Changes in Bitcoin On-Chain Data in the First Week of 2026 — Has the Bitcoin Bull Market Arrived?

Let me state the conclusion upfront: based on the data, I do not believe we are in a bull market yet. Even though prices have risen, I still do not see any fundamental changes. Just as I disagreed with the notion that we were in a bear market for BTC before, I personally believe we are still in an accumulation phase.

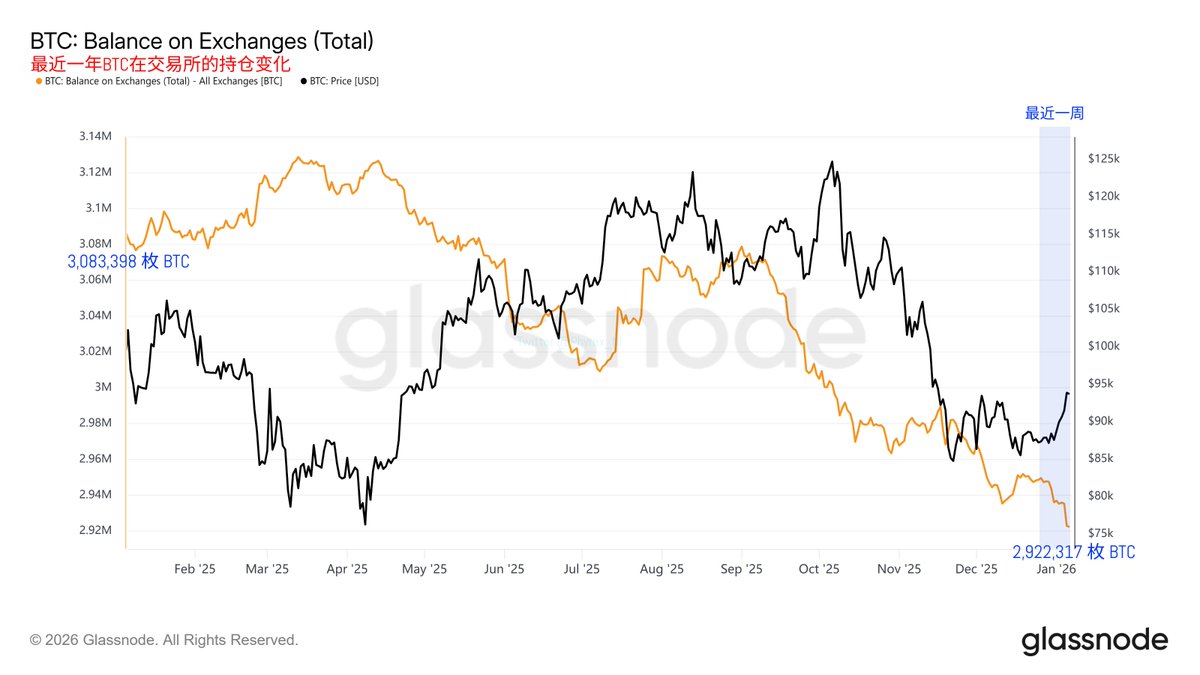

The stock on exchanges has always been a primary focus, as it represents the most tangible investor sentiment. When investors panic or lose confidence in the future, signs of selling will emerge, leading to an increase in exchange stock. Conversely, if the stock on exchanges continues to decrease, it at least proves that there are more investors wanting to hold $BTC than those wanting to sell it.

Recent Year’s BTC Stock on Exchanges

While this does not guarantee that Bitcoin will rally, it will gradually create a situation of "reluctance to sell." As the amount of BTC on exchanges decreases, even if it may not necessarily lead to a price surge, it can at least slow down the rate of price decline. This is why I have never believed that the bear market for BTC has arrived. After all, the data clearly shows that even when prices drop, investors have not increased their selling; instead, they are transferring out.

In the past week, it is also evident that even though BTC has maintained around $88,000 for a long time, the stock on exchanges is still decreasing. In the last two days, when BTC's price surged, the stock continued to decline, indicating that most investors remain optimistic.

