The cryptocurrency market continues to exhibit a range-bound oscillation pattern, with Bitcoin and Ethereum showing fluctuating intraday movements, failing to break through key resistance zones, and the tug-of-war between bulls and bears remains stuck.

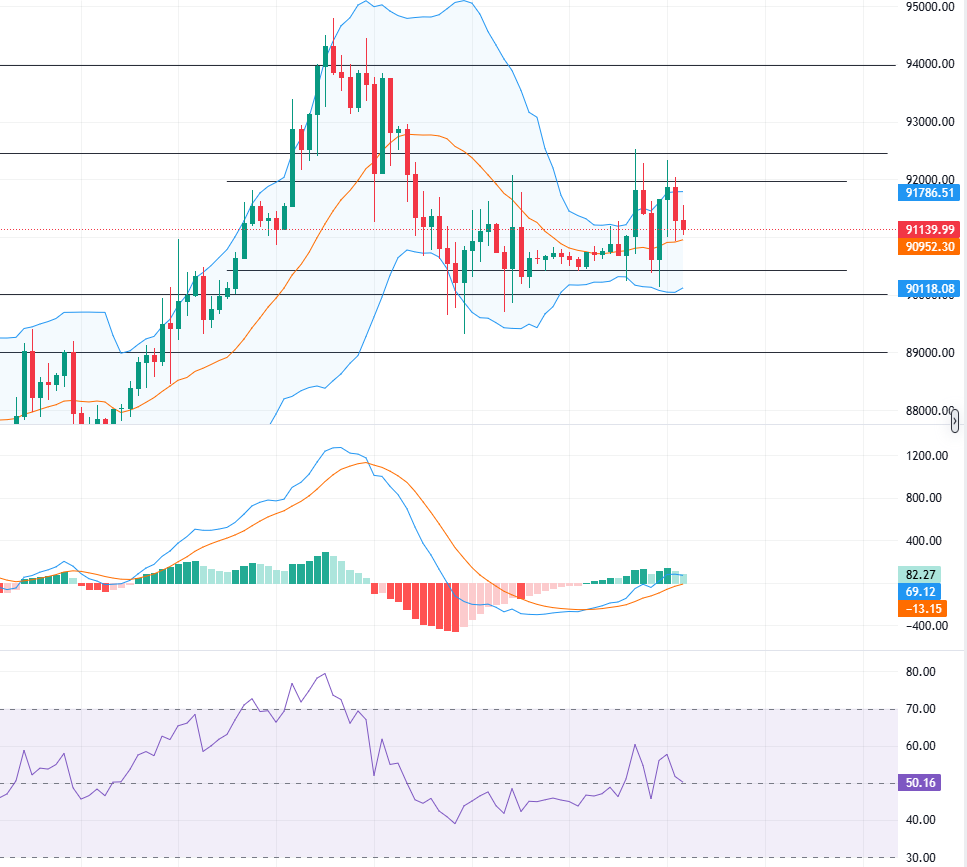

Bitcoin's performance yesterday was volatile, peaking around 92,500 before facing pressure and retreating. Before the evening session, it hit a low of 90,000, then quickly rebounded off support; during the early morning hours, the price briefly erased losses and rose back to around 92,300, but the rebound lacked momentum and could not sustain the upward trend, leading to another decline. Ethereum showed significant correlation, rebounding intraday to encounter resistance near 3,170, then dipping to a low of 3,065 in the evening before stabilizing and rebounding to around 3,150 in the early morning, ultimately also retreating, with both cryptocurrencies trapped in a clear range-bound oscillation.

On a macro level, market sentiment is suppressed by multiple bearish factors. Trump's public "war" against the Federal Reserve has raised concerns about policy uncertainty, and the risk of losing control has heightened cautious sentiment among investors; coupled with the market pricing in a high probability of the Federal Reserve maintaining interest rates in January, expectations for rate cuts have temporarily cooled, leading to a continued weak performance in the cryptocurrency market with low willingness for capital entry.

From a technical perspective, both cryptocurrencies exhibit characteristics of "oscillation and accumulation, with unclear direction." The Bollinger Bands for Bitcoin on the four-hour chart have flattened, and although the MACD indicator is slowly expanding, the moving average system is intertwined, highlighting insufficient momentum from both bulls and bears, making it likely to continue the range-bound oscillation in the short term. Key resistance levels to watch above are 92,500 and 93,500, while support focuses on the 90,000 level and the previous low of 89,000; an effective breakout from this range is needed to clarify the short-term trend.

Ethereum's technical formation leans bearish, with the daily MACD continuing to contract, indicating insufficient rebound momentum; the moving averages on the four-hour chart are flat, overall in a weak corrective state, and the intraday volatility is expected to be limited. Key short-term resistance levels to watch above are 3,160 and 3,200, while support should be noted at the 3,050 area and the 3,000 level; the focus is on whether the evening session can break the oscillation deadlock.

In summary, the current market lacks a clear driving logic, making it difficult to change the range-bound oscillation pattern in the short term. Today, two core events need to be closely monitored: the U.S. CPI data will impact inflation expectations and the Federal Reserve's policy path, while speeches from Federal Reserve executives may release new policy signals; both are expected to be key variables in breaking the current oscillation pattern.

This article is exclusively contributed by Jane Crypto (WeChat Official Account: Jane Crypto) and represents personal views only. Due to the timing of the article's release, the above views or suggestions may not be timely and are for reference only; risks are borne by the reader. Manage your trading positions reasonably, and avoid heavy or full positions. Developing good investment habits is essential for a positive cycle!

Market fluctuations are time-sensitive; feel free to scan the QR code to follow the official account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the official account (as shown above) of Jane Crypto, and any other advertisements at the end of the article or in the comments section are unrelated to the author!! Please discern carefully between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。