This article is written by Tiger Research. One of the defining narratives of 2026 is "privacy." As institutional participants dominate the cryptocurrency space, privacy has become a key technological feature connecting blockchain with real-world business.

Key Points

- The core advantage of blockchain—transparency—may expose corporate trade secrets and investment strategies, posing substantial risks to businesses.

- Fully anonymous privacy models like Monero do not support KYC or AML, making them unsuitable for regulated institutions.

- Financial institutions require selective privacy that can protect transaction data while remaining compliant with regulatory requirements.

- Financial institutions must determine how to connect with the open Web3 market for expansion.

1. Why is Blockchain Privacy Necessary?

One of the core characteristics of blockchain is transparency. Anyone can check on-chain transactions in real-time, including who sent the funds, to whom, the amount, and when it was sent.

However, from an institutional perspective, this transparency presents obvious problems. Imagine a scenario where the market can observe how much Nvidia transferred to Samsung Electronics or when a hedge fund precisely deployed capital. This visibility would fundamentally alter the competitive dynamics.

The level of information disclosure that individuals can tolerate differs from what businesses and financial institutions can accept. The transaction history of a business and the timing of institutional investments constitute highly sensitive information.

Therefore, it is unrealistic to expect institutions to operate on a blockchain where all activities are fully exposed. For these participants, a system without privacy is less a practical infrastructure and more an abstract ideal with limited real-world applications.

