撰文:Glendon,Techub News

当加密市场行情陷入停滞不前的胶着状态时,部分机构仍在持续扩大布局。昨晚,Strategy 创始人 Michael Saylor 发推表示,Strategy 上周再次以约 12.5 亿美元增持 13627 枚比特币,此次资金投入规模达到了去年 8 月以来的最高水平。截至 1 月 11 日,Strategy 总共持有约 68.74 万枚比特币,总投资约 518 亿美元。

与此同时,作为全球最大的以太坊「新资金」买家,BitMine 昨日也披露其上周斥资约 7537 万美元购入 24266 枚以太坊,当前持仓总量达到约 416.78 万枚以太坊,总价值约 129 亿美元,占全网 ETH 代币供应量的 3.45%。

然而,虽然双方各自作为比特币和以太坊 DAT 市场的龙头老大,但在增持过程中却出现了截然不同的情况。据链上分析师余烬统计,截至 1 月 12 日,Strategy(MSTR)的比特币持仓成本均价为 75353 美元,凭借先行者的优势,尽管受到行情影响,但是其浮盈仍高达约 105.5 亿美元;相比之下,BitMine(BMNR)的以太坊持仓成本均价为 3862 美元,浮亏则是达到了 32.25 亿美元。在此情形下,一系列疑问随之而来。为何 BitMine 浮亏如此之大,其增持以太坊的速度却并未放缓?在此期间,BitMine 还在持续质押大量的以太坊,这背后又有着怎样的考量?

从 DAT 公司到基础设施提供商的跃迁

BitMine 高频率增持和看似激进质押的行为,其实是多重因素共同作用的结果。首先是 BitMine 的股价表现与净资产价值比率(mNAV)方面。在加密市场经历「10.11」闪崩以及数月行情低迷的冲击后,BitMine 也深受其害,BMNR 的整体股价走势与 Strategy(MSTR)颇为相似,均遭遇了大幅下跌。截至撰稿时,BMNR 从去年 10 月高点的 65.6 美元跌至 31.13 美元,跌幅约 53%;MSTR 股价现为 162.23 美元,相较于 10 月约 365 美元的高点,下跌幅度更是超过 55%。

不过,二者也存在明显区别。BMNR 股价在 11 月底触及低点 24.33 美元后,自 12 月起便呈现出震荡上涨的趋势,一度重回 40 美元,目前市值为 132.61 美元;而 MSTR 股价则持续下行,在 1 月 2 日更是触及 149.75 的低点,当前市值已跌破 500 亿美元,约为 466.17 亿美元。

上述股价数据的关键差异,直接导致双方净资产价值比率(mNAV)有所不同。作为重要的观察指标,Strategy 的 mNAV(企业市值与持有 BTC 价值的比率)现已大幅跌破 1,约为 0.75,这意味着 Strategy 的融资能力可能会受到一定程度的限制;相比之下,BitMine 的 mNAV 目前为 1.02,虽然与去年 7 月峰值 5.7 倍相差甚远,但仍能维持在 1 以上,这表明其股价依然具备一定的价值支撑。

其次,从投资成本与战略考量角度来看,BitMine 的以太坊购入均价为 3862 美元,而当前以太坊价格约为 3125 美元,其浮亏主要源于市场的周期性回调,并非资产本身出现劣化。在 BitMine 看来,浮亏 32 亿美元本质上并非投资失败,而是一种战略成本。此前,BitMine 董事会主席 Tom Lee 曾提出该公司的长期目标——「5% ETH 的炼金术」,即收购以太坊总供应量的 5%。在昨日发布的公告中,BitMine 着重强调,该公司仅用 6 个月就完成了该目标的近 70%,这充分说明 BitMine 及其董事会高层依然高度认可以太坊的长期价值。

而在增持以太坊的过程中,BitMine 提高股价和 mNAV 的重要手段正是「质押 ETH」。12 月 27 日,BitMine 开始尝试将其持有的以太坊进行质押以获取利息收益,首次质押数量约为 7.49 万枚 ETH,一度引发业内热议。此后,BitMine 每日均大量质押其以太坊储备。在今日再次质押约 15.42 万枚 ETH 后,短短 18 天的时间,BitMine 已累计质押超过 134.42 万枚 ETH,总价值高达 42 亿美元,成为全球最大的以太坊质押实体。

与此同时,BitMine 与 3 家质押服务提供商合作,正在开发专为以太坊原生质押而设计的定制基础设施「美国本土以太坊验证器网络 MAVAN」,并计划于 2026 年第一季度全面上线。其目的十分明确,即计划摆脱对 Lido、Coinbase 等第三方质押服务商的依赖,通过在美国本土部署符合机构与监管对托管安全要求的设施,打造「自主基础设施」,进而提升安全性、合规性与收益确定性。这意味着,BitMine 的终极目标,或许并不局限于成为最大的 ETH 持有者,而是成为以太坊质押生态的底层操作系统之一。

