Original Title: "Six Years Ago, 220,000 People's Hard-Earned Money from Dongguan Flowed into a U.S. Stock That Increased 38 Times"

Original Author: Lin Wanwan, Dongcha Beating

On January 19, 2026, Martin Luther King Jr. Day, the U.S. stock market was closed.

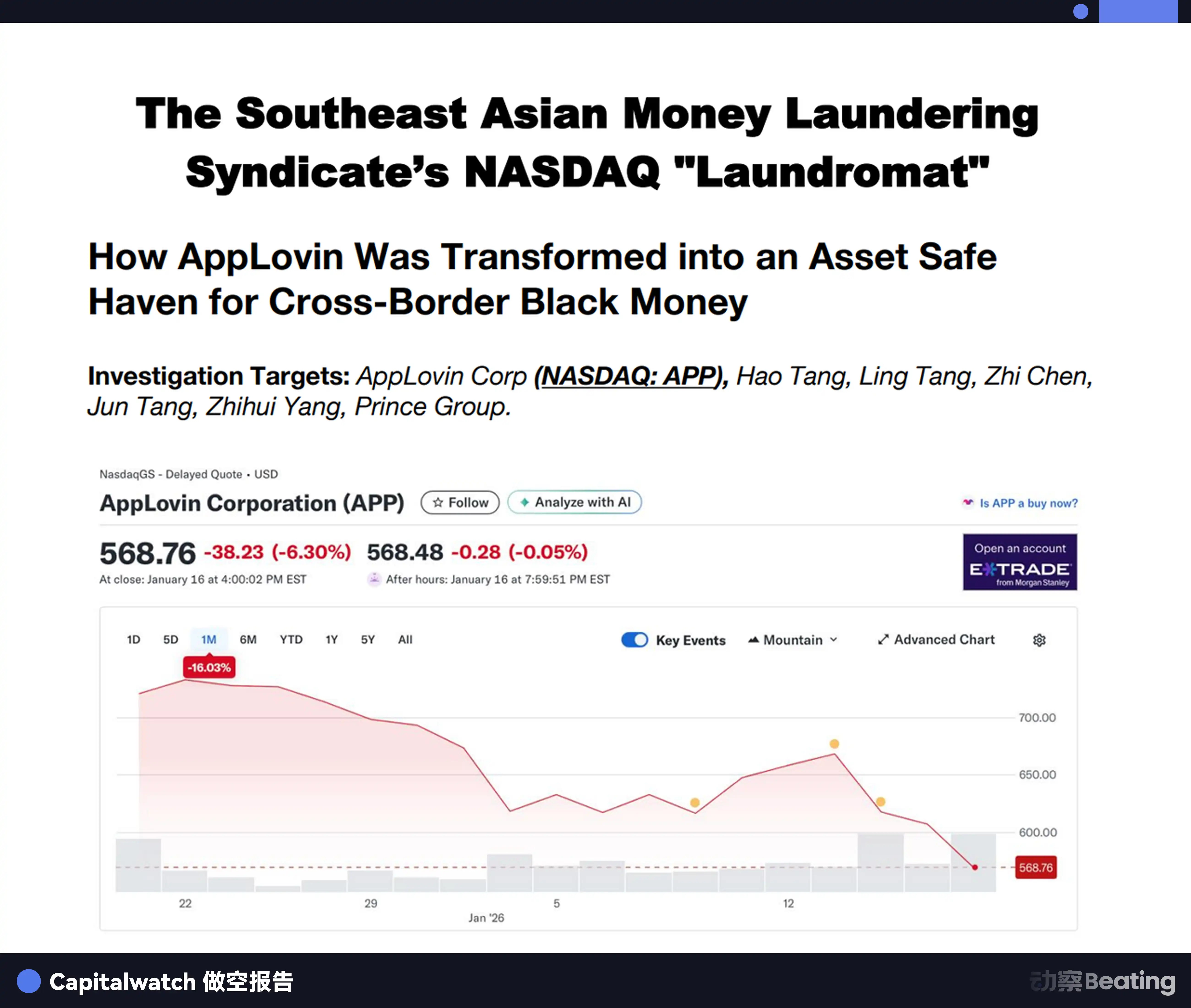

A 35-page short-selling report quietly went online. The title was shocking: "The Nasdaq 'Laundry' of Southeast Asian Money Laundering Groups."

The core conclusion of the report was just one sentence: "AppLovin is the ultimate milestone of new multinational financial crime in the 21st century."

The publisher, Capitalwatch, is an investigative agency focused on Chinese stocks listed in the U.S. Given their previous allegations of financial fraud against Nuohe Health, which ultimately led to its delisting in 2025, investors had reason to take this report seriously.

