原文作者:Sanqing,Foresight News

1 月 13 日,Polygon Labs 宣布完成对加密货币支付基础设施 Coinme 以及区块链开发平台 Sequence 的收购,总收购金额超过 2.5 亿美元,但 Polygon Labs 未透露每家公司的具体收购价格,也未说明交易是以现金、股权还是两者混合的方式进行。

Polygon Labs 首席执行官 Marc Boiron 和 Polygon 基金会创始人 Sandeep Nailwal 表示,此次收购旨在助力该区块链网络的稳定币战略,Coinme 在美国拥有一系列汇款牌照,Sequence 则致力于构建区块链基础设施,包括加密钱包。

Coinme:补齐稳定币生态的线下入口

CoinDesk 1 月 9 日报道,有消息人士透露,Polygon 正洽谈收购比特币 ATM 运营商 Coinme。Polygon 计划花费 1 至 1.25 亿美元完成此项收购。

Coinme 成立于 2014 年,在美国合规加密业务中长期运营。它曾推出美国首个获许可的比特币 ATM,并与 Coinstar、MoneyGram 等传统品牌合作,在美国 48 个州建立了超过 5 万个零售点的现金网络。

Coinme 受美国国家抵押贷款许可系统(NMLS)和各州金融监管机构监管,提供线上钱包与自动售卖机交易服务,并支持包括比特币、以太坊、莱特币等主流加密货币的兑换与提现,使用户能更便捷地进行加密资产交易。

早在 2024 年,Coinme 的交易额便突破 10 亿美元并首次实现盈利,这显示其合规支付模式具备持续交易需求。

对 Polygon 而言,收购 Coinme 意味着直接获得了全美一系列汇款牌照,让 Polygon 能够直接在合规框架内连接现金、借记卡与链上资产,进一步推动稳定币支付与链下资金流入的融合布局。

Sequence:简化 Web3 用户体验

Sequence 与 Coinme 负责「钱」不同,Sequence 负责「用户」。Sequence 致力于通过模块化栈(包括智能钱包、账户抽象及 Trails 跨链编排引擎)来消除区块链的复杂性。

Sequence 的核心技术包括智能合约钱包(Smart Wallet),通过账户抽象让钱包行为更贴近 Web2 帐户体验,支持社交恢复、Gas 费抽象、自动交易等功能。

而其跨链执行的关键组件在于 Trails,能让用户在不感知跨链、Gas 费或代币兼容性的情况下,在用户发出意图后自动寻找并执行最优路径完成跨链或跨协议的交易。

结合链抽象与账户抽象,Sequence 不仅让开发者可以「一次构建,多链运行」,还能让终端用户像使用互联网服务一样,通过单一身份就在多个链间交易、支付和互动,降低新手用户进入链上世界的门槛。

