Today, the momentum for $BTC is quite good. On one hand, it is due to the correlation with tech stocks; on the other hand, the U.S. actions towards Venezuela have provided the most direct answer to the market. Futures for U.S. stocks began to rise in the morning from the Asian time zone, and continued to rise after the U.S. stock market opened in the evening, indicating that investors in the U.S. and Europe also see this as a positive development. After all, the smooth flow of Venezuelan oil can reduce global inflation, not to mention that the U.S. also plans to develop gold and rare earths together with Venezuela.

Although the price has risen well, the trading volume has not seen a significant increase, which indicates that the current rise is not driven by a large influx of funds. Liquidity remains a constraint on cryptocurrencies. However, entering 2026, liquidity has shown signs of rebounding. The focus in 2026 will still be on U.S. monetary policy, and the key to this policy remains Trump.

Regarding the situation in Venezuela, my personal view is that even though there may be disputes between the two parties in the U.S., the possibility of releasing Maduro is low. The U.S. "taking over" and "helping" Venezuela with oil extraction should be highly certain. Venezuela was once the largest oil exporter in the world, far exceeding Saudi Arabia, and the main reason for the decline in Venezuelan oil exports is primarily due to the "nationalization" of the oil industry.

U.S. assistance in development means that Venezuela's oil trading will gradually open up. This is also why it could potentially lower global inflation.

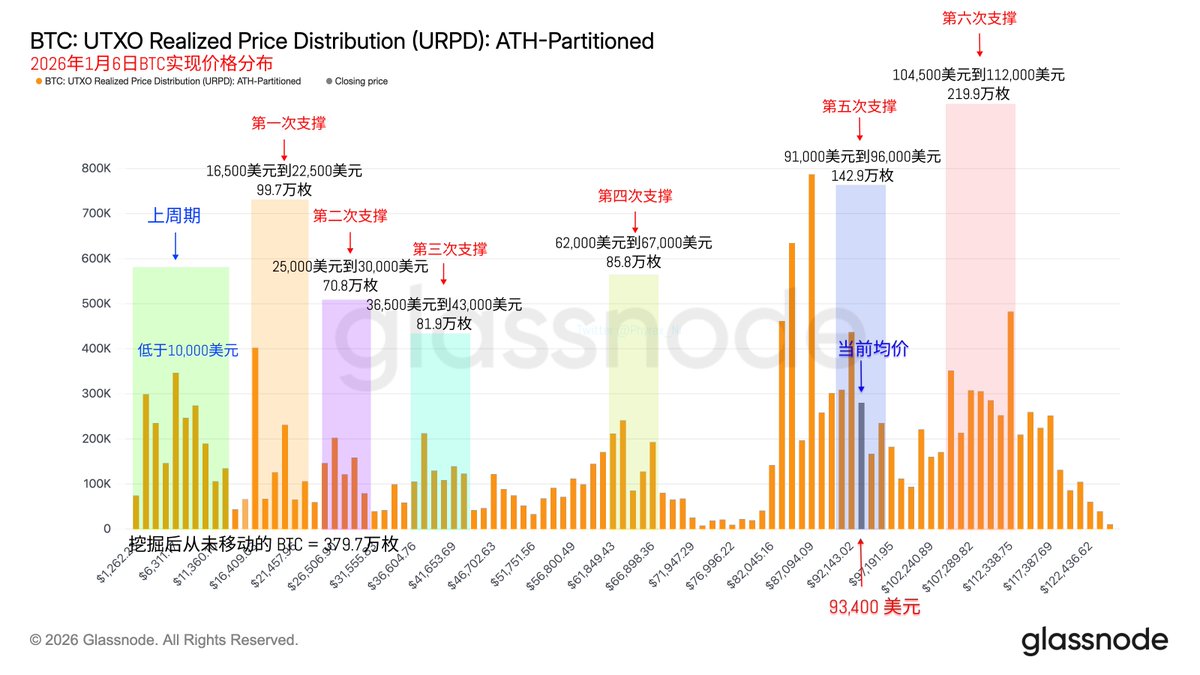

Looking back at Bitcoin's data, the price increase has led to a continued rise in turnover rate, but the trading volume has not changed much. Therefore, the increase in turnover rate is likely due to internal changes within exchanges. From the data, it still appears that short-term profit-taking investors are the main force behind the turnover, while earlier investors remain very calm.

The chip structure is still very healthy. I originally thought it would oscillate around $87,000 for some time to form a new bottom, but unexpectedly, the U.S. actions towards Venezuela stimulated the risk market, leading to a wave of increases. Next, we will see if this rise can stabilize.

Generally speaking, if it is event-driven rather than liquidity-driven, there is a high possibility of a pullback. Let's wait and see.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。