美国劳工部于2026年1月13日美东时间上午8:30,正式公布2025年12月消费者物价指数数据报告。这份报告显示,整体通膨年率持稳,完全符合市场预期。而核心通膨则略低于预期,为市场带来小幅正面讯号。

CPI数据公布后,市场几乎笃定本月Fed将按兵不动,继续将利率维持在3.5%-3.75%区间不变;3月与4月重启降息的机率则小幅下降,分别报26.1%与33.8%。

受CPI数据影响,风险资产情绪回温,加密货币市场出现短线反弹。比特币价格一度突破92500美元,不过随后卖压涌现,出现小幅回落。以太坊走势类似,在CPI数据公布时最高冲上3160美元。

贵金属市场更为强势,现货黄金短暂站上4620美元,创下历史新高,现货白银涨势更猛,冲破87美元,日内涨幅超过3%。

而在今日(14日)加密市场迎来久违的狂欢,晨间六点左右,比特币迎来强势上攻,最高一度触及96495美元,刷新近两个月以来最高记录。截止撰稿时间回落至95000美元水平。以太坊也随着比特币联动截止撰稿时间回落至3350美元。随着指标性关卡被强势突破,市场上演“轧空”行情,让之前看空市场的投资者血流成河。过去24小时内,加密市场爆发逾6.85亿美元的清算潮,其中空头占据5.98亿美元。

