原文标题:Bitcoin's Strategic Rebound: A Post-CPI Bull Case for 2026

原文作者:AInvest News Editorial Team

编译:Peggy,BlockBeats

编者按:昨夜,比特币短时连续突破,24 小时涨幅达 3.91%。本文从宏观流动性、机构行为与链上估值三条线索出发,解释比特币为何仍可能迎来一轮结构性反弹:一是美联储若在 2026 年开启降息与 QE,流动性回流将重新抬升风险资产估值;二是市场回撤时 ETF 资金撤退,但核心机构反而在波动中持续吸筹,提前为反弹布局;三是多项链上估值指标显示比特币正接近历史「价值区间」,为中长期资金提供了更具性价比的入场窗口。

以下为原文:

加密货币市场,尤其是比特币(BTC),长期以来一直被视为衡量宏观经济变化与机构情绪的重要指标。随着我们迈向 2026 年,宏观层面的多重利好与机构资金的再度回流正在汇聚,为比特币价格的策略性反弹铺垫基础。本文将分析美联储政策路径、通胀降温以及机构行为的变化,如何共同构成未来一年比特币的一个有力看多逻辑。

宏观趋势:美联储政策转向与通胀带来的助推

美联储决定在 2026 年第一季度启动降息与量化宽松(QE),标志着货币政策出现关键转向。这些措施旨在刺激经济增长,并应对仍然存在但正在缓和的通胀压力。从历史经验看,这类政策通常利好风险资产,包括比特币。

截至 2025 年底,核心 CPI 已降温至 2.6%,缓解了市场对长期高通胀的担忧,也降低了继续大幅加息的紧迫性。在这样的环境下,资金更可能重新配置到替代资产中,而比特币也越来越被视为「数字黄金」,成为对标黄金的数字化资产选项。

美联储的量化宽松(QE)计划尤其可能进一步放大金融市场的流动性,为比特币价格上涨提供有利的外部环境。从历史表现来看,比特币在第一季度的平均回报率约为 50%,而这一阶段往往伴随着对第四季度波动的修复性反弹。随着各国央行的政策重心逐渐从「控制通胀」转向「优先增长」,围绕比特币的宏观叙事也正在从偏防御的逻辑,转向更具建设性的看多框架。

机构回归:在波动中持续吸筹

尽管 2025 年底出现了显著资金外流,例如 11 月比特币 ETF 录得 63 亿美元的净流出,机构对比特币的兴趣依然强劲。MicroStrategy 等公司仍在持续增持:其在 2025 年初新增买入 11,000 枚比特币(约合 11 亿美元)。

与此同时,中等规模持仓者在 2025 年第一季度进一步提升了其在比特币总供应中的占比,这类在波动中进行的策略性买入,反映出机构与中型资金对比特币「价值储存工具」定位的长期承诺。

ETF 资金外流与机构持续增持之间的背离,凸显了市场中一种更微妙的结构性变化:当价格下跌时,由散户情绪驱动的 ETF 资金选择撤退,而更核心的机构投资者却似乎正在为反弹提前布局。

这一趋势也符合比特币历史上的典型规律:尽管比特币整体长期呈上行轨迹,短期持有者往往持续在波动中「亏着卖出」。这一点可以从短期持有者已花费输出利润率(Short-Term Holder Spent Output Profit Ratio,SOPR)得到验证:在 2025 年初,该指标连续 70 多天保持在 1 以下,意味着短期持有者在卖出时普遍处于亏损状态。

