Original Title: "Gold vs Bitcoin: 12 Years of Data Tells You Who the Real Winner Is"

Original Authors: Viee, Amelia, Biteye

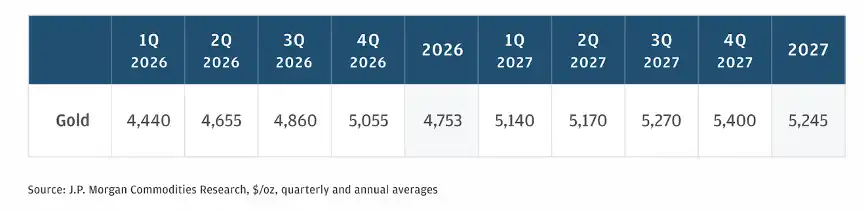

On January 29, 2026, gold plummeted 3% in a single day, marking its largest drop in recent times. Just a few days earlier, gold had just surpassed $5,600 per ounce, setting a new high, with silver also following suit. The year 2026 has already far exceeded JPMorgan's expectations from mid-December.

Data Source: JPMorgan

In contrast, Bitcoin remains in a weak oscillation range after a correction, with the market performance of traditional precious metals and Bitcoin continuing to diverge. Despite being dubbed "digital gold," Bitcoin seems unstable; during times of inflation, war, and other traditional favorable conditions for gold and silver, it behaves more like a risk asset, fluctuating with risk appetite. Why is this the case?

If we cannot understand Bitcoin's actual role in the current market structure, we cannot make reasonable asset allocation decisions.

Therefore, this article attempts to answer from multiple perspectives:

- Why have precious metals surged recently?

- Why has Bitcoin performed so poorly in the past year?

- Looking back at history, how has Bitcoin performed when gold rises?

- For ordinary investors, how should they choose in this divided market environment?

I. The Cross-Cycle Game: A Decade of Showdown Between Gold, Silver, and Bitcoin

From a long-term perspective, Bitcoin remains one of the highest-returning assets. However, over the past year, Bitcoin's performance has clearly lagged behind that of gold and silver. The market trends from 2025 to early 2026 exhibit a stark binary divergence, with the precious metals market entering a phase referred to as a "super cycle," while Bitcoin appears somewhat sluggish. Below are comparative data from three key periods:

Data Source: TradingView

Data Source: TradingView

This divergence in trends is not new. Back in early 2020, during the initial stages of the pandemic, gold and silver surged due to risk aversion, while Bitcoin experienced a drop of over 30% before rebounding. In the 2017 bull market, Bitcoin skyrocketed by 1,359% while gold only rose by 7%. In the 2018 bear market, Bitcoin plummeted by 63% while gold only fell by 5%. In the 2022 bear market, Bitcoin dropped by 57% while gold slightly increased by 1%. This seems to indicate that the price correlation between Bitcoin and gold is not stable; Bitcoin appears to be an asset at the intersection of traditional finance and new finance, possessing both technological growth attributes and being influenced by liquidity, making it harder to equate with gold, a timeless safe-haven asset.

Therefore, when we are surprised that "digital gold isn't rising while real gold is exploding," the real question should be: Is Bitcoin truly regarded as a safe-haven asset by the market? From the current trading structure and the behavior of major funds, the answer may be negative. In the short term (1-2 years), gold and silver have indeed outperformed Bitcoin, but in the long term (10+ years), Bitcoin's returns are 65 times that of gold—over time, Bitcoin has proven its worth with a 213-fold return; it may not be "digital gold," but it is the greatest asymmetric investment opportunity of this era.

II. Analysis of Reasons: Why Have Gold and Silver Outperformed BTC Recently?

The frequent new highs of gold and silver and the lagging narrative of Bitcoin are not just a divergence in price trends but also a deep-seated divergence in asset attributes, market perception, and macro logic. We can understand the watershed between "digital gold" and "traditional gold" from the following four perspectives.