The next day, AppLovin's stock price fell 4.8% in pre-market trading. In the previous three trading days, the stock had already lost 15%.

Interestingly, three days later, the buying volume for AppLovin continued to increase, and bullish sentiment remained high.

This created a typical Rashomon scenario: the short-selling agency claimed it was a "false empire," while retail investors said it was "another case of extortion."

Who is telling the truth?

1. Accusation: Advertising is Money Laundering

Capitalwatch's report identified three key figures.

The first is Hao Tang, one of the main shareholders of AppLovin.

The report accused him of having wealth that includes approximately $957 million related to illegal gains from the collapse of the Chinese P2P platform Tuandaiwang, as well as about $2.15 billion in funds related to gambling. Capitalwatch described him as a "fugitive from justice" and claimed that "every dollar of his equity is soaked in the blood and tears of victims of illegal fundraising."

The second is Ling Tang, who holds about 20.49 million shares of AppLovin through Angel Pride Holdings, accounting for 7.7% of the company, making her one of the largest individual shareholders. The report claimed she is Hao Tang's sister, and her holdings are "a key component of the Tang family's money laundering network."

The third figure is the most critical: Chen Zhi, the founder of the Prince Group in Cambodia. In October 2025, the U.S. Department of Justice charged him with operating forced labor scam camps and engaging in "pig-butchering" cryptocurrency fraud. On the same day, the Department of Justice announced the seizure of approximately $15 billion in Bitcoin, the largest asset seizure in U.S. history. On January 7, 2026, just 12 days before the report was released, Chen Zhi was arrested in Cambodia and deported.

The report attempted to prove that these three individuals formed a money laundering network spanning China, Cambodia, and the U.S. And AppLovin was the terminal outlet that ultimately "whitened" the dirty money.

The core accusation is a system referred to as the "Mobius Loop": criminal groups pay AppLovin for advertising through intermediaries, converting dirty money into legitimate income.

The specific operation method is as follows: the Cambodian super app WOWNOW's advertising spending on AppLovin is severely disproportionate to its market size, and this excessive advertising spending is essentially the "service fee" for money laundering.

The Prince Group opened advertiser accounts through shell companies, paying hundreds of millions of dollars to purchase traffic. AppLovin recognized this income as legitimate revenue in its financial reports and then settled it to overseas accounts controlled by the Prince Group in the form of "developer revenue sharing." At this point, the scam funds had been converted into legitimate remittances from a Nasdaq-listed company.

The report also accused AppLovin's technology of becoming a tool for crime. The "silent installation" mechanism allegedly allows applications to implant themselves on devices without user consent. The AXON algorithm was accused of helping distribute gambling and scam applications, precisely targeting vulnerable users.

If these accusations are true, it means that a significant portion of AppLovin's astonishing performance growth over the past few years comes from "unsustainable money laundering budgets of criminal groups."

But the question is: how astonishing are the company's results?

2. Myth: The AI Darling That Increased 700% in a Year

To understand the impact of this short-selling report, one must first grasp the capital market myth that AppLovin has created over the past three years.

In 2025, AppLovin's stock price rose by 108%. In 2024, this figure was even more exaggerated, exceeding 700%, with a market value that once surpassed $140 billion.

From the lowest point in 2022, AppLovin increased by 38 times. During the same period, Nvidia increased 10 times, Bitcoin 6 times, and gold less than 1 time.

The company was founded in Silicon Valley in 2011, initially as a platform to help mobile developers acquire users and monetize. In 2018, it acquired the advertising intermediary platform MAX, and in 2020, it launched the AI-driven advertising optimization engine AXON. It went public on Nasdaq in 2021, but its performance was mediocre in the first two years.

The turning point occurred in 2023. After AXON was upgraded to version 2.0, its effectiveness surged. Just as Apple's iOS 14 privacy policy severely impacted the entire mobile advertising industry, causing Meta to lose hundreds of billions in market value, AppLovin rose against the trend. Wall Street began to rediscover the company, labeling it as a "beneficiary of AI."

By the third quarter of 2025, the company's revenue grew by 68% year-on-year to $1.4 billion, the second-highest quarterly growth rate in the past four years; net profit increased by 92% to $836 million.

In July 2024, the company sold the game studio Tripledot Studios for $800 million, completely transforming into a pure advertising technology company. A month later, it increased its stock buyback plan by $3.2 billion and joined the S&P 500 index.

From an obscure mobile advertising company to a component of the S&P 500 and an AI concept darling, AppLovin achieved this transformation in less than two years.

However, the doubts never ceased. In February 2025, Fuzzy Panda and Culper Research simultaneously announced short positions, accusing AppLovin of "systematic abuse of application permissions." In March 2025, Muddy Waters joined the fray, claiming that 52% of e-commerce conversions came from retargeted users, with incremental value only between 25%-35%.