这种行为通常意味着市场正进入「长线资金吸筹」的阶段:当短期资金被迫止损离场,反而为长期投资者创造了更具策略性的买入窗口,也为机构寻找低位布局的入场点提供了条件。

链上指标:处于「价值区间」,但仍需警惕偏空风险

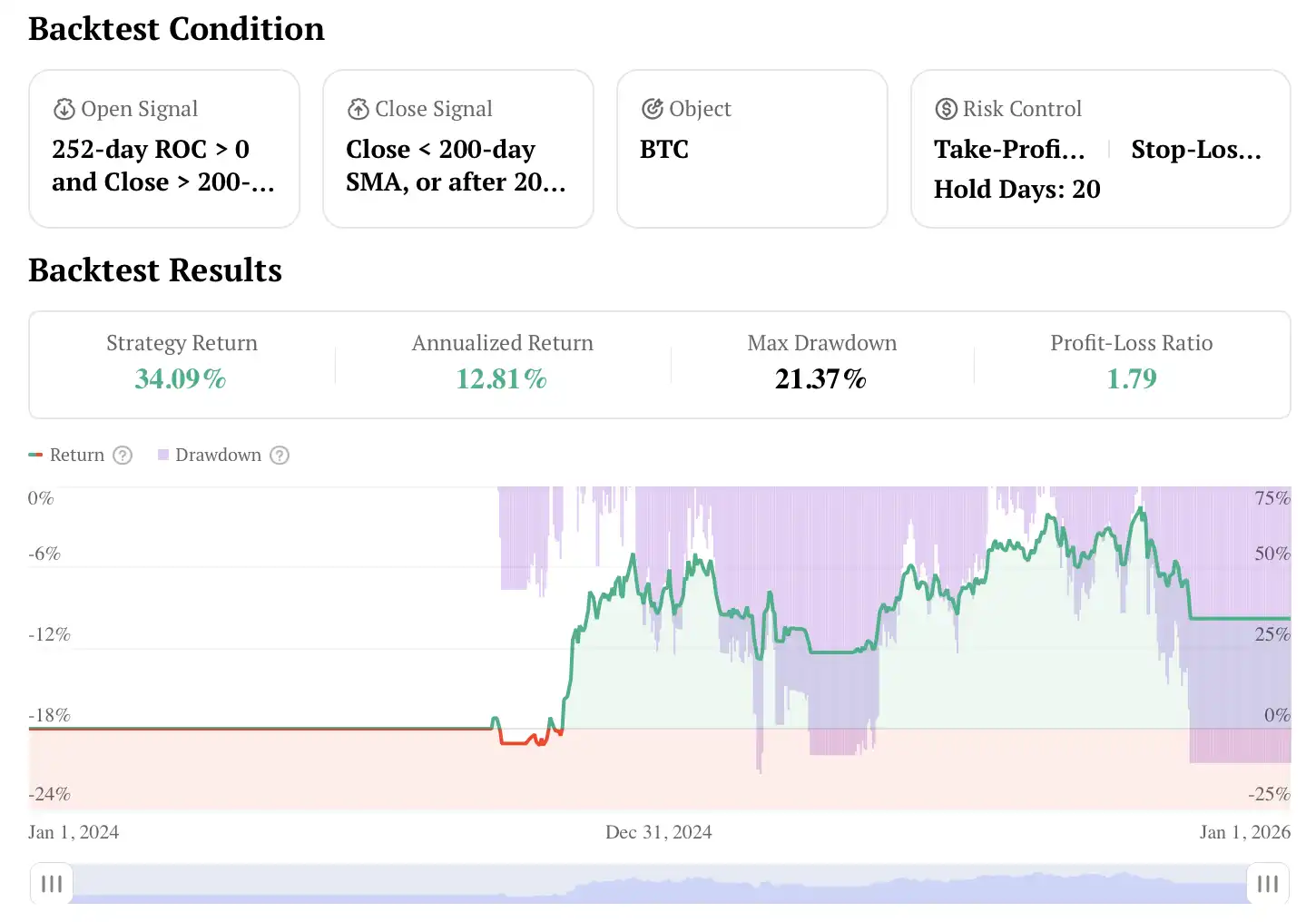

BTC 绝对动量策略(仅做多)

当 252 日涨幅(Rate of Change)为正,且价格收盘站上 200 日简单移动均线(200-day SMA)时做多。当价格收盘跌破 200 日 SMA 时离场;或在以下任一条件触发时退出:持仓满 20 个交易日后退出;止盈(TP)+8% / 止损(SL)-4%

2025 年末,比特币的价格走势呈现出明显的回撤:全年累计下跌约 6%,第四季度跌幅更超过 20%。与此同时,链上信号也出现分化。一方面,「盈利地址占比」(Percent Addresses in Profit)等指标持续走弱,长期持有者的抛售行为也有所增加;但另一方面,「动态区间 NVT」(Dynamic Range NVT)与「Bitcoin Yardstick」等指标却显示,比特币可能正处于历史性的「价值区间」,类似过去多次重要底部区域曾出现的估值状态。

这种矛盾意味着市场正站在一个关键分岔口:短期看空趋势仍在延续,但底层基本面却暗示资产可能被低估。对于机构投资者而言,这种结构性分化反而提供了一种非对称机会——下行风险有限,而潜在反弹空间可观。尤其是在美联储政策转向与比特币在 2026 年第一季度的历史表现可能共同催化下,这种机会进一步被放大;与此同时,比特币作为「抗通胀资产」的叙事也正在重新获得市场认可。

结论:2026 年反弹正在酝酿

宏观顺风与机构资金回归的叠加,正在构建一个更具说服力的 2026 年比特币看多逻辑。美联储降息与 QE 的开启,加上通胀逐步降温,可能推动更多流动性流向包括比特币在内的替代资产;而即便在 2025 年第四季度大幅波动之下,机构仍持续买入,也在一定程度上体现了其对比特币长期价值的信心。

对于投资者而言,核心结论很明确:比特币接下来的「策略性反弹」并不只是价格层面的修复,更是货币政策环境变化与机构行为转向共同塑造的结果。当市场在这一轮过渡期中寻找新均衡时,那些更早识别宏观与机构趋势开始同向的人,可能会在比特币下一阶段的行情中占据更有利的位置。

[原文链接]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。