2. Forms of Blockchain Privacy

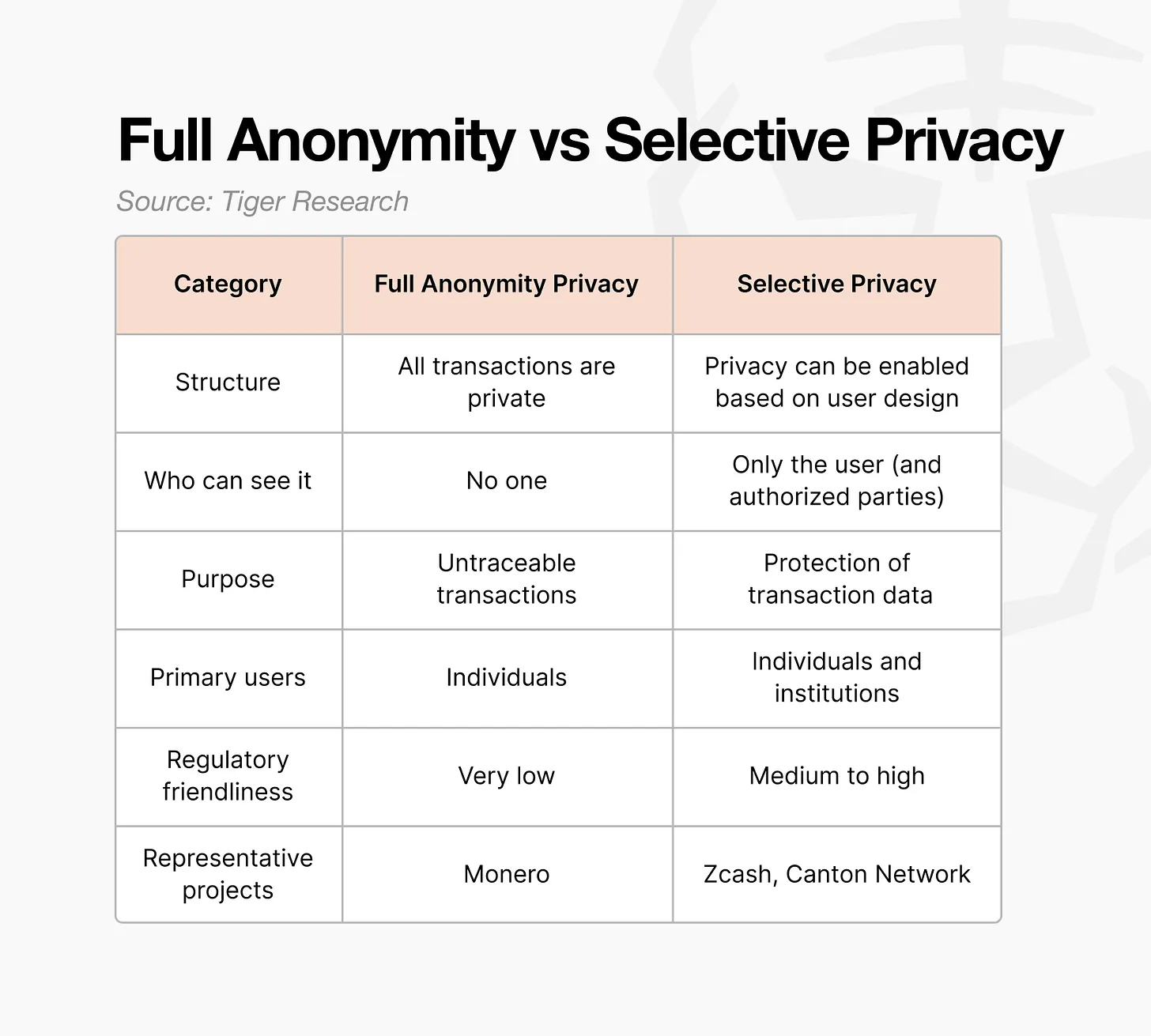

Blockchain privacy is generally divided into two categories:

- Fully Anonymous Privacy

- Selective Privacy

The key distinction lies in whether information can be disclosed when the other party needs verification.

2.1. Fully Anonymous Privacy

Fully anonymous privacy, simply put, is about hiding everything.

The sender, receiver, and transaction amount are all concealed. This model stands in direct opposition to traditional blockchains, which prioritize transparency by default.

The primary goal of fully anonymous systems is to prevent third-party surveillance. They do not aim for selective disclosure but rather seek to completely block external observers from extracting meaningful information.

