CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $3.06 trillion, down from $3.09 trillion last week, representing a decrease of approximately 0.97% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.62 billion, with a net outflow of $782 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.34 billion, with a net outflow of $102 million this week.

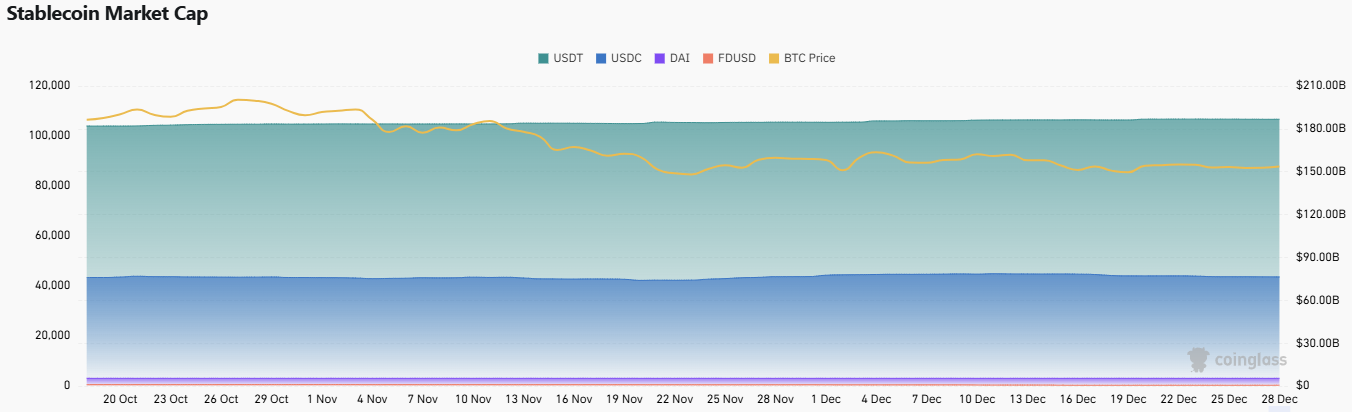

The total market capitalization of stablecoins is $313 billion, with USDT having a market cap of $186.7 billion, accounting for 59.65% of the total stablecoin market cap; followed by USDC with a market cap of $76.36 billion, accounting for 24.4%; and DAI with a market cap of $5.36 billion, accounting for 1.71% of the total stablecoin market cap.

According to DeFiLlama, the total TVL of DeFi this week is $118.2 billion, down from $119.6 billion last week, a decrease of approximately 1.17%. By public chain, the top three chains by TVL are Ethereum, accounting for 68.33%; Solana, accounting for 8.23%; and Bitcoin, accounting for 6.69%.

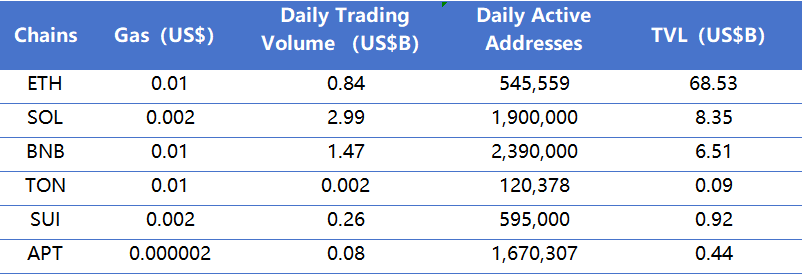

This week, the overall transaction costs of public chains remained stable, with adjustments mainly on the user and funding levels. In terms of daily trading volume on on-chain DEXs, Sui saw the largest increase, growing by approximately 56.6%; BNB Chain experienced the largest decrease, falling by approximately 38.6%; Ethereum and Solana increased by approximately 18.8% and 25.8%, respectively; Ton and Aptos saw slight growth. In terms of transaction fees, the gas levels of each public chain remained basically unchanged from last week. In terms of daily active addresses, Aptos had the largest change, increasing by approximately 48.7%; Ton decreased by about 7.5%; Ethereum and Solana increased by approximately 16.6% and 5.6%, respectively; BNB Chain saw a slight decline; Sui showed slight growth. In terms of TVL, Ton had the most significant increase, approximately 9.8%; Ethereum decreased by about 1.4%, while the overall fluctuation of TVL in other public chains was relatively small.

