| Hot News |

1: [Thirty Democrats, including Pelosi, unite to promote the "Predictive Market Anti-Insider Trading" bill]

2: [High-net-worth European investors have accepted purchasing European real estate through crypto assets]

What do we think about Bitcoin and Ethereum today? Bitcoin has been consolidating over the weekend without significant fluctuations, maintaining a narrow range between 90,000 and 91,000, while Ethereum has been consolidating between 3,060 and 3,100. Although there were signs of a small breakout last night, the upper resistance at 91,500 still poses a challenge. In the previous article, Tommy mentioned the small range for long and short trades over the weekend, which was successfully capitalized on. This week, we still need to pay attention to the breakthrough of the upper pressure at 90,400-91,500 and the support below to choose a new medium-term direction. The range of 3,080-3,150 for Ethereum is also crucial to observe.

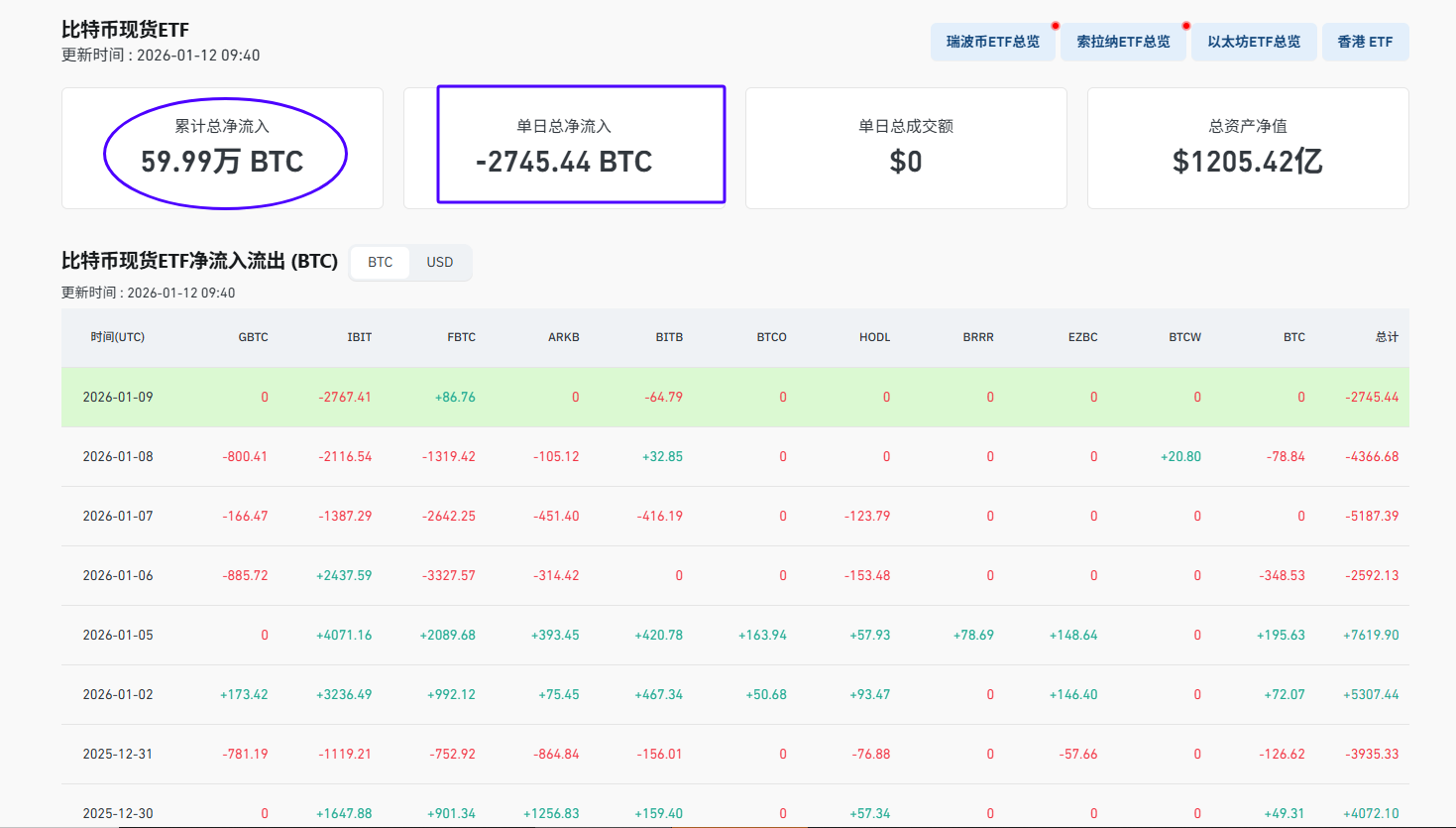

BTC: Currently, the overall market for Bitcoin remains relatively weak, and the trading volume during the consolidation has not seen significant inflows. On the 1-hour and 4-hour charts, we are in a testing phase. We only need to focus on whether the upper level of 91,500 can break through with volume and stabilize. If it stabilizes, the next target range is 92,800-93,700.

ETH: The support area for Ethereum is at 3,050-3,030, and the resistance area is at 3,150-3,180. The key defense below is at 3,080-3,050. A breakout above 3,150 will allow the bulls to continue to exert strength. In summary, for short-term operations, if a breakout does not have volume, go short; if a pullback does not break support, go long, and wait for a new direction to emerge. To summarize today's intraday operations: the daytime lacks liquidity, so wait for the U.S. stock market to open. The daytime is in a narrow range; take a little profit and move on, don’t be greedy. Avoid being washed out by this sideways movement; we won’t panic when the new trend direction erupts.

So, buying on support and selling on rebounds to take a little profit is the most stable rhythm for today.

In this recent bull market, I have repeatedly emphasized that I believe the underlying logic of the crypto market has changed. The factors determining market trends are now more complex than before, and this complexity is something investors have not experienced in previous bull and bear markets. I am Tommy, a companion in the crypto circle who trades while practicing. If you want real-time entry points and personalized strategies, click on my homepage and join the community. We have professional trading instructors available around the clock to help you maintain your mindset; don’t bear it alone.

The points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Lastly, everyone should remember the two key points I mentioned in my previous article: focus on testing positions in the short term, and once we move away from our target range, it will be the last opportunity to make significant gains before the end of the year. I am Tommy from K-Line Life, your real-time crypto steward.

Mainly focused on spot, contracts, BTC/ETH/ETC.

Specializing in style: K-Line Trading

Original volume trading strategy.

Short-term wave highs and lows, medium to long-term trend trades, daily extreme pullbacks, weekly K-line top predictions, monthly K-line head predictions.

WeChat public account QR code (K-Line Life Tommy)

Warm reminder: The only WeChat public account at the end of the article is created by the author!!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。