Author | @ballsyalchemist

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Ding Dong (@XiaMiPP)

Liquidity is the prerequisite for assets to gain confidence. When the market has sufficient depth, large amounts of capital can be smoothly absorbed, whales can freely build positions, and assets can be used as reliable collateral. Lenders are aware that they can exit at any time if needed. However, if the asset itself lacks liquidity, the situation is completely reversed. Shallow liquidity struggles to attract users, and a lack of users further compresses trading depth, ultimately forming a self-reinforcing "liquidity exhaustion cycle."

Tokenization was initially filled with high hopes: it was seen as a key tool to enhance capital liquidity, unleash DeFi financial utility, and bridge on-chain and off-chain assets. In an ideal scenario, the traditional financial market, worth trillions of dollars, would be brought on-chain, allowing anyone to trade freely, collateralize loans, and engage in combinations and innovations that are difficult to achieve in the traditional financial system.

However, the reality is that beneath the surface of prosperity, most tokenized assets operate in extremely fragile, illiquid markets that cannot support meaningful capital scales. The "liquidity," which is a prerequisite for financial composability and practical utility, has not been truly realized. These issues may not be apparent in small transactions, but once capital attempts to flow at scale, hidden costs and risks quickly emerge.

Current Liquidity Reality

The first hidden cost of tokenized assets is reflected in slippage.

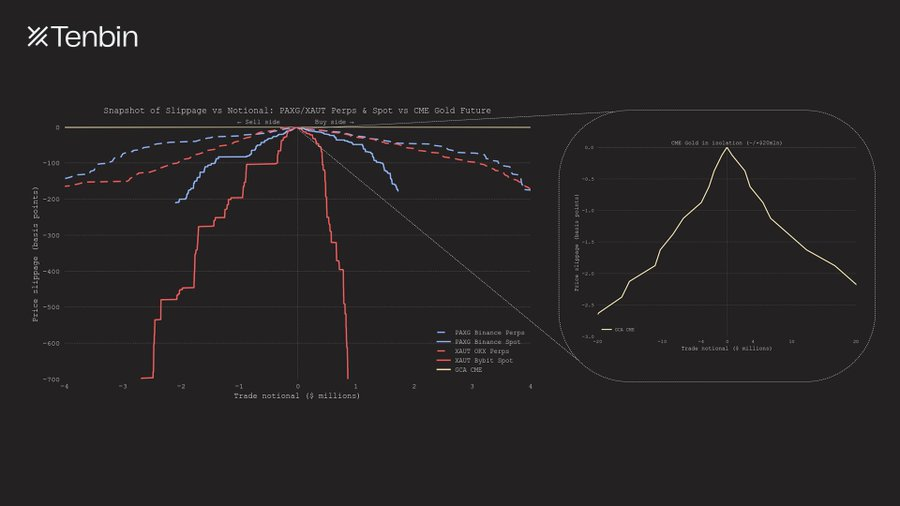

Taking tokenized gold as an example, the following chart compares the expected slippage of major centralized exchanges with the traditional gold market at different trading scales, and the differences are evident.

PAXG / XAUT perpetual and spot vs CME deliverable gold futures: trading scale and slippage

As the trading scale increases, the slippage of PAXG and XAUT perpetual contracts rises exponentially. At a nominal trading volume of about $4 million, the slippage approaches 150 basis points. In contrast, the CME's slippage curve is almost flat, making it nearly imperceptible.

At the spot market level, the liquidity constraints of PAXG and XAUT are even more pronounced. Even when selecting the best liquidity spot trading venues, the order books can provide effective depth of less than $3 million on either side of the buy or sell. This liquidity ceiling is directly reflected in the curve being "truncated" at smaller trading scales.

The right side shows the slippage curve of CME separately, whose nearly flat shape intuitively reflects the depth advantage of traditional markets. Even when trading scales far exceed $4 million, the expected slippage remains highly stable. A $20 million scale gold futures trade experiences a price impact of less than 3 basis points. In terms of magnitude, CME's liquidity depth is far beyond any comparable product in the crypto market.

This difference has direct consequences. In traditional deep markets, even large trades have a negligible price impact; whereas in the shallow markets of tokenized assets, the same operation immediately incurs significant costs, and the difficulty of closing positions increases rapidly with scale. The daily average trading volume comparison below clearly illustrates this gap, and this issue is not limited to the gold market but applies to other assets as well.

CME gold futures vs PAXG / XAUT perpetual and spot: daily average trading volume comparison

The above discussion mainly focuses on CEX. So, would the situation be better if we switched to AMM DEX? The answer is quite the opposite; the situation would only worsen.

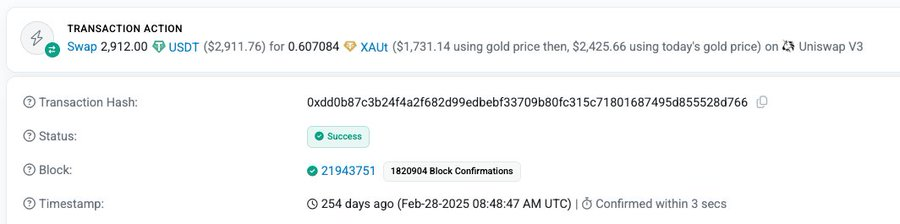

For example, in a February 2025 XAUT transaction, a user spent 2,912 USDT but only received XAUT worth approximately $1,731 based on the real gold price at that time, effectively paying a premium of up to 68% for this transaction.

