On January 14, a bill aimed at regulating the U.S. crypto market—the CLARITY Act—will face a crucial vote in the Senate Banking Committee. On the eve of this industry breakthrough, Coinbase's founder and CEO Brian Armstrong announced that the company would completely withdraw its support for the bill, stating that "a bad bill is worse than no bill at all."

The news immediately caused a stir in the industry. But what was truly surprising was the stance of Coinbase's counterparts, with almost all other heavyweight players in the industry standing in opposition.

Chris Dixon, a partner at venture capital giant a16z, believes "now is the time to push forward"; Brad Garlinghouse, CEO of payment giant Ripple, stated that "clarity beats chaos"; Arjun Sethi, co-CEO of competitor exchange Kraken, bluntly said, "this is a test of political will"; even the nonprofit organization Coin Center, known for defending decentralization principles, stated that the bill is "basically correct in terms of developer protection."

On one side is the undisputed leader of the industry, and on the other side are the important allies of that leader. This is no longer the old story of the crypto industry fighting against Washington regulators, but rather a civil war occurring within the industry.

Coinbase Is Isolated

Why is Coinbase isolated from others?

The answer is simple: almost all other major players have judged that this imperfect bill is the best option available based on their respective business interests and survival philosophies.

First, there is a16z. As the most prestigious crypto investment firm in Silicon Valley, a16z's portfolio spans nearly all sectors of crypto. For them, the most fatal issue is not the harshness of specific provisions, but the ongoing regulatory uncertainty.

A clear legal framework, even if flawed, can provide a growth environment for the entire ecosystem they invest in. Chris Dixon's position represents the consensus among investors; in their eyes, regulatory certainty is more important than a perfect bill.

Next is the exchange Kraken. As one of Coinbase's most direct competitors, Kraken is actively preparing for an IPO.

A regulatory endorsement from Congress would greatly enhance its valuation in the public market. In contrast, the restrictions on stablecoin yields in the bill would have a far smaller financial impact on Kraken than on Coinbase. For Kraken, trading short-term business losses for long-term IPO benefits is a no-brainer.

Then there is payment giant Ripple. Its CEO, Brad Garlinghouse, summarized his position in six words: "clarity beats chaos." This comes in the wake of Ripple's years-long, hundreds of millions of dollars legal battle with the SEC.

For a company exhausted by regulatory struggles, any form of peace is a victory. Even if the bill is not perfect, it is far better than being endlessly consumed in court.

Finally, there is the advocacy organization Coin Center. As a nonprofit, their position is least driven by commercial interests. Their core demand over the years has been to ensure that software developers are not misclassified as "money transmitters" and subjected to excessive regulation.

This bill fully incorporates their advocated Blockchain Regulatory Clarity Act (BRCA), legally protecting developers. With their core goal achieved, other details can be compromised. Their support represents the recognition of the industry's "purists."

When venture capitalists, exchanges, payment companies, and advocacy organizations all stand on the same side, Coinbase's position becomes particularly glaring.

So the question arises: if the entire industry sees a path forward, what does Coinbase see that leads it to risk causing a split in the industry to stop it?

Business Model Determines Position

The answer lies in Coinbase's financial statements, which reveal a $1.4 billion hole.

To understand Armstrong's table-flipping behavior, one must first grasp Coinbase's survival anxiety. For a long time, a significant portion of Coinbase's revenue has relied on transaction fees from cryptocurrency trading.

The fragility of this model was laid bare during the crypto winter; it thrived in bull markets but saw revenues plummet and even quarterly losses in bear markets. The company must find new, more stable sources of income.

Stablecoin yields are the second growth curve Coinbase has identified.

Its business model is not complicated: users hold USDC, a stablecoin pegged 1:1 to the dollar, on the Coinbase platform, and Coinbase lends out these idle funds through DeFi protocols (like Morpho) to earn interest, returning part of the earnings as rewards to users. According to data from Coinbase's official website, regular users can earn an annualized yield of 3.5%, while paid members can earn up to 4.5%.

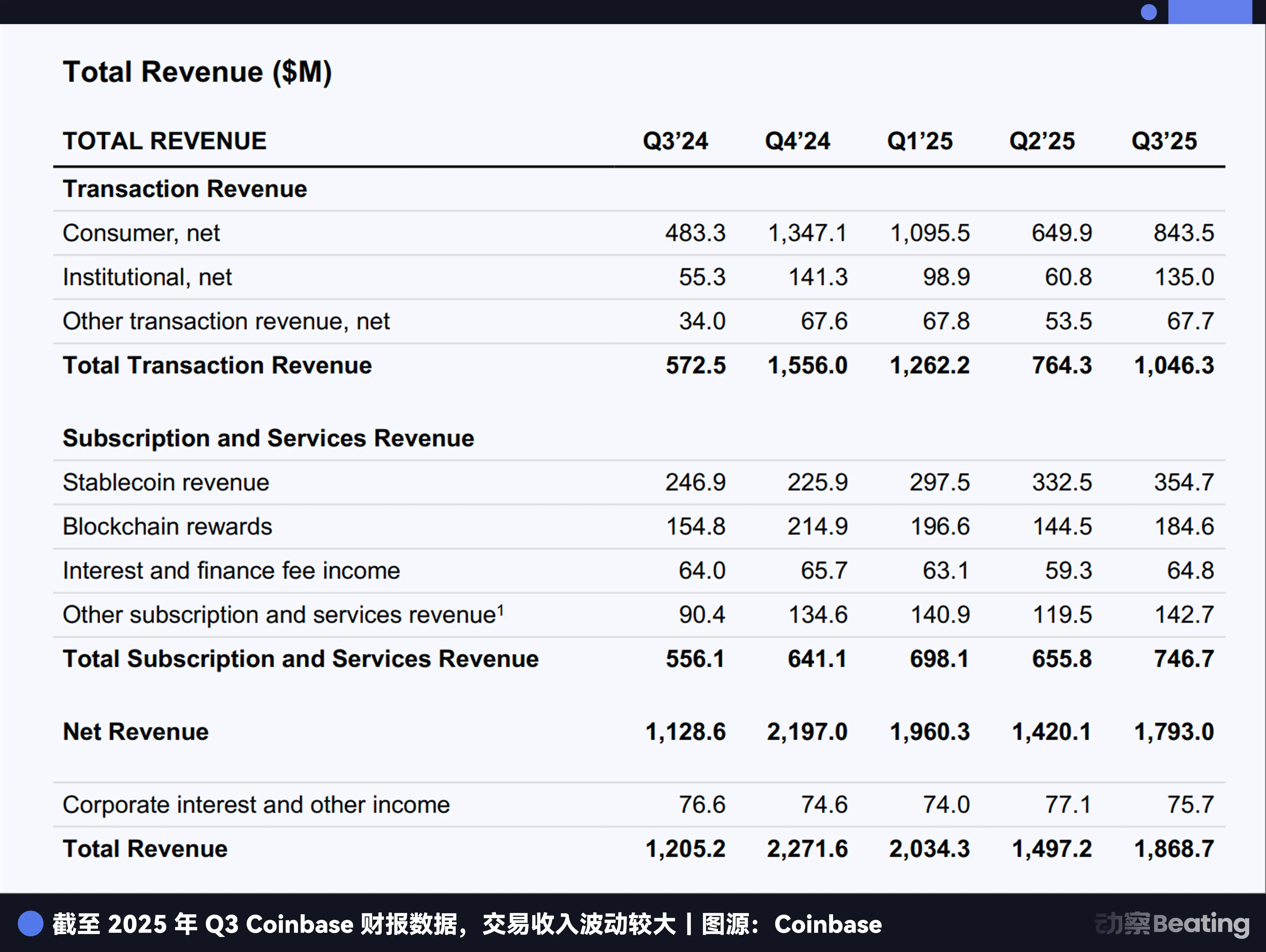

According to Coinbase's Q3 2025 financial report, its "interest and financing income" reached $355 million, with the vast majority coming from stablecoin operations. Based on this, it is estimated that this business contributed approximately $1.4 billion in revenue to Coinbase in 2025, increasingly accounting for a larger share of its total revenue. In a bear market with sluggish trading volumes, this stable and substantial cash flow is Coinbase's lifeline.

However, a new provision in the CLARITY Act directly targets Coinbase's Achilles' heel. This provision stipulates that stablecoin issuers or affiliates cannot pay yields for users' "Static Holdings," but can pay yields for "Activities and Transactions."

This means that users' behavior of simply holding USDC in their Coinbase accounts to earn interest will be prohibited. This is a fatal blow to Coinbase; if the bill passes, this $1.4 billion in revenue could significantly shrink or even vanish.

In addition, the various issues Armstrong listed on social media seem more like a struggle at the structural level of the market: the draft could effectively block the path for tokenized stocks/securities, set higher barriers for DeFi, make it easier for regulators to access users' financial data, and weaken the CFTC's role in the spot market.

The ban on stablecoin yields is just the most direct and immediately harmful blow to Coinbase.

Different interests lead to different choices.

Kraken's stablecoin business is much smaller than Coinbase's, allowing it to trade short-term losses for long-term IPO value; Ripple's core is payments, where regulatory clarity outweighs everything; a16z's chessboard is the entire ecosystem, where the gains and losses of individual projects do not affect the overall situation. Coinbase sees a cliff, while other companies see a bridge.

However, there is a third party in this game: traditional banking.

The American Bankers Association (ABA) and the Bank Policy Institute (BPI) believe that allowing stablecoins to pay yields will lead to trillions of dollars in deposits flowing out of the traditional banking system, posing a survival threat to thousands of community banks.

As early as July 2025, the Stablecoin Genius Act was passed, which explicitly allowed "third parties and affiliates" of stablecoins to pay yields, leaving legal space for Coinbase's model. But in the seven months that followed, the banking industry launched a powerful lobbying campaign, ultimately succeeding in adding the "Static Holdings" ban to the CLARITY Act.

Banks are not afraid of a 3.5% yield; they fear losing control over deposit pricing. When users can freely choose to deposit their funds in banks or crypto platforms, the decades-long low-interest monopoly of banks comes to an end, which is the essence of the conflict.

So, in the face of such a complex game of interests, why did only Armstrong choose the most resolute approach?

Two Survival Philosophies

This is not just a conflict of business interests, but a clash of two fundamentally different survival philosophies. One is Silicon Valley-style idealism and uncompromising stance, while the other is Washington-style pragmatism and gradual reform.

Brian Armstrong represents the former. This is not his first public confrontation with regulators; back in 2023, when the SEC sued Coinbase for operating an illegal securities exchange, Armstrong publicly criticized the SEC for its "inconsistent stance" and revealed that Coinbase had held over 30 meetings with regulators, repeatedly requesting clear rules but receiving no response.

His position has been consistent: support regulation, but firmly oppose "bad regulation." In his view, accepting a fundamentally flawed bill is more dangerous than having no bill at all. Once a law is enacted, modifying it in the future will be extremely difficult. Accepting a bill that stifles the core business model for the sake of short-term certainty is akin to drinking poison to quench thirst.

Armstrong's logic is that now is the time to resist at all costs; although painful, it preserves the possibility of fighting for better rules in the future. If they compromise now, it would mean permanently giving up the ground on stablecoin yields. In this war concerning the company's future, compromise is surrender.

In contrast, other leaders in the crypto industry exhibit a distinctly different pragmatic philosophy. They are well aware of Washington's rules of the game; legislation is the art of compromise, and perfection is the enemy of excellence.

Kraken's CEO Sethi believes that it is important to first establish a legal framework that gives the industry a legitimate social status, and then gradually improve it through continuous lobbying and participation. First seek survival, then seek development.

Ripple's CEO Garlinghouse places certainty above all else. Years of litigation have made him understand that struggling in the quagmire of law is a huge drain on the company. An imperfect peace is far better than a perfect war.

Dixon from a16z views it from a global competitive strategic perspective, believing that if the U.S. delays legislation due to internal disputes, it will only hand over the center of global financial innovation to Singapore, Dubai, or Hong Kong.

Armstrong is still fighting Washington with a Silicon Valley approach, while others have learned to speak Washington's language.

One side adheres to the principle of "better to be shattered than to compromise," while the other considers the reality of "as long as the green mountains remain, one need not worry about firewood." Which is the wiser choice? Until time provides us with an answer, no one can draw a conclusion. But it is certain that both choices come with heavy costs.

The Cost of Civil War

What is the true cost of the civil war ignited by Coinbase?

First, it has caused a political split in the crypto industry.

According to a report by Politico, the decision by Senate Banking Committee Chairman Tim Scott to postpone the vote was made after Coinbase's last-minute reversal and when the number of supporting votes among bipartisan lawmakers was still uncertain. Although Coinbase's actions were not the sole reason, they undoubtedly played a key role in pushing the entire effort toward chaos.

If the bill ultimately fails as a result, other companies may place some of the blame on Coinbase, believing that it affected the progress of the entire industry for its own self-interest.

More seriously, this public infighting has significantly weakened the crypto industry's collective bargaining power in Washington.

When legislators see that the industry cannot form a unified voice internally, they will feel confused and frustrated. A divided industry will be vulnerable in the face of powerful traditional financial lobbying groups.

Secondly, it exposes the dilemma of regulation in the digital age.

The CLARITY Act attempts to walk a tightrope between encouraging innovation and preventing risks, but this balance is nearly impossible to satisfy everyone. For Coinbase, the bill is too restrictive; for traditional banks, it is too lenient; for other crypto companies, the bill may be just right.

The dilemma of regulation lies in its attempt to set boundaries for insatiable desires. Each implementation of rules is merely the beginning of the next round of negotiations.

But the most significant cost is that this civil war has shaken the foundations of the crypto industry.

What exactly is the crypto industry? Is it a social experiment about decentralization and personal freedom, or is it a business focused on asset appreciation and wealth creation? Is it a revolution against the existing financial system, or is it a supplement and improvement to it?

Armstrong's resoluteness, along with the compromises of others in the industry, collectively outlines the current reality of this sector: a contradiction constantly oscillating between ideals and reality, revolution and commerce.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。