在达沃斯论坛的聚光灯下,这位加密货币巨头指出,未来十年实体银行将急剧减少,而国家资产上链、加密支付与AI自主交易将成为行业新支柱。

2026年1月22日,币安创始人赵长鹏(CZ)在达沃斯世界经济论坛“金融新时代”小组讨论中发表了重要演讲。他指出,加密货币的交易平台和稳定币已成为大规模应用的成熟产业,而行业未来的三大方向是:国家层面的资产代币化、作为“隐形”支付通道的加密货币,以及使用加密货币作为原生货币的AI智能体自主交易。

CZ预测,随着加密技术和电子化KYC的普及,未来10年实体银行将显著减少。他同时坦言,由于各国监管政策差异巨大,建立统一的全球加密监管框架面临严峻挑战。

一、未来基石:CZ划定的三大战略方向

CZ在达沃斯的核心论断是,加密行业的基础设施已得到验证,未来的增长将集中在三个深度融合实体经济的领域。

● 国家资产代币化被置于首位。CZ透露,他正与超过12个国家的政府进行洽谈,探索将国有资产上链。这一进程已有实质性进展,例如巴基斯坦已计划将高达20亿美元的主权债务进行代币化。

在技术层面,美国纽约证券交易所(NYSE)也已确认正在搭建一个用于交易代币化股票和ETF的平台。

● 加密货币支付正从台前走向幕后,成为“隐形”的底层通道。CZ预见,加密货币与传统支付方式将在后台深度融合,推动支付业务大规模增长。这并非替代现有支付界面,而是提升其清算结算的效率与广度。

● AI智能体与加密经济的原生结合是颇具科幻色彩的远景。CZ认为,加密货币将成为AI代理的“原生货币”。未来,AI智能体在识别需求、处理任务后,可以绕过传统金融中介,直接使用加密货币进行支付和价值结算,实现完全的自动化商业闭环。

二、银行改革:传统金融基础设施的范式转移

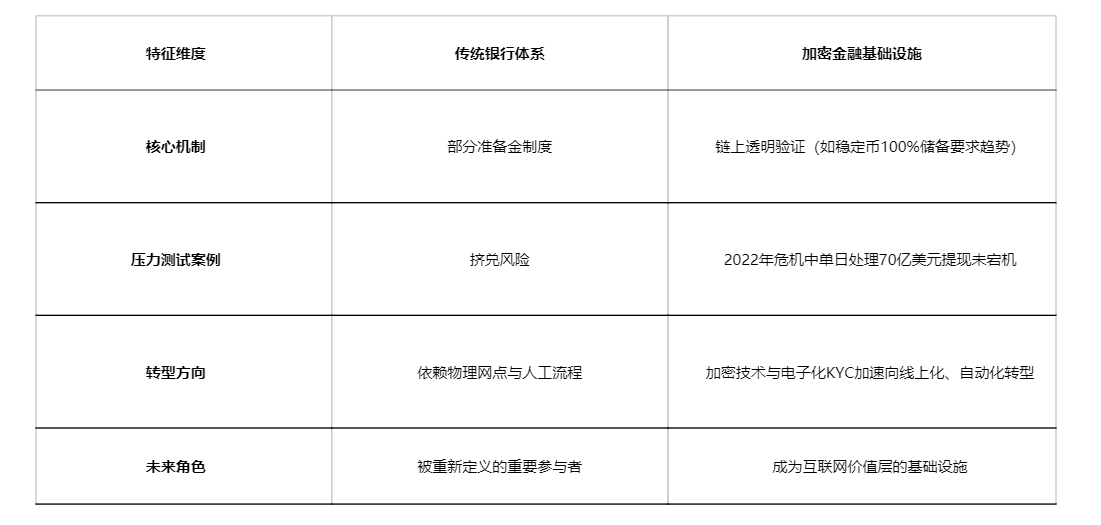

CZ在达沃斯对传统银行的未来做出了大胆预测,其核心论据建立在加密金融基础设施已通过的压力测试之上。

● 他回顾了2022年12月FTX暴雷后的市场恐慌。彼时,币安在一天内处理了约70亿美元的提现,一周内累计处理约140亿美元,期间未出现任何问题。他将此作为加密机构具备韧性的证明。