New Project Focus: Railnet is positioned as an open yield layer infrastructure for asset managers, with the core goal of unifying and integrating various yield sources in a multi-chain, multi-protocol environment, allowing professional institutions and strategy managers to build complex yield strategies in a modular and composable manner; Predictir is a decentralized prediction market platform, with its launched Predictir Quests being one of the three core new features set to go live, aiming to reshape participation in prediction markets through a task-based mechanism; Yusan is a cross-chain lending protocol, primarily focused on addressing the liquidity isolation issue between the Bitcoin and Ethereum ecosystems.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $3.06 trillion, down from $3.09 trillion last week, representing a decrease of approximately 0.97%.

Data Source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of December 28, 2025

As of the time of writing, the market cap of Bitcoin is $1.75 trillion, accounting for 57.27% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $313 billion, accounting for 10.22% of the total cryptocurrency market cap.

Data Source: Coingecko, https://www.coingecko.com/en/charts

Data as of December 28, 2025

2. Fear Index

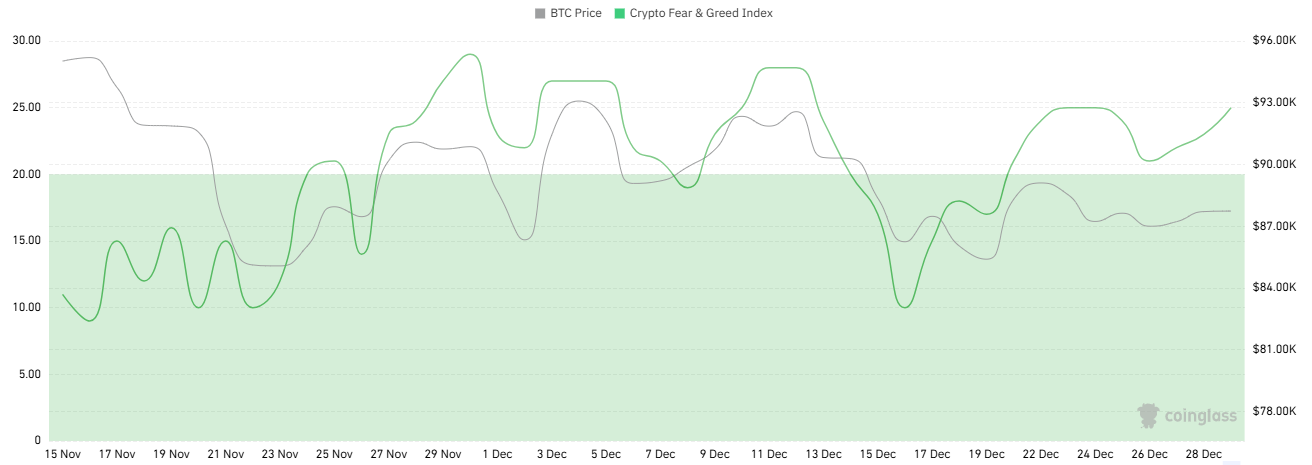

The cryptocurrency fear index is 25, indicating fear.

Data Source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of December 28, 2025