With each short-selling attempt, the stock price briefly dipped, then continued to rise.

Until Capitalwatch's report. It no longer entangled itself in technical details or financial metrics but directly pointed to a more fatal question: where does the company's money come from?

To answer this question, we need to turn back the clock seven years to Dongguan, China.

3. Source: The Collapse of Tuandaiwang and "Sister's" 5.3 Million

On March 27, 2019, Dongguan, China.

Tuandaiwang's founder Tang Jun and co-founder Zhang Lin surrendered to the police. This company, once a top P2P platform in China, collapsed overnight.

Tuandaiwang was established in 2012 and facilitated over 130.7 billion RMB in online lending business at its peak. Tang Jun himself was an entrepreneurial star, serving as a mentor at a startup incubator in Dongguan, often teaching young people how to start and finance a company. His company, Derivative Technology, was listed on the Shenzhen Stock Exchange, with a market value that once exceeded 20 billion RMB.

Then, in the summer of 2018, the Chinese P2P industry faced a "thunderstorm." Regulatory tightening, liquidity depletion, and bank runs spread, leading to the collapse of hundreds of platforms within months.

The police acted swiftly, arresting 41 individuals involved, freezing 3.1 billion RMB in bank accounts, 35 properties, one airplane, and 40 vehicles. Investigations revealed that Tang Jun and Zhang Lin attempted to transfer and hide assets before the incident, and over 880 million RMB of hidden funds were subsequently recovered.

At the time of the collapse, Tuandaiwang had about 220,000 active lenders, with a total loan amount of 14.5 billion RMB. Most of these individuals were ordinary families lured by high interest rates, and their savings vanished overnight.

In 2022, the court ruled: Tang Jun was sentenced to 20 years in prison and fined 51.5 million RMB.

The case was closed, but where did the money go? There was a significant gap between the recovered assets and the investors' losses.

Capitalwatch's report claims that part of the answer lies in a 2021 extradition hearing in Bordeaux, France.

That year, a man named Hao Tang flew from Iceland to France on a private jet and was arrested at the airport. An extradition request was immediately made. However, the Bordeaux Court of Appeal ultimately rejected the extradition on the grounds of "political exception," determining that although the request was ostensibly based on money laundering charges, it actually had political motives, as Hao Tang's defense team argued that he was involved in a high-level political case.

Hao Tang regained his freedom. But the court's ruling unexpectedly revealed a chain of evidence for money laundering.

The ruling showed that during the critical window period before the collapse of Tuandaiwang, from February 2018 to March 2019, Hao Tang used a network of shell companies to assist Tang Jun in transferring 632.89 million RMB of illegal funds. The money laundering methods included disguising funds as "aircraft custody fees," 27 labyrinthine cross-border transfers, and using underground banks to "match trades" to evade foreign exchange controls.

The court did not deny the facts of these fund transfers.

The ruling also revealed a key detail: judicial audits found that approximately 5.3 million RMB was transferred to a company account controlled by Hao Tang's "sister."

This clue later led Capitalwatch to AppLovin's shareholder list.

The report cross-referenced SEC documents and found that Ling Tang held 7.7% of AppLovin through Angel Pride Holdings. SEC documents showed her communication address in Hong Kong's Kowloon, Changsha Bay, Yongkang Street, was in the same neighborhood as Hao Tang's reported address, and there was physical overlap in their office addresses in early business registrations.

The report's conclusion was: "There is ample reason to conclude that Ling Tang is Hao Tang's sister, and the shares worth billions of dollars held by Angel Pride Holdings are a key component of the Tang family's money laundering network."

But Tuandaiwang was just the "original accumulation" of funds. To complete the entire money laundering loop, another key node was needed.

This node is in Phnom Penh, Cambodia.

4. Under Currents: The Industrialization of Pig Butchering and the $15 Billion Seizure Case

Chen Zhi, a mysterious tycoon born in Fujian and later naturalized in Cambodia. Over the past decade, he has built the Prince Group into Cambodia's largest business empire, with operations spanning banking, aviation, and real estate.

However, according to court documents from the U.S. Department of Justice, beneath this glamorous business landscape lies another world. Since 2015, Chen Zhi and his executive team have "secretly developed the Prince Group into one of Asia's largest multinational criminal organizations."

The indictment paints a shocking picture: the Prince Group operates multiple forced labor scam camps in Cambodia, "housing large dormitories surrounded by high walls and barbed wire, functioning like violent forced labor camps."