构建 Open Money Stack 战略

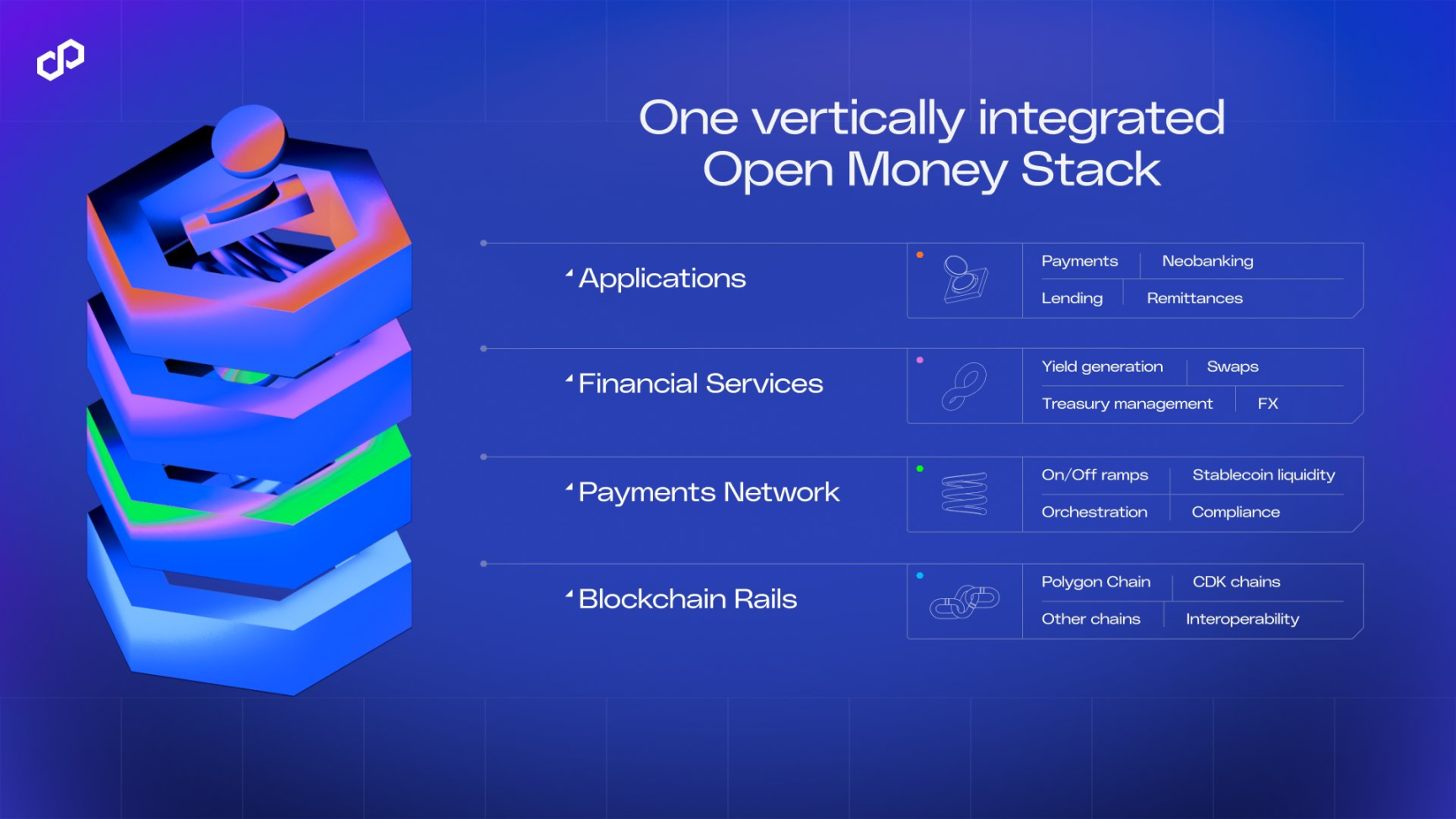

Polygon Labs 表示,此次收购的核心目标是其稳定币战略与 Open Money Stack,希望通过统一 API 减少系统割裂。

Open Money Stack | 图源:Polygon 推文

入金 / 出金层(On/Off & Cash Ramps):利用 Coinme 的合规网络与美国监管牌照,实现现金与法币的即时出入金,无论是实体现金还是电子法币,都能转换成稳定币或其他链上资产。

钱包与交互层(Wallet Infrastructure):依托 Sequence 提供的企业级智能钱包与账户抽象技术,加上一键式跨链交易和跨链交互能力,让终端用户无须关心底层链、Gas 或中间资产,就能完成链上接收、发送与支付操作。

跨链互操作层(Crosschain Interop):结合 Sequence 的 Trails 跨链编排引擎和 Polygon 的互操作协议,使得不同链之间的价值流动对用户完全透明,并支持任意链、任意代币的跨链交易。

结算层(Blockchain Rails):依托 Polygon 网络及其扩展技术,提供高速、低成本、安全的链上清算基础设施,让稳定币支付和价值流转具备商业级规模与效率。

此外,Open Money Stack 还计划整合稳定币编排(Stablecoin Orchestration)与合规、身份、收益生成等模块,为企业提供支付与资金管理。

L2 竞争转向「全栈整合」

Polygon 此次 2.5 亿美元的收购,反映出 L2 赛道的竞争重心正从底层的技术参数转向全栈式的业务整合。

这一路径与 Coinbase 扶持 Base 的逻辑高度一致。合规入口,收购 Coinme 是为了补齐法币出入金短板,对标 Coinbase 的 CEX 核心优势;交互体验,整合 Sequence 则是为了降低链上门槛,对标 Coinbase Wallet(Base)的易用性。

在 L2 技术逐渐趋同的背景下,拥有合规渠道与低门槛体验的生态将更容易吸引增量资金。Polygon 正在通过这一系列并购,试图在与 Base 等具备原生中心化优势的对手竞争中,构建起自己的全链路护城河。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。