原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

作为开年以来仍在持续上涨的热门赛道,预测市场不缺少造富奇迹。

但奇迹背后,是凭借审时度势、闪转腾挪而实现的真实奇观,还是人为造假、混淆视听的虚假炒作,就需要看客拥有一双分辨真假的慧眼了。近日,X 上一位 Polymarket 交易员发文称自己实现了一场“8300 倍奇迹”,从 12 美元本金一路押注活力超 10 万美元,但旋即被人揭发称其多账号造假、流量炒作;而另外一位交易员则凭借对 XRP 的价格操纵,在“15 分钟预测涨跌”板块豪取 23 万美元,对 Polymarket 上的押注机器人实现了一次单向收割。

在押注正反的舞台上,有人想要借助谎言翩翩起舞,也有人利用规则漏洞巧取豪夺,在正反是非的赌局中,没有不败的战法,只有灵活的策略。

从 12 美元到 10 万美元的 8300 倍奇迹:Polymarket 活招牌 VS 交易员造假局

故事的开始,还要从一篇“自述从 12 美元本金一路搏杀到 10 万美元利润、实现 8300 倍收益”的帖子说起。

1 月 16 日,交易员 ascetic 发文表示,通过“在比特币短期波动中的孤注一掷”,连续 16 次将本金翻倍,最终,实现了从 12 美元到 10 万美元利润的里程碑式成就。同时,其强调,押注过程中“还具体分享了自己的投注策略和背后原因”。

随后,其在评论区放出了自己的 Polymarket 账号链接,并直言这样的造富奇迹只有在 Polymarket 得以上演(Odaily星球日报 注:是不是感觉似曾相识?之前的交易员们使用类似表述的平台包括但不限于 OpenSea、Blur、Pump.fun、Hyperliquid、Aster 等等)。

评论区随后上演了一场“ Polymarket 社区成员的鸡血式狂欢”,无数人对其表示祝贺,甚至 Polymarket 全球增长负责人 LeGate 发言表示:“恭喜你,兄弟!我觉得你实至名归!恭喜你获得 @PolymarketTrade 徽章!”(Odaily星球日报 注:该账号为 Polymarket 活跃交易员社区账号.)

如果你以为,这会是一个常规的“一夜暴富式炫耀推文”的话,那么你可能低估了事情的抓马程度。

很快,这场“Polymarket 上的 8300 倍回报奇迹”事件的风向迎来急转直下。

从押注奇迹到造假骗局:8300 倍回报数据遭质疑

1 月 16 日当天,自称“Polymarket 2025 年交易排名第 515 位”的交易员 Moses 发文对交易员 ascetic 的账号数据表示质疑称:“你有没有想过为什么他在第一篇帖子中的账户余额有 3000 美元?答案很简单:他运营着一个庞大的“女巫农场”。他并非从 12 美元起步,而是从数百个账户开始,每个账户都投入了 10 到 20 美元。一旦其中一个账户的资金达到 2900 美元,他就开始发布信息。从那以后,他进行了七笔交易,全部获胜。

但请注意,他每次都押注全部资金。真正的交易员不会这样做。他只是在追逐名利,为了达到目的不择手段。

由于未能获得足够的成交量,他甚至似乎还利用其他账户进行虚假交易,以达到他想要的价格成交。

在盲目相信‘网红’之前,请务必自行调查。附图展示了他的一些失败的女巫账户,这些账户最多只赚到了 1000 美元。”

随后,Moses 在评论区补充到,所有账户均创建于 7 个月前,并持续参与随机市场,所有账户均于 2 个月前的同一天开始参加相同的挑战。整个“10 美元到 10 万美元”的说法都是假的!

