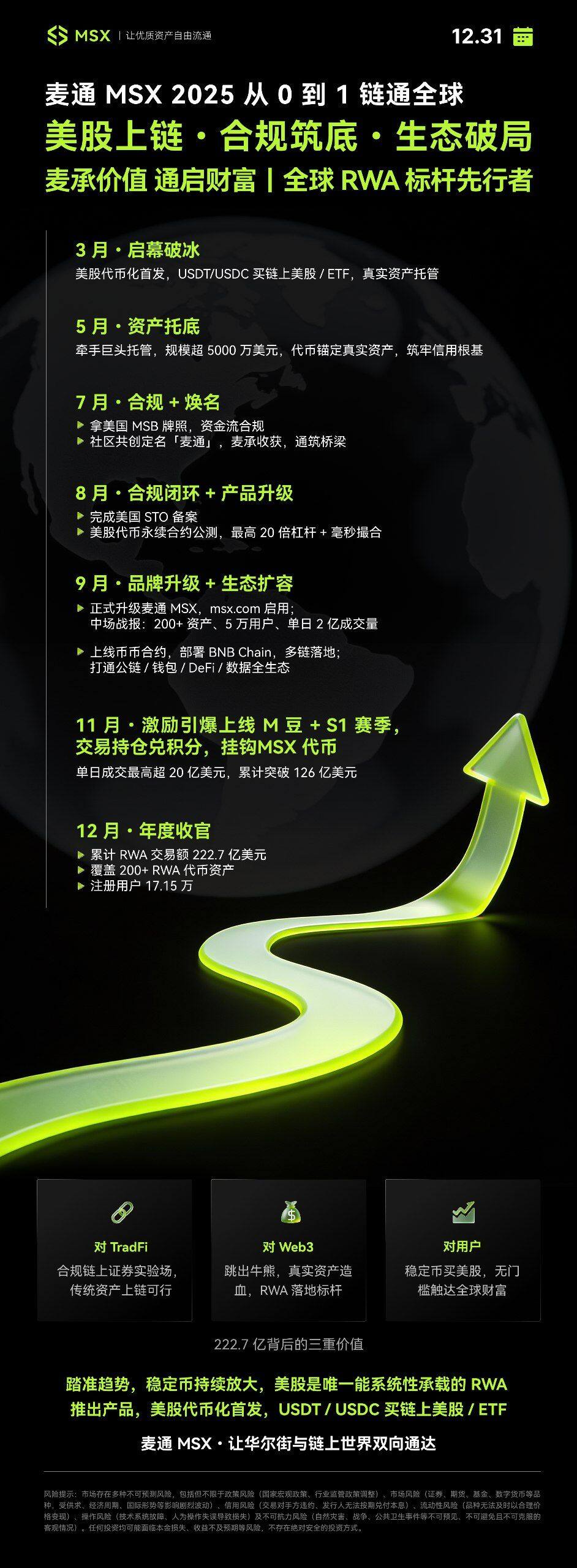

In 2025, both the tokenization of U.S. stocks and Pionex MSX will mark a milestone year. This year, the sector officially entered the mainstream narrative, and Pionex MSX achieved a breakthrough from 0 to 1, firmly establishing itself on the global competitive stage. Looking back at the development trajectory of the year, its core focus is on three major directions: seizing the era's opportunities for U.S. stock tokenization, reconstructing on-chain trading logic through product and mechanism innovation, and deeply cultivating industry education and brand trust with a long-term perspective.

U.S. Stock Tokenization: From Marginal Experiment to Irreversible Era Window

In recent years, RWA has always been regarded as the "next big narrative" in the crypto industry, but it has long remained at the conceptual level. It wasn't until 2025 that this sector truly formed a scale effect, moving from marginal experiments to industrial-level implementation.

The global RWA tokenization market size has surged past hundreds of billions of dollars, with various real assets such as U.S. Treasury bonds, equities, and real estate completing their on-chain migration. U.S. stock tokens have completely shed the label of "niche experimental products" and have become a formal category of focus for mainstream financial institutions. Traditional financial giants like UBS and Apollo have entered the space, moving billions of dollars' worth of assets on-chain; several authoritative research institutions have directly defined 2025 as the "year of RWA transitioning from experiment to infrastructure," predicting that tens of trillions of dollars in assets will gradually achieve on-chain circulation within a compliant framework.