Source: Tiger Research

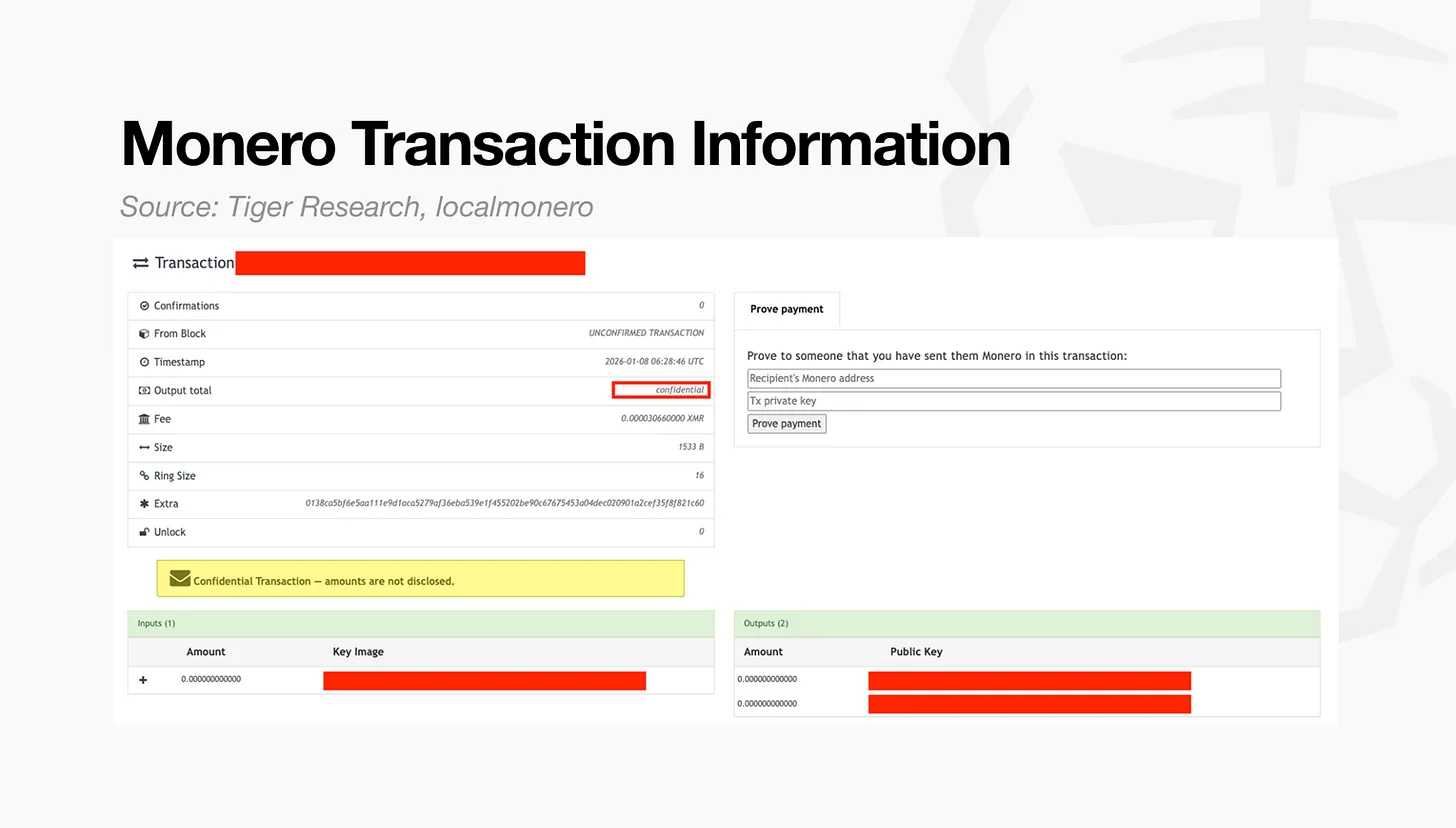

The above image shows the transaction records of Monero, a representative example of fully anonymous privacy. Unlike transparent blockchains, details such as transfer amounts and counterparties are not visible.

Two features explain why this model is considered fully anonymous:

- Output Total: The ledger does not display specific numbers but shows values as "confidential." Transactions are recorded, but their contents cannot be interpreted.

- Ring Signature Size: Although a single sender initiates the transaction, the ledger mixes it with multiple decoys, making it appear as if multiple parties are sending funds simultaneously.

These mechanisms ensure that transaction data remains opaque to all external observers, without exception.

2.2. Selective Privacy

Selective privacy operates on different assumptions. Transactions are public by default, but users can choose to make specific transactions private by using designated privacy-enabled addresses.

