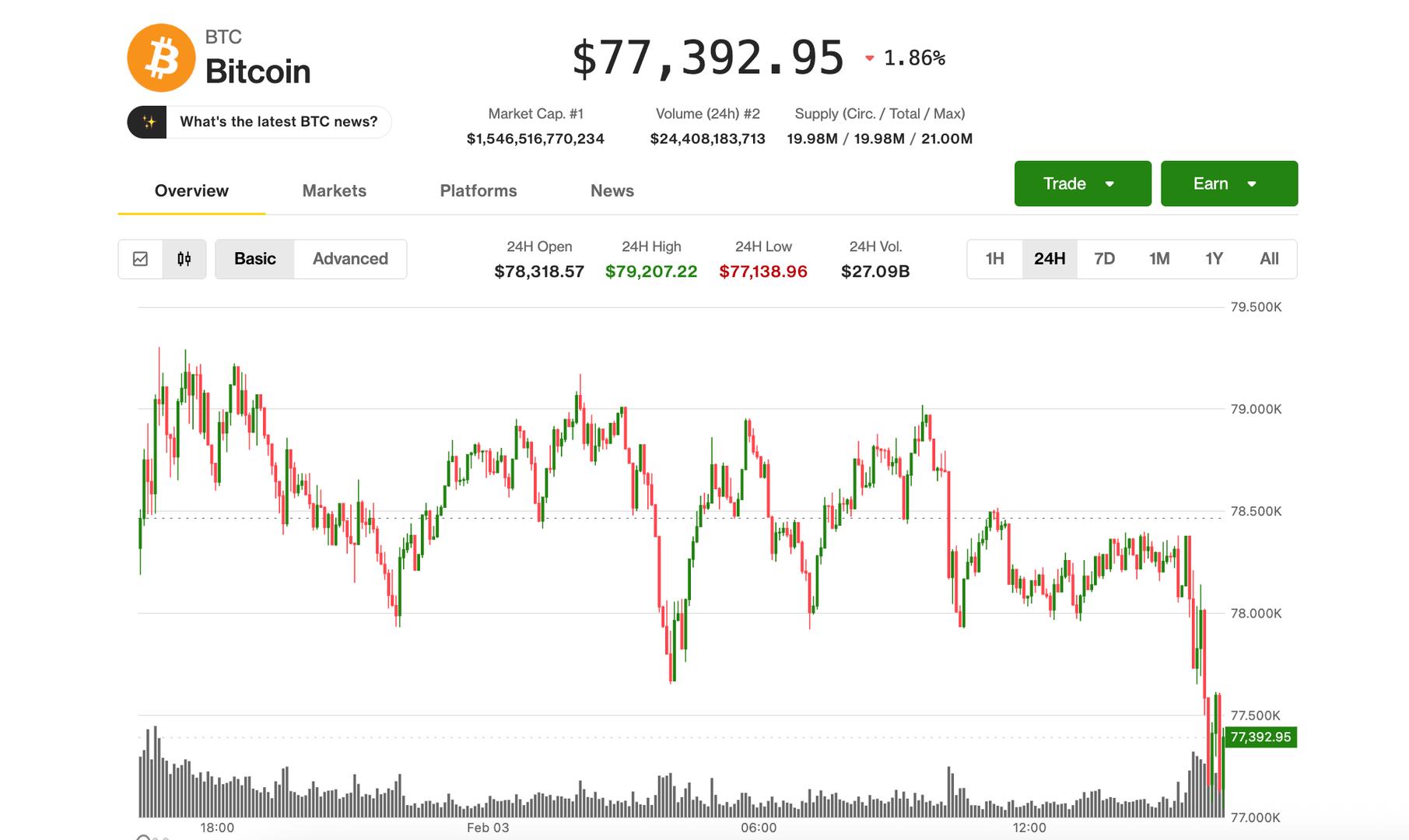

What to know : Bitcoin's very modest bounce from the weekend lows appears to be failing, the price falling back to just above $77,000. Gold and silver, meanwhile, have renewed their bull runs, with gold close to reclaiming the $ 5,000-per-ounce level. Looking at the options market positioning, one analyst isn't yet comfortable calling the low in bitcoin's price.

After having climbed roughly 7% to above $79,000 from its panickly weekend lows near the $74,000 mark, bitcoin is again giving ground during morning U.S. trade.

Bitcoin was recently changing hands at $77,100, lower by 2% over the past 24 hours. Ether was faring worse, down to $2,260, or 4.7% lower.

The selloff is occurring as gold and silver are both posting strong gains in what appears to be a real rebound from their own panicky price action last Friday.

Alongside, U.S. stocks — particularly, a sizable group of AI-related names — are declining. Nvidia (NVDA), Oracle (ORCL), Broadcom (AVGO), Micron (MU) and Microsoft (MSTR) are all lower by 3%-5%, leading the Nasdaq's 1% drop.

The largest publicly traded bitcoin holder Strategy (MSTR) continues to make fresh lows and is down more than 2%. Coinbase (COIN) and Bullish (BLSH) are off similar amounts.

Galaxy Digital (GLXY) shares are down more than 12% following disappointing fourth-quarter results. Stablecoin issuer Circle (CRCL) is down another 3.5%.

Bitcoin miners turned AI infrastructure providers are posting gains, led by TeraWulf (WULF), which advanced 12% after acquiring two industrial sites in the U.S. that could more than double the firm's power capacity to 2.8 gigawatts. Cipher Mining (CIFR) shares are up 4% after announcing plans to raise $2 billion in the junk bond market to fund its Black Pearl data center in Texas, which will deliver 300 megawatts of capacity under a long-term lease with Amazon Web Services.

Dead-cat bounce

Options flows suggest traders are bracing for a short-lived bounce off of the weekend lows below the $75,000 level, according to Jake Ostrovskis, head of OTC at crypto trading firm Wintermute.

The absence of demand for upside exposure mirrors conditions seen in April 2025, he added.

Heavy demand for near-term downside protection has distorted the options market, pushing short-dated volatility higher than longer-dated contracts, a setup known as backwardation, Ostrovskis noted. The analyst said he's watching when volatility cools and the options curve normalizes back into contango as bottom signals.

"At that point I'd be more comfortable calling local lows," he said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。