3. ETF Inflow and Outflow Data

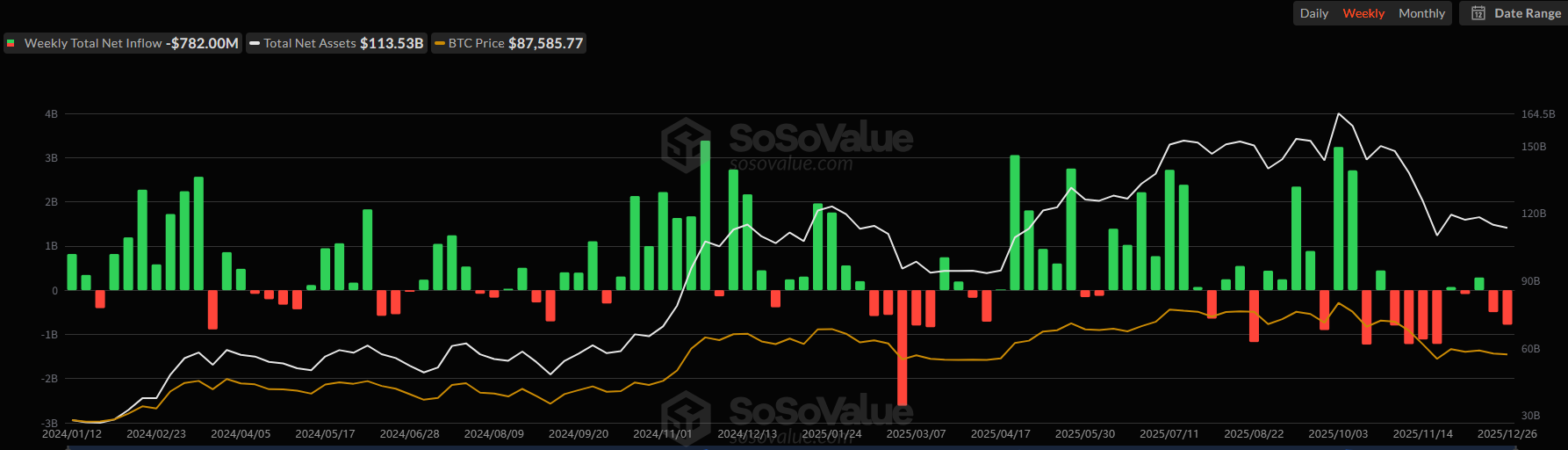

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $56.62 billion, with a net outflow of $782 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.34 billion, with a net outflow of $102 million this week.

Data Source: Sosovalue, https://sosovalue.com/zh/assets/etf

Data as of December 28, 2025

4. ETH/BTC and ETH/USD Exchange Rates

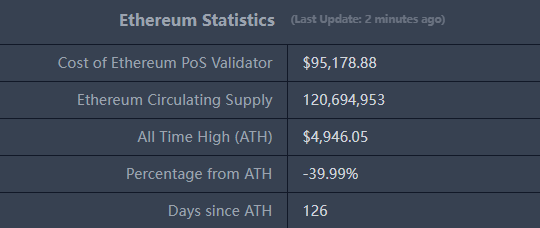

ETHUSD: Current price $2,972, historical highest price $4,946.05, down approximately 39.99% from the highest price.

ETHBTC: Currently at 0.033652, historical highest at 0.1238.

Data Source: Ratiogang, https://ratiogang.com/

Data as of December 28, 2025

5. Decentralized Finance (DeFi)

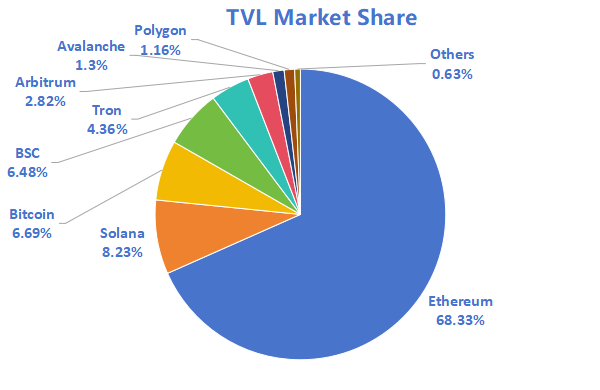

According to DeFiLlama, the total TVL of DeFi this week is $118.2 billion, down from $119.6 billion last week, a decrease of approximately 1.17%.

Data Source: Defillama, https://defillama.com

Data as of December 28, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 68.33%; Solana, accounting for 8.23%; and Bitcoin, accounting for 6.69%.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 28, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the daily trading volume of on-chain DEXs, daily active addresses, and transaction fees for the current major Layer 1s including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 28, 2025

On-Chain DEX Daily Trading Volume and Transaction Fees: The daily trading volume and transaction fees of on-chain DEXs are core indicators of public chain activity and user experience. In terms of daily trading volume on on-chain DEXs, Sui saw the largest increase, growing by approximately 56.6%; BNB Chain experienced the largest decrease, falling by approximately 38.6%; Ethereum and Solana increased by approximately 18.8% and 25.8%, respectively; Ton and Aptos saw slight growth. In terms of transaction fees, the gas levels of each public chain remained basically unchanged from last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, Aptos had the largest change, increasing by approximately 48.7%; Ton decreased by about 7.5%; Ethereum and Solana increased by approximately 16.6% and 5.6%, respectively; BNB Chain saw a slight decline; Sui showed slight growth. In terms of TVL, Ton had the most significant increase, approximately 9.8%; Ethereum decreased by about 1.4%, while the overall fluctuation of TVL in other public chains was relatively small.

