Author: Bootly

If I had to summarize the prediction market for 2025 in one sentence, it might be:

This is the year when prediction markets no longer rely on black swan events, but begin to depend on structural trading demand.

This was almost unimaginable in the past. For a long time, prediction markets resembled an "event tool": they would only briefly come alive during major uncertainties like elections, pandemics, or wars, and then quickly cool down. However, in this year, high-frequency events such as sports competitions, macro data, and policy changes provided a stable trading rhythm for prediction markets, allowing them to exhibit characteristics similar to financial exchanges with sustained liquidity, frequent trading, and clear settlements.

On the surface, this is a change in scale; but more importantly, it is a change in roles.

Prediction markets are shifting from "betting on whether something will happen" to "how the market prices uncertainty." In other words, probabilities are no longer just personal opinions but are starting to be treated as price signals that can be referenced repeatedly, much like interest rates, exchange rates, or stock prices.

The Real Scale of Prediction Markets in 2025

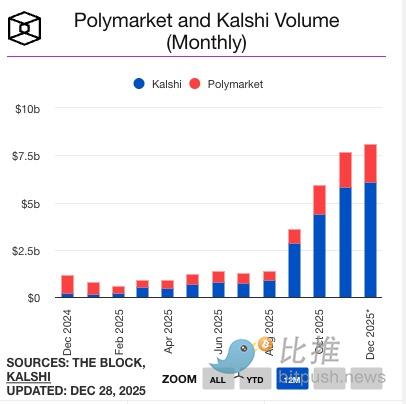

The overall trading volume of prediction markets has experienced exponential growth over the past two years. According to industry data from Dune&Keyrock, the monthly trading volume of prediction markets has increased from less than $100 million at the beginning of 2024 to a stable range of over $1 billion by the end of 2025, demonstrating explosive growth.

For example, data from The Block shows that Kalshi's trading volume approached $6 billion in November 2025, with sports contracts contributing the vast majority of the transactions.

At the same time, on-chain data from Polymarket and disclosures from the platform indicate that it maintained a monthly trading volume in the billions during several peak months in 2025.

The message behind these numbers is clear: prediction markets are no longer reliant on "occasional major events" but have entered a phase where they can operate continuously in everyday environments.

The Industry Gradually Forms "Five Major Camps"

If we only look at trading volume, it is easy to overlook the most critical change in 2025—platforms have embarked on completely different development paths.

For the average reader, this can be simply understood as: some platforms are striving to "become like exchanges," some are trying to "make predictions lighter and more frequent," and others are exploring "whether predictions can be embedded into everyday products."

These differences will determine the future form of prediction markets.

First Camp: The Compliance Prediction Market Mainstream—Parallel Competition of Two Paths

In 2025, the true sign of prediction markets entering the mainstream financial context is not the growth in trading volume, but the clear differentiation of compliance paths.

One path is represented by Kalshi, which follows a "local compliance, exchange-like route." From the beginning, Kalshi chose to fully operate within the regulatory framework of the U.S. Commodity Futures Trading Commission (CFTC), defining prediction contracts as standardized event derivatives. In 2025, with the large-scale launch of sports contracts, its trading structure has clearly evolved towards high-frequency, short-cycle trading, and its product form is increasingly resembling that of traditional financial exchanges.

The other path is represented by Polymarket. This is a more challenging route: after initially relying on global liquidity to accumulate scale, Polymarket completed a compliance restructuring in 2025 by acquiring licensed entities and obtaining regulatory approval, officially returning to the U.S. market. This makes it one of the few platforms in the industry that possesses both a global user base and U.S. compliance status.

The difference between the two does not lie in "whether they are compliant," but in the different accumulations prior to compliance. Kalshi's advantage lies in institutional certainty and local distribution capabilities; Polymarket's advantage lies in its established global liquidity and broader event coverage. They represent two different evolutionary directions for prediction markets within the regulatory framework.

Second Camp: Crypto-Native Experimental Platforms

Beyond the mainstream compliance path, there exists a category of platforms that undertake the function of trial and error and innovation.

