The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts. I welcome all coin friends to follow and like, and I refuse any market smoke screens!

After finishing yesterday's article, several old friends had a long conversation with me; coinciding with the arrival of the year 2026, I would like to congratulate everyone on earning more in the new year than in 2025! Everyone feels that my views on the cryptocurrency market are overly pessimistic, and many users project this pessimism onto the market of 2025. As I mentioned, 2025 is not without opportunities for profit; we must acknowledge that Bitcoin and BNB have both set historical highs. Observing from a yearly perspective, it is still within the bull market cycle. My concerns are not about the market issues but about the future. The biggest positive news for the cryptocurrency market in 2025 is undoubtedly stablecoins, as can be seen from the market capitalization; the choices of the giants are more about issuing their own. However, the overflow of market capitalization has not propelled the prices of cryptocurrencies upward. What does this mean? It means that stable circulation may no longer intervene in the cryptocurrency market, and we might even categorize stablecoins separately.

So why has the application scenario for stablecoins expanded while Bitcoin remains unmoved? This can only indicate that the emergence of stablecoins has encroached on Bitcoin's living space. The only consolation is the decline in exchange rates, meaning that the U.S. dollar cannot stabilize its exchange rate. Currently, 1 U.S. dollar is worth less than 1.82 CNY, while the actual exchange rate has just broken 7, which is quite a significant gap in large volumes. Generally, a decline in exchange rates leads to an appreciation of dollar assets, but if you look at the current price of Bitcoin, it has not appreciated and is instead trending bearish. This year's U.S. endorsement has granted Bitcoin the status of a dollar asset; the current trend contradicts this, indicating that the giants do not fully recognize this newcomer! The road is long and difficult, especially in Europe, which insists on implementing a regulatory framework for Bitcoin in 2027. What does this signify? I just want to remind you that Trump's term ends in 2028.

Europe's actions are merely an attempt to gauge the attitude of the next administration, as the U.S. strategy is unstable, often resulting in new policies after a change in administration. Here, you need to understand that Trump is not eligible for the next election. Once the U.S. starts to backstab the cryptocurrency market, the current prices will definitely not hold. Backstabbing allies is something the U.S. often does; it can be said that the current U.S. has almost exhausted all means for the cryptocurrency market, and the market capitalization of the cryptocurrency sector is not increasing but decreasing, which is not a good signal. Secondly, let's review the market; since Bitcoin's inception, the best-performing year remains 2020, during which there was a significant increase in the issuance of fiat currency due to the pandemic. Although it dropped 63% in the first quarter of that year, Bitcoin still achieved an overall increase of 303.87%. Following closely is 2023, with an increase of 154.48%, ranking second. The worst-performing years were the bear markets of 2018 and 2022, which fell by 73.41% and 65.38%, respectively.

Considering that the current highest point for 2025 is 126,208 and the low after the new high is 80,600, the overall decline is about 30%, which will be a relatively rare year. It neither belongs to a bull market nor is it a traditional bear market with a decline of over 50%. If it must be defined, a more appropriate term for the cryptocurrency market's trend would be "range-bound oscillation." Bitcoin holders may be experiencing a shift from individual large holders to institutional takeovers. As the asset class is no longer dominated by retail investors and gradually transitions to institutionalization, the entry of institutional investors, reduced volatility, and increased market capitalization may lead to a decline in annual performance. The decline in bear market years may be less than 65%, while the average decline in bull market years may also be smaller. The future cryptocurrency market may resemble the stock market and the gold market. This turnover is not my definition but is driven by the increasing positions of BlackRock, MicroStrategy, and others, leading to insufficient individual momentum.

Just as I finished discussing some points, DOGE started a rebound in the evening; most friends are using this short-term rebound to confirm the market trend. Currently, I do not see the trend for the later period; in my view, this rebound is merely a corrective rise. This magnitude is not too large; previously, everyone was in a stable state, and only a few rebounding cryptocurrencies have started to decline. Everyone should not develop a panic mentality; a slight corrective rise is just a test by the market makers. Future declines or increases are both possible. During yesterday's Asian trading session, there was already a momentary trading volume that reached 21 times the previous level. This confirms our earlier speculation that small cryptocurrencies can only emerge in the form of independent trends. As long as these small cryptocurrencies start to pull, the cryptocurrencies using their blockchain will definitely experience some volatility, so it is advisable to invest in larger cryptocurrencies that have their main blockchain.