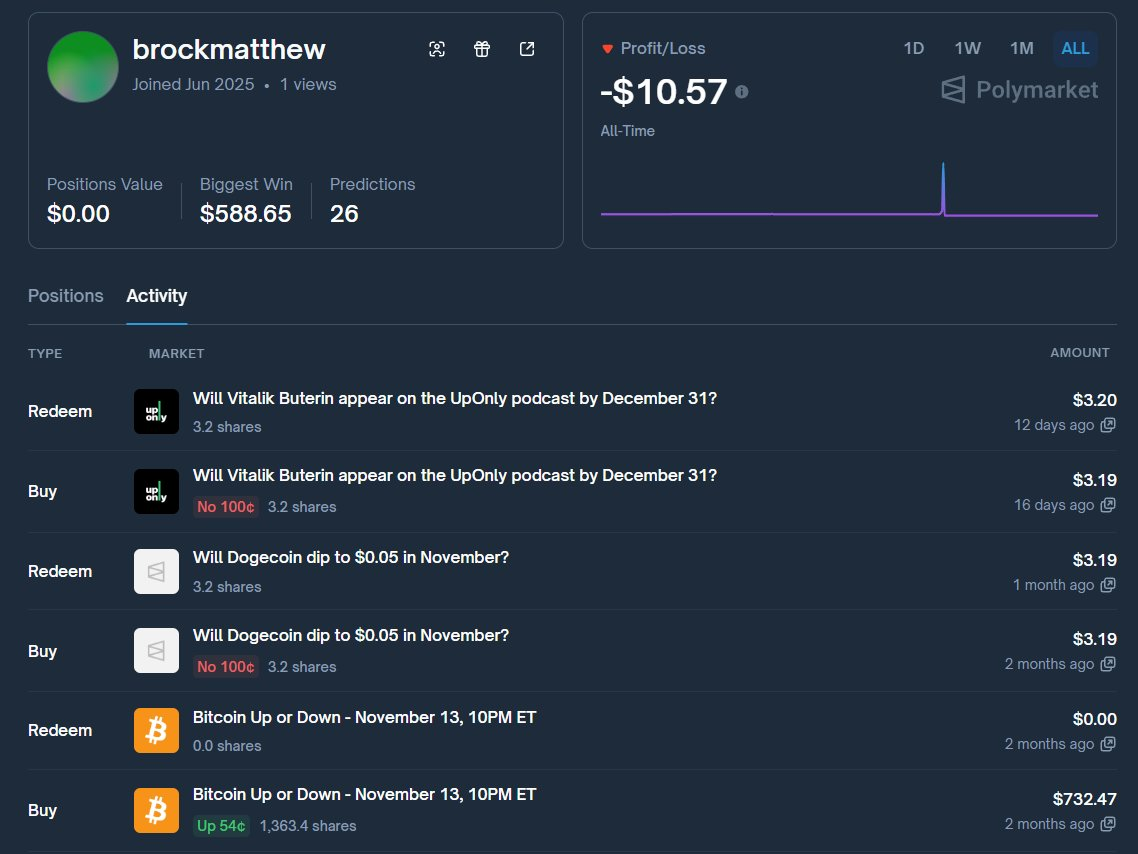

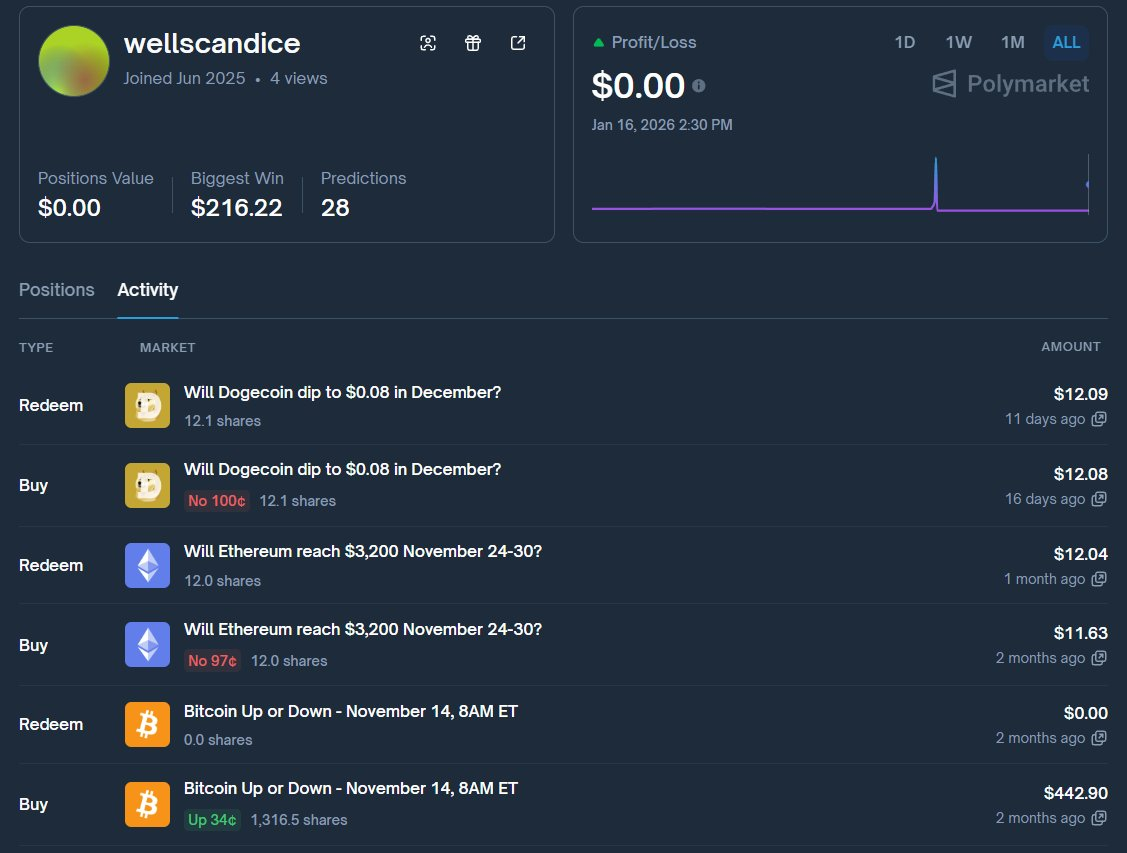

