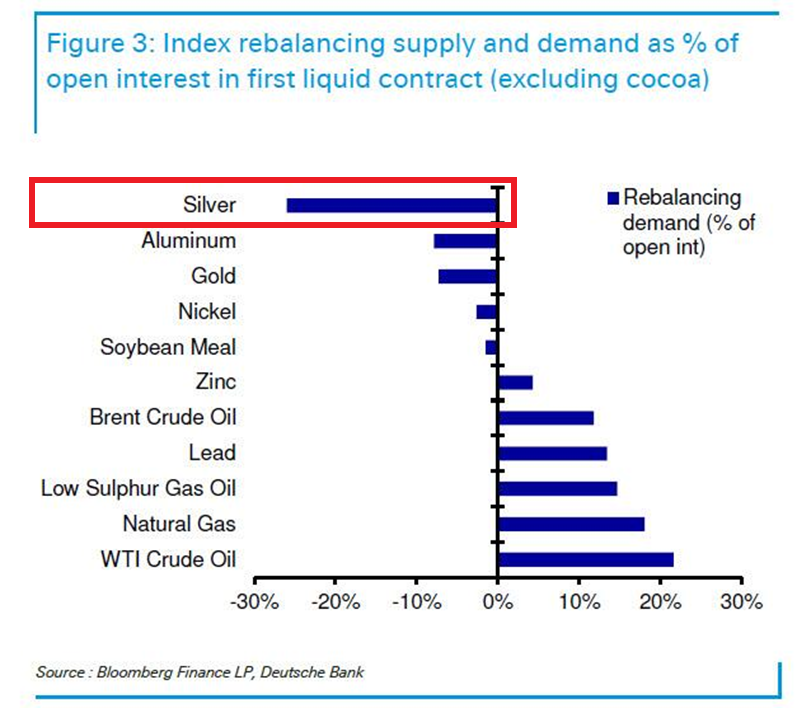

In this round of index rebalancing, the scale of silver futures that passive funds need to sell is approaching about 25% of the open interest of the main silver contract. This is mainly because silver had a significant increase in the previous cycle, has stronger financial attributes, and its weight in the commodity index has been passively elevated. Therefore, it automatically became a "reduction target" during the rebalancing.

It is clear that as long as the index rebalancing is still in effect, silver will find it difficult to establish a smooth trend, even if logically it should rise; the price will be repeatedly interrupted by structural selling. Only after the clearing is completed may silver have the opportunity to rise significantly again.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。