Hot News|

1. On January 8 at 21:30, the U.S. will announce the number of initial unemployment claims for the week ending January 3 (in ten thousand).

2. On January 9 at 21:30, the U.S. will announce the seasonally adjusted non-farm employment population for December (in ten thousand).

Review: After a continuous half-month consolidation, Bitcoin has given everyone a good start in the Year of the Horse in 2026, rising from 87,800 to a high of 94,700, an increase of 7,500 points in a week, or 8.6%. Ethereum also rose from 2,930 to the target level of around 3,310 that we mentioned before the holiday. Currently, although the entire market has performed impressively in the first week of 2026, from the current consolidation pattern, the market still lacks a continuous supply of liquidity. The supply-demand relationship remains relatively unbalanced. Additionally, the U.S. Senate is scheduled to review the cryptocurrency market structure bill on January 15. This could lead to a real explosion in the market. This will determine the status of Bitcoin and Ethereum; Bitcoin is no longer seen as an alternative asset by most, but will become a core component of the global financial system. The passage of this legislation could make Bitcoin a truly sovereign-level asset, stepping into the center stage of global assets. In the second week of 2026, our core focus will be on the data releases while closely monitoring political changes in the U.S. Don’t just blindly stare at a few candlesticks chasing highs and lows.

BTC: 12H is currently facing strong resistance. After three attempts to break higher and retreat in the last two weeks of 2025, it has undergone half a month of consolidation and accumulation. The pressure level of 94,700 is still showing weakness. It is currently in a high-level fluctuation, not a one-sided trend. The direction will wait for the data releases in the next two days to confirm the new direction after the key support below gives an answer. The current price of Bitcoin is 90,800. We need to watch if the support at 88,000 can hold. The key level to watch above is the bullish testing platform at 92,500. If it stabilizes, a new round of breakthroughs will be stronger, and the strong resistance at 94,700 will turn into strong support for the next round. If 89,000 does not receive effective support, mid to late January will be a wide-ranging consolidation process. So to summarize, the key is to break through the upper pressure level while watching the support level for accumulation. Yesterday's movement was very typical; the price was pulled up but not sustained, and when it retraced, there were buyers again, indicating that the main force is not in a hurry to express itself and will not let retail investors profit easily in a short time. It is more about testing the endurance of retail investors, whether they can hold onto their gains; those who cannot will inevitably be forced out.