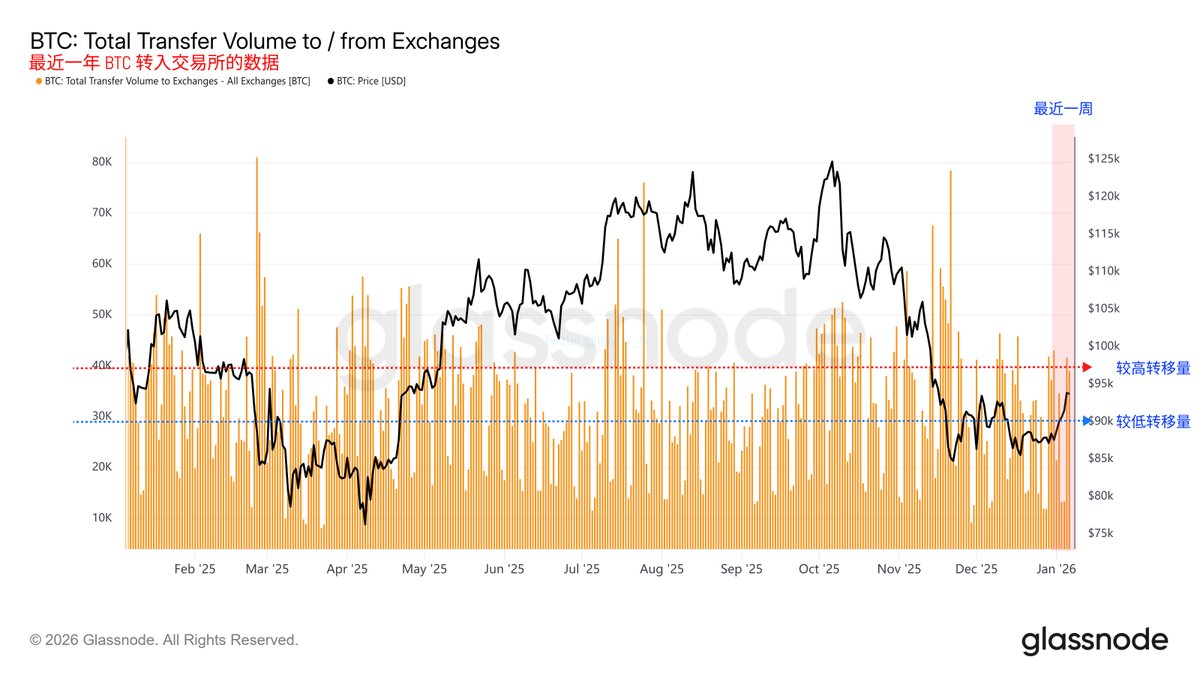

Of course, I can imagine many friends asking why there is such a significant outflow, yet the price increase is still slow or even declining. This is normal. From the detailed data on BTC inflows to exchanges, the blue line indicates a relatively low transfer volume, suggesting that investor selling sentiment is low. The red line represents a higher transfer volume, indicating that investor selling sentiment is high.

Recent Year’s BTC Inflows to Exchanges

Especially in recent months, it is clear that most of the time has been characterized by high transfer volumes. Although the corresponding stock on exchanges is still declining, it cannot avoid the fact that many investors sell for various reasons. Therefore, even if the buying or outflow volume is higher, there is no way to avoid the selling from inflows.

Regarding the impact on BTC's price, inflows are not the main constraint on price because inflows do not necessarily mean selling; sometimes, it is about waiting for a better price. Additionally, it needs to be accompanied by favorable liquidity or political conditions, as well as positive sentiment.