This transformation has brought ordinary investors a more concrete and perceptible upgrade in experience. U.S. stock assets, which previously required cross-border account opening, complex compliance processes, and high capital thresholds to access, can now be traded directly on-chain using stablecoins, significantly reducing geographical and institutional barriers. Furthermore, the fundamental change in asset composability and holding methods allows on-chain U.S. stock tokens to support fragmented ownership, enabling investors to build cross-industry and cross-sector U.S. stock portfolios with smaller amounts of capital, avoiding the structural limitations of "high-priced stocks being difficult to allocate" in traditional securities accounts. At the same time, on-chain trading has also brought higher transparency and verifiability. Transaction records, asset mappings, and circulation paths can be publicly verified on-chain, reducing information asymmetry and allowing ordinary investors to experience an audit-level experience close to that of "native crypto assets" when participating in traditional financial assets. Finally, with the gradual integration of derivatives and the DeFi ecosystem, U.S. stock tokens are no longer just "passively held assets," but can participate as fundamental components in hedging, arbitrage, and portfolio management, truly integrating traditional U.S. stock assets into the on-chain financial system, becoming standardized financial units that can be dynamically managed and allocated over the long term.

In 2025, the U.S. stock tokenization sector is no longer a solo performance by overseas pioneers like Robinhood and Ondo. Pionex MSX, with its solid implementation capabilities, has entered the ranks of core players, filling the gap of a decentralized trading platform for U.S. stocks on-chain, becoming an important participant that can be discussed alongside leading global platforms.

Pionex MSX's Innovative Practices: Returning On-Chain Trading to Reality and Sustainability

In the competitive landscape of 2025, Pionex MSX chose a "difficult yet correct" path, focusing not on hype but on refining products and mechanisms, driving on-chain U.S. stock trading back to its essence of "real, compliant, and sustainable," creating actual value for users.

Order Flow Model: Achieving On-Chain Liquidity Synchronized with the Real U.S. Stock Market

Its core innovation is reflected in the application of the order flow (PFOF) model. Unlike some platforms in the industry that build virtual trading pools detached from the native market on-chain, Pionex MSX chose to accurately "transport" the liquidity of the real U.S. stock market to the on-chain environment. Every buy and sell order from users is routed through a compliant order flow path to upstream market makers and brokers for matching, ultimately achieving a high degree of synchronization between on-chain prices, trading depth, and the real U.S. stock market, fundamentally eliminating the liquidity disconnection issue of "one price on-chain, another off-chain."

Users can still place orders using familiar stablecoins and complete accounting on-chain, but the underlying connection is to the real U.S. stock order book. This model makes on-chain trading an effective extension of the real financial market, rather than an isolated capital game. To ensure the long-term viability of this innovation, the platform is simultaneously advancing two key areas to solidify its foundation. Pionex MSX has established a rigorous asset selection system, not blindly pursuing the quantity of assets but focusing on core indicators such as profitability quality, fundamental stability, market liquidity, and regulatory compliance, prioritizing the resolution of the "can the asset be held long-term" issue before optimizing the details of "trading experience quality," resulting in a curated whitelist of RWA stock tokens rather than speculative long-tail assets.

The underlying guarantees of compliance and custody have also been successfully implemented, with the platform obtaining the MSB license issued by the U.S. FinCEN and completing the registration for the issuance of U.S. security tokens (STO), achieving regulatory transparency throughout the entire process of fund flow and securities issuance; at the same time, it collaborates with traditional asset management institutions to handle the custody of underlying real U.S. stock assets, ensuring that every token on-chain corresponds one-to-one with real shares offline, truly realizing that "every token is backed by a real U.S. stock."

For users, the value of Pionex MSX is not merely "adding a trading entry," but for the first time seamlessly connecting the core liquidity and order book of the real U.S. stock market with a familiar operational experience on the blockchain.

Completing the Derivatives Matrix: Creating a Full-Scenario Trading Workbench

After solidifying the core foundation of cash and compliance, Pionex MSX shifted its focus in the second half of the year to fill the gaps in trading scenarios, providing users with a more complete set of risk management tools through a rich product matrix.

On August 11, the platform officially launched the public beta of RWA U.S. stock token perpetual contracts, supporting up to 20x leverage, paired with a millisecond-level matching engine to fully meet the strategic needs of professional trading users; shortly thereafter, the cryptocurrency contract section was successfully launched, covering mainstream currencies such as BTC and ETH. These two initiatives enable users to manage the risk exposure of "on-chain U.S. stocks + crypto assets" on the same platform, transforming Pionex MSX from a simple "U.S. stock token trading platform" into a full-scenario trading workbench that supports hedging, arbitrage, and multi-asset portfolio management throughout all trading hours of U.S. stocks.

S1 Season and M Credits: Achieving Symbiosis Between Trading Behavior and Long-Term Value

By the end of 2025, the platform's trading data experienced explosive growth, driven primarily by the launch of the S1 points season and the M Credit incentive mechanism. Unlike the common short-term rebate models in the industry, this mechanism places greater emphasis on the retention of core users rather than fleeting traffic surges.