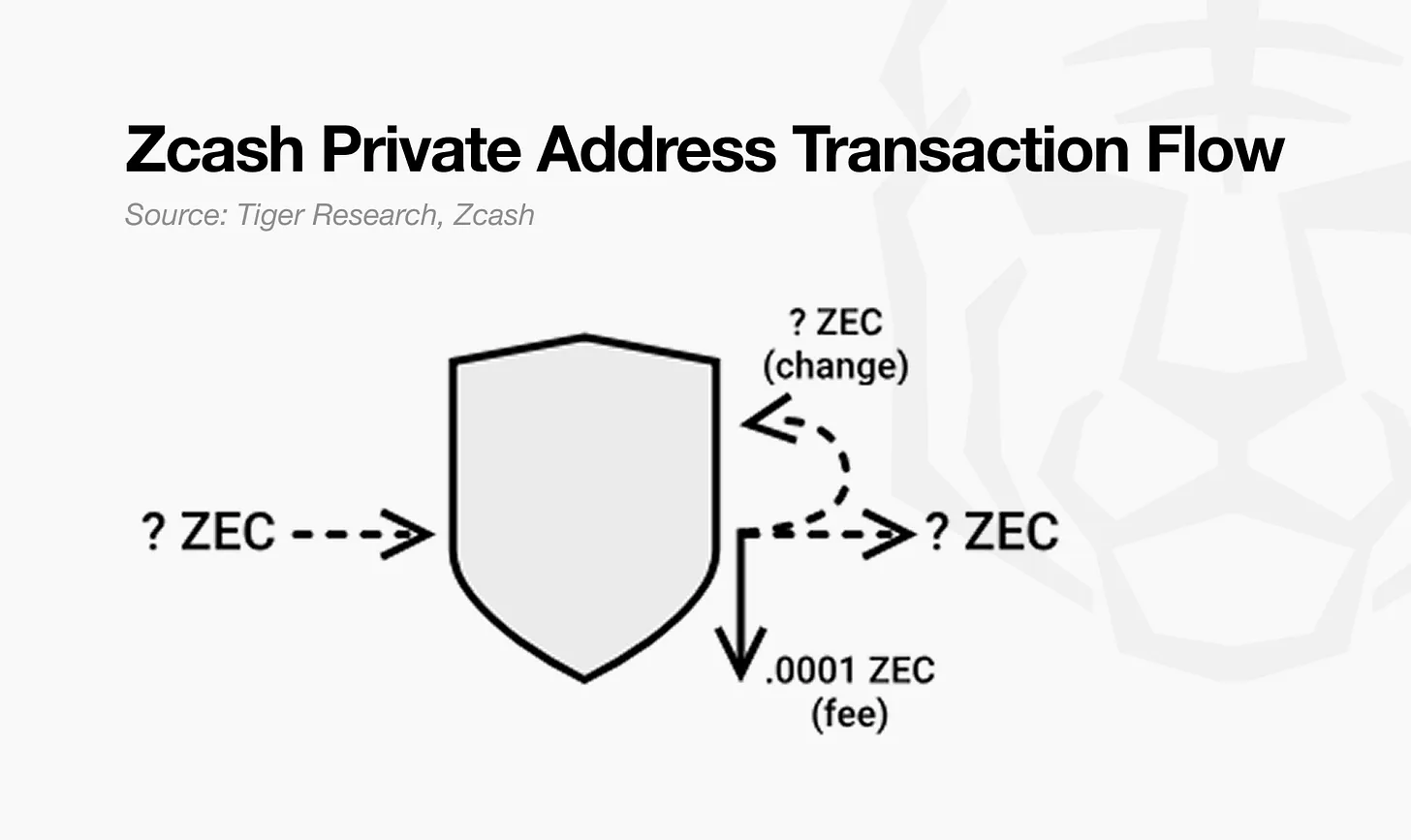

Zcash provides a clear example. When initiating a transaction, users can choose between two types of addresses:

- Transparent Address: All transaction details are publicly visible, similar to Bitcoin.

- Shielded Address: Transaction details are encrypted and hidden.

Source: Tiger Research

The above image illustrates what elements Zcash can encrypt when using a shielded address. Transaction records sent to a shielded address are on the blockchain, but their contents are stored in an encrypted state.

While the existence of the transaction remains visible, the following information is hidden:

- Address Type: Using a shielded (Z) address instead of a transparent (T) address.

- Transaction Record: The ledger confirms that a transaction occurred.

- Amount, Sender, Receiver: All encrypted and inaccessible from external observation.

- Viewing Rights: Only parties granted viewing keys can inspect transaction details.

This is the essence of selective privacy. Transactions remain on the chain, but users control who can view their contents. When necessary, users can share viewing keys to prove transaction details to another party, while all other third parties remain unable to access that information.

3. Why Financial Institutions Prefer Selective Privacy

Most financial institutions have know your customer (KYC) and anti-money laundering (AML) obligations for every transaction. They must retain transaction data internally and respond promptly to requests from regulators or oversight bodies.

However, in an environment built on fully anonymous privacy, all transaction data is irreversibly hidden. Because information cannot be accessed or disclosed under any conditions, institutions are structurally unable to fulfill their compliance obligations.