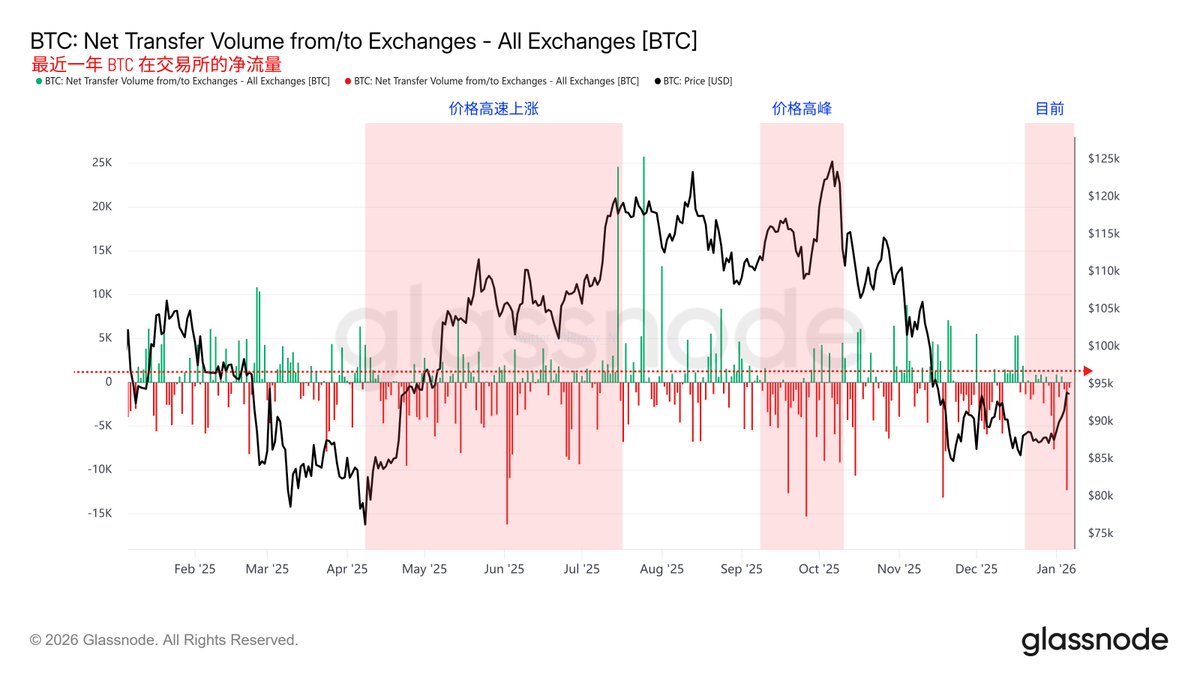

From the data on BTC's net flow, it is evident that during the peak period from April to June this year, the outflow was significantly higher than the inflow. Even during the new price highs in October, it was due to a substantial increase in net inflows. Both instances were almost entirely driven by events that influenced investor sentiment: in April, it was due to reduced tariffs, and in October, it was due to the restoration of relations with China.

Recent Year’s BTC Net Flow on Exchanges

Currently, although inflows are increasing, it is still primarily net outflows. The lack of liquidity has prevented the net outflow numbers from expanding, so the price changes are not very pronounced. Applying the sentiment from April and October, the recent events in Venezuela are not sufficient to impact the U.S. economy or inflation in the short term.

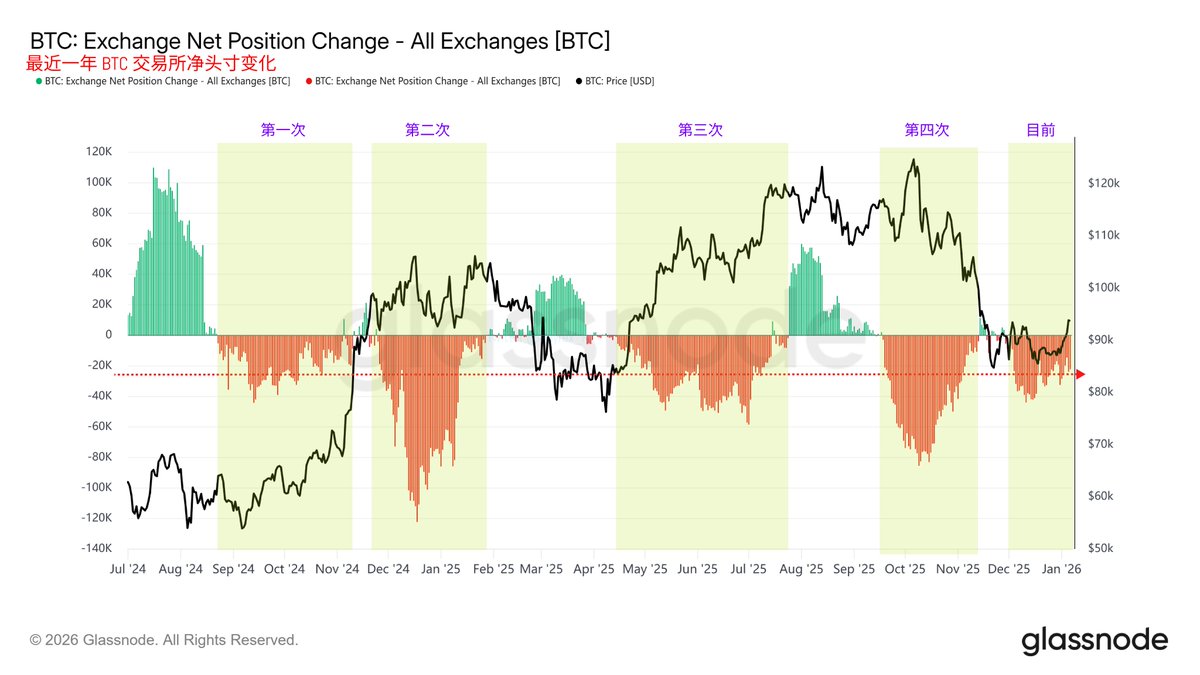

Recent Year and a Half BTC Positions on Exchanges

This is not just a casual statement. From the exchange position data, specifically the 30-day average stock data, it can be seen that although there is a trend of significant outflows for the fifth time, the duration of the outflow is still just beginning compared to the previous four times, and the outflow volume is not dominant. There have not been any significant emotional or political stimuli.

However, from the previous trends, it can be seen that if investors can continue to maintain a focus on outflows and keep a strong net outflow, at least it cannot be considered a bear market for BTC. But if one insists that a bull market has arrived, I do not believe it, as liquidity, trading volume, and even withdrawal volume have not shown explosive growth.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。