Tom Lee 对此曾表示,「当 BitMine 的 ETH 全部由 MAVAN 及其质押合作伙伴进行质押时(规模达到一定程度),ETH 质押费用将达到每年 3.74 亿美元(按 2.81% 的 CESR 计算),或是每天超过 100 万美元。」

按照目前约 2.86% 的 APY 计算,如果 BitMine 将以太坊持仓全部进行质押,一年便可以获得约 12 万枚的 ETH 利息,价值将接近 3.75 亿美元。

正是通过这一方式,市场开始重新评估「质押收益」对 BitMine 估值的支撑力。一个重要体现就是 BitMine 的 mNAV 回升至 1.02,此前这一指标曾跌至 0.85。并且通过质押行为,BitMine 形成了一种收益闭环,即利用质押收益覆盖浮亏,形成正向现金流,从而支撑股价修复。值得注意的是,现阶段,BitMine 股价已开始与质押收益曲线呈现出正相关关系。

此外,BitMine 的这些举措也推动了华尔街机构认知的转变,它们的注意力正从「纯 ETH 杠杆工具」模型转向「质押收益流资产」模型。例如,同为以太坊头部财库公司的 SharpLink 于 1 月 8 日宣布已在 Linea 上部署价值 1.7 亿美元的以太坊,并采用增强型收益策略。