In another transaction, a user exchanged approximately $1.107 million worth of PAXG (based on the gold price at that time) for 1.093 million USDT, with a slippage of about 1.3%. Although the slippage is not as extreme as the former, it is still unacceptably high when price impacts in traditional markets are usually measured in single-digit basis points.

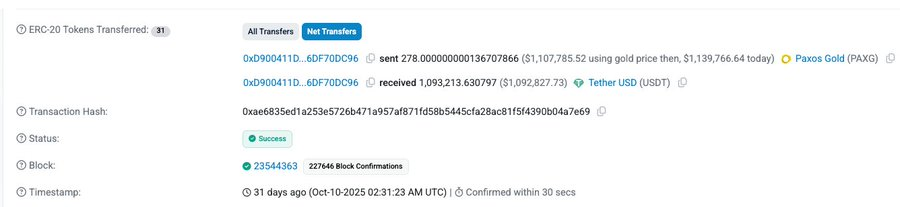

Additionally, over the past six months, the average slippage of XAUT and PAXG on Uniswap has consistently remained in the 25–35 basis points range, and during certain periods, it even exceeded 50 basis points.

Average absolute slippage of XAUT and PAXG on Uniswap V3

The reason this article chooses gold as the main object of analysis is that it is currently the largest non-USD, non-credit tokenized asset on-chain. However, the same issues also appear in the tokenized stock market.

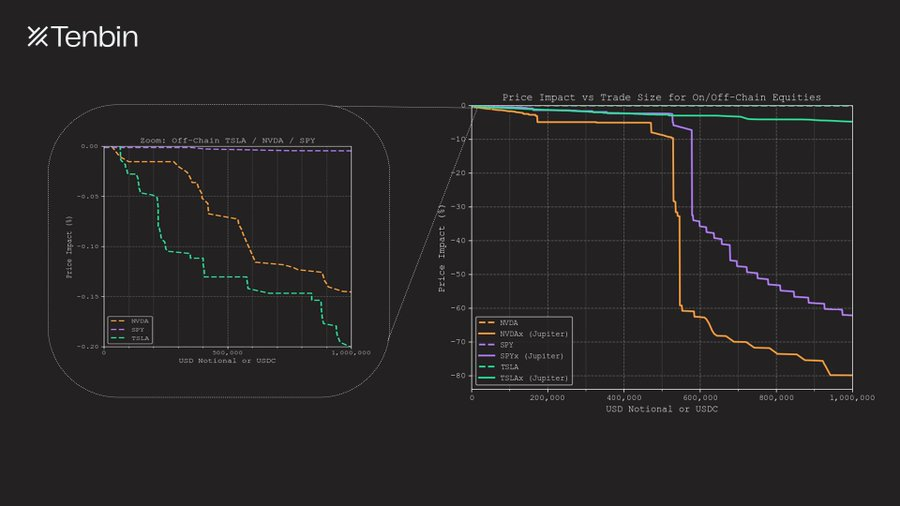

NVDAx / TSLAx / SPYx vs Nasdaq NVDA / TSLA / SPY: trading scale and slippage

TSLAx and NVDAx are currently among the top-ranked tokenized stocks by market capitalization. On Jupiter, a $1 million scale TSLAx trade has a slippage of about 5%; while NVDAx's slippage reaches as high as 80%, nearly losing its tradability. In contrast, in the traditional market, the price impact of trading Tesla or Nvidia stocks of the same scale is only 18 basis points and 14 basis points (not accounting for off-exchange liquidity such as dark pools).

These costs are easy to overlook in small transactions, but once the trading scale increases, they become unavoidable. Insufficient liquidity directly translates into actual losses.

Why is the Tokenized Market More Dangerous?

The problems caused by insufficient liquidity are not limited to trading costs; they also directly undermine the market structure itself.

When market liquidity is thin, the price discovery mechanism becomes fragile, order book noise is significantly amplified, and oracle data sources can be affected by this noise. In a highly interconnected system, even very small-scale trades can trigger massive chain reactions.

