The price of gold has broken through $4,500, setting a new historical high, while silver has seen an annual increase of over 140%. In contrast, Bitcoin, once referred to as "digital gold," has faded into the background during this rush for safe-haven assets.

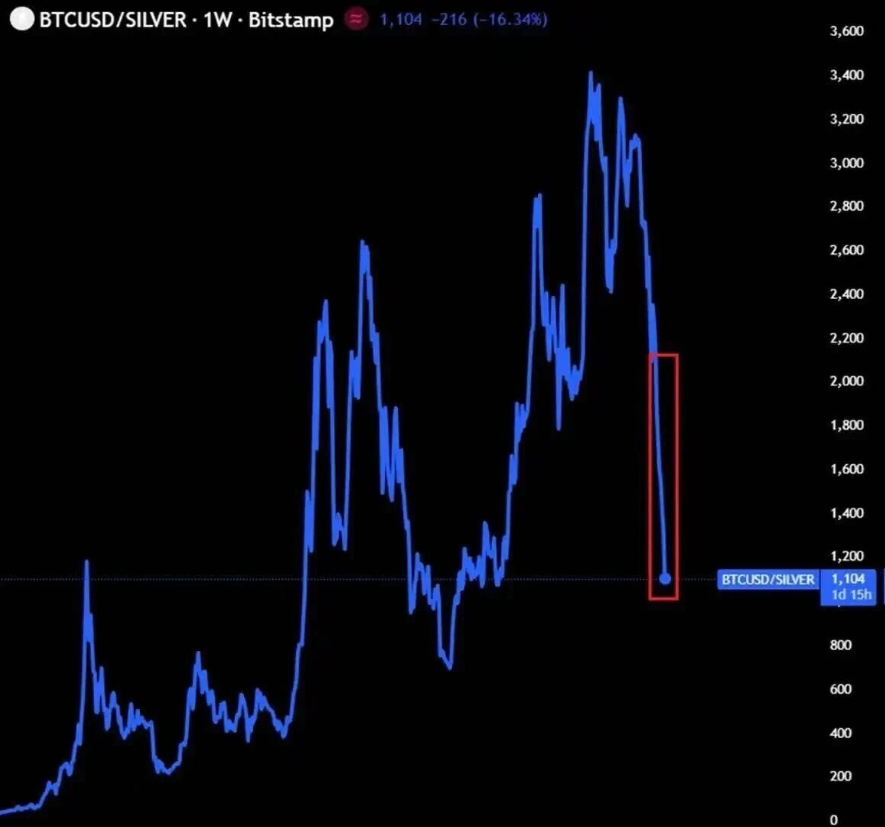

The ratio of Bitcoin to gold has dropped to 19, marking the lowest level since November 2023, down 50% from January this year; the ratio of Bitcoin to silver has fallen even further to 1,104, the lowest since September 2023.

Behind the data is an epic rise in the precious metals market in 2025—gold prices reached $4,524.30 per ounce, with a 70% annual increase; silver prices hit a historical high of $72 per ounce, soaring 143% over the year.

1. Market Anomalies

● The global financial market at the end of 2025 presents a divided picture. The traditional precious metals market continues to celebrate, with gold and silver prices soaring and constantly breaking historical records.

● Meanwhile, Bitcoin, once highly sought after, appears to be overshadowed. By the end of December, Bitcoin's price was reported at $87,498, down 8% for the year and approximately 30% from its peak of $126,000 in October.

● This divergence is particularly evident in the ratios between Bitcoin and precious metals. The Bitcoin to silver ratio has dropped to 1,104, the lowest since September 2023; the Bitcoin to gold ratio has fallen to 19, a new low since November 2023.

The significant decline in these two key ratios is not coincidental. Since May 2025, the Bitcoin to silver ratio has dropped by 67%; since January this year, the Bitcoin to gold ratio has decreased by 50%.

2. Bitcoin/Gold and Silver Ratios

The performance gap between Bitcoin and precious metals can be clearly illustrated through several key data points:

● 2025 Price Performance Comparison:

○ Gold: Up 70% for the year, reaching a historical high of $4,524.30 per ounce

○ Silver: Soared 143% for the year, hitting a historical high of $72 per ounce

○ Bitcoin: Down 8% for the year, with a 30% drop from the October peak

● Changes in Bitcoin to Precious Metals Ratios:

○ Bitcoin/Silver Ratio: 1,104 (lowest since September 2023), down 67% since May

○ Bitcoin/Gold Ratio: 19 (lowest since November 2023), down 50% since January

○ Comparison to the 2022 bear market low: At that time, the Bitcoin/Silver ratio was 680, and the Bitcoin/Gold ratio was 9

Market Structure Data:

● Approximately 33%-33.5% of the circulating supply of Bitcoin is currently at a paper loss, corresponding to over 7 million Bitcoins, with daily trading volumes on major exchanges like Binance exceeding 500,000 BTC.

