Original Title: The Case for Selling $OP Before $BASE

Original Author: @13300RPM, Researcher at Four Pillars

Original Translation: AididiaoJP, Foresight News

Core Points

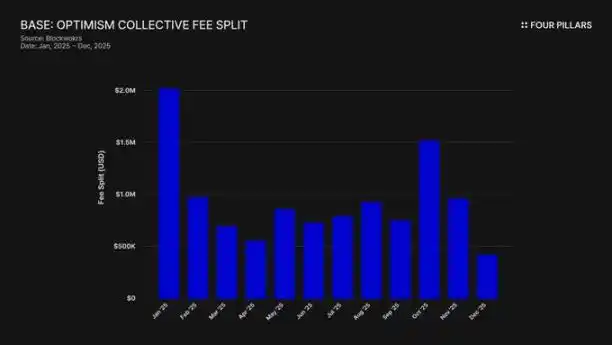

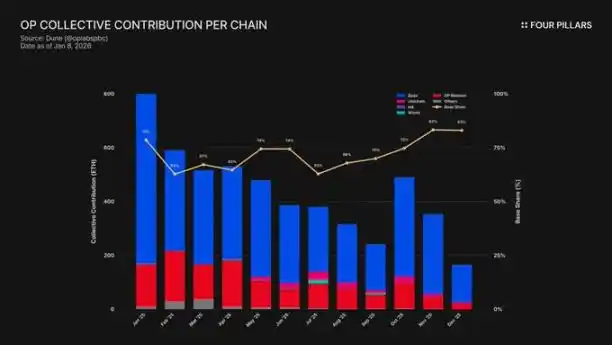

· Highly Concentrated Revenue: In 2025, Base contributed approximately 71% of the sequencer revenue for Superchain. This concentration trend is intensifying, yet Coinbase's payment to Optimism is fixed at 2.5%.

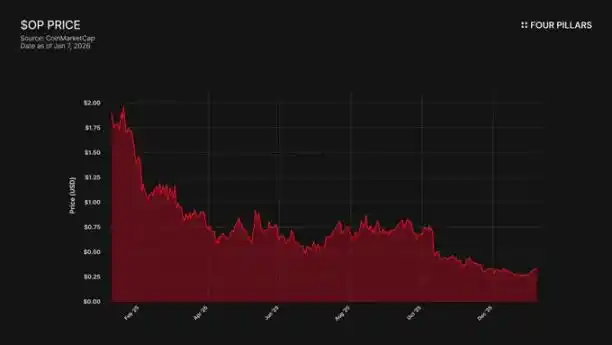

· Price and Ecosystem Divergence: The OP token has plummeted 93% from its historical high ($4.84 → $0.32), while the total value locked (TVL) of Base has grown by 48% during the same period ($3.1 billion → $5 billion). The market has recognized that Base's growth has not benefited OP holders, but has yet to consider the risk of Base potentially exiting.

· Zero Technical Barriers: The OP Stack uses the MIT open-source protocol, meaning Coinbase can fork it at any time. Currently, the only link keeping Base within Superchain is the governance relationship, and a BASE token with independent governance rights would sever this connection entirely.

· Fragile Alliance: Optimism granted Base 118 million OP tokens to ensure long-term cooperation, but limited its voting power to 9% of the total supply. This is not a true alignment of interests, but rather a minority stake with an attached "exit option." If renegotiation leads to a drop in OP price, Coinbase's forfeiture of the value of this grant in exchange for revenue sharing would be a worthwhile trade.

Coinbase's L2 network, Base, contributed approximately 71% of the sequencer revenue for Superchain in 2025, yet only paid 2.5% of that to Optimism Collective. The OP Stack uses the MIT open-source protocol, and from both a technical and legal standpoint, nothing prevents Coinbase from threatening to exit to renegotiate terms or build independent infrastructure, rendering Superchain membership nominal. OP holders are exposed to a significant revenue dependency on a single counterparty, with substantial downside risks, and we believe the market has not fully recognized this.