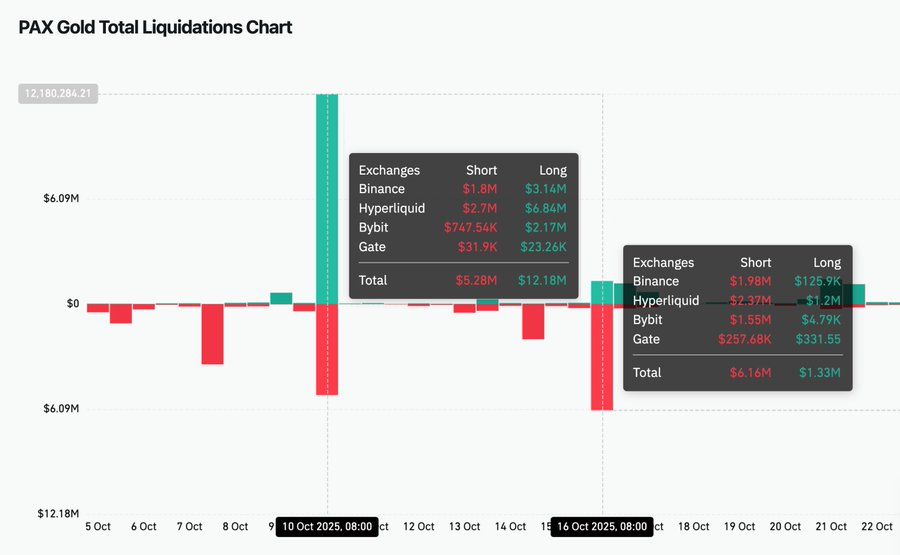

In mid-October 2025, PAXG experienced two notable "anomalous" events in the Binance spot market within a week. On October 10, the price dropped by 10.6%; on October 16, the price surged by 9.7%. Both fluctuations quickly reverted, almost certainly not due to fundamental changes, but rather a direct reflection of order book fragility.

Due to the highly interconnected nature of the tokenized asset ecosystem, this instability is not confined to a single exchange. Binance spot holds the highest weight in the oracle construction of Hyperliquid, thus during these two anomalous fluctuations, Hyperliquid saw $6.84 million in long positions and $2.37 million in short positions liquidated, with the liquidation scale even exceeding that of Binance itself.

This outcome is concerning. It indicates that a single illiquid market is sufficient to amplify and propagate volatility across multiple trading venues. In extreme cases, this structure may even increase the risk of oracle manipulation. Even if traders have never participated in the original spot market, they may still suffer losses passively due to forced liquidations, price distortions, and spread widening.

Ultimately, all these issues stem from the same fact: the main market lacks real, scalable liquidity.

PAXG liquidation chart on Coinglass

Insufficient liquidity is a Structural Problem

The lack of liquidity in tokenized assets is a structural problem.

Liquidity does not automatically arise from asset tokenization. It relies on the continuous supply from market makers, who themselves are subject to strict capital constraints. They allocate funds to markets where inventory can turn over efficiently, risks can be continuously hedged, and positions can be exited with minimal time and cost friction.

However, most tokenized assets struggle to meet these key dimensions.

First, for market makers to provide liquidity, they must first complete asset minting. But in reality, minting itself comes with clear costs. Issuers typically charge minting and redemption fees ranging from 10 to 50 basis points; at the same time, the minting process often involves operational coordination, KYC verification, and settlement through custodians or brokers, rather than direct on-chain execution. Market makers need to pre-fund and wait for hours or even days to truly obtain the tokenized assets.

Second, even if the inventory has been generated, it cannot be redeemed immediately. The redemption cycle of most tokenized assets is measured in "hours or days," not seconds. Common redemption rules range from T+1 to T+5, often accompanied by daily or weekly limits. For larger positions, a complete exit often takes several days or even longer.

From the perspective of market makers, such inventories largely equate to "low liquidity assets" that cannot be quickly recovered and redeployed.

To maintain market depth, market makers must hold inventory over a longer period, continuously bear the risk of price fluctuations, and hedge while waiting for redemptions to be completed. During this time, the same capital could have been allocated to other crypto markets—where inventory is almost unnecessary, hedging is continuous, and positions can be closed at any time. For this reason, the opportunity cost in the crypto market is particularly high.

In light of this trade-off, rational liquidity providers will naturally choose to allocate capital to other markets.

The existing market structure is also insufficient to solve this problem. AMMs transfer inventory risk to liquidity providers but do not eliminate redemption constraints; while order book-based trading venues disperse the liquidity of market makers across multiple exchanges, further weakening overall depth.

The end result is a persistent lack of liquidity, creating a vicious cycle. Insufficient liquidity suppresses the willingness to participate, and a lack of participation further weakens liquidity. The entire tokenized asset ecosystem thus falls into this cycle.

A New Market Structure

Insufficient liquidity is a structural barrier that restricts the scalable development of tokenized assets.

Shallow market depth cannot support positions of meaningful size, and a fragile market structure amplifies local fluctuations and transmits them to different protocols and trading venues. Assets that cannot exit smoothly under predictable conditions are naturally difficult to use as reliable collateral. Under the current mainstream tokenization model, liquidity is long-term constrained, and capital efficiency remains low.

To enable tokenized assets to truly possess usability at scale, the market structure itself must change.

What if the price discovery and liquidity supply of assets could directly mirror off-chain markets, rather than being rediscovered and cold-started on-chain? What if users could acquire tokenized assets at any trading scale without forcing market makers to hold low-liquidity inventory for extended periods? What if the redemption mechanism were fast enough, with clear paths and no restrictions?

Asset tokenization has not failed due to the technical path of "bringing assets on-chain."

Its real failure lies in the fact that—the market structure supporting the operation of these assets has never truly been established.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。