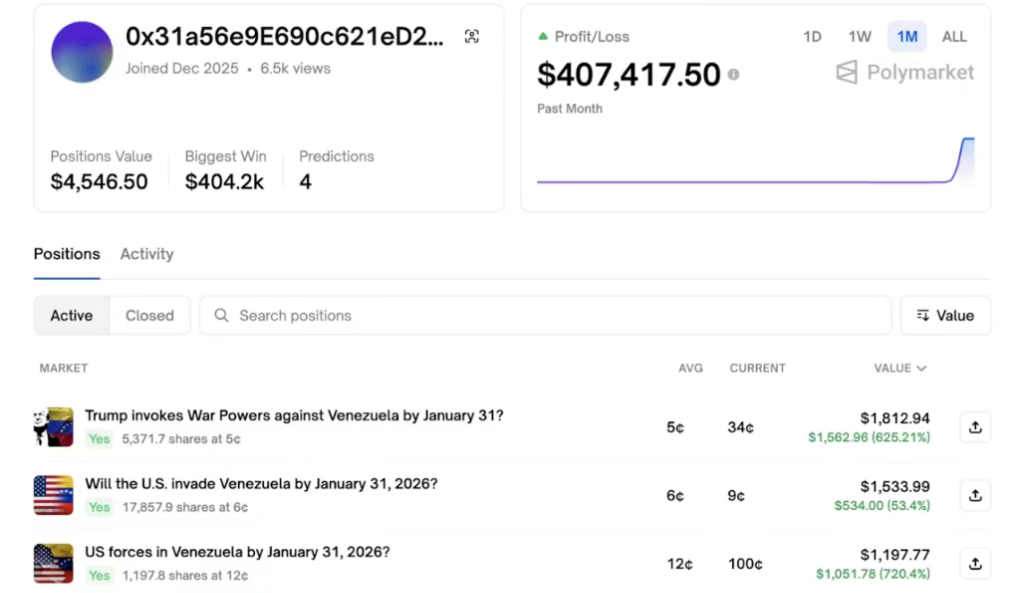

A mysterious account created less than a week ago placed a $30,000 bet late at night on the ousting of Venezuelan President Maduro. Twelve hours later, as Trump announced the success of military operations, this account made a staggering $400,000 profit, with a return rate exceeding 1200%.

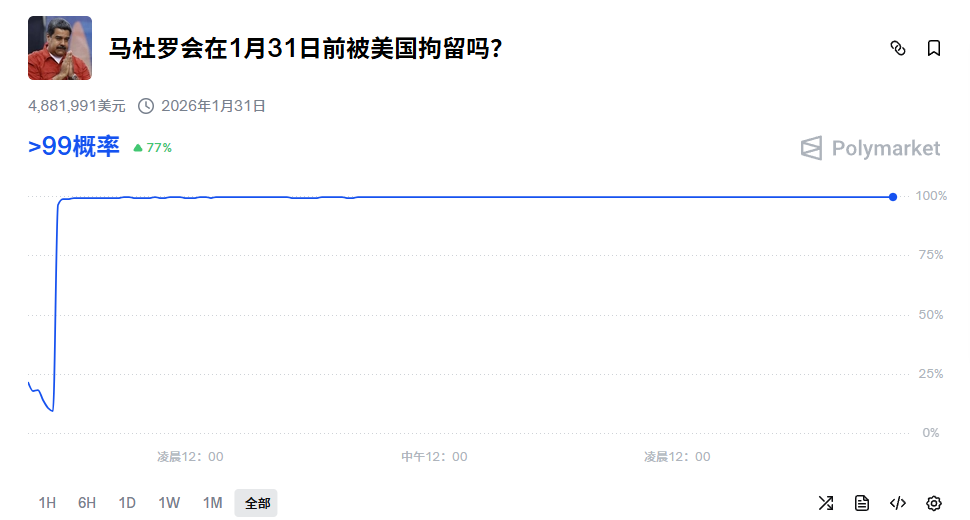

On the Polymarket platform, a prediction contract regarding "Will Maduro be ousted before January 31?" skyrocketed from 5 cents to nearly $1 within just a few hours, with trading volume surpassing $120 million.

Moreover, on the Friday night before Trump officially announced the raid, individuals had already begun to place large bets on "yes" through newly created anonymous accounts, which were almost entirely focused on Venezuela-related markets.

1. Event Review

On December 27, 2025, an account named "Burdensome-Mix" was quietly created on the prediction market platform Polymarket. This account went largely unnoticed for the following week until it became the account holding the most "yes" positions in the "Maduro ousting" market.

● The account invested a total of $32,537 over the past four days, specifically betting that Maduro would be ousted before January 31. On Friday night, just hours before the military operation news broke, the account made significant purchases. At that time, the market estimated the probability of U.S. intervention in Venezuela to be around 6%, with contract trading prices approximately 5-7 cents.

● Following Trump's official announcement early Saturday morning that U.S. special forces had successfully captured Maduro and his wife near Caracas and removed them from Venezuela, this prediction contract quickly soared to nearly 100%.

● The value of that mysterious account's position skyrocketed, ultimately yielding a profit of $404,222, with a return rate of 1242%. This precise bet achieved astonishing returns in less than a day.

2. Market Anomalies

● According to multiple media reports, the price of the prediction contract on whether Maduro would lose power by the end of January exhibited unusual fluctuations late Friday night before Trump's official statement.

● Axios's analysis pointed out that trading activity on Polymarket began to rise around 10 PM Eastern Time on Friday and peaked around 4:20 AM Saturday—just before and after Trump announced the news.

