The cryptocurrency market of 2025 came to a dramatic close amidst wild fluctuations and magical realism. This year, the industry swung between madness and innovation, staging a series of farcical events that even the boldest screenwriters would envy. Below is a recap of the major news, capturing the unique tapestry woven from human nature, technology, and greed in this "casino."

1. A New Height of "Performance Art" by Founders

The "performance art" of project teams reached astonishing heights this year, with founders' antics evolving from "running away" to even more bizarre scripts.

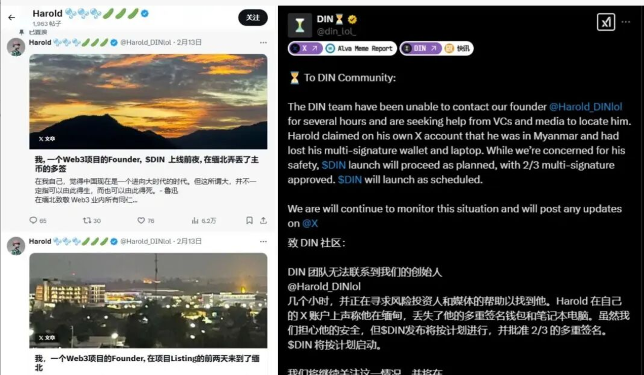

- The "Lost Wallet in Northern Myanmar" Incident:

● In February, on the day of the TGE (Token Generation Event), the DIN project announced that founder Harold had gone missing in Northern Myanmar, claiming to have lost the multi-signature wallet and laptop that held the main coins.

● The absurdity lies in the fact that the team immediately declared that even with the founder missing and the core wallet lost, the token issuance would proceed as planned, having received 2/3 multi-signature approval. This scenario split the community: one side saw it as excellent hype, while the other questioned the seriousness of a project that couldn't even ensure basic security.

● The incident starkly revealed the vast chasm between marketing and substance in certain crypto projects.

- The "Fake Death Exit" Farce:

● In May, a "suicide" video of Zerebro co-founder Jeffy Yu circulated online, along with a subsequent obituary, causing the market cap of the associated meme coin LLJEFFY to soar to $30 million. However, the truth quickly reversed.

● Jeffy Yu admitted to investors that the so-called "suicide" was a meticulously planned "fake death exit" strategy aimed at addressing personal disputes and avoiding a price crash.

● This manipulation of the market using the topic of death was seen as the first "fake death exit" in crypto history, dragging the moral bottom line into the abyss. It was not just a personal farce but also reflected the dark side of the industry, where some projects resort to extreme deceit to escape pressure.

2. Is There a "Way" for Thieves? The Magical Reality of Hackers

Security incidents are typically tragedies, but some plots this year took a comically absurd turn.

- Hackers Becoming Victims:

● In April, a hacker who had stolen a large amount of funds from zkLend attempted to launder the money through Tornado Cash but accidentally entered a phishing site, resulting in the theft of 2,930 ETH in stolen funds. Subsequently, the hacker even sent an on-chain message to zkLend apologizing and "pleading" with the project team to shift their investigation towards the phishing site operators, attempting to collaborate to recover the funds.

● zkLend's response was equally calm and pragmatic, stating they would monitor the relevant addresses and cooperate with all parties. This peculiar interaction, where the victim and the perpetrator nearly "collaborated" after a "black eats black" incident, resembled a surreal black comedy, mocking the anonymity and complexity of asset flows in the crypto world, which even hackers cannot fully control.

- "Dropping the Mask" Offline:

● In May, the Base chain project Clanker announced a split with developer proxystudio. The reason was not on-chain data analysis but because he was recognized by an old colleague at the FarCon offline conference—this person was none other than Gabagool.eth, who had previously returned $350,000 after absconding with the Velodrome team’s funds in 2022.

● The former detective turned thief, now rebranded and entering a new project, ultimately exposed himself due to being "familiar" offline. This offline "mask-dropping" comedy revealed the awkwardness and risks when the anonymity of the crypto world intersects with offline identities, also indicating that past behaviors are hard to completely conceal in tight-knit circles.

3. "Self-Subversion" by Project Teams

Some project teams' operations directly challenged users' basic perceptions and trust boundaries.

- Wallets "Devouring" User Balances:

● In June, the Bitcoin Lightning wallet Alby deducted the balances of long-inactive accounts to zero, citing its service terms, as users failed to migrate from the old shared wallet in time. This imposition of a "custodial" logic on the decentralized wallet concept was mocked by the community as "Alby redefining wallets."

● The incident sharply raised a question: When wallet service providers can unilaterally dispose of user assets, how much of the so-called "self-custody" spirit remains?

- "One-Click Solution" for Global Debt:

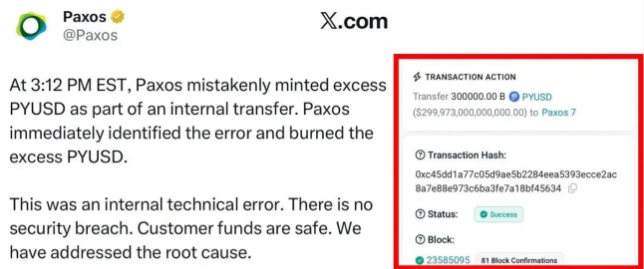

● In October, stablecoin issuer Paxos accidentally minted $300 trillion worth of PYUSD due to an operational error, which was then urgently destroyed within 22 minutes.

● This figure exceeded twice the total global GDP. Although this scare did not cause actual market impact, its dramatic nature was akin to a financial nuclear drill, exposing the potential risks of human error in large on-chain operations and serving as an alternative footnote to "blockchain efficiency."

- "We Have No Users": The Layer2 project Eclipse, after experiencing founder scandals and management changes, recently stirred up social media again.

● First, they mocked the community with a post claiming "Harvard University's 36-month sociology study has been completed," followed by an official comment introducing their ecological project stating, "We have no users." This self-deprecating or apathetic communication reflects the complex mindset of some projects after losing community trust and struggling with ecological development, as well as a form of distorted marketing or emotional venting in an intensely competitive industry.

4. The Ultimate Conspiracy of Power and Traffic

When the crypto market combined with the most popular political entertainment IPs, a wonderful chemical reaction occurred.

- "First Lady" Enters the Token Scene:

● After Trump issued his eponymous meme coin and gained significant attention, his wife Melania quietly launched a token named MELANIA late at night.

● It had nothing to do with technology or vision; it was purely an attempt to maximize traffic and fame, pushing the meme frenzy in the crypto market to a new height tinged with political family comedy. It harshly confirmed that in the attention economy, any identity can be rapidly tokenized and become a speculative symbol.

- K-Line Becomes "Drawing Line":

● Throughout the year, several incidents showed that the price charts of certain altcoins were not the result of market competition but were highly manipulated "drawings" by market makers.

● Chat records from market makers circulating on social media revealed that they could relatively freely "draw" the expected K-line patterns, crushing quantitative trading models. This starkly exposed that the short-term price discovery mechanism in the small-cap crypto asset market could completely fail, devolving into a pure game of capital manipulation.

2025 was an extreme product of the industry's wild growth, bubble expansion, and the collision of technological ideals with real-world greed. From the moral risks of founders, the blurring of security boundaries, the collapse of trust in project teams, to the bottomless cashing out of traffic and the naked market manipulation, each farce questioned the foundation of the crypto world: What kind of new system are we actually building?

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。