Pionex MSX designed a clear link of "trading equals value," using users' real trading volume as the core basis, automatically settling points through multi-dimensional weighted calculations, which can be directly exchanged for M Credits, with M Credits serving as the core basis for future platform token distribution. This design effectively avoids the industry pain point of "volume brushing," ensuring that only users who maintain long positions and continuously contribute real trading depth can earn high-quality points, thus becoming core ecological partners of the platform; at the same time, it allows the platform's growth dividends to tilt more towards "high contributors," rewarding "early participants" while focusing on returning benefits to "deep participants."

After the mechanism was implemented, significant market feedback was generated, with the entire season's trading volume reaching a historical high, with a single-day trading volume exceeding $2 billion and a cumulative trading volume surpassing $12.688 billion.

By the end of 2025, Pionex MSX achieved significant results: the cumulative scale of RWA trading reached $22.249 billion, supporting over 200 RWA token assets, and the number of registered users exceeded 171,900. In the initial stage of the U.S. stock tokenization sector, these figures indicate that Pionex MSX has completed a breakthrough from 0 to 1, positioning itself among the core players that can be discussed alongside leading overseas platforms.

Deepening Long-Termism: Promoting Brand and User Co-Growth

Products and mechanisms form the "skeleton" of the platform, while brand building and industry education are its "soul," directly influencing user long-term retention and trust. In 2025, Pionex MSX, with long-termism at its core, built a trust bridge with users.

The Name "Pionex": Originating from the Community, Built on Trust

In mid-2025, Pionex MSX undertook an important initiative—delegating the decision-making power of its Chinese brand name to the global community. In the platform's view, a financial brand that carries user trust should not be unilaterally decided by the team but should stem from the collective expectations of the community.

After a public solicitation and a community vote, the name "Pionex" won by a large margin. "Pion" symbolizes harvest, embodying the market's expectation of traversing cycles and obtaining stable value; "ex" represents a pathway, signifying the connection between traditional finance and the on-chain world. Pionex MSX has gradually grown from a "strange new project" to a professional fintech brand that is "memorable, trustworthy, and referable."

For a financial platform, a name is not just a simple identifier. The birth of "Pionex" stems from community co-creation, becoming the starting point of trust between the platform and users. This community-built brand memory further reinforces its development orientation of "coexisting with users."

Pionex Research Institute: Accompanying Users to Understand the Sector

In 2025, Pionex MSX continued to promote a challenging yet profoundly meaningful task—focusing on accompanying users to understand the U.S. stock tokenization sector. In a context where most trading platforms chase short-term trading volume, Pionex MSX established a research institute, investing significant effort in industry education.

The Pionex Research Institute continuously produces professional yet easy-to-understand content, breaking down complex industry logic into simple language to help users establish correct investment perceptions. The platform always adheres to one viewpoint: as a trading platform centered on transaction fees, helping users cultivate asset analysis skills and trading discipline, and growing together with users is the foundation for the platform's long-term survival.

This persistence not only fills the gap in user understanding of the U.S. stock tokenization sector, allowing more users to grasp the sector's value rather than blindly following market fluctuations, but also drives a qualitative change in the relationship between Pionex MSX and its users, transforming from a mere "order-matching party" to a "companion witnessing the transformation of financial infrastructure."

Looking Ahead to 2026: From Establishing a Foothold to Participating in Defining Industry Standards

Looking back at the end of 2025, Pionex MSX has completed the leap from "innovative ideas" to "stable global RWA infrastructure." With a cumulative RWA trading volume of $22.249 billion, over 200 supported RWA token assets, and more than 171,900 registered users, these figures affirm its year-long dedication. Entering 2026, its development goals are clearer: moving from "establishing a foothold" to "participating in defining standards," creating value on a broader stage.

The incentive mechanism will further evolve into a complete long-term equity system. After the S1 season and M Credits have completed their launch from 0 to 1, the subsequent steps will connect the platform tokens, user principal returns, and platform governance rights, allowing users who "trade more and hold long" to gain both short-term profits and sustained ecological governance weight, achieving a symbiotic win-win between the platform and its users.

For Pionex MSX, 2025 is a clear starting point. This year, it has demonstrated through practical actions that a platform that adheres to compliance, deeply engages in education, and emphasizes mechanism innovation has the capability to compete on the same stage as the world's leading players in the global RWA wave. In 2026, the core question it needs to address is no longer "can it survive," but rather how much influence it can exert on the definition of global standards for "on-chain U.S. stocks" in the future tens of trillions of dollars scale of the global tokenized asset market. From the perspective of industry development trends, adhering to a user value orientation and long-termism will be the core support for its continued breakthroughs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。