The labor force within the camps is mostly foreign individuals lured by high-paying jobs; once inside, their passports are confiscated, and they are forced to work over ten hours a day under the watch of armed guards, engaging in "pig-butchering" scams. Chen Zhi himself directly participated in the use of violence against individuals within the camps and possesses photos depicting beatings and other forms of torture.

By 2018, the Prince Group was profiting over $30 million daily from these fraudulent activities.

In October 2025, the U.S. Department of Justice announced the seizure of approximately $15 billion in Bitcoin, the largest asset seizure in U.S. history. On the same day, the Treasury Department designated the Prince Group as a multinational criminal organization, imposing sanctions on Chen Zhi and over 100 related individuals and entities.

On January 7, 2026, Chen Zhi was arrested in Cambodia and subsequently deported for investigation. The Cambodian Ministry of Interior confirmed that his Cambodian nationality had been revoked.

Capitalwatch's report attempts to establish a connection between Hao Tang and Chen Zhi. The report points out that at the end of 2018, just before the Tuandaiwang crisis, a change of control occurred at the Hong Kong-listed company Geotech Holdings, with the sole shareholder of the acquiring BVI company being Chen Zhi. The report argues that the operational overlap during this time window proves the collaborative relationship between the two in the money laundering network.

The key link connecting both to AppLovin is the Cambodian super app WOWNOW.

In May 2022, Prince Bank established a payment partnership with WOWNOW, fully integrating the underlying payment system. WOWNOW claims to serve over 800,000 users and connect with over 13,000 merchants.

But in a country with a population of only 16 million, why would such a local lifestyle app need to invest a massive budget on a U.S. advertising platform?

The report's answer is: this advertising expenditure is essentially a money laundering channel.

5. Rashomon: Who is Telling the Truth?

The accusations are serious, but AppLovin is not without its defense space.

CEO Adam Foroughi has initiated an independent investigation into the activities of the short-selling agency, insisting that these accusations are "false and misleading," driven by "the personal economic interests of individuals profiting from short-selling."

There is also another rational perspective to consider: "Anything is possible. But if I were to assume I needed to launder a large sum of money, I probably wouldn't try to do it through a publicly listed entity registered in the U.S., which is subject to more regulatory scrutiny than an ordinary global company."

This is a thought-provoking counter-question. A Nasdaq-listed company is regulated by the SEC, undergoes audits by the Big Four, faces due diligence from institutional investors, and is targeted by short-selling agencies. Conducting large-scale money laundering in such a transparent environment requires not only courage but also an extremely sophisticated system.

There are also different interpretations regarding the French court's ruling. The court's refusal to extradite Hao Tang was based on the "political exception" clause, rather than denying the facts of money laundering. Does this prove his innocence, or does it merely indicate that he successfully exploited a legal loophole?

As of January 21, 2026, several key questions remain unresolved.

What is the actual advertising expenditure of WOWNOW on AppLovin? This is the core verifiable point of the entire "advertising is money laundering" accusation. The SEC has been investigating AppLovin's data collection practices since October 2025; is there any overlap between this investigation and Capitalwatch's allegations? After Chen Zhi's deportation, if he confesses to financial transactions with Hao Tang, will it trigger further scrutiny of AppLovin's shareholder structure by U.S. regulatory agencies?

Currently, AppLovin's short interest is about 5%, indicating that investors remain cautious. The company is set to announce its fourth-quarter results in February.

Capitalwatch's final conclusion is: this is an "empire built on quicksand," its foundation "buried under the tears of Tuandaiwang victims and the sweat of Southeast Asian park workers."

Whether this judgment is correct will be answered by time. However, the questions raised by the report regarding shareholder backgrounds, sources of funds, and compliance reviews are indeed worthy of serious consideration by the market and regulatory agencies.

The capital market has never lacked myths. Every few years, a company rises at an astonishing speed, its stock price soars, and its valuation breaks the imagination, with analysts scrambling to endorse it with the most extravagant language. In this process, skeptics are often seen as "outdated individuals who don't understand the new paradigm," until one day, the tide recedes.

Will AppLovin be the next myth to be debunked, or will it be another failed attempt by short-selling agencies? No one knows. But one thing is certain: in a market where everyone is shouting "AI revolution," there are still those willing to ask, "Where does the money come from?" This in itself is a rare form of clarity.

For every investor, perhaps the most important lesson is not to take sides but to learn to remain vigilant amid the revelry. When a stock rises 700% in a year, and everyone is discussing how advanced its technology is and how magical its algorithms are, perhaps we should also ask a few more fundamental questions: Who are the major shareholders of this company? Where does their money come from? Is this money clean?

After all, in the world of capital, the most expensive cost is never missing out on a tenfold stock but forgetting that the dealer is always sitting across the table during the frenzy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。