● Market data showed that the relevant prediction contracts on the Polymarket platform rapidly surged from low probabilities to nearly 100% after the successful U.S. special forces operation on January 3, leading to trading volume skyrocketing to over $120 million.

● In stark contrast, the contract prices regarding Maduro's departure on another regulated prediction site, Kalshi, fluctuated only around 13 cents during the same period, indicating that the specific capital flows on Polymarket exhibited clear precursors and anomalies.

This discrepancy raised serious concerns among market observers about potential information leaks.

3. Core Doubts

The most striking doubt regarding this unusual trading is the timing of the trades, which closely aligns with the timeline of U.S. military decision-making. U.S. military officials initially discussed conducting strikes during the Christmas period but postponed them until early January due to weather conditions.

While the Trump administration was relatively successful in preventing media leaks, the abnormal fluctuations in market data suggest that details of the operation may have been known in advance by certain market participants.

● Sports business analyst Joe Pompliano wrote on social media platform X: "Yesterday, a newly created Polymarket account invested over $30,000 on 'Maduro will be ousted.' The U.S. will strike at night, and traders made $400,000 in less than 24 hours."

He sharply pointed out: "Insider trading is not only allowed in prediction markets, but it is even encouraged."

● Another trader shared a more eye-catching post on X, claiming to have made $80,000 overnight on Polymarket by utilizing signals related to U.S. military activity. This trader revealed that the U.S. had earlier mobilized its largest aircraft carrier, which convinced him that a strike on Venezuela was imminent.

● The only unknown was the timing, so he created a simple bot to monitor Domino's Pizza orders near the Pentagon, a pattern long associated with government late-night work.

● This trader wrote: "As soon as the pizza indicator bot detected unusual activity, my phone alerted me, and I immediately bought as many 'Will the U.S. strike Venezuela?' contracts on Polymarket as possible."

4. Regulatory Vacuum

This incident once again highlights the gray area of prediction market regulation. The U.S. Commodity Futures Trading Commission typically prohibits contract trading involving war, terrorism, and assassination, which are against public interest.

However, Polymarket, as a global platform, theoretically does not open to U.S. users, thus cleverly avoiding direct jurisdiction from U.S. regulators.

This regulatory vacuum creates conditions for potential insider trading and information abuse. Prediction markets were originally designed as tools to gather collective intelligence and predict future events, but when it comes to highly sensitive political and military information, they can become channels for profiting from non-public information.

Notably, some newly created accounts were almost entirely focused on Venezuela-related markets, a highly specialized investment strategy that is extremely rare under normal circumstances.

Market observers pointed out on X: "This account Burdensome-Mix has only existed for a week but has quickly become the account holding the most 'yes' positions in the 'Maduro ousting' market. This is very suspicious."

This pattern suggests that certain participants may possess non-public information regarding geopolitical events and are using prediction markets to convert that information into substantial profits.

5. Calls for Legislation and Reform

In response to the potential insider information abuse risks exposed by this incident, U.S. lawmakers have begun to take action. According to Axios, Congressman Ritchie Torres plans to introduce the "2026 Financial Prediction Market Public Integrity Act."

The bill aims to restrict federal officials from participating in such markets to prevent profiting from non-public political or military information.

Torres emphasized in a statement: "When elected officials or government employees can profit in prediction markets using insider information, it undermines public trust in financial markets. We need clear rules to prevent this abuse."

In addition to legislative responses, this incident has sparked widespread discussion about the ethical boundaries and regulatory framework of prediction markets. Some analysts argue that prediction markets should impose stricter trading restrictions or completely ban such contracts when involving geopolitical events.

Market supporters argue that prediction markets provide a valuable tool for measuring event probabilities, and the issue lies not with the markets themselves but with how to prevent insider information abuse.

Notably, at the time of this incident, the prediction market industry was facing increasing scrutiny. The CFTC had previously taken enforcement action against Polymarket, accusing it of offering unregistered binary options contracts.

Although both parties eventually reached a settlement, regulatory pressure has not dissipated. This precise bet on "Maduro ousting" may further intensify regulatory agencies' focus on prediction markets.

6. Impact and Future Outlook

The impact of this incident has transcended the financial market realm, touching on sensitive nerves of national security. When market participants can potentially predict military actions by monitoring government activity patterns, it exposes a disturbing intersection between national security decision-making processes and financial market activities.

Geopolitical analysts point out that this precise bet is not only about individual traders' profits but also reflects new challenges to national security in the information age. In today's world of advanced social media and prediction markets, traditional confidentiality measures face unprecedented tests.

Looking ahead, this incident may have multifaceted impacts. On the legislative front, Torres's proposed bill may just be the beginning, with more legislative initiatives targeting prediction market regulation likely to emerge.

On the industry front, prediction market platforms may be forced to strengthen self-regulation, implement stricter trading monitoring mechanisms, or proactively limit the types of contracts involving national security.

On the international relations front, this incident reveals how non-state actors can utilize financial market tools to respond to or even predict geopolitical events, a capability that may influence decision-making considerations in future conflicts.

As markets can almost "predict" military actions in real-time, decision-makers will have to consider whether and how their plans are reflected in market prices.

As the role of prediction markets in measuring event probabilities continues to grow, how to leverage their information aggregation function while preventing insider information abuse and national security risks will become a key challenge for policymakers, regulators, and market operators.

This precise bet on "Maduro ousting" may just be the tip of the iceberg of this complex issue.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。