the highest "January layoff total" since the global financial crisis.

6. Institutional Retreat

The behavior patterns of institutional investors are changing. A report from CryptoQuant indicated that the U.S. ETF that purchased 46,000 Bitcoins during the same period last year has turned into a net seller in 2026.

● Maja Vujinovic, CEO of digital asset company FG Nexus, commented on the current market situation: “The linear bull market that many anticipated has not truly materialized. Bitcoin is no longer traded based on speculation; the narrative has lost some of its plot, and it is now purely based on liquidity and capital flow.”

● Weak U.S. employment data further dampened market sentiment. The U.S. Department of Labor reported that initial jobless claims for the week ending January 31 rose more than expected, and job vacancies in December 2025 fell to the lowest level since September 2020.

● Allianz's chief economic advisor, Mohamed El-Erian, stated: “It is noteworthy that these layoffs are occurring while GDP is still growing at about 4%, accelerating the decoupling of employment from economic growth—if this phenomenon continues, it will have profound economic, political, and social implications.”

The complete collapse of global risk assets is sending an important signal to investors: the financial markets in early 2026 are more fragile than most people anticipated. The plunge in cryptocurrencies and the sell-off in U.S. stocks and precious metals are not isolated events, but rather an inevitable resonance against the backdrop of tightening global liquidity.

The shift in market sentiment is reshaping asset pricing logic, moving from optimistic narratives to balance sheet mechanisms, and this process is far from over.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。