1. Taking 71% of Revenue, Only Paying 2.5% in "Rent"

When Optimism initially signed the agreement with Base, the assumption was that no single chain could dominate the economic ecosystem of Superchain, leading to an imbalance in revenue sharing. The fee sharing is calculated based on the higher of "2.5% of chain revenue" or "15% of on-chain profit (revenue minus L1 Gas costs)," which seemed reasonable for a collaborative, diversified Rollup ecosystem.

But this assumption was wrong. In 2025, Base generated $74 million in chain revenue, accounting for over 71% of all OP chain sequencer fees, yet only paid 2.5% to Optimism Collective. This means Coinbase received 28 times the value it paid. By October 2025, Base's TVL had reached $5 billion (a 48% increase over six months), becoming the first Ethereum L2 to cross this threshold. Its dominance has only increased since then.

The subsidy mechanism exacerbates this imbalance. While Base dominates revenue generation, the OP mainnet, which shares 100% of profits with the Collective, bears an excessive burden in ecological contributions. Essentially, the OP mainnet is subsidizing the political cohesion of this alliance, while its largest member pays the smallest share.

Where is this revenue going? According to Optimism's official documentation, sequencer revenue flows into the treasury of Optimism Collective. To date, this treasury has accumulated over $34 million from Superchain fees, but these funds have not been used or allocated to any specific projects.

The envisioned "flywheel" (fees funding public goods → public goods strengthening the ecosystem → ecosystem generating more fees) has not even begun to turn. Current projects like RetroPGF and ecological grants are funded by the issuance of OP tokens, rather than ETH from the treasury. This is significant because it undermines the core value proposition of joining Superchain. Base contributes about $1.85 million annually to a treasury, but this treasury has not provided direct economic returns to the member chains that pay fees.

Governance participation also illustrates the issue. Base released the "Base Participation in Optimism Governance Declaration" in January 2024. Since then, there have been no public actions: no proposals, no forum discussions, no visible governance participation. As a chain contributing over 70% of the economic value of Superchain, Base is conspicuously absent from the governance process it claims to participate in. Even Optimism's own governance forum rarely mentions Base. The so-called "shared governance" value is merely talk for both parties.

Thus, the "value" of Superchain membership remains entirely future-oriented—future interoperability, future governance influence, future network effects. For a publicly traded company that needs to be accountable to shareholders, when current costs are concrete and ongoing, "future value" is hard to sell.

The ultimate question boils down to: Does Coinbase have any economic incentive to maintain the status quo? And what will happen when they decide they no longer need it?

2. A Fork Could Happen at Any Time

This is the legal reality behind all Superchain relationships: the OP Stack is a public good under the MIT protocol. Anyone in the world can clone, fork, or deploy it for free without any permission.

So, what keeps chains like Base, Mode, Worldcoin, and Zora within Superchain? According to Optimism's documentation, the answer is a series of "soft constraints": shared governance participation rights, shared upgrades and security, ecological funds, and the legitimacy of the Superchain brand. Chains choose to join voluntarily, not out of coercion.

We believe this distinction is crucial when assessing the risks of OP.

Imagine what Coinbase would lose if they forked: participation rights in Optimism governance, the "Superchain" brand, and the channels for coordinating protocol upgrades.

Now consider what they would retain: 100% of the $5 billion TVL, all users, all applications deployed on Base, and over $74 million in sequencer revenue annually.

For "soft constraints" to be effective, Base needs to obtain something from Optimism that it cannot build or buy itself. However, there is evidence that Base is already building this independence. In December 2025, Base launched a cross-chain bridge directly to Solana, using Coinbase's own infrastructure and built on Chainlink CCIP, rather than relying on Superchain's interoperability solutions. This indicates that Base is not waiting for Superchain's interoperability solutions.

We are not asserting that Coinbase will fork tomorrow. We want to point out that the MIT protocol itself is a fully matured "exit option," and recent actions by Coinbase indicate that they are actively reducing their dependence on the value provided by Superchain. A BASE token with independent governance scope would complete this transition, turning those "soft constraints" from meaningful limitations into purely ceremonial associations.

