Original Title: Polymarket's eye-watering brush with the 1958 Onion Futures Act

Original Authors: George Steer and Anna Nicolaou, Financial Times

Translated by: Peggy, BlockBeats

Editor’s Note: As the Golden Globe Awards red carpet increasingly resembles a "carefully orchestrated traffic business," the biggest novelty this year is that it is sponsored by the prediction market Polymarket. This article traces the historical origins of the "Onion Futures Act" and the ban on box office futures through this collaboration, revealing how prediction markets navigate regulatory boundaries through dual platforms in the U.S. and offshore.

The following is the original text:

The Golden Globe Awards ceremony held on Sunday was, as always, a mix of tired old jokes and political performances. The only fresh element this year was that this "show" was sponsored by the betting site Polymarket.

For the dozens of viewers at home glued to the live broadcast, Polymarket's presence as the ceremony's "exclusive prediction market partner" was almost impossible to ignore:

"Our partnership with Polymarket has opened up a groundbreaking new frontier, redefining the way audiences interact and connect with the content they love," said Craig Perreault, President of Penske Media Corporation. © Golden Globe Awards

How did it come to this?

In 2023, following a series of scandals, the Golden Globe Awards were sold by the Hollywood Foreign Press Association to a joint venture formed by sports mogul Todd Boehly's Eldridge Industries and Penske Media.

By then, Jay Penske (whose father amassed a fortune through motorsports) had acquired multiple media assets, including Hollywood's most important industry publications. This meant that Penske now controlled not only the Golden Globe Awards but also the major media outlets reporting on the awards, such as Variety, The Hollywood Reporter, and Deadline, which clearly raised questions about the fairness of reporting and promotion.

In the Sunday night television broadcast, the traces of "Penske's takeover" were evident: there was a skit in the program where "security" protected the stars of "Heated Rivalry," which was essentially an advertisement for the UFC, coincidentally in partnership with CBS, the broadcaster of the Golden Globe Awards.

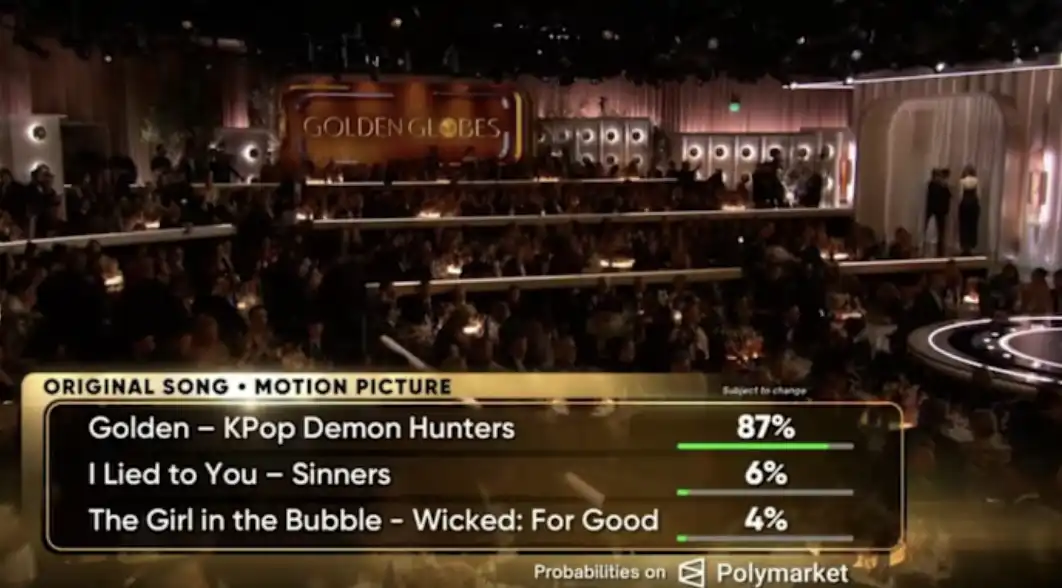

But that wasn't all. In a red carpet pre-show led by Variety, senior writers Angelique Jackson and Marc Malkin repeatedly urged viewers to "submit your predictions," while a scrolling chyron at the bottom of the screen continuously displayed Polymarket's probability predictions for various award outcomes.

