📌 #Binance HODLer 空投第 60 期项目 – Brevis($BREV)投资挖掘与价格分析——

Binance HODLer 空投一般来说是市场开始回暖的一个重要信号,

而作为本年度第一个 Hodler 空投项目,Brevis $BREV 的出现备受关注;

我关注 Brevis @brevis_zk 很久了:

Brevis 本质上是一种ZK 协处理器或计算网络,其核心创新在于让复杂的数据处理工作在链下完成,仅将经过验证的证明返回区块链,以此减轻区块链的工作负荷。

V神曾经公开称赞过Brevis 的Pico Prism 技术,说在技术圈,这代表了“正统性”。

1️⃣所以 Brevis 到底在做什么?

如果只用一句话说:它在把「链下无限算力 + 链上可验证性」这件事,真正产品化。

Brevis 提出的“可验证计算”范式,本质上是在解决一个老问题:链上计算贵、慢、重复;但很多 DeFi / 激励 / 数据判断,又必须可信。

Brevis 的解法是:计算放到链下,然后用零知识证明(ZK)把“我算对了”带回链上,合约只做毫秒级验证,不再重复执行。

这不是一个新概念,但 Brevis 是少数已经跑到“生产级规模”的团队:Pico zkVM、ZK Data Coprocessor、ProverNet 去中心化证明市场。

这些已经被 PancakeSwap、Uniswap、Linea、MetaMask 等真实使用。

2️⃣把视角拉远:隐私 + ZK 这条线,真的结束了吗?

我看项目留言区很多人说隐私+ZK路线其实已经无路可走,但是如果你把时间维度拉长,会发现一件事:ZK 从来没有消失,只是在等基础设施成熟。

隐私、可验证计算、链下协处理,本身就是 Web3 的“内生需求”,不论是 BNB Chain 对中长期生态的布局,还是 a16z 对下一代区块链架构的判断,

ZK 都反复被提到,但形态正在变化:

从「Rollup 专属工具」到「通用计算与验证层」,巧合的是 Brevis 正好站在这个拐点上。

它不是在赌某一条链,而是在赌:未来越来越多链上行为,需要“可验证但不在链上完成”。

3️⃣Airdrop 的设计,本身就是一种筛选。

Brevis 这里主要要聊下的,是这次空投,应该是可圈可的,首先覆盖面很广,其次收益也不错。

不少人一开始对这个空投并没有太高预期——

拿到之后,反而开始去看:这项目到底在干嘛?

这是我觉得 Brevis 做得比较“聪明”的地方在于,它并没有试图通过稀缺空投制造 FOMO,而是:把 token 发到尽可能多的真实用户手里:

用一个“不过分刺激价格”的方式,让市场自己去消化、理解、定价这个项目

结果就是:很多人是先拿到 BREV,才开始真正读它的产品逻辑。从长期来看,这种路径比“空投即抛弃”要健康得多。

4️⃣行情与价格策略(个人节奏,非建议)