3. Macroeconomic Factors

The divergence in asset performance stems from changes in the global economic environment and the differing attributes of various assets.

● The global macroeconomic landscape is experiencing multiple uncertainties. Rising geopolitical risks, persistent inflation pressures, and unclear monetary policy directions from the Federal Reserve collectively shape the current market backdrop. In such an environment, the advantages of traditional safe-haven assets like gold become more pronounced. Gold has a credibility system and tangible asset characteristics built over centuries, making it a preferred choice for capital during turbulent times.

● Central banks around the world have been continuously increasing their gold reserves throughout the year, and retail funds have shifted towards physical precious metals after Bitcoin's decline at the beginning of the year, further boosting gold demand.

● Meanwhile, the narrative of Bitcoin as "digital gold" faces challenges. Although supporters have long anticipated that a weakening dollar and expectations of interest rate cuts would drive Bitcoin prices up, the market seems to favor tangible traditional assets for actual safe-haven allocations.

4. Structural Differences

The performance differences between gold and Bitcoin partly stem from their fundamentally different attributes.

● Gold's status as a safe-haven asset is built on long-term historical performance and institutional trust. Multiple studies in 2025 have confirmed that gold exhibits more stable safe-haven performance during various macro shocks.

● In contrast, Bitcoin's price behavior often resembles that of high-risk assets, showing a positive correlation with traditional stock markets, and it has not led the way in this round of safe-haven trading.

● Silver's performance is driven by dual factors. In addition to its safe-haven properties as a precious metal, silver has seen record demand in industrial sectors such as photovoltaics and electronics.

The scarcity of substitutes in the supply chain has intensified the tight supply of silver, creating a dual support of macro safe-haven and industrial demand, a structural advantage that Bitcoin completely lacks. Bitcoin has no industrial use, with demand primarily concentrated in financial speculation and on-chain settlement, lacking the physical demand to buffer its price.

5. Capital Movements

● Changes in market capital flows have further exacerbated the performance gap between Bitcoin and precious metals. The asset allocation adjustments of institutional investors are particularly evident, with hedge funds reallocating from cryptocurrencies back to precious metals.

● Gold ETFs attracted approximately $1.2 billion in inflows in the fourth quarter of 2025. Meanwhile, the capital flow for Bitcoin ETFs has turned negative, with support significantly weakened. On-chain data reveals changes in the structure of Bitcoin holders. Monitoring indicates that about 33%-33.5% of the circulating supply of Bitcoin is currently at a paper loss, corresponding to over 7 million Bitcoins.

● This widespread floating loss has weakened the willingness to buy in the short term and altered the elasticity of market chip distribution. At the same time, some on-chain addresses have chosen a counter-cyclical accumulation strategy.

New addresses from Binance have recently accumulated approximately 1,600 Bitcoins, displaying funding behavior that is starkly different from retail sentiment. This type of "concentrated accumulation, dispersed holding" model is often seen as a medium to long-term allocation strategy by institutions or high-net-worth investors.

6. Future Directions

Looking ahead, for Bitcoin to reverse its current relative weakness, several key conditions may be necessary. An increase in regulatory clarity could prompt institutional investors to reallocate Bitcoin assets.

● The restoration of retail sentiment is also an important factor; current market sentiment is cautious, and the presence of a large number of floating loss chips has weakened short-term buying willingness. Changes in the macro environment could provide opportunities for Bitcoin; if specific macro shocks occur, Bitcoin's anti-censorship and programmable features may highlight its unique value.

● The extreme performance of the silver market may have made it relatively crowded; if events such as a shift in Federal Reserve policy occur, it could trigger volatility in the precious metals market, indirectly affecting Bitcoin.

● Standard Chartered recently adjusted its Bitcoin price targets, lowering the end-of-2025 target from $200,000 to $100,000, and the 2026 target from $300,000 to $150,000, reflecting a reassessment of mid to short-term risks by institutions.

● Fundstrat's head of digital assets, Sean Farrell, noted that the year-end "Christmas rally" often manifests as investors selling the year's "losers" and buying "winners" to welcome the new year. However, he believes that as more long-term allocation funds flow in early 2026, Bitcoin may have a chance for a rebound.

● From the performance of other areas on-chain, overall risk appetite has not shown a systemic collapse. The prediction market Opinion has surpassed $10 billion in cumulative trading volume within about 55 days of its launch, indicating that high-risk appetite capital remains active.

As gold breaks through $4,500 and silver rises 143% for the year, 33% of Bitcoin's circulating supply is facing paper losses.

The Bitcoin to silver ratio has dropped 67% since May, reaching a 15-month low. The market's capital voting indicates that in the face of genuine safe-haven demand, the narrative of "digital gold" still needs to bridge the dual gaps of trust and practicality. The endgame of this asset rotation may redefine the paradigm of value storage for the next decade.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。