Still unable to escape the $90,000 curse, Bitcoin continues to fluctuate around $88,000. In this low liquidity environment, it can be considered a good thing. The most important event today was the Federal Reserve's release of the meeting summary. After a brief look, overall, the Fed officials believe that the current rise in inflation is largely related to tariffs, and they also think that it may be difficult for inflation to drop to 2% in the short term.

The lack of vitality in the labor market reflects economic uncertainty or measures taken by businesses to control costs, leading to a decrease in labor demand. A reduction in labor supply related to decreased immigration, an aging population, or a decline in labor participation rate, along with the risk of further downward pressure on labor, indicates that the U.S. economy may not be as good or stable as many might think.

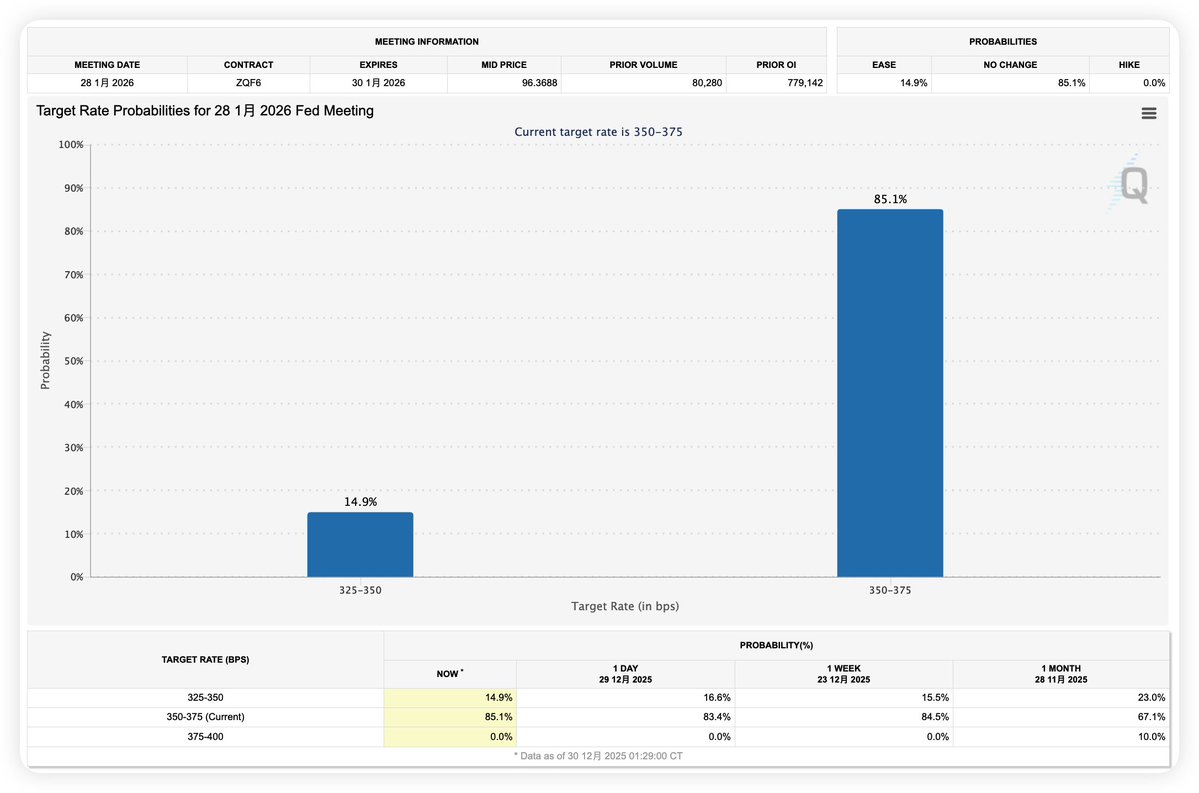

However, the Fed still believes that the U.S. economy will see growth in 2026. Regarding monetary policy, Fed officials think that if inflation can continue to decline by 2026, it would be feasible to adjust monetary policy further, but for now, maintaining the status quo and closely monitoring data is the consensus among most Fed officials, indicating that the probability of not lowering interest rates in January is very high. The next adjustment may not happen until March.

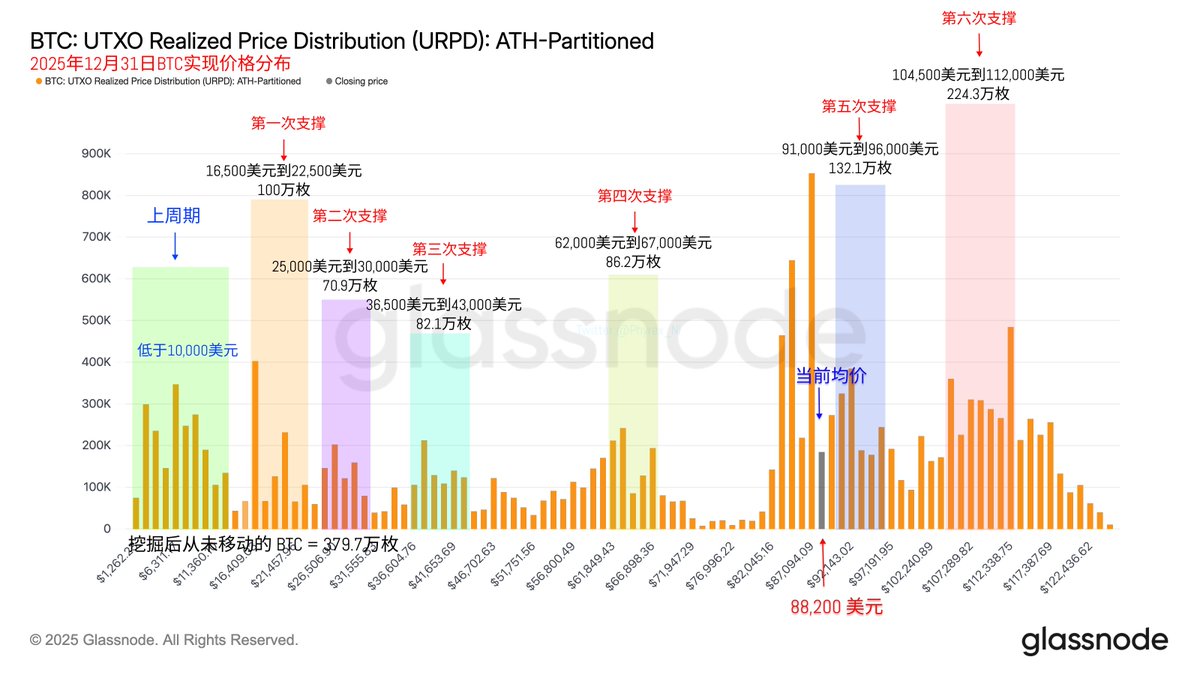

Looking back at Bitcoin's data, the turnover rate has decreased significantly compared to normal working days, indicating lower participation from institutions and quantitative investors, likely due to holiday factors. During such times, the price of $BTC reflects the thoughts of real investors more, and although it faces the $90,000 curse, making it difficult for the price to sustain an upward trend, its stability is still quite good, showing that investor sentiment remains relatively optimistic.

The chip distribution represented by URPD is also very healthy, but it feels like the process of building a bottom has not yet ended. It is worth monitoring for a while, as investors who are stuck at high levels remain very calm, which is also a guarantee for price stability.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。