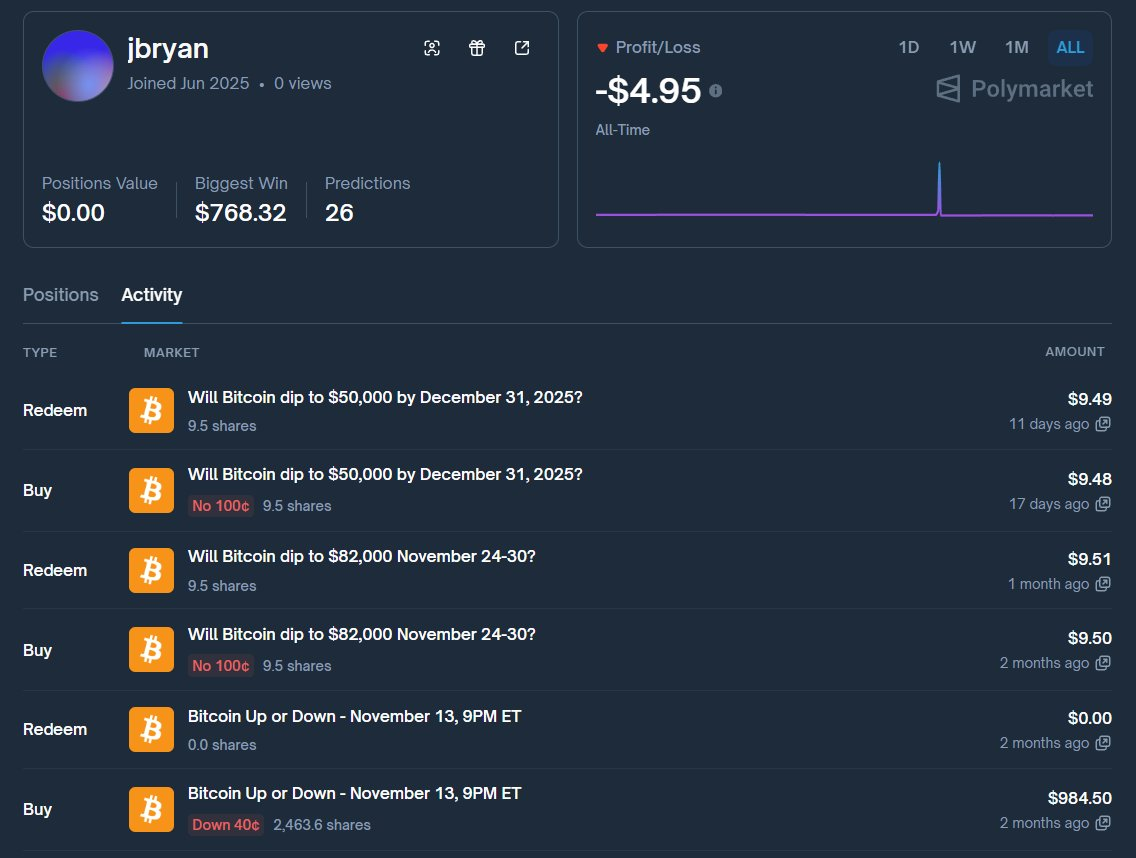

不仅如此,他还贴出了对应女巫账号的主页截图及链接:

