撰文:Bootly

加密货币托管机构BitGo( $BTGO)于美东时间1月22日正式敲响纽约证券交易所开市钟。

这家被视为加密资产「基础设施命脉」的公司以每股18美元完成IPO,开盘即冲至22.43美元,首日短线跳涨约25%,为2026年的加密企业上市潮打响头炮。

按照 IPO 发行价计算,BitGo 估值约为 20 亿美元。虽然这一数字远低于去年以近 70 亿美元估值上市的稳定币发行商Circle( $CRCL ),但作为今年首批上市的大型加密企业,BitGo 的表现也算稳健。

十年磨一剑:从多签先驱到机构门神

BitGo是继2025年多家加密公司成功上市后,最新一家尝试登陆公开市场的原生加密企业。

它的故事得从2013年讲起,那时的加密世界尚处于「蛮荒时代」,黑客攻击频繁,私钥管理如同噩梦,创始人 Mike Belshe 和 Ben Davenport 敏锐地察觉到,如果机构投资者要入场,他们需要的绝不是花哨的交易软件,而是「安全感」。

Bitgo 创始人 Mike Belshe

站在纽交所的敲钟台上,Mike Belshe 或许会想起十多年前的那个下午。

作为 Google Chrome 创始团队的前十号员工、现代网页加速协议 HTTP/2 的奠基人,Mike 最初对加密货币并不感冒,甚至怀疑它是个骗局。但他用了最「程序员」的方式去证伪:「我试着黑掉比特币,结果失败了。」

这次失败让他瞬间从怀疑论者变成了硬核信徒。为了给沙发底下那台存满比特币的旧笔记本电脑找个更安全的去处,他决定亲手为这个荒蛮市场挖掘一套「战壕」。

早期 BitGo 的办公室更像是一个实验室,当同期的 Coinbase 忙着获客、拉升散户交易量时,Mike 团队在研究多重签名(Multi-sig)的商业化可能。尽管他与 Netscape 的创始大佬及 a16z 掌门人 Ben Horowitz 私交甚笃,但他没有选择走「风投推手」的快车道,而是选择了最慢、也最稳的那条路。

2013年,BitGo 率先推出了多重签名(Multi-sig)钱包技术,这一技术后来成为了行业的标准配置。然而,BitGo 并没有止步于卖软件,它在战略上做出了一个关键选择:向「持牌金融机构」转型。

通过在南达科他州和纽约州获取信托牌照,BitGo 成功变身为「合格托管人」。这个身份在 2024 年和 2025 年的加密 ETF 浪潮中发挥了定海神针的作用。当贝莱德(BlackRock)等资管巨头推出比特币和以太坊现货 ETF 时,背后负责守卫资产安全、处理结算流程的,正是 BitGo 这样的底层服务商。

与Coinbase等交易所不同,BitGo 构建了一个稳固的「机构飞轮」:先用极致合规的托管锁死资产(AUM),再围绕这些沉淀资产,衍生出质押、清算和大宗经纪服务。

这种「基建先行」的逻辑,让 BitGo 在市场波动中展现出了惊人的韧性。毕竟,无论行情牛熊,只要资产还在「保险柜」里,BitGo 的生意就在持续。

10 倍市销率,底气何在?

翻看 BitGo 披露的招股书,其财报数据看起来很「唬人」。

由于美国 GAAP(通用会计准则)的要求,BitGo 必须将交易的全部本金计入营收。这导致其 2025 年前三季度的「数字资产销售」毛收入达到了惊人的 100 亿美元。但在成熟的投资者眼中,这些数字只是「过手钱」,并不能反映真实的盈利能力。