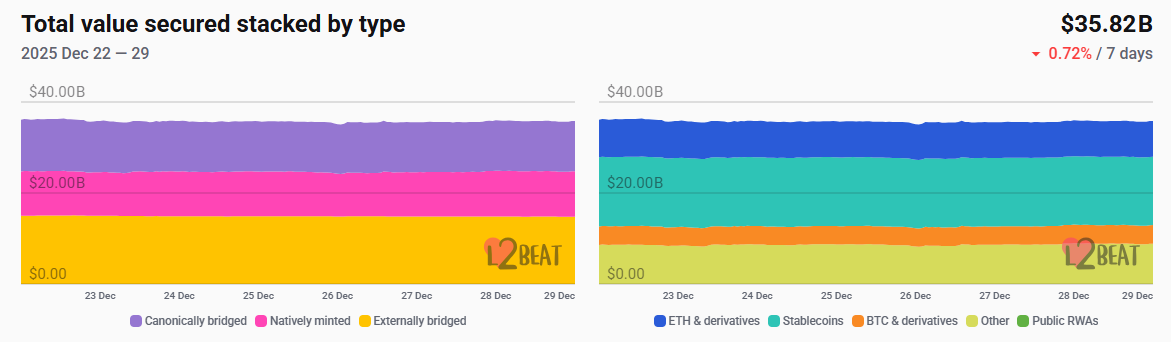

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $35.82 billion, down from $36.24 billion last week, a decrease of approximately 0.72%.

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of December 28, 2025

Base and Arbitrum hold the top positions with market shares of 36.85% and 34.77%, respectively, with Base ranking first in Ethereum Layer 2 TVL this week.

Data Source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of December 28, 2025

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market cap of stablecoins is $313 billion, with USDT having a market cap of $186.7 billion, accounting for 59.65% of the total stablecoin market cap; followed by USDC with a market cap of $76.36 billion, accounting for 24.4%; and DAI with a market cap of $5.36 billion, accounting for 1.71%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of December 28, 2025

According to Whale Alert data, USDC Treasury issued a total of 2.008 billion USDC this week, while Tether Treasury did not issue any USDT this week. The total issuance of stablecoins this week was 2.008 billion, up approximately 99.4% from last week's total issuance of 1.007 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of December 28, 2025

II. This Week's Hot Money Trends

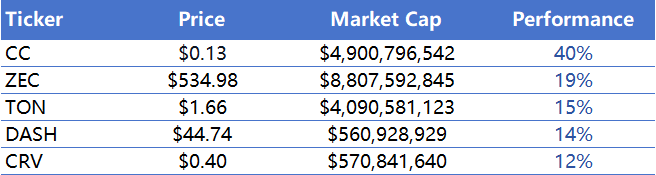

1. Top Five VC Coins and Meme Coins by Growth This Week

Top five VC coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 28, 2025

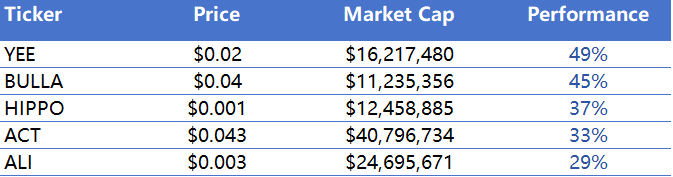

Top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 28, 2025

2. New Project Insights

Railnet is positioned as an open yield layer infrastructure for asset managers, with the core goal of unifying and integrating various yield sources in a multi-chain, multi-protocol environment, allowing professional institutions and strategy managers to build complex yield strategies in a modular and composable manner. Through standardized yield abstraction and strategy interfaces, Railnet supports the packaging, reuse, and distribution of strategies from different yield sources such as DeFi, RWA, and on-chain interest markets, and can be flexibly deployed to wallets, front-end applications, institutional platforms, or other distribution channels, thereby lowering the development and distribution threshold for yield strategies and promoting on-chain asset management towards a more open, composable, and scalable direction.

Predictir is a decentralized prediction market platform, with its launched Predictir Quests being one of the three core new features set to go live, aiming to reshape participation in prediction markets through a task-based mechanism. This feature combines users' real trading behaviors with a challenge system, allowing users to earn XP points by participating in prediction trades and completing specified tasks, which can then be converted into rewards of actual value, effectively incentivizing high-quality and sustained market participation.

Yusan is a cross-chain lending protocol, primarily focused on addressing the liquidity isolation issue between the Bitcoin and Ethereum ecosystems, allowing users to deposit BTC on the Bitcoin mainnet and use it as collateral to borrow USDC on the Base network, thereby improving cross-chain efficiency without wrapping or bridging BTC assets.