- 账号一:https://polymarket.com/@brockmatthew;

- 账号二:https://polymarket.com/@wellscandice;

- 账号三:https://polymarket.com/@jbryan。

尽管 ascetic 随后于评论区回应称 Moses 提及的钱包及账号与自己无关,且部分 ZSC DAO(Polymarket 某交易员社区)成员也对其予以声援,称 Moses 这是网络攻击行为,但 ascetic 此前推文的机器人回复内容与其 Polymarket 账号与诸多行为轨迹类似的账号之间存在的关联还是让这场“8300 倍回报奇迹”的可信度大打折扣。

评论区也有人提到,难以理解其这样做的原因,因为“连续 7 次押注成功”本身已经是一件很牛的事情了;但随后有人指出,这还是一场“机器人式广撒网的游戏”。

当然,或多或少有些讽刺的是,Moses 的个人简介也写着自己“从 1 美元到 100 万美元之路”的标签,至于是真实战绩,还是个人目标,我们不得而知。

与难以判断真假的 ascetic 相比,下面这位在 XRP “15 分钟涨跌押注市场”中通过价格操纵实现 23 万美元盈利的案例或许更值得巨鲸玩家们研究。

交易员借助币安现货反向收割预测市场:100 万美元本金豪取 23 万美元利润

1 月 18 日, Polymarket 交易员 PredictTrader 发文爆料了一位交易员堪比《华尔街之狼》戏剧版的交易操作——通过收割交易机器人的流动性,他在短短数小时内赚取了 23.3 万美元,而且尚未引起市场的大规模注意。

这个名为 a4385 的交易员选择出手的时机也极为巧妙——彼时为周六晚上,市场流动性不足,币安现货订单簿流动性也较为一般。

在“XRP 涨跌——1 月 17 日,美东时间下午 12:45-1:00”的交易中,其大量买入“上涨”筹码。

而他的交易对手,则是 Polymarket 上较为常见的“个人做市商”——各种交易机器人。(Odaily星球日报 注:Polymarket 做市相对简单,对个人开发者来说准入门槛低,交易机器人现在非常流行)。到交易开始 10 分钟时,XRP 较开盘价下跌了约 0.3%,但他已将“上涨”的份额推高至 70%。交易机器人看到了盈利机会,却不想反而落入了该交易员提前设置好的“价格陷阱”,转而向其卖出了更多“上涨”筹码。

最终,该交易员以 48%的均价买入了 7.7 万美元的“上涨”筹码。

而就在该押注事件结算前的 2 分钟,币安上的某个钱包买入了价值约 100 万美元的 XRP 现货,将其价格推高了约 0.5%;押注事件结算后几秒钟,这笔 100 万美元的现货又被快速卖出。

换言之,这场价格操纵事件的成本是——约 0.25% 的单边交易滑点 + 手续费。

使用币安 VIP 4 级账号(0.06%)(很容易获得)和 0.25% 的双向滑点,总成本约为 6,200 美元,实际的操作成本可能更低。通过多次重复同样的操作,加之周末流动性不足的漏洞,该交易员借此清空了多个机器人钱包资金。

有些机器人及时被关闭,而另一些则反应不够迅速,损失了全部资金——其中包括@aleksandmoney ,该账号损失了其一整年的全部利润(约 16 万美元)。

a4385 Polymarket 账号链接:https://polymarket.com/profile/0x506bce138df20695c03cd5a59a937499fb00b0fe

文章的最后,希望在预测市场上押注正反、激情搏杀的交易员们能够辨明事实与表象。有时,真相并不总是客观的,而平台判定的标准和规则却是人为认定的。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。