For OP holders, the question is simple: if the only reason to keep Base within Superchain is the superficial "ecological alliance," what will happen when Coinbase feels this performance is no longer worthwhile?

3. Negotiations Have Already Begun

"Starting to explore"—this is the standard phrase for every L2 in the 6-12 months before officially issuing a token.

In September 2025, Jesse Pollak announced at the BaseCamp conference that Base is "starting to explore" issuing a native token. He cautiously added that "there are currently no clear plans," and Coinbase "does not intend to announce a release date soon." This is noteworthy because until the end of 2024, Coinbase had explicitly stated there were no plans to issue a Base token. This announcement came months after Kraken's Ink network revealed its INK token plans, marking a shift in the competitive landscape for L2 tokenization.

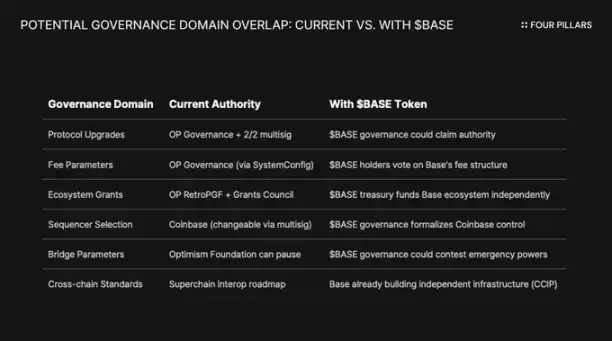

We believe that the way this is phrased is as important as the substance. Pollak described the token as "a powerful lever for expanding governance, ensuring developer incentives are aligned, and opening new design pathways." These are not neutral terms. Protocol upgrades, fee parameters, ecological grants, sequencer selection—these are all areas currently governed by Superchain. A BASE token with governance rights over these decisions would overlap with Optimism's governance, giving Coinbase greater economic dominance.

To understand why a BASE token would fundamentally change the relationship, one must first understand the current governance mechanism of Superchain.

The Optimism Collective operates a bicameral system:

· Token House (OP holders): Votes on protocol upgrades, grants, and governance proposals.

· Citizens' House (badge holders): Votes on RetroPGF fund allocations.

Base's upgrade rights are controlled by a 2/2 multisig wallet, with signers from both Base and the Optimism Foundation—neither party can unilaterally upgrade Base's contracts. Once fully implemented, the security council will execute upgrades "according to the directives of Optimism governance."

This structure grants Optimism shared control over Base, rather than unilateral control. The 2/2 multisig is a check and balance: Optimism cannot force upgrades that Base does not want, but Base cannot upgrade independently without Optimism's signature.

If Coinbase decides to follow the path of other L2 governance tokens like ARB and OP, structural conflicts will be inevitable. If BASE holders vote to decide protocol upgrades, whose decision takes precedence—BASE governance or OP governance? If BASE has its own grant program, why would Base developers still wait for RetroPGF? If BASE governance controls sequencer selection, what power remains for the 2/2 multisig?

Crucially, Optimism governance cannot prevent Base from issuing a token with overlapping governance scope. The "Law of Chains" establishes user protection and interoperability standards but does not restrict what chain governors can do with their own tokens. Coinbase could launch a BASE token with complete governance rights over the Base protocol tomorrow, and Optimism's only countermeasure would be political pressure—namely, the increasingly ineffective "soft constraints."

Another interesting angle is the constraints of a publicly traded company. This would be the first time a publicly traded company leads a token generation event. Traditional token issuance and airdrops aim to maximize token value for private investors and founding teams. However, Coinbase has a fiduciary duty to its COIN shareholders. Any token distribution plan must demonstrate its ability to enhance Coinbase's corporate value.

This changes the game. Coinbase cannot simply airdrop tokens to maximize community goodwill. They need a structure that can enhance COIN's stock price. One way to do this is by leveraging the BASE token to renegotiate and lower the revenue share from Superchain, thereby increasing Base's retained earnings and ultimately improving Coinbase's financial statements.

4. Rebuttal to "Reputation Risk"

The strongest argument against our position is that Coinbase is a publicly traded company that positions itself as a model of "compliance and cooperation" in the crypto space. Forking the OP Stack to save a few million dollars in revenue sharing seems petty and could damage its carefully maintained brand image. This argument deserves serious consideration.

