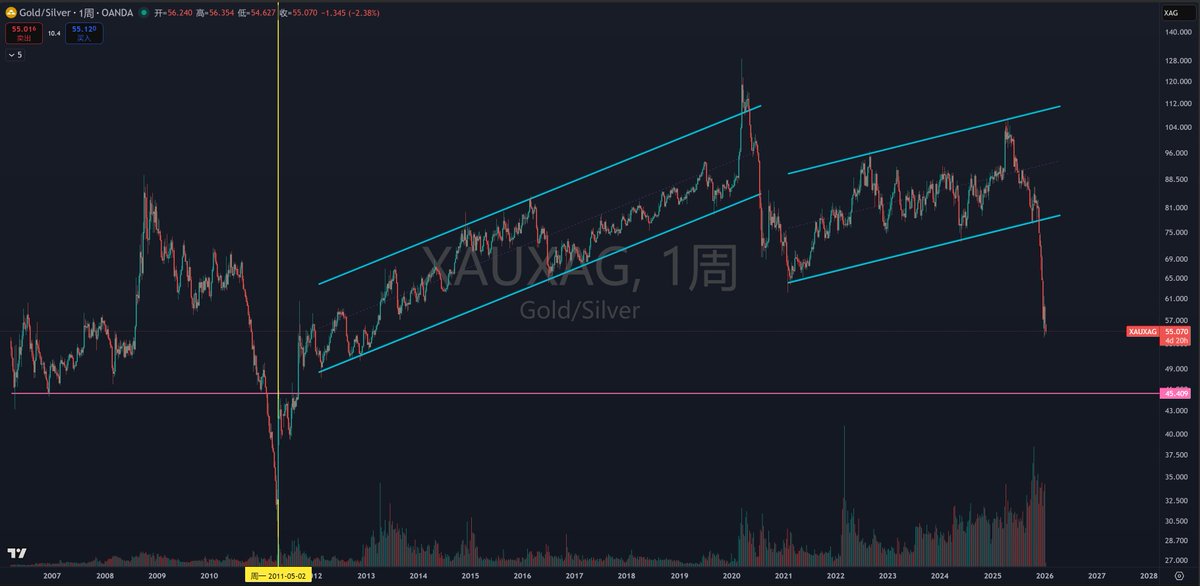

历史中XAUXAG金银比的暴跌往往预示着即将迎来的牛市终点

虽然,这20年里仅出现了一次大级别的暴跌

在2011年也终结了那一轮黄金波澜壮阔的牛市

而我正好在2012年进入那所谓的“炒现货黄金”的行列...

也有幸见到了其后13年4月的历史暴跌

然而在2013-2018年这样的大级别周期的震荡趋势中

我特么竟然没有完善出一套震荡的交易系统...

但也因此,离开外汇市场进入了加密货币市场...

24年的黄金那一轮单边上涨趋势也看见了

可惜留在加密圈,看不上那点波动...

没想到最后的结局

小丑竟然是我自己...

2024年3月也刚好是这轮加密牛市资产的巅峰期...

唉,只能说,德不配财...

2026开始,多反思,多复盘,多总结吧

目前来看,未来一两年最有潜力仍然数美股和A股...

当然,美股是青铜局,A股是王者局...

所以,A股我只买了大盘和热门赛道的指数基金,不买个股...

毕竟,炒个股已亏损几百万,劳资怕了😭😭😭

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。