Odaily specially invited market analyst Cody Feng, a master's degree holder in financial statistics from Columbia University, has focused on quantitative trading in U.S. stocks since college and has gradually expanded to Bitcoin and other digital assets. He has built a systematic quantitative trading model and risk control system through practical experience; he possesses keen data insights into market fluctuations and is committed to continuously delving into the professional trading field, pursuing stable returns. He will deeply analyze changes in BTC technology, macroeconomics, and capital flow weekly, review and showcase practical strategies, and forecast recent significant events for reference.

Bitcoin Midweek Review (01.05~01.11)

Conclusion First:

This week, Bitcoin's overall trend has largely operated within the 84,000~94,500 USD fluctuation range we provided at the beginning of the week. The price was precisely blocked at the 93,000~94,500 USD resistance zone and subsequently fell back to the lower part of the range, with the core point judgment validated by the market in real-time.

In this trade, we established a short position near 94,000 USD and exited entirely near 91,000 USD, capturing approximately 3.4% profit in a single transaction (spot), completing a high-certainty, low-drawdown profit realization in a fluctuating market.

1. Core Range and Key Point Verification This Week

At the beginning of the week, we clearly pointed out that the focus should be on the long and short game around the 84,000~94,500 USD range.

The actual trend showed that Bitcoin faced significant resistance after rebounding to the 93,000~94,500 USD pressure zone, making multiple unsuccessful attempts to break through, and then fell back under pressure, validating the effectiveness of this area as a temporary "ceiling."

Regarding support points, the price showed clear signs of stabilizing after dipping to 86,000~86,500 USD, with buying pressure beginning to take hold, while the lower 84,000 USD key defense line has not yet been touched, maintaining an overall structure within a wide fluctuation framework.

2. Execution of Plan A (From Entry to Exit)

Based on the judgment of the fluctuation range, our Plan A formulated at the beginning of the week was effectively executed.

When the price rebounded to the 93,000~94,500 USD area and showed signs of weakness, while both (momentum and spread trading) models resonated to issue a top signal, we immediately established a short position at 93,771 USD, and the market subsequently fell back as expected.

When the "spread trading" model issued a bottom signal, we ultimately exited entirely at 90,584 USD, completing a full, emotion-free short trade. The entire trading process was not a "hindsight analysis," but rather pre-planned, executed in real-time, and verified afterward.

3. Operational Thoughts for the Second Half of the Week

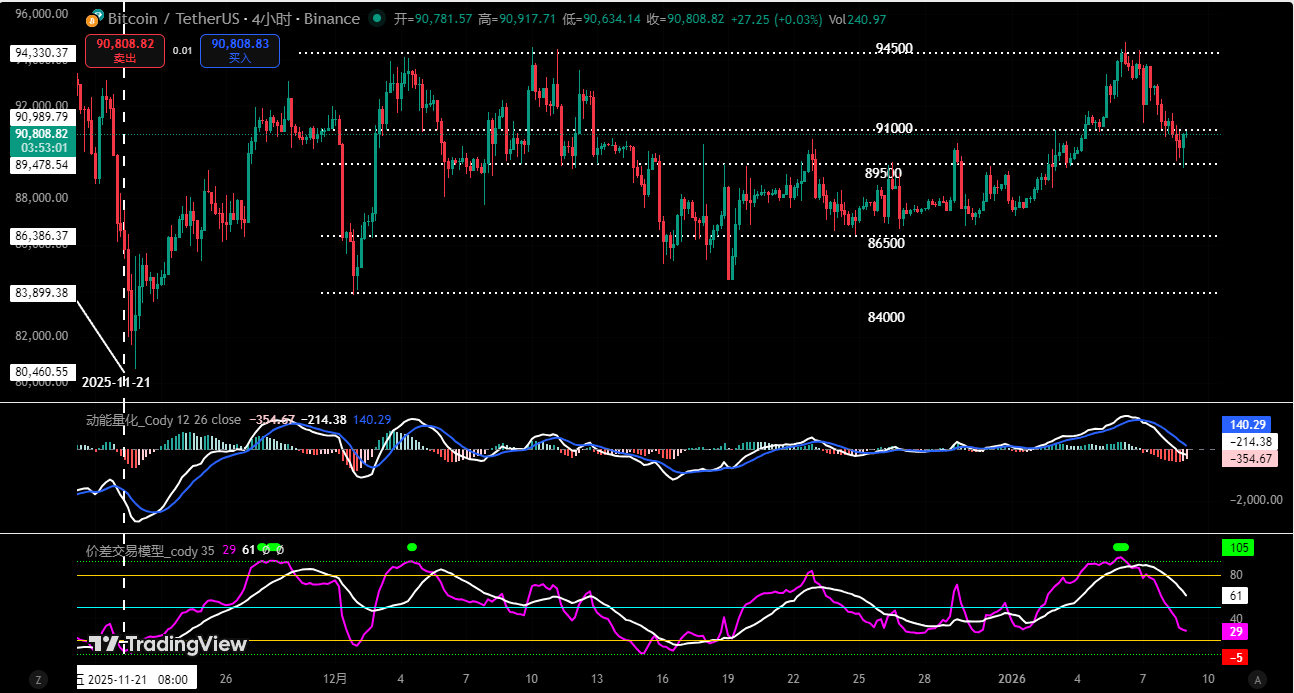

Bitcoin 4-hour chart: (Momentum Quantitative Model + Spread Trading Model)

From the 4-hour technical structure perspective (see the above chart), Bitcoin is currently receiving effective support near 86,500 USD, with multiple technical indicators entering the oversold zone, indicating that short-term selling pressure has been released, and there is a demand for technical rebound repair (fluctuating rebound), but it is still insufficient to confirm a reversal of the downtrend.

Based on this, we expect the price may first rebound to test the 92,000~93,000 USD area, which is also the upper part of the previous fluctuation range and is expected to form pressure again.

In terms of short-term operations, we will still focus on the range: if it rebounds to this area and shows signs of momentum exhaustion or failure to break through, we may consider positioning for shorts; if it effectively breaks through 94,500 USD, we need to decisively stop loss and reassess the market trend structure.

4. Summary

Overall, Bitcoin is still operating within the wide fluctuation pattern defined at the beginning of the week: support below provides rebound space, while pressure above limits height. Rather than betting on a one-sided market, it is better to respect the range structure, focusing on high-certainty points and strict risk control.

In a fluctuating market, developing flexible response strategies and stabilizing profits is far more important than judging direction.

Disclaimer: The above content is merely a personal market opinion sharing and does not constitute any investment advice. Cryptocurrency is highly volatile; please make independent judgments and strictly control risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。