Superchain does provide real value. Its roadmap includes native cross-chain communication, and the total locked value of all Ethereum L2s peaked at around $55.5 billion in December 2025. Base benefits from composability with the OP mainnet, Unichain, and Worldchain. Abandoning this network effect comes at a cost.

Additionally, there are the 118 million OP tokens granted. To solidify the "long-term alliance," the Optimism Foundation granted Base the opportunity to receive approximately 118 million OP tokens over six years. At the time the agreement was reached, this grant was valued at about $175 million.

However, we believe this defense misunderstands the real threat. The rebuttal assumes a public, hard fork. The more likely path is a gentle renegotiation: Coinbase leveraging the BASE token to secure more favorable terms within Superchain. This negotiation is unlikely to make headlines outside of governance forums.

Looking at the interoperability argument, Base has already built a bridge to Solana independently of Optimism's interoperability solutions, using CCIP. They are not waiting for Superchain's interoperability solutions. They are concurrently building their own cross-chain infrastructure. When you are actively solving problems yourself, the "shared upgrades and security" soft constraint becomes less significant.

Now consider the OP grants. Base's power to vote or delegate using these grants is limited to 9% of the votable supply. This is not a deep binding but rather a minority stake with limited governance rights. Coinbase cannot control Optimism with 9%, but Optimism also cannot control Base with this. At the current price (around $0.32), the total value of the 118 million grants is approximately $38 million. If renegotiation leads to a 30% drop in OP due to lowered revenue expectations from Base, Coinbase's paper loss on this grant would be trivial compared to permanently canceling or significantly reducing revenue sharing.

Reducing the 2.5% share of over $74 million in annual revenue to 0.5% could permanently save Coinbase over $1.4 million each year. In contrast, the one-time impairment of the OP grant's value is about $10 million, which is a small amount.

Institutional investors do not care about the politics of Superchain. They care about Base's TVL, transaction volume, and Coinbase's profitability. A renegotiated revenue share will not cause COIN's stock price to fluctuate. It will merely appear as a routine governance update on Optimism's forum and make Coinbase's L2 business margins look slightly better.

5. A Single Revenue Source with an "Exit Option"

We believe that OP has not yet been viewed by the market as an asset with counterparty risk, but it should be.

The token has dropped 93% from its historical high of $4.84 to about $0.32, with a circulating market cap of approximately $620 million. The market has clearly revalued OP downward, but we believe it has not fully absorbed the structural risks embedded in the Superchain economic model.

The divergence in the market illustrates the issue. Base's TVL rose from $3.1 billion in January 2025 to over $5.6 billion in October. Base is winning, while OP holders are not. Consumer attention has almost entirely shifted to Base, and despite new partners joining, the OP mainnet still lags in usage among ordinary users.

Superchain appears to be a decentralized collective. However, economically, it is heavily reliant on a single counterparty, which has ample motivation to renegotiate.

Looking at revenue concentration: Base contributes over 71% of all sequencer revenue for Optimism Collective. The OP mainnet's contribution is high not because of rapid growth, but because it shares 100% of profits, while Base only shares 2.5% or 15%.

Now consider the asymmetric return structure faced by OP holders:

· If Base stays and grows: OP captures 2.5% of the revenue. Base retains 97.5%.

· If Base renegotiates to ~0.5%: OP will lose about 80% of its revenue from Base. The largest economic contributor to Superchain becomes insignificant.

· If Base completely exits: OP will lose its economic engine overnight.

In all three scenarios, the upside potential is limited, while the downside risk could be infinite. You hold a long position on a revenue stream, while the largest payer holds all the chips, including an MIT protocol exit option and a nascent token that could establish independent governance at any time.

The market seems to have digested the notion that "Base's growth does not effectively benefit OP holders." However, we believe it has not yet digested the exit risk—that is, the possibility of Coinbase leveraging the BASE token to renegotiate terms or, worse, gradually completely disengaging from Superchain governance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。