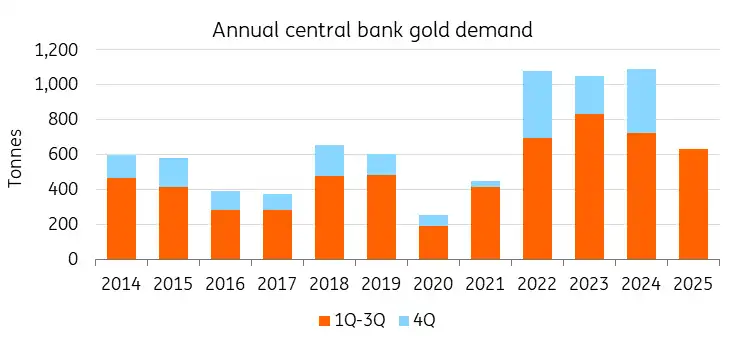

2.1 In a Trust Crisis, Central Banks Lead the Way in Buying Gold

In an era of strong expectations for currency devaluation, who continues to buy determines the long-term trend of assets. From 2022 to 2024, central banks around the world have significantly increased their gold holdings for three consecutive years, with an average net purchase of over 1,000 tons per year. Whether in emerging markets like China and Poland or resource-rich countries like Kazakhstan and Brazil, gold has become the core reserve asset to combat dollar risk. The key is that the higher the price rises, the more central banks buy—this "buy more as it gets more expensive" behavior reflects central banks' firm belief in gold as the ultimate reserve asset. Bitcoin struggles to gain recognition from central banks, which is a structural issue: gold is a 5,000-year consensus that does not rely on any national credit; Bitcoin requires electricity, networks, and private keys, making central banks hesitant to allocate it on a large scale.

Data Source: World Gold Council, ING Research

2.2 Gold and Silver Return to "Physical First"

As global geopolitical conflicts escalate and financial sanctions are frequently imposed, asset security becomes a question of whether it can be redeemed. After the new U.S. government took office in 2025, high tariffs and export restrictions were frequently introduced, disrupting global market order, making gold the only ultimate asset that does not rely on the credit of other countries. Meanwhile, silver's value in industrial applications began to be released: the expansion of industries such as new energy, AI data centers, and photovoltaic manufacturing has increased silver's industrial demand, revealing a real supply-demand mismatch. In this context, the speculation in silver resonates with its fundamentals, leading to a more significant increase than gold.

2.3 Bitcoin's Structural Dilemma: From "Safe-Haven Asset" to "Leveraged Tech Stock"

In the past, Bitcoin was seen as a tool to combat central bank monetary expansion, but with the approval of ETFs and the entry of institutions, the funding structure has fundamentally changed. Wall Street institutions include Bitcoin in their portfolios, typically treating it as a "highly elastic risk asset"—we can see from the data that in the second half of 2025, the correlation between Bitcoin and U.S. tech stocks reached 0.8, an unprecedented high correlation, indicating that Bitcoin is increasingly resembling a leveraged tech stock. When market risks arise, institutions are more willing to sell Bitcoin for cash first, unlike gold, which is bought.

Data Source: Bloomberg

More notably, during the crash on October 10, 2025, $19 billion in leveraged positions were liquidated all at once, and Bitcoin did not exhibit safe-haven properties; instead, it experienced a crash-like decline due to its high-leverage structure.

2.4 Why is Bitcoin Still Falling?

In addition to structural dilemmas, Bitcoin's recent continued slump can be attributed to three deeper reasons:

1️⃣ The crypto ecosystem is struggling, losing business to AI. The construction of the crypto ecosystem is severely lagging. While the AI sector is frantically attracting capital, the crypto space is still playing with memes. There are no killer applications, no real demand, only speculation.

2️⃣ The shadow of quantum computing. The threat of quantum computing is not unfounded. Although true quantum cracking is still years away, this narrative has already deterred some institutions. Google's Willow chip has demonstrated quantum advantages, and while the Bitcoin community is researching quantum-resistant signature solutions, upgrades require community consensus, slowing the anti-quantum process but also making the network more robust.

3️⃣ OGs are selling off. Many early Bitcoin holders are exiting the market. They feel that Bitcoin has "changed"—from a decentralized idealistic currency to a speculative tool for Wall Street. After the approval of ETFs, the spiritual core of Bitcoin seems to have vanished. Institutions like MicroStrategy, BlackRock, and Fidelity are increasing their holdings, and Bitcoin's price is no longer determined by retail investors but by the balance sheets of institutions. This is both a blessing (liquidity) and a curse (loss of original intent).