● CZ将银行风险的根本原因归咎于 “部分准备金制度” 的设计。相比之下,他暗示以稳定币为代表的加密资产遵循着更透明的储备规则。

● 他预测,ING银行推动的网上银行只是开端,加密技术和电子化KYC将加速这一转变。未来十年,人们将越来越不需要亲临实体银行。

这并非意味着银行消失,而是整个行业的形态将被重新定义。银行的核心账本系统可能通过与稳定币、代币化资产对接,以“低风险创新路径”实现升级,从而支持实时支付等新功能。

三、监管迷局:全球统一框架的理想与现实

CZ在指出行业光明前景的同时,也坦率承认了当前面临的最大系统性挑战——割裂的全球监管。

● 他直言,由于不同国家有着“不同的优先事项、不同的议程、不同的考量”,因此建立一个全球性的统一监管机构“相当困难”。这种差异在现实中体现为不同的监管取向。

● 例如,美国、香港、新加坡与欧盟、日本、韩国形成了两大重点取向不同的监管体制。而普华永道的报告指出,2026年全球监管趋势正从规则制定转向全面执法,清晰的框架将加剧各司法管辖区对加密枢纽地位的竞争。

● 尽管困难,CZ仍表达了建立有利于创新的积极全球监管框架的期望,认为这将极大简化行业参与者的工作。他正花费大量时间探索这一框架的形态,并努力与各国政府合作。

● 行业也在积极适应。例如,德勤报告指出,“资产分离保管” 和严格的反洗钱(AML) 要求,已成为全球发达经济体对虚拟资产服务提供商(VASP)的监管“基础套餐”。

四、行业激辩:Meme币狂热与理性未来

在达沃斯这个强调全球治理与可持续发展的场合,CZ对当前市场中的Meme币热潮发表了审慎看法,将其与过去的NFT和元宇宙热潮类比。

● 他明确指出这类资产具有极高风险和高度投机性。他认为,虽然像狗狗币这样具有独特文化价值的Meme币可能长期存在,但绝大多数Meme代币将无法持久。

● 这番表态与币安高层对行业趋势的整体判断一脉相承。币安联席首席执行官Richard Teng曾预测,2026年将是加密货币从实验阶段转向主流金融融合的关键一年。

● 这种融合意味着市场估值将更转向基本面因素,如实际应用价值、可持续经济性和合规性。Meme币的狂热,恰恰反衬出行业向价值支撑和应用落地回归的理性需求。

五、趋势共震:机构报告印证的发展主线

CZ的三大方向预测并非孤例,全球顶尖投资机构与专业服务机构的最新报告,从不同侧面印证了这些趋势的确定性。

顶级风投a16z在其发布的2026年加密领域趋势前瞻中,详细描绘了与CZ观点相呼应的未来图景。

● 在支付领域,报告指出稳定币年交易量已达约46万亿美元,接近Visa的3倍,核心挑战在于打通与日常金融体系的“出入金通道”。一批初创公司正致力于通过二维码、实时支付等方式整合区域网络,让数字美元直接用于日常消费。

● 关于AI智能体,a16z报告提出了 “从KYC到KYA(了解你的智能体)” 的深刻洞见。报告指出,AI智能体目前是“无法接入银行系统的幽灵”,未来需要通过加密签名凭证来建立其身份、约束和责任归属,这是智能体经济真正运行的前提。

● 德勤的报告则从会计与合规实务角度,揭示了资产代币化进入主流的另一面。随着美国GENIUS(稳定币创新)法案的通过,企业使用稳定币进行B2B转账交易量“疯狂暴涨”。

● 同时,企业如何在财务报表上确认和计量加密资产,已成为迫切议题。这看似技术的细节,恰恰是资产类别被传统金融体系真正接纳的标志。

当被问及Meme币的未来时,CZ在达沃斯给出了冷静的回应,他将当下的狂热与过往的NFT、元宇宙浪潮类比,明确指出绝大多数缺乏内在价值的Meme代币将昙花一现。

与此同时,纽约证券交易所正在构建代币化证券交易平台,a16z的报告则设想AI智能体将凭借加密凭证在链上自主完成价值交换。两个场景勾勒出一条清晰的轨迹:加密货币的叙事核心,正在从零售市场的投机符号转向重塑全球价值转移与金融基础设施的严肃工具。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。