Arthur Hayes 小黑的操作我感觉很迷惑!

卖出以太坊加仓 Defi 赛道?

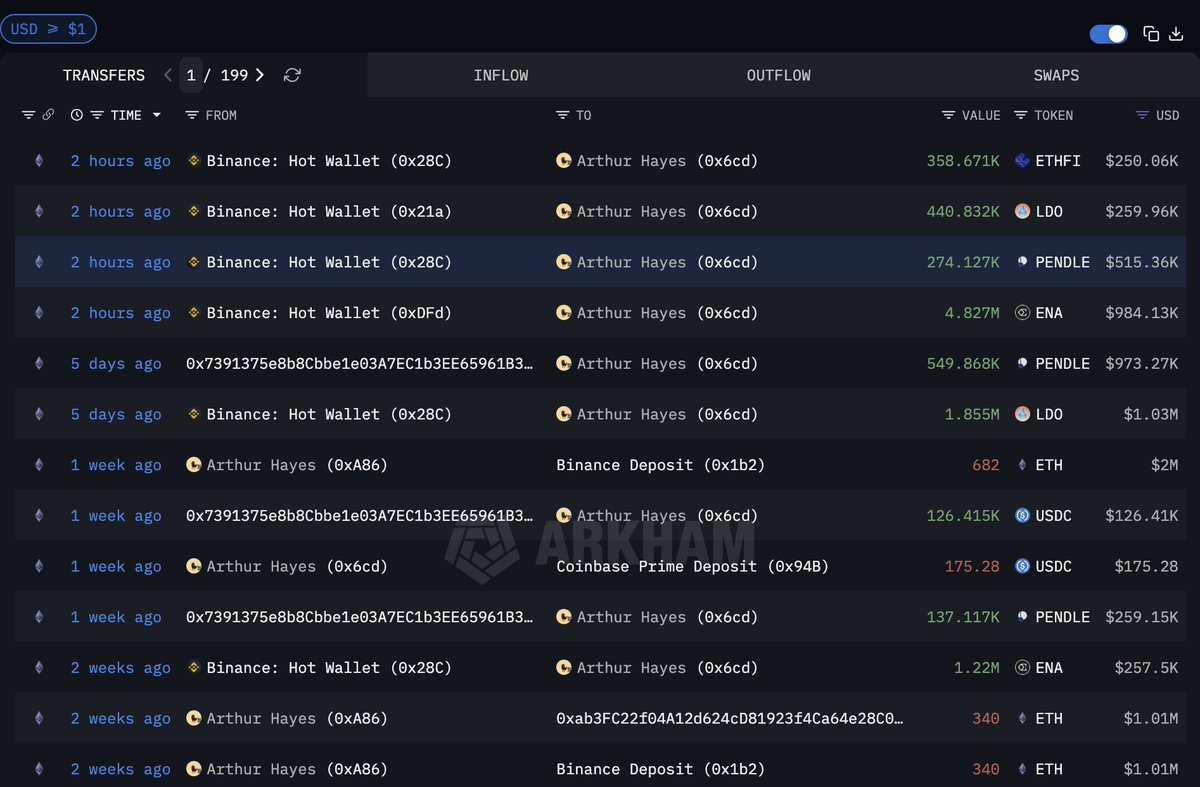

小黑过去两周内卖出 1871 枚 $ETH 加仓 $PENDLE $LDO $ENA $ETHFI 这些资产?

如果以太坊不爆发,这些 Defi 可以爆发?我的理解如果 ETH 不爆发是因为大盘 risk-off,那这些 DeFi 多半更难爆发,甚至更脆。

所以他这个时候押注这些,除非他认为以太坊会有大爆发,而这些机遇以太坊的 Defi 和 Restaking 的收益比会更高,所以才换仓的。

不过谁知道呢?

小黑他娘的总是时不时反指一下!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。