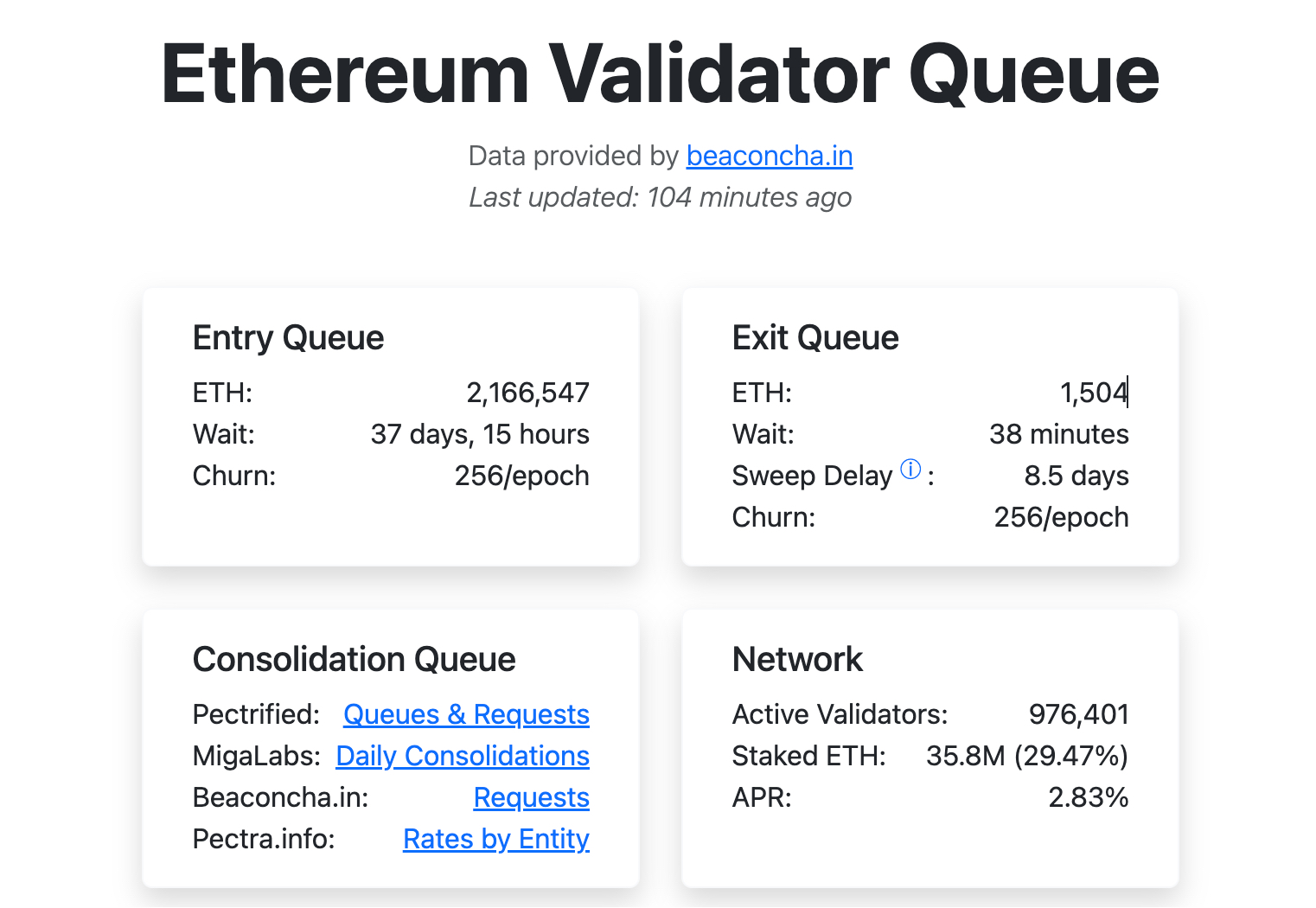

更直观的数据体现在于,以太坊质押需求的显著回升。据 Ethereum Validator Queue 最新数据,当前约 216.65 万枚 ETH 正排队等待进入以太坊验证者网络,预计等待时长达到 37 天 15 小时,而退出队列仅约为 1504 枚 ETH(此前退出队列甚至完全清空)。同时,以太坊总质押量也达到 3580 万枚 ETH,占总供应量的 29.47%,活跃验证者数量接近 98 万。

与之形成鲜明对比的是,去年 9 月,该网络「退出队列」超过 267 万枚 ETH,达到历史高点。这一指标的反转,表明市场对以太坊生态的信心回归,也预示着以太坊正步入资本积累阶段。

值得关注的是,当下,BitMine 正处于以太坊战略执行的关键时期。1 月初,Tom Lee 在新年致辞中表示,BitMine 董事会已提出大幅增加公司授权股数的提案,该提案提议将公司股份数量从 5 亿股增加到 500 亿股,并敦促股东在 1 月 14 日前对该提案进行投票表决。

Tom Lee 着重说明,此次增股并非稀释股份,而是有着多重考量:一是为筹集资金提供便利,涵盖公开市场发行、可转换证券及担保融资等途径;二是赋予潜在并购或战略交易股权支付能力;更重要的是,为未来必要时进行股票拆分创造条件,降低投资门槛以吸引散户参与。

然而,BitMine 章程有一项特殊规定,增发股份需获得 50.1% 的流通股支持,这是一个极高的门槛,因此,获得增发股份的授权非常困难。而 BitMine 目前的 5 亿股授权即将耗尽,若提案未通过,公司将无法增发新股,融资渠道将受限,ETH 增持也将因此停滞。

不过,从现状来看,BitMine 尚未达成其「5% ETH 的炼金术」的目标,且该公司发展前景较为明朗。此外,Tom Lee 解释称,「BitMine 旨在创造股东价值,通过每股增值 ETH 来实现这一目标。只以高于 mNAV 的价格发行股票,优化 ETH 持有的收益,并将资产负债表战略性地投资于『登月计划』项目。」因此,综合各方面因素,该提案通过的可能性很高。

结语

从 BitMine 的这些举措来看,其本质上是运用机构级金融工程,将加密资产从波动性投机品,转化为可预测、可审计和可融资的基础设施资产。作为以太坊生态的重要参与者,BitMine 持续增持以太坊并大规模质押的行为,传递出了机构对以太坊长期价值的坚定看好,也表明尽管短期价格震荡,但机构更注重长期收益和网络稳定性。

另一方面,尽管加密市场当前尚未全面复苏,但多项数据暗示抛售可能已接近尾声,市场流动性较为良好。摩根大通分析师 Nikolaos Panigirtzoglou 指出,比特币和以太坊 ETF 的资金流出在本月开始趋于稳定,期货市场定位指标也显示 2025 年末的投资者减仓行为已基本完成。

Tom Lee 也公告中指出,2026 年对加密货币来说预示着诸多利好,稳定币的普及和代币化将推动区块链成为华尔街的结算层,尤其有利于以太坊的发展。「我们仍然认为去年 10 月 10 日之后的杠杆重置类似于『微型加密市场寒冬』,2026 年将是加密市场复苏之年,并且市场将在 2027-2028 年迎来更强劲的涨幅。」

由此可见,BitMine 颇为「疯狂」的增持和质押行为,其实并不是一个「赌徒」的执念,而是一个意图成为以太坊质押生态基础设施的公司的冷静布局。超 32 亿美元浮亏是市场周期的代价,质押收益是现金流的「锚」,而即将上线的 MAVAN 将成为 BitMine 长期价值「护城河」的基石。当市场还在争论「以太坊何时能够涨到 5000 美元」时,BitMine 已在计算「每天 100 万的收益,能够支撑多少年」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。