不谈预测,只谈节奏。

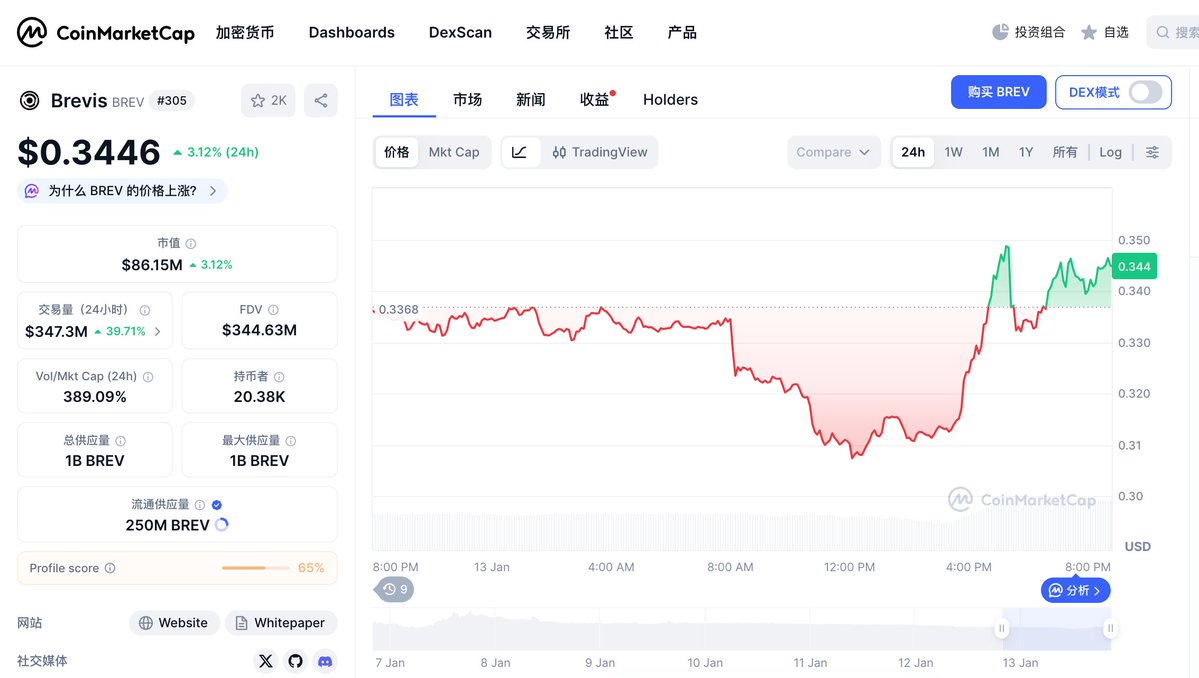

从 TGE 到现在,Brevis 的盘面给我的第一感觉是挺稳。

没有夸张的拉升,Binance 随后 Upbit 上线后,价格有所回升,也没有情绪化的抛压,价格运行看起来是在一个相对合理的区间内完成换手。

这通常意味着一件事:团队并不急着用价格去换关注度,所以我目前给这个项目定了一些价格。

从 K 线看,BREV 这波是典型的 TGE 后“冲高—回落—横盘—二次反抽”结构:

前面一度冲到 $0.55 附近,随后一路回落并在 $0.32–0.34 形成底部横盘,最近这根反抽更像是“底部换手后的第一脚抬头”。

流通:250M / 1B(25%),筹码并不算极紧,但也不是那种全流通砸盘结构。

1)市值:$85.8M,FDV:$343M;

2)关键价位(我会盯的线):

支撑区:$0.32(最近底部箱体)、再往下是 $0.30(心理位/更强防线);

压力区:$0.36(反抽第一阻力)、$0.40(前中枢/密集成交)、$0.45(若继续走强才会去挑战);

3)短线策略:

适合小仓位做波段,别追涨。更偏向 回踩 $0.32–0.33 附近观察承接,跌破 $0.30 就当结构走弱先撤。

如果能放量站稳 $0.36,才算“二次反抽成立”,上方才有继续摸 $0.40 的空间。

4)中线观察:

重点看两件事:

1)这次反抽之后能不能在 $0.34 上方“横住”形成更高的箱体;

2)成交额回落后,价格是否还能稳住(量缩不跌,才是真强)。

5️⃣最后的话

Brevis 很多人拿到空投之后,才花时间去研究的项目。

而这种“顺序反过来”的路径,反而更容易留下真正的长期参与者。

ZK 这条线没有结束,只是在换形态;可验证计算也许不会马上成为主角,但一旦成为“默认能力”,价值释放会是非线性的;

Brevis 至少已经走到了从概念到生产级落地的那一步。

至于价格,短期是节奏问题,中期是数据问题,长期才是方向问题。

我更愿意等它用更多真实使用,慢慢回答这些问题。

期待未来更好的表现!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。