As Bitcoin breaks through the $97,000 mark, a whale today suffered a real loss of $39.15 million from the sale of 300 WBTC, while another whale achieved a profit of over $28 million through precise trading.

At the moment when Bitcoin's price is hitting $97,000 and market sentiment is high, the whales in the crypto world are engaged in a fascinating tug-of-war behind the scenes.

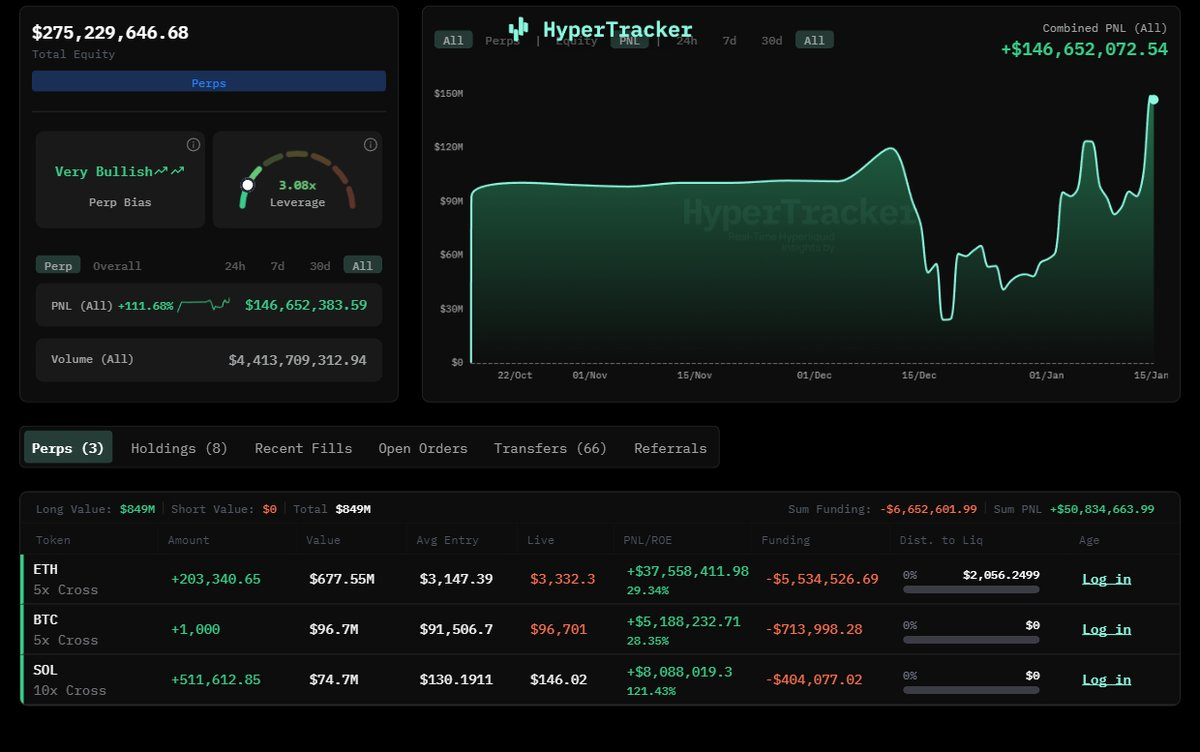

As of today, a whale known as "pension-usdt.eth" quickly re-established a long position of 20,000 ETH with 3x leverage after closing a $66.4 million ETH long position for profit, demonstrating its precise control over the short-term market.

1. Market Pulse

● The cryptocurrency market has reached a critical juncture today. Data shows that Bitcoin's price has surpassed the $96,000 mark, with a daily increase of over 3%. This breakthrough not only ignited market sentiment but also prompted the whales in the crypto world to adjust their strategies.

● The Fear and Greed Index, which measures market sentiment, has remained in the "Extreme Greed" zone for three consecutive days. This sentiment has driven an increase in trading volume across the entire crypto market, with Ethereum performing particularly well, rising over 5% in 24 hours and reaching a nearly three-month high.

● In the derivatives market, the open interest continues to rise. The total open interest for BTC futures on major exchanges has surpassed $35 billion, setting a new historical high, indicating strong participation from investors.

● Market volatility is also on the rise, with Bitcoin's 30-day volatility index increasing from 45% a week ago to 58%. This environment creates both opportunities and risks, prompting various whales to adopt distinctly different operational strategies today.

2. The King of Swing Trading

The most notable operator today is undoubtedly the whale known as "pension-usdt.eth." In just a few hours, this swing trading expert executed a textbook-level short-term operation.

● The whale's trading path was clear and decisive: First, it closed a long position in ETH worth approximately $66.4 million, locking in a profit of about $740,000; immediately afterward, it opened a new long position of 20,000 ETH with 3x leverage, valued at about $67 million.

● Behind such operations lies the precise timing of professional traders in the market. After Bitcoin led the market to break through a key resistance level, many short-term traders chose to take profits, but this whale quickly reopened a leveraged long position after closing, indicating that its bullish outlook had not changed.

● Tracking public data, this address has realized profits exceeding $28 million since last November. Its trading style is characterized by moderate leverage (usually 3-5x) and shorter holding periods, with an average holding time of 7-15 days.

● On-chain analysis shows that this whale's operations often lead market short-term fluctuations. Today's operation seems to indicate its confidence that ETH will continue to outperform BTC in the short term. The ETH/BTC exchange rate has risen 4.5% in the past week, and this trend may continue.

3. The Observers

In stark contrast to the active operations of swing traders is a large holder known as the "BTC OG Insider Whale." This holding giant did not make any significant opening or closing operations today, but that does not mean it is inactive.

● As market prices rise, the value of this whale's existing long positions continues to grow. Data shows that its total unrealized profit has exceeded $60 million, primarily from its large ETH long position.

● The holding behavior of such long-term whales often serves as a barometer. They typically do not participate in short-term market fluctuations but instead make allocations based on medium- to long-term fundamentals. This whale's current strategy of holding steady likely reflects its judgment that there is still room for further market increases.

● Analyzing its holding structure reveals that this whale's long positions are mainly concentrated in ETH, supplemented by a moderate amount of BTC positions as a hedge. This configuration has proven effective recently: when BTC hits new highs, ETH often shows stronger follow-through performance.

● Changes in the holdings of long-term whales are also worth noting. Although there were no operations today, this address had slightly increased its BTC holdings by about 500 coins over the past month, with the purchase price range between $82,000 and $87,000, indicating its confidence in a medium- to long-term bull market.

4. The Status of the "10.11" Whale

When discussing today's whale dynamics, one cannot overlook the "10.11" whale, which attracted widespread attention in the market.

● This whale earned its nickname because it opened a large short position against the market trend after the flash crash on October 11 last year. As the market continued to rise, these short positions faced immense pressure.

● The latest data shows that despite the significant market increase, this whale's short positions have not been fully closed. As the BTC price breaks through the $90,000 mark, the unrealized loss on its short positions has narrowed from a high of nearly $50 million to about $24.86 million.

● Notably, the losses on this whale's short positions are primarily concentrated in ETH. This indicates that its initial short judgment may have been based on a pessimistic outlook for ETH fundamentals rather than a bearish view of the entire crypto market.

● There are no new operational records for the "10.11" whale today, which may suggest that it is adjusting its strategy or waiting for a better exit opportunity. For such contrarian traders, the timing of closing positions is particularly critical.

5. The Market Logic Behind the Bull-Bear Tug-of-War

The differentiated operations of different whales today actually reflect the complex game dynamics in the current crypto market.

● From a market structure perspective, the bull and bear forces are fiercely clashing at the critical price level of $97,000. On one hand, breaking through this level could open the door to the $100,000 mark; on the other hand, it is also a concentrated area for many short positions.

● Derivatives data shows that when the price breaks above $96,500, about $2.4 billion in Bitcoin short positions face liquidation risk. This factor may explain why some whales choose to adjust or close positions at this level.

● The market long-short ratio also shows a divergence in investor sentiment. Although the overall sentiment leans towards bullish, short positions have increased recently, indicating that a significant portion of investors believes the market is nearing a short-term top.

● The operations of different whales reflect their judgments on different time frames in the market. Swing traders focus on trends over days to weeks, while long-term holders pay attention to cycles spanning months to years. The different operations of both in the same market actually create liquidity, allowing the market to function effectively.

6. The Interaction Between Whales and Retail Investors

Whale operations often have a profound impact on retail investor sentiment. Today's differentiated operations by whales may convey complex signals to retail investors.

● When well-known whales like "pension-usdt.eth" reopen leveraged long positions, it may be interpreted by some retail investors as a bullish signal, triggering follow-on buying. However, the case of the whale suffering significant losses serves as a warning about the potential risks of high leverage in a bull market.

● Historical data shows that there is a certain leading-lagging relationship between whale operations and retail investor sentiment. Typically, whale operations precede changes in retail sentiment by 1-3 days. Therefore, tracking whale dynamics may provide insights into short-term market direction.

● However, simply mimicking whale operations is not a wise strategy. Whales often have better risk management and more ample capital reserves, allowing them to withstand greater short-term volatility. Retail investors need to make decisions based on their own risk tolerance when considering these signals.

● A healthy market requires the coexistence of whales and retail investors. Whales provide liquidity and bear market risks, while retail investors contribute to trading activity and market breadth. Their interactions drive the crypto market forward.

The crypto market is always playing a game of wealth redistribution. As Bitcoin's price breaks through $97,000, today's whale operations reveal that even in a bull market, strategy differentiation can lead to vastly different outcomes.

The swing trading whale continues to expand its profit pool, while the whale facing losses is forced to bear nearly $40 million in losses.

The market is fair to every participant.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。