Let's focus on the recent trends. If you believe that 2026 still has a bull market segment, my estimate is that a new round of trends will emerge under the combination of interest rate cuts and the expansion of the balance sheet and money printing at the beginning of the year. Regarding the U.S. interest rate cuts and the change in administration, my estimate is that everything will be concluded before June; it may differ from 2025, as the three interest rate cuts will be concentrated in the second half of the year. Once it is confirmed that there will only be one or two interest rate cuts, then it can be confirmed that by June at the latest, all interest rate cuts will be concluded. It is likely that the distribution of the two interest rate cuts will be in March and June, and it will not be delayed until after October. The current consistent information is that monetary easing, balance sheet expansion, and money printing will all come; as long as these three are achieved, if the cryptocurrency market still possesses the characteristics of dollar assets, then a bull market can be confirmed to come. The cryptocurrencies I have not recommended do not mean there are no bull market segments; rather, I do not believe they can create historical new highs.

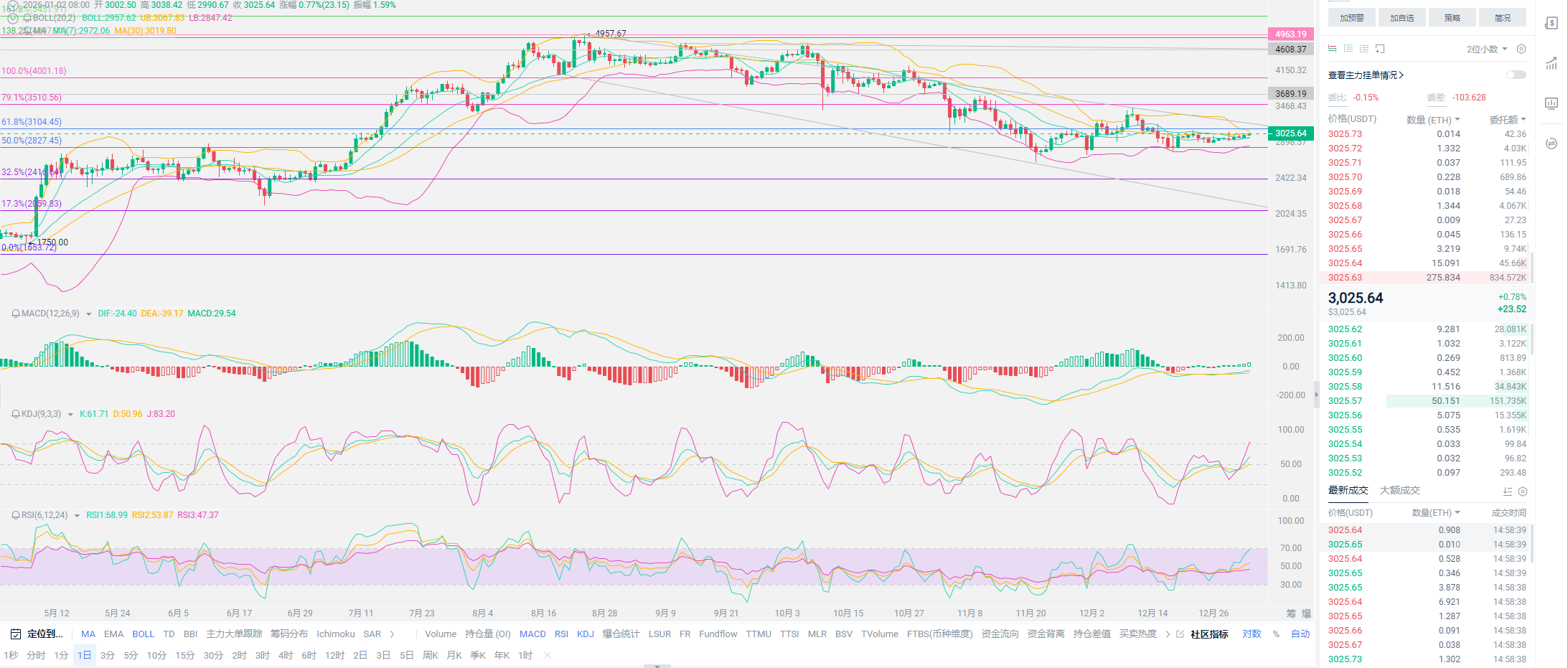

In summary, this article took two days to complete, so there may be some discrepancies in the timeline, and I am too lazy to modify it; please bear with it. My estimates have never changed. If there are any exits or other good cryptocurrency recommendations, I will mention them in the article. The above arrangements are for spot users; as for contract users, as long as they do not touch small cryptocurrencies, they will basically not face liquidation. Especially for those who are following me to go long, you should all be in a profitable state at this stage, so I won't elaborate further. Just remember the pressure levels I provided earlier; Ethereum is currently approaching them. As long as Ethereum can break and stabilize, Bitcoin will quickly follow. This will confirm the next round of trends. For contract users, do not look too far ahead; the current stage is just running within a range, and you can profit within that range without overthinking. Spot users should buy the dip, hold, and wait for half a year before discussing; if possible, stake as much as you can.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trends, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。