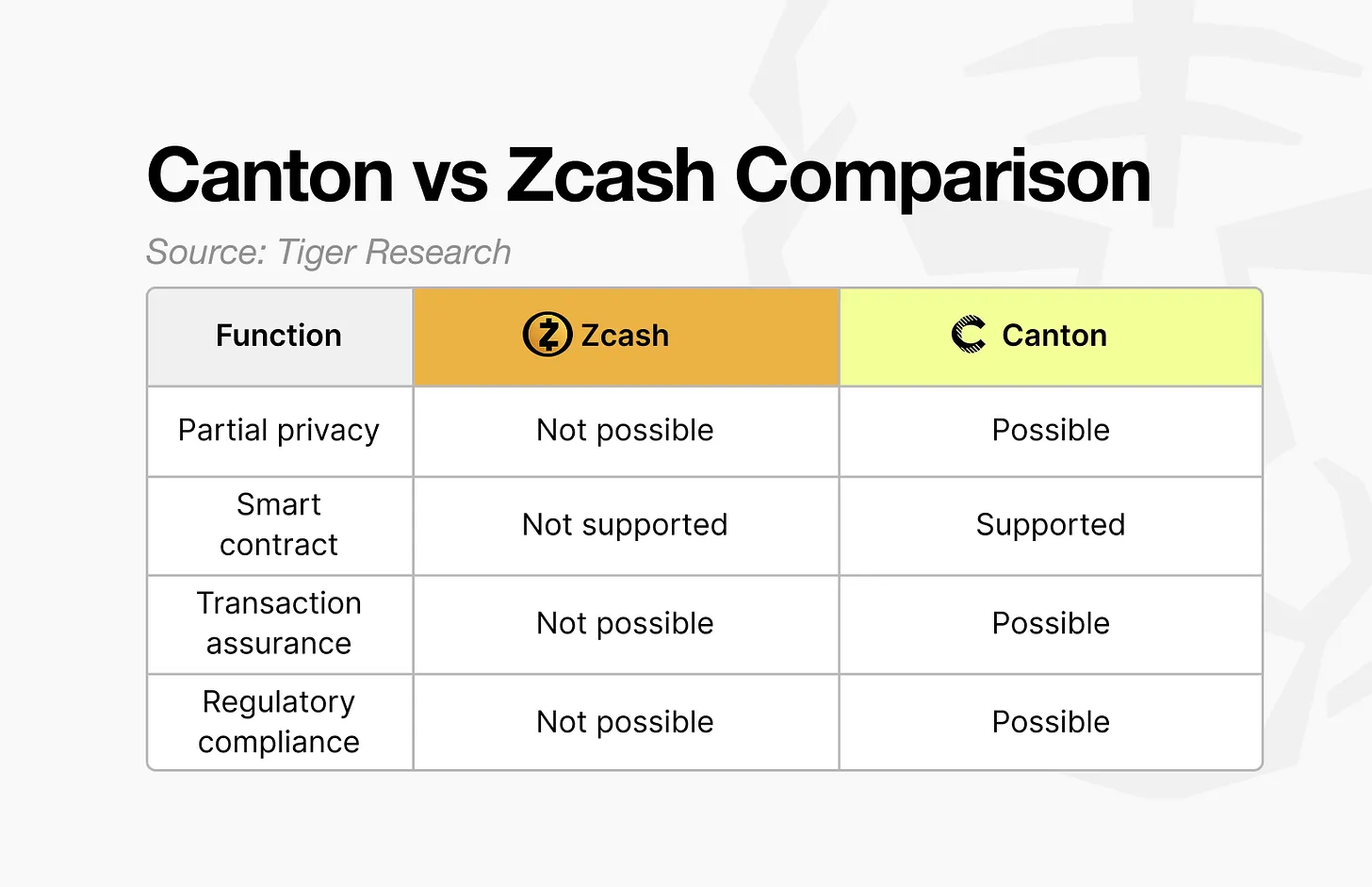

A representative example is the Canton Network, which has been adopted by the Depository Trust & Clearing Corporation (DTCC) and is currently used by over 400 companies and institutions. In contrast, Zcash, despite being a selective privacy project, has seen limited institutional adoption in the real world.

What accounts for this difference?

Source: Tiger Research

Zcash offers selective privacy, but users cannot choose which information to disclose. Instead, they must choose whether to disclose the entire transaction.

For example, in a transaction where "A sends $100 to B," Zcash does not allow hiding just the amount. The transaction itself must be either fully hidden or fully disclosed.

In institutional trading, different participants require different information. Not all participants need access to all data in a single transaction. However, Zcash's structure forces a binary choice between full disclosure and complete privacy, making it unsuitable for institutional trading workflows.

In contrast, Canton allows transaction information to be managed in separate components. For instance, if a regulator only requests the transaction amount between A and B, Canton enables institutions to provide just that specific information. This functionality is achieved through the smart contract language Daml used by Canton Network.

Other reasons for institutional adoption of Canton are detailed in previous Canton research.

4. Privacy Blockchain in the Era of Institutions

Privacy blockchains evolve with changing demands.

Early projects like Monero aimed to protect individual anonymity. However, as financial institutions and businesses began to enter the blockchain environment, the meaning of privacy has shifted.

Privacy is no longer defined as making transactions invisible to everyone. Instead, the core goal has become to protect transactions while still meeting regulatory requirements.

This shift explains why selective privacy models like the Canton Network have gained attention. Institutions need not just privacy technology but infrastructure designed to match real-world financial trading workflows.

In response to these demands, more institution-focused privacy projects continue to emerge. Looking ahead, the key differentiating factor will be how effectively privacy technology can be applied in real trading environments.

Alternative forms of privacy may emerge that stand in contrast to the current institution-driven trends. However, in the short term, privacy blockchains may continue to develop around institutional trading.

Source: Tiger Research

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。