真正支撑其 20 亿美元估值的,是「订阅与服务」这一业务板块。

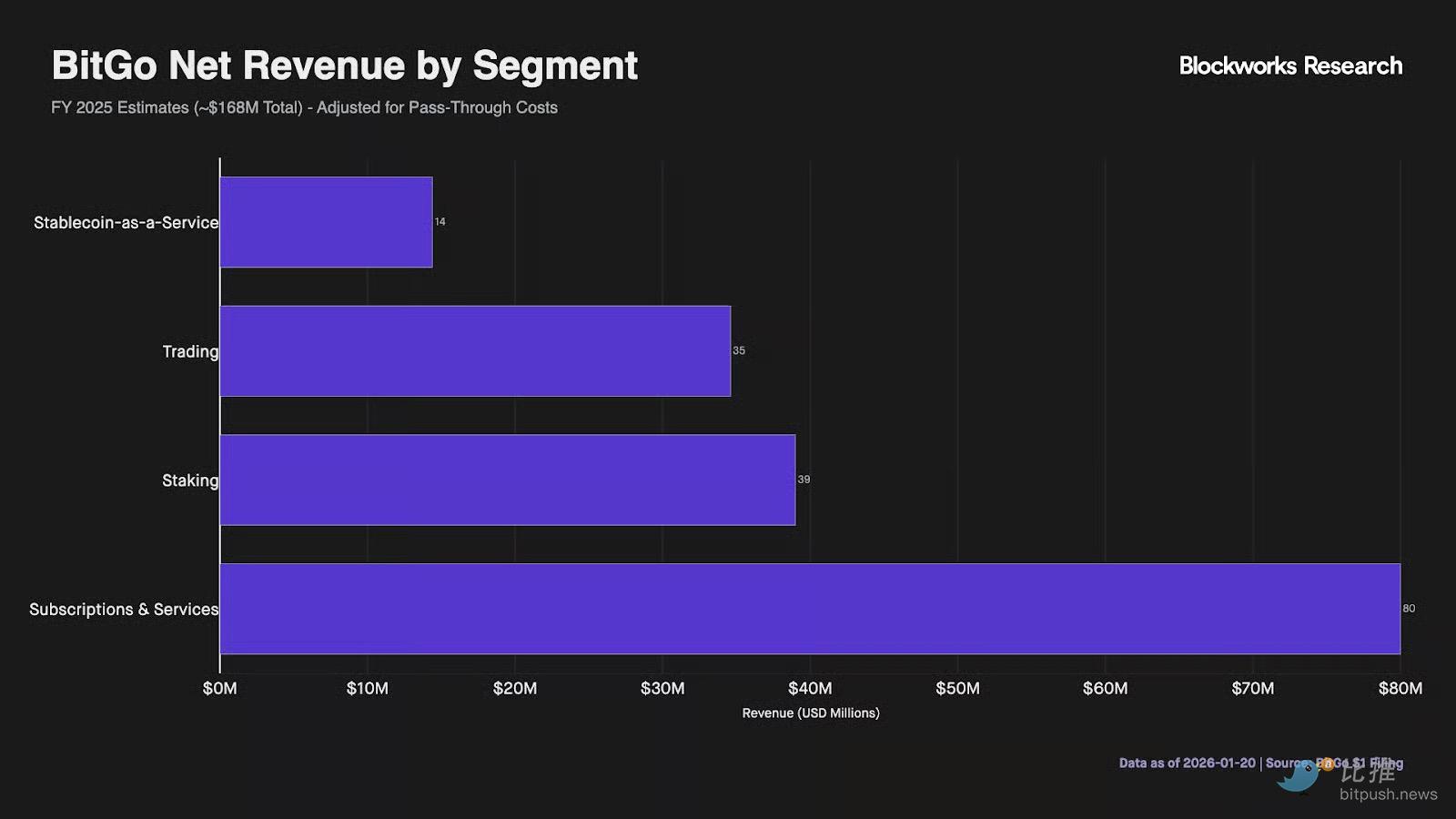

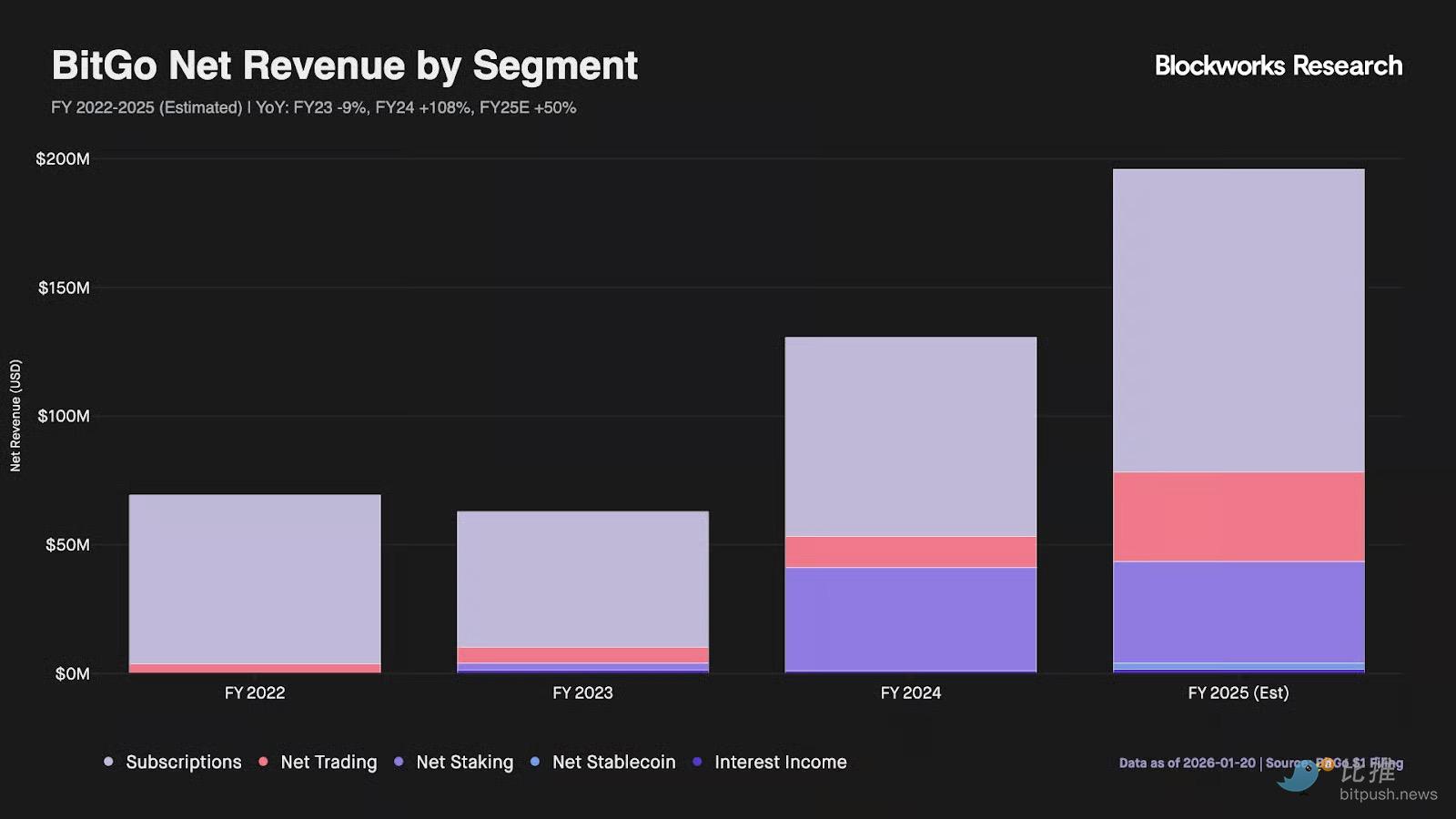

根据Blockworks Research的图表数据,BitGo 的核心经济收入(剔除掉代缴费用和 pass-through 成本)在 2025 财年预计约为 1.959 亿美元。其中,订阅业务贡献了绝大部分高利润的经常性收入,该业务以 8,000 万美元 的贡献了总净收入的近 48%。这部分收入主要来自 BitGo 对 4,900 多家机构客户收取的经常性费用。

此外,质押业务成为意外增长点。质押收入高达 3,900 万美元,排名第二。这反映了 BitGo 不再只是单纯的「保险柜」,而是通过在托管资产基础上提供增值收益,极大提高了资本的利用效率。

再看交易与稳定币业务,尽管交易流水在总营收中占比最高,但在调整后的净收入中仅占 3,500 万美元。

而新推出的「稳定币即服务(Stablecoin-as-a-Service)」贡献了 1,400 万美元,虽然起步不久,但已展示出一定的市场渗透力。

如果想看BitGo的真实估值,需对其纸面上的财务指标进行调整,若仅按其约160亿美元的GAAP收入计算,其估值显得极低(市销率约0.1倍)。但若剔除pass-through交易成本、质押分成及稳定币发行方支付等非核心项目后,其核心业务的护城河很深:

2025财年核心经济收入(估算):约1.959亿美元

隐含估值倍数:企业价值/核心收入 ≈ 10倍

这一10倍的估值倍数使其高于以零售业务为主的钱包类同行,溢价部分反映了其作为「合格托管机构」的监管护城河。说白了,在19.6亿美元的估值水平下,市场愿意为订阅业务的溢价进行买单,低利润率的交易与质押业务只是锦上添花。

VanEck研究总监 Matthew Sigel认为,相比绝大多数市值超过20亿美元却从未产生净利润的加密代币,BitGo的股权是更实在的资产。这门生意的本质是 「卖铲子」,无论市场牛熊,只要机构还在交易、ETF仍在运作、资产需要存放,它就能持续赚取手续费。这种模式在牛市中可能不如某些山寨币亮眼,但在震荡市和熊市中,它是「铁饭碗」。

更具象征意义的是其上市方式本身。 与其他加密公司 IPO 不同,BitGo 采取了更具「加密原生」色彩的方式:通过与 Ondo Finance 合作,在上市首日便将其股份在链上同步。

代币化后的 BTGO 股份将在以太坊(Ethereum)、Solana 和 BNB Chain 上流通,全球投资者可以几乎瞬时地接入这一刚上市的托管机构。代币化的 BTGO 股票未来可能作为抵押品,直接参与 DeFi 的借贷协议,打通 TradFi(传统金融)与 DeFi 通道。

小结

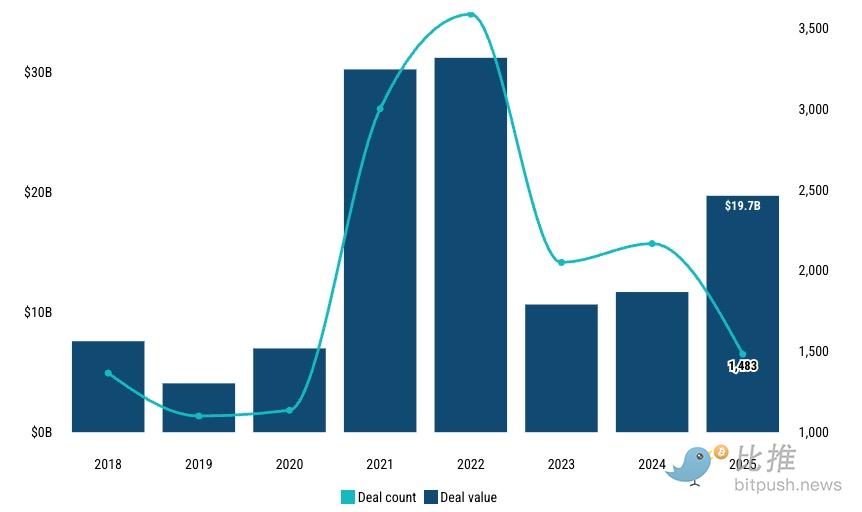

图源:PitchBook

回看刚刚过去的 2025 年,加密风投(VC)交易额激增至 197 亿美元,正如普华永道 IPO 专家 Mike Bellin 所言,2025 年完成了加密货币的「职业化改造」,而 2026 年将是流动性彻底爆发的一年。

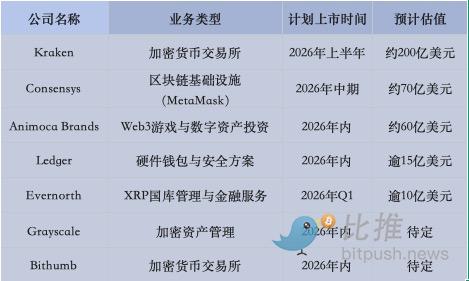

继 Bullish、Circle、Gemini 等先驱在 2025 年成功上岸后,加密公司上市已呈现出「基建化」与「巨头化」的双重特征。目前,Kraken 已向 SEC 提交保密申请,有望冲击年度最大crypto交易所 IPO;Consensys 正与摩根大通紧密协作,谋求以太坊生态的资本话语权;而 Ledger 也在自托管需求爆发的浪潮中,锚定了纽约证券交易所。

当然,市场从未摆脱宏观局面的波动,2025年部分公司上市即破发的记忆依然鲜活。但这恰恰说明行业正在成熟,资本不再为每一个好故事买单,而是开始挑剔财务健康、合规框架和可持续的商业模式。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。