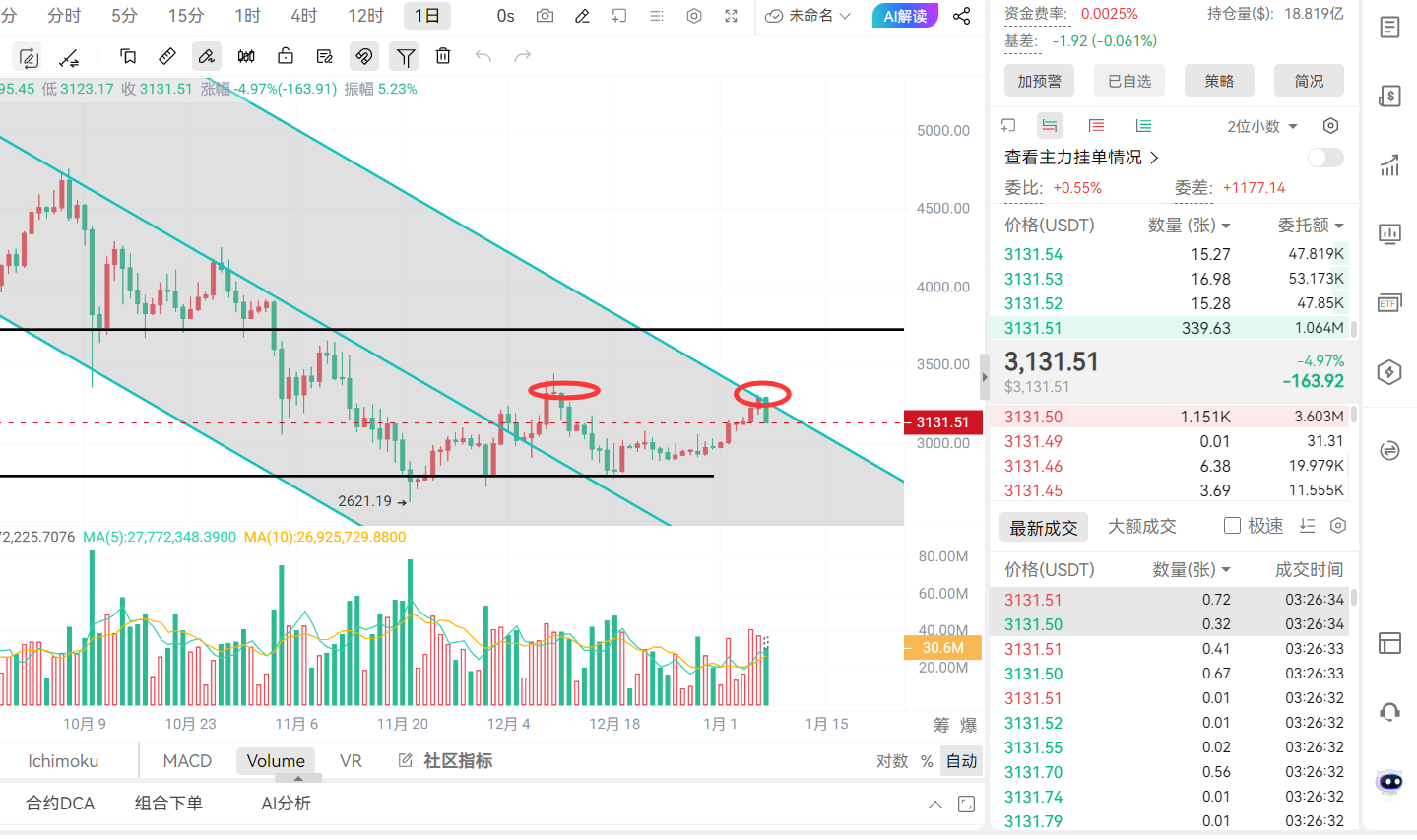

ETH: The 12-hour structure is relatively clearer than Bitcoin. The upper pressure is at 3,310, and the lower support is at 3,030-2,930. From a structural perspective, Ethereum is clearly lagging behind. In summary, Ethereum is waiting for Bitcoin to give instructions. In the evening, we need to pay more attention to the changes in the Dow Jones and Nasdaq to choose our entry points.

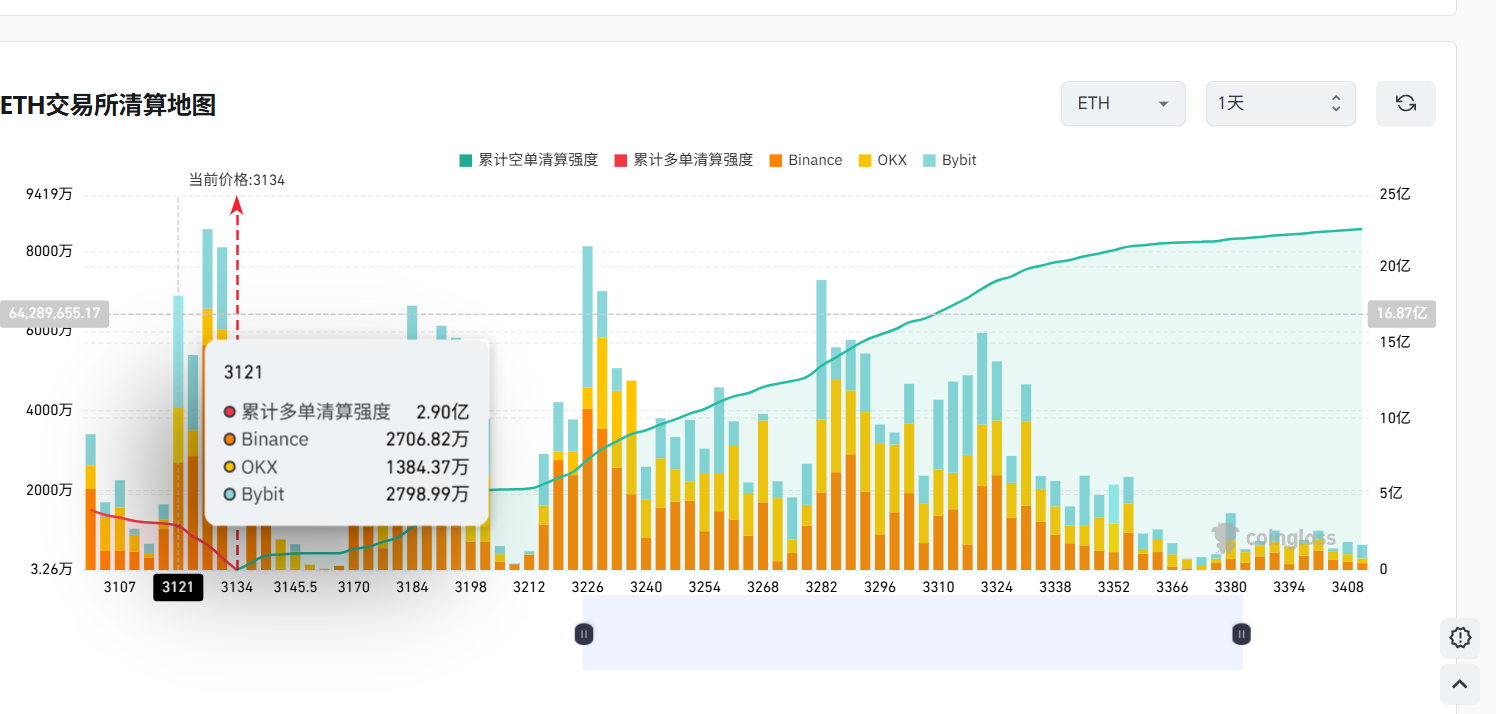

Latest Liquidation Map:

The recent market is also quite volatile, and it is a good time to practice basic skills, learn more techniques, and practice patience. Waiting for the real explosion will allow you to hold on without panic. I am Tommy, a companion in the crypto circle who trades while practicing. If you want real-time entry points and personalized strategies, click on my homepage to join the community. We have professional live trading teachers accompanying you around the clock to help you maintain your mindset; don’t bear it alone.

Points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Finally, everyone should remember the two key points I mentioned in my last article: focus on trial positions in the short term, and once we move away from our target range, it will be the last opportunity to make significant profits before the end of the year. I am Tommy from K-line Life, your real-time crypto steward. For more analysis on related cryptocurrencies, please follow my public account for details.↓

Mainly focused on spot, contracts, BTC/ETH/ETC

Specializes in style: K-line trading

Original volume trading strategy.

Short-term wave highs and lows, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, monthly head predictions.

Public account QR code (K-line Life Tommy)

Warm reminder: The only public account at the end of the article is created by the author!!

Please be cautious in distinguishing authenticity, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。