III. In-Depth Analysis: The Historical Connection Between Bitcoin and Gold

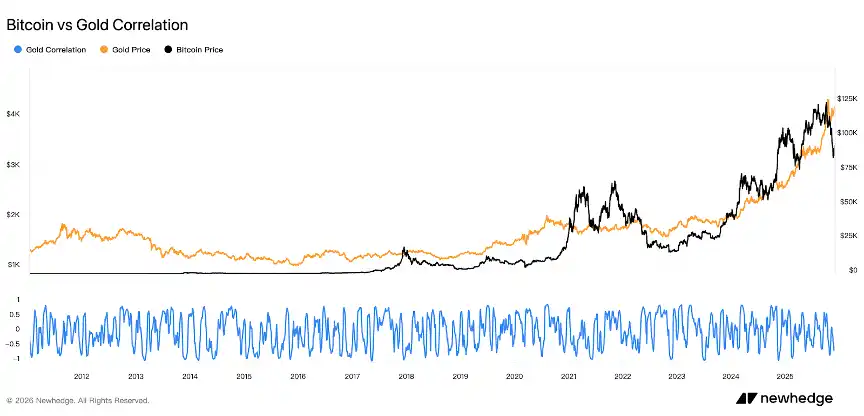

By reviewing the historical connection between Bitcoin and gold, we find that the price correlation between the two during significant economic events is quite limited, often diverging. Therefore, the term "digital gold" is repeatedly mentioned, perhaps not because Bitcoin truly resembles gold, but because the market needs a familiar reference point.

First, the linkage between Bitcoin and gold has never been a safe-haven resonance from the beginning. In its early days, Bitcoin was still in the nascent stage of geek circles, with negligible market capitalization and attention. During the banking crisis in Cyprus in 2013, when some capital control measures were implemented, gold prices fell sharply by about 15% from their highs; during the same period, Bitcoin soared to over $1,000. This was interpreted by some as capital flight and safe-haven funds flowing into Bitcoin; however, in hindsight, the surge in Bitcoin in 2013 was more driven by speculation and early sentiment, and its safe-haven properties were not widely recognized. That year, gold plummeted while Bitcoin surged, with a low correlation between the two—monthly return correlation was only 0.08, nearly zero.

Second, true synchronization only occurred during periods of liquidity flooding. After the pandemic in 2020, central banks around the world unprecedentedly flooded the market with liquidity, and investors became increasingly concerned about fiat currency over-issuance and inflation expectations, leading to a simultaneous strengthening of gold and Bitcoin. In August 2020, gold prices reached a historical high (surpassing $2,000), while Bitcoin broke through $20,000 at the end of 2020 and accelerated to over $60,000 in 2021. Many viewpoints suggest that during this period, Bitcoin began to exhibit "anti-inflation" properties akin to digital gold, benefiting from the loose monetary policies of various countries. However, it should be noted that it was essentially the loose environment that provided a common ground for the rise of both; Bitcoin's volatility is far higher than that of gold (annualized volatility 72% vs 16%).

Third, the correlation between Bitcoin and gold is long-term unstable, and the narrative of digital gold remains to be validated. Data shows that the correlation between gold and Bitcoin has long been volatile and overall unstable. Particularly after 2020, while the prices of both sometimes rose in sync, the correlation did not significantly strengthen and often exhibited negative correlation. This indicates that Bitcoin has not consistently played the role of "digital gold," and its movements are more driven by independent market logic.

Data Source: Newhedge

Through the review, it is evident that gold is a historically validated safe-haven asset, while Bitcoin resembles an unconventional hedging tool that only holds under specific narratives. When a crisis truly strikes, the market will still prioritize certainty over imaginative potential.

IV. The Essence of Bitcoin: Not Digital Gold, But Digital Liquidity

Let’s consider a different perspective: what role should Bitcoin actually play? Does it truly exist to become "digital gold"?

First, Bitcoin's underlying attributes determine that it is inherently different from gold. Gold is physically scarce, does not require a network, and does not depend on a system; it is a true doomsday asset. In the event of a geopolitical crisis, gold can be physically delivered at any time, making it the ultimate safe haven. In contrast, Bitcoin is built on electricity, networks, and computational power, with ownership relying on private keys and transactions depending on network connectivity.

Secondly, Bitcoin's market performance increasingly resembles that of a highly elastic tech asset. During periods of liquidity easing and rising risk appetite, Bitcoin often leads the charge. However, in the context of rising interest rates and heightened risk aversion, it can also be reduced by institutions. The current market tends to believe that Bitcoin has not yet truly transitioned from a "risk asset" to a "safe-haven asset"; it possesses both a high-growth, high-volatility adventurous side and a hedging side against uncertainty. This "risk-hedge" ambiguity may only be validated through more cycles and crises. Until then, the market still tends to view Bitcoin as a high-risk, high-reward speculative asset, associating its performance with tech stocks.

Perhaps only when Bitcoin demonstrates a stable value retention capability similar to gold can this perception truly be reversed. However, Bitcoin will not lose its long-term value; it still possesses scarcity, global transferability, and the advantages of decentralization. In the current market environment, its positioning is more complex, serving as a pricing anchor, a trading asset, and a speculative tool.