III. Industry News

1. Major Industry Events This Week

FHE cryptography company Zama announced that OG NFT claim holders can participate in the token public offering at a price of $0.005, with an FDV of $55 million, allowing a maximum purchase of 40,000 tokens. These claimed OG NFTs account for 2% of the total 5,500. Additionally, at the end of the public auction, anyone holding a Zama OG NFT will receive a reward of 5% of the transaction amount.

Sonic updated its S token airdrop model, with the remaining 92.2 million tokens to be used for long-term incentives and destruction. Sonic distributed approximately 89,500,000 S tokens in the first quarter and approximately 6,000,000 S tokens in the second quarter, with about 2,800,000 S tokens distributed in the Kaito Campaign. Currently, there are still about 92.2 million S tokens in the Sonic Labs treasury, which will continue to be used for airdrop incentive programs in 2026 and 2027. However, with changes in the industry landscape, Sonic will abandon a one-size-fits-all airdrop model in favor of a targeted growth approach. It is important to note that there will be no additional airdrop issuance, and the remaining tokens will be used for airdrops, rewards, or destruction.

ZK smart verifiable computing platform Brevis announced its BREV token economics. The total supply of BREV is 1 billion tokens, of which 37% will be used for ecosystem development, 32.2% for community incentives (validators, stakers, and community contributors), 20% allocated to the team, and 10.8% allocated to investors. The allocations for the team and investors will be locked for one year, followed by a linear unlock over 24 months.

The Espresso Foundation, a blockchain infrastructure organization, has opened the ESP token registration portal. Users can now connect their wallets to check if they qualify for the Espresso airdrop, with the token claim page set to open in early 2026.

Web3 robotics company XMAQUINA announced a partnership with Virtuals Protocol for the community sale of DEUS. DEUS will accept both USDC and VIRTUAL tokens for swaps. The input of VIRTUAL will be used to launch the DEUS/VIRTUAL liquidity pool at the time of DEUS token issuance, with an initial total locked value exceeding $1 million. In terms of specifics, the auction start date is January 8, with an FDV of $60 million (DEUS price $0.06). At TGE, 33% will be liquid assets, and 67% will vest linearly over 12 months.

2. Major Upcoming Events Next Week

The crypto AI Agent protocol HeyElsa has processed over $300 million in on-chain transactions and plans to conduct a TGE in January 2026, distributing ELSA tokens to the community. A qualification checker is expected to go live in early January, and before finalizing qualifications, the official will run an anti-witch check. After TGE, HeyElsa plans to launch a trading arena, support a new points system for earning through usage, and other incentive programs on the Base network. HeyElsa completed a $3 million funding round in June 2025, led by M31 Capital, with participation from Coinbase Ventures, MH Ventures, Absoluta Digital, Levitate Labs, and others.

The first quarter token airdrop (ZBT) claim for ZEROBASE will close on December 31, 2025. This airdrop has been open for claims since October 17, 2025, targeting various groups including early adopters of ZEROBASE, Galxe event participants, and Binance Wallet Booster program users, covering a period of approximately two and a half months.

Solstice announced updates to its token public offering terms, with public offering token shares set to unlock 100% at TGE; users who are shaken by short-term fluctuations of USX can apply for a full refund within a 14-day window after the public offering ends; the SLX issuance will proceed as planned without delays, with TGE scheduled for the first quarter of 2026.

Cross-chain aggregation DeFi platform Infinex updated its token sale details on Echo's Sonar. This sale will offer 5% of the token supply, with the fundraising amount reduced from $15 million to $5 million, and FDV decreased from $300 million to $99.99 million. User registration opened on December 27, with sales set to begin on January 3. Additionally, the official will sell an extra 2% of tokens to Uniswap CCA.

Huma Finance announced that the second part of the second quarter airdrop is now live, with the claim window closing on January 26. Wallets that missed the first part can claim in this phase. Additionally, liquidity providers (LPs) who transfer or withdraw locked PST and mPST will see a reduction in their allocation for the second part.

3. Important Investments and Financing from Last Week

Coinbax has completed a seed round financing of approximately $4.2 million, with investors including core institutions in the stablecoin and compliance infrastructure sectors such as Paxos, as well as Connecticut Innovations, BankTech Ventures, and SpringTime Ventures, which have local financial and banking technology resources. