A 30-page SEC report has for the first time not mentioned cryptocurrency, a new bill draft is about to be reviewed in the Senate, and Wall Street investment banks predict that hundreds of billions in new funds are waiting to enter the market.

The U.S. Senate Banking Committee has confirmed that it will hold a review meeting on the cryptocurrency market structure bill on January 15, 2026. Committee Chairman Tim Scott stated: “The core goal of this bill is to make the U.S. the global center of the cryptocurrency industry.”

I. Legislative Process: Key Turning Point from Stagnation to Acceleration

● Congress is accelerating the passage of the comprehensive digital asset bill that was shelved last year, which is seen as a foundational step for the U.S. to establish a legal framework for digital assets. According to the latest bill progress, the House's CLARITY Act was overwhelmingly passed by a vote of 294 to 134 in July 2025, while the Senate version draft was released on November 10 of the same year.

○ This legislative progress marks a shift in the discussion of crypto regulation from macro policy debates to specific rule-making, which may directly impact market confidence and capital allocation.

● The core goal of the bill is to reduce the legal uncertainty faced by domestic companies in the U.S. and to minimize the risk of sudden regulatory shocks. A more predictable regulatory framework may support higher liquidity and more institutional participation, strengthening the U.S. position in the global digital asset landscape.

● Notably, a landmark event in the legislative process was the SEC's release of its 2026 fiscal year examination priorities report on November 17, 2025, which for the first time did not mention “crypto assets.” This contrasts sharply with the previous five years, during which the SEC listed “crypto assets” as a top risk area annually.

This change is interpreted by the market as a signal of a shift in the U.S. regulatory stance from “suppression” to “embrace.”

II. Bill Content: Core Provisions Balancing Innovation and Protection

● The Digital Asset Market Clarification Act aims to incorporate digital assets into a clear, tailored U.S. regulatory system that protects investors, enhances national security, and promotes responsible innovation. The bill clearly delineates the jurisdiction of the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission, replacing the SEC's enforcement-based regulatory model with a feasible statutory framework.

● According to the draft text of the bill, the stablecoin reward program adopts a relatively lenient stance, clarifying that incentives tied to usage will not automatically classify payment stablecoins as regulated securities or bank deposits. The draft allows rewards related to everyday financial activities, including payments, transfers, and settlement services. Discounts related to the use of digital wallets, trading platforms, or blockchain networks are also permitted.

● It is noteworthy that the draft explicitly prohibits paying interest solely for holding stablecoins, focusing allowed rewards on usage behavior rather than passive storage.

● The bill also includes the strongest illegal financial framework for digital assets that Congress has considered. It ensures that major digital asset intermediaries comply with anti-money laundering and counter-terrorism financing requirements, strengthens sanctions compliance, and authorizes the Treasury to handle high-risk foreign activities.

The bill specifically targets illegal activities while protecting legitimate software development and innovation. It explicitly protects software developers and retains the right to self-custody digital assets.

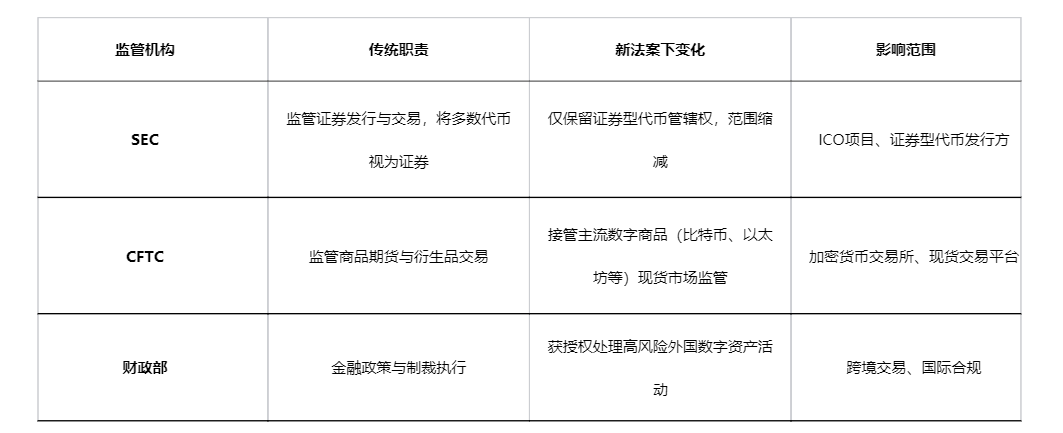

III. Regulatory Restructuring: Rebalancing Powers between SEC and CFTC

● The U.S. cryptocurrency regulatory framework is undergoing a fundamental restructuring, with the core change being the reallocation of regulatory authority between the SEC and CFTC. Under the new bill, the spot markets for “digital commodities” like Bitcoin and Ethereum will officially fall under CFTC regulation.

● This change means that the SEC will only retain jurisdiction over “security tokens,” significantly reducing its scope. This shift may end the long-standing issues of regulatory overlap and unclear compliance expectations, which have been major obstacles to U.S. crypto-related business activities.

Changes in the responsibilities of major U.S. crypto regulatory agencies

The market's response to this regulatory restructuring has been swift and positive. When the SEC no longer treats the crypto industry as an enemy but as a “national strategic asset,” the real institutional bull market is just beginning. The bill explicitly establishes a joint advisory committee between the SEC and CFTC, aimed at coordinating digital asset regulatory requirements. This arrangement seeks to address issues of regulatory fragmentation and outdated rules.

IV. Market Structure: From Legal Ambiguity to Rule Transparency

● The most direct contribution of the Clarification Act is to provide long-lacking regulatory certainty for crypto market participants. By establishing a more transparent and consistent regulatory environment, businesses can better understand which activities are permitted and under what conditions.

● Different regulatory agencies have interpreted existing laws inconsistently, forcing businesses to operate under constantly changing expectations, increasing compliance costs and strategic risks. The new bill seeks to reduce legal ambiguity by defining a clear market structure, providing more predictable rules for operations within U.S. jurisdiction.

● For the decentralized finance sector, the bill adopts a regulatory approach that balances innovation and risk management. It protects software developers and peer-to-peer activities while ensuring that centralized intermediaries interacting with DeFi comply with tailored risk management, cybersecurity, and compliance standards.

The bill also delineates clear boundaries by focusing on “control” rather than “code,” protecting software developers while ensuring appropriate regulatory coverage. This approach keeps the U.S. competitive while safeguarding the market and investors.

V. Capital Flows: Institutional Funds Become the New Engine of the Market

JPMorgan's latest report indicates that in 2025, capital inflows into the crypto market reached a historic high of approximately $130 billion, an increase of about one-third compared to 2024.

● The bank expects that funds flowing into the crypto market will further grow in 2026, with a year-on-year increase of about one-third. Analysts believe that the new funds will be more dominated by institutional investors rather than retail or digital asset custody companies.

● The growth in capital inflows in 2025 primarily stems from Bitcoin and Ethereum ETFs and purchases by digital asset custody companies. More than half of the inflows—approximately $68 billion—came from digital asset custody companies, with Strategy contributing about $23 billion.

● JPMorgan points out that regulatory clarity will directly drive institutional adoption of digital assets, leading to increased venture capital, mergers and acquisitions, and IPO activities in areas such as stablecoin issuers, payment companies, exchanges, wallets, blockchain infrastructure, and custody.

● The institution's estimates incorporate multiple indicators, including ETF fund flows, CME futures implied fund flows, crypto VC fundraising, and digital asset custody purchases. Notably, institutional participation in Bitcoin and Ethereum futures has seen a decline.

VI. Transition from “Crypto Police” to “Crypto Lighthouse”

● The advancement of the U.S. crypto bill may mark a turning point for the global crypto industry. Analysts believe that the U.S. is transitioning from “crypto police” to “crypto lighthouse,” a shift that will have profound implications for the global crypto market.

● With the clarity of the regulatory framework, institutional funds are expected to flood into the crypto market like “opening the floodgates.” Bitcoin spot ETFs are just the beginning of this trend, and more traditional financial institutions are likely to increase their allocations to digital assets in the future.

● DeFi projects will be able to openly register, conduct advertising, and access dollar channels in the U.S. Stablecoin issuers will finally have legal backing, no longer needing to anxiously turn to jurisdictions like Singapore.

● Long-standing legal disputes that have plagued the industry, such as those involving Ripple, Coinbase, and Uniswap against regulators, are likely to end with “not guilty” outcomes.

● The bill particularly emphasizes protecting ordinary Americans, ensuring they have the tools, information, and protections needed to safely participate in the digital asset market. The bill strengthens disclosure requirements, retains anti-fraud powers, limits insider abuse, and promotes coordinated oversight and financial literacy.

VII. A New Era of Regulation Built on Bipartisan Cooperation

The advancement of the U.S. crypto bill is based on bipartisan cooperation. The bill is the result of over six months of bipartisan negotiations and extensive engagement with regulators, law enforcement, academia, and the industry.

● This cross-party collaboration indicates that, despite differing views on specific policy details, there is a growing consensus on the need for structured oversight of digital assets. The existence of bipartisan support reduces the uncertainty of the legislative path and enhances the likelihood of future regulatory changes being pursued in a more prudent and market-sensitive manner.

● If the bill's review proceeds smoothly and garners some Democratic support, it is expected to become law within this year. Congressional sources indicate that the first national “crypto market structure law” in the U.S. could emerge as early as the first quarter of 2026.

Trump has promised to sign a bill to “make America the crypto capital again” in his first year in office. This political statement further enhances the likelihood of the bill's passage.

The long-awaited regulatory certainty for the crypto industry is about to arrive. Inside the U.S. Capitol, lawmakers are drawing a clear blueprint for digital asset rules; meanwhile, in Wall Street offices, JPMorgan analysts predict that more institutional funds will flow into this field in 2026.

As the regulatory framework shifts from ambiguity to clarity, and institutional capital moves from observation to action, a new era of crypto driven by innovation and compliance is quietly beginning.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。