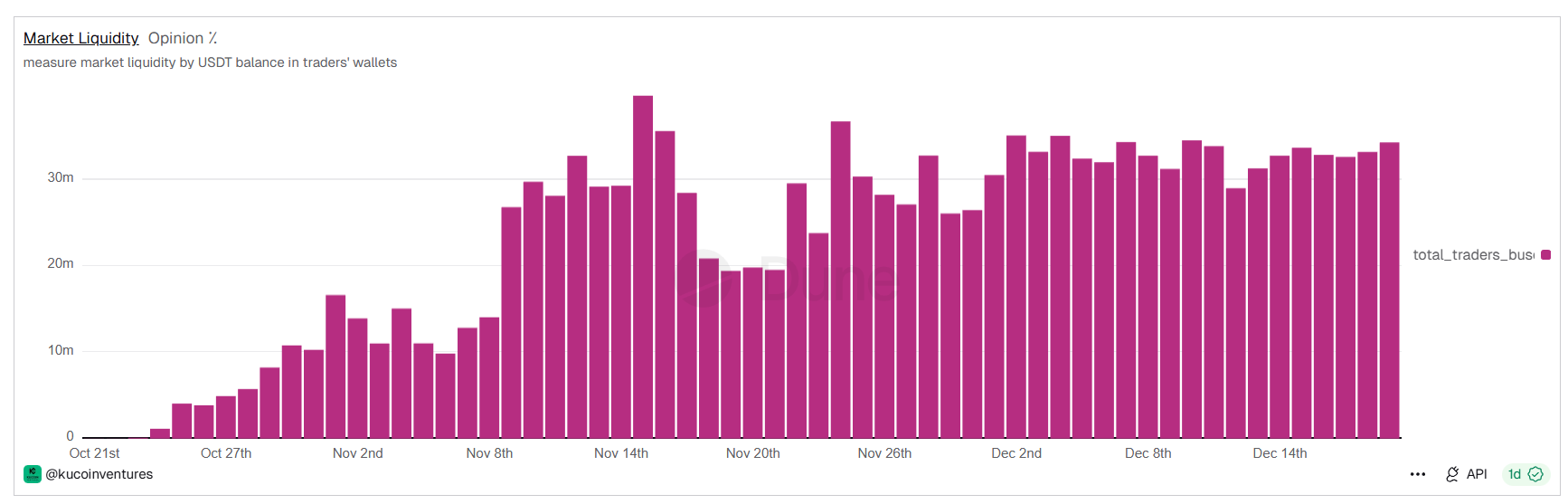

Platforms like Opinion represent this camp, relying on the native liquidity of the crypto ecosystem and community diffusion capabilities to achieve rapid growth. They are more aggressive in event selection, often covering crypto policies, extreme hypotheses, or highly controversial topics that mainstream platforms have yet to explore.

The significance of these platforms lies not in short-term scale, but in being the first to price highly uncertain issues. However, at the same time, their trading data often comes from platform displays or third-party statistics and has not yet entered a clear compliance framework, leaving long-term sustainability to be verified.

Third Camp: High-Frequency, Exchange-Minded Prediction Markets

Platforms represented by Limitless are pushing prediction markets in a new direction.

Here, predictions are no longer an act of "waiting for results," but a high-frequency trading behavior of entering and exiting positions. Contract cycles are deliberately shortened, settlement frequencies are continuously increased, and user behavior is more akin to that of short-term traders rather than event analysts.

This model blurs the lines between prediction markets and derivative trading, and also suggests that future regulators may need to confront new product definition issues.

Fourth Camp: Wallet and Super Entry Embedded Route

The value of Myriad Markets lies not in trading volume, but in the choice of path.

By integrating with mainstream wallets, prediction markets are embedded into users' daily asset management processes. Users are not "entering a prediction market," but are participating conveniently while viewing assets or completing interactions.

The long-term significance of this model lies in its extremely low customer acquisition costs and highly natural user conversion, indicating that prediction markets are shifting from "high participation cost behaviors" to "everyday light decision-making behaviors."

Fifth Camp: Public Chain and Content Ecosystem Native Information Markets

Platforms represented by predict.fun are attempting to position prediction markets as a native information application.

They rely on the public chain ecosystem for diffusion, promote participation through incentive mechanisms, and deeply bind prediction behavior with content and community. At the same time, traditional media is also exploring similar directions, using prediction markets as an interactive supplement to news content rather than merely a trading tool.

Although this camp may struggle to compete with compliant platforms in trading scale in the short term, the product forms and participation mechanisms they explore may influence the usage and content organizational structure of prediction markets in the medium to long term.

Compliance is Not About Loosening, But Setting Boundaries

In 2025, prediction markets were not "fully released."

A more accurate statement is: regulators have clearly acknowledged for the first time that prediction contracts can exist as financial instruments, but have not relinquished control over their boundaries. The federal attitude is gradually becoming clear, while state-level gambling regulations have become a new source of friction. This inconsistency means that prediction markets will remain in a state of "scalable but not uncontrollable."

For the average user, the most important cognitive shift in 2025 is: prediction markets are no longer just about "betting right or wrong," but about "the market's pricing of uncertainty."

Prices reflect consensus rather than facts; liquidity is often more important than opinions; profits come from poor judgments rather than the final outcome itself; and the greatest risks often stem from changes in rules rather than judgment errors.

Conclusion

Looking back at 2025, the real change in prediction markets is not which platform is more lively, but a more fundamental question is beginning to be taken seriously:

Who has the authority to price uncertainty?

Compliance platforms are setting boundaries, experimental platforms are exploring possibilities, and the true winners may not become apparent until after 2026. What is certain is that prediction markets are no longer just gambling, but are becoming a tool to help people understand uncertainty. A report released by Certuity predicts that by 2035, the scale of prediction markets could reach $95.5 billion, with a compound annual growth rate of 46.8%.

2025 is just the beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。