The real "fun" happened on Polymarket's website: ultimately, the betting on "who will win Best Picture" approached $250,000. Another contract betting on "what will be mentioned during the ceremony" included options like "Venezuela/Maduro" (not mentioned), "Jesus" (mentioned), and "Epstein" (not mentioned), attracting $86,000 in bets.

However, what caught our attention more were several other film-related contracts on Polymarket.

For instance, betting on how much "Greenland 2" or the latest "Avatar" would earn at the box office before the end of January seemed harmless. But you wouldn't see similar bets on Polymarket's U.S. regulatory counterpart Kalshi, and there are good reasons for that, rooted in the 1955 incident of market manipulation in the U.S. onion market.

The Onion Incident

Vincent Kosuga, born in New York, was an amateur pilot who reportedly carried a baton with him wherever he went. He began trading onion futures on the Chicago Mercantile Exchange in the late 1940s or early 1950s and quickly became an expert.

By the end of 1955, Kosuga and his business partners held about 1,000 carlots of onions, with each carlot containing 600 bags, each bag weighing 50 pounds, of "spot" onions, which are vegetables ready for delivery through the spot market. According to an extremely detailed record from the U.S. Commodity Futures Trading Commission (CFTC) released five years later, this inventory accounted for an astonishing 98% of the deliverable onion supply in Chicago.

A summary from Sherwood Financial Partners describes how Kosuga then sat down with other onion growers and told them that unless they collectively agreed to raise onion prices, he would flood the market with onions. The other growers/shippers agreed and began purchasing Kosuga's inventory at these inflated prices.

After discovering another market opportunity, Kosuga and his partners quickly established short positions on a large number of onion contracts.

Then, they broke their promise and dumped all the onions stored in various local warehouses into the market. At one point, onion prices plummeted to the point where the canvas bags containing the onions were worth more than the onions themselves. The situation deteriorated to the extent that entire truckloads of onions were dumped into the Chicago River.

The losses from this incident were so significant that Congress held hearings in the summer of 1956 to discuss whether to ban onion futures trading altogether. The Onion Futures Act, signed into law two years later, indeed did just that.

History turned into legend, and legend into myth. For the next 52 years, onions became the only commodity in the U.S. banned from futures trading.

All of this changed in 2010: under the lobbying of the Motion Picture Association of America, the ban on onion derivatives was amended to include a new provision prohibiting any futures trading based on box office revenue—arguing that betting on a film's box office performance could influence whether audiences would go see the movie and incentivize studios to engage in various "manipulations."

Today, this law stipulates that anyone caught trading "contracts for the sale of box office revenue (or any index, measure, value, or data related to that revenue), or contracts for future delivery of onions," will be fined "not more than $5,000" upon conviction.

Of course, what Polymarket offered during the Golden Globe Awards were event contracts related to award outcomes, which do not involve box office revenue, so there was no issue.

However, some other film-related contracts on Polymarket—such as betting on "Avatar," "Greenland 2," and other films' box office revenue before a certain point in time—did not appear in the awards ceremony television broadcast and could potentially cross the red line of the 2010 amended provision at first glance.

So, why can Polymarket still offer such bets? As always, the answer lies in its offshore operations.

Keep Your Onions

Although Polymarket received permission from the CFTC last year to re-enter the U.S. market, the version currently operating in the U.S. is a limited site, primarily focused on relatively "harmless" events, such as sports results or which country Trump might "acquire" next.

The provisions in the Dodd-Frank Act prohibiting futures contracts based on box office revenue remain in effect. However, by providing two different platforms for U.S. users and non-U.S. users, Polymarket is able to comply with the regulatory boundaries of different jurisdictions.

Therefore, bets related to the box office of "Avatar" or "Greenland 2" can only appear on Polymarket's main site, which is the version not subject to U.S. regulatory constraints. U.S. gamblers are blocked from accessing that platform to comply with the CFTC's order issued in 2022: at that time, Polymarket paid a $1.4 million fine and agreed to stop providing certain services to U.S. customers while shutting down non-compliant markets.

"It's a bit like that common disclaimer: 'Void where prohibited by law,'" said lawyer and former Wall Street regulator Bill Singer. "If Polymarket accepts bets from U.S. customers, it looks illegal until the company provides a strong clarification."

Polymarket did not respond to requests for comment. A knowledgeable source indicated that Kalshi neither offers box office futures nor onion derivatives.

FTAV plans to sail into international waters and start trading these two types of contracts, regardless of how much VPN manipulation occurs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。