In summary: Gold is an inflation-resistant safe-haven asset, while Bitcoin is a growth asset with stronger yield attributes. Gold is suitable for preserving value during periods of economic uncertainty, with low volatility (16%) and a small maximum drawdown (-18%), serving as an "anchor" for assets. Bitcoin is suitable for allocation during times of ample liquidity and rising risk appetite, with an annualized return of up to 60.6%, but it also has high volatility (72%) and a maximum drawdown of -76%. This is not a choice of one or the other, but rather a combination strategy for asset allocation.

V. Summary of KOL Perspectives

In this round of macro repricing, gold and Bitcoin are playing different roles. Gold acts more like a "shield," used to resist external shocks such as war, inflation, and sovereign risk; while Bitcoin acts like a "spear," seizing value-added opportunities from technological changes.

OKX CEO Xu Mingxing @star_okx emphasizes that gold is a product of old trust, while Bitcoin is a new cornerstone of trust for the future; choosing gold in 2026 is akin to betting on a failed system. Bitget CEO @GracyBitget states that although market volatility is inevitable, the long-term fundamentals of Bitcoin remain unchanged, and he remains optimistic about its future performance. KOL @KKaWSB cites Polymarket prediction data, forecasting that Bitcoin will outperform gold and the S&P 500 in 2026, believing that value realization will come.

KOL @BeiDao98 provides an interesting technical perspective: the RSI of Bitcoin relative to gold has once again fallen below 30, a signal that historically has indicated an impending Bitcoin bull market. Notable trader Vida @VidaBWE approaches from the perspective of short-term capital sentiment, believing that after gold and silver lead a surge, the market is eager to find the next "dollar alternative asset," thus he has bought a small position in BTC, betting on the FOMO sentiment of capital rotation in the coming weeks.

KOL @chengzi_95330 proposes a grander narrative path. He believes that traditional hard assets like gold and silver should first absorb the credit shock brought by currency devaluation, and only after they fulfill their roles should Bitcoin enter the scene. This "traditional first, digital later" path may be the story currently unfolding in the market.

VI. Three Suggestions for Retail Investors

Faced with the differences in the price increases of Bitcoin, gold, and silver, the most common question from ordinary retail investors is: "Which one should I invest in?" There is no standard answer to this question, but we can provide four practical suggestions:

1. Understand the positioning of each asset and clarify the purpose of allocation. Gold and silver still have strong "hedging" properties during periods of macro uncertainty, making them suitable for defensive allocation; Bitcoin is currently more suitable for increasing positions when risk appetite rises and tech growth logic prevails, but be careful not to gamble on getting rich overnight with gold. If you want to hedge against inflation and seek safety → buy gold; if you want long-term high returns → buy Bitcoin (but be prepared for a -70% drawdown).

2. Do not fantasize that Bitcoin will always outperform everything. Bitcoin's growth comes from technological narratives, capital consensus, and institutional breakthroughs, not from a linear return model. It will not outperform gold, the Nasdaq, or oil every year, but in the long run, its decentralized asset attributes still hold value. Do not completely deny it during short-term drawdowns, nor blindly go all in during surges.

3. Build an asset portfolio and accept the reality of different assets playing roles in different cycles. If you have a weak perception of global liquidity and limited risk tolerance, consider a combination of gold ETFs and a small amount of BTC to cope with different macro scenarios; if you have a stronger risk appetite, you can also combine emerging assets like ETH, AI sectors, and RWA to build a more volatile portfolio.

4. Can gold and silver still be bought now? Be cautious about chasing highs, and prioritize buying on dips. From a long-term perspective, gold, favored by global central banks, and silver, which has industrial properties, still hold allocation value during turbulent cycles. However, in the short term, their price increases have been significant, and technically there is pressure for a pullback; the 3% drop in gold on January 29 is an example. If you are a long-term investor, consider waiting for a pullback to gradually buy in, such as gold below $5,000 and silver below $100; if you are a short-term speculator, pay attention to the rhythm and avoid jumping in at the peak of market sentiment. In contrast, although Bitcoin has performed poorly, if liquidity expectations improve in the future, it may present a window for low-position allocation. Paying attention to the rhythm and avoiding chasing highs and cutting losses is the core defensive strategy for ordinary people.

In conclusion: Understanding positioning is essential for survival!

Gold has risen, and no one will question Bitcoin's value because of it; Bitcoin has fallen, and it does not mean that gold is the only answer. In this era of reshaping value anchors, no single asset can meet all demands at once.

In 2024-2025, gold and silver will lead. But when looking back over 12 years, Bitcoin has proven its worth with a 213-fold return: it may not be "digital gold," but it is the greatest asymmetric investment opportunity of this era. Last night's sharp drop in gold may mark the end of a short-term adjustment or the beginning of a larger pullback.

However, for ordinary traders, what truly matters is understanding the role positioning behind different assets and establishing their own investment logic to survive through cycles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。