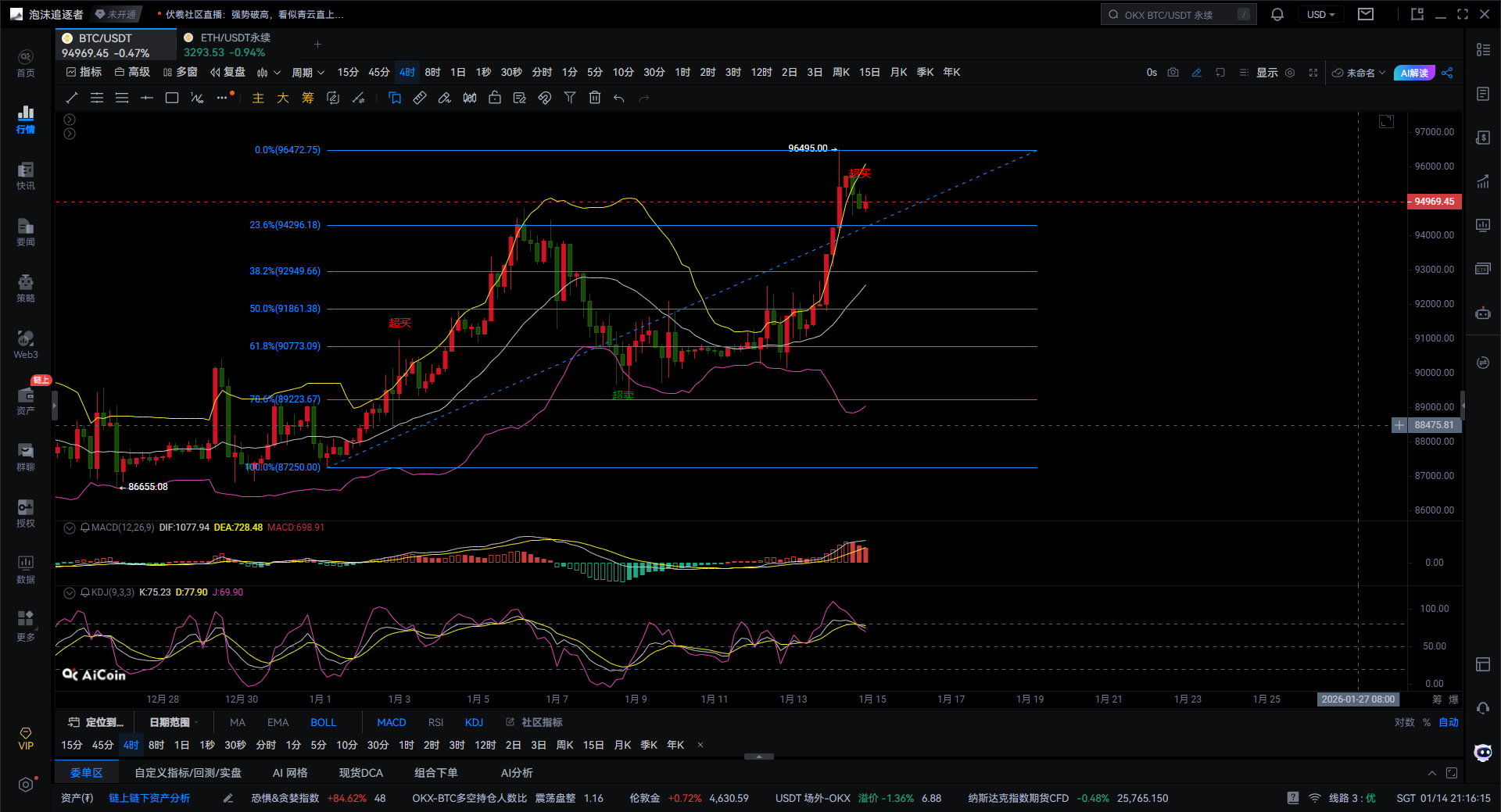

比特币四小时图

从BOLL来看,价格经历一波强势拉升,直接贴着上轨运行,上轨被明显打开,这说明了趋势的强度。但目前K线已从上轨回落,开始向中轨靠拢。简单的理解是,贴上轨意味着短期涨幅可能被透支,而回踩中轨是正常的趋势修复,并非转向空头。只要价格不跌破中轨,多头的整体结构就仍然保持完好。

观察KDJ指标,目前K、D、J三线值均处于高位区域,J线值已经开始拐头向下,呈现典型的高位钝化后修正状态。用通俗的话说,就是现在追多操作容易面临短期的震荡洗盘风险,等待价格回踩企稳会是更安全的选择。

再看MACD指标,细节上,MACD红色柱状图虽然依然存在,表明多头力量尚未离场,但红色柱状图已经开始缩短,显示上行动能正在减弱。不过,DIF和DEA线尚未形成死叉。总的来说,当前的上涨动能在消化过程中,但并未发展到翻空转折的阶段。

通过斐波那契回调分析,关键支撑位较为清晰:23.6%位置在94296附近,构成第一道支撑;38.2%位置在92949附近,是更强的支撑区域;50%位置在91861附近,可视为多头的生命线。从当前视角看,94200至93000区间是最可能形成止跌并进入震荡整理的区域。而91800一线至关重要,如果被跌破,则需要警惕短线可能出现更深的调整。

综合分析,这不是见顶,是拉升后的技术性回踩。短线有回落空间,但趋势仍然在多头通道里,属于“涨多了要歇一口气”。此次回踩的位置恰好接近上升趋势线,使得支撑线、趋势线以及斐波那契回调位形成技术共振。这种结构通常更倾向于洗盘整理,而非主力出货行为。

综上所述大仙给出以下建议供参考

价格回踩至94000一线,随后进入横盘震荡,以此修复技术指标,之后再次蓄力上攻,冲击96500上方。

价格跌破94000,进一步下探93000甚至91800附近,但随后可能快速拉回,完成一次深度洗盘。无论哪一种情形,只要91800关键位不被有效跌破,整体上涨趋势就不应看空。

真正的多头行情,从来不会害怕回调,真正需要警惕的是在最高点盲目追涨。当前的位置,不适合进行追涨操作。更合理的策略是耐心等待回踩确认信号。同时需要保持警惕,如果在高位出现放量却无法形成突破的情况,要小心诱多风险。整体来看,市场处于强势趋势中的正常休整阶段,在关键支撑之上,多头格局未变。

给你一个百分百准的建议,不如给你一个正确的思路与趋势,授人与鱼不如授人与渔,建议赚一时,思路学会赚一生!

撰稿时间:(2026-01-14,21:10)

(文-大仙说币)特此申明:网络发布具有延迟,以上建议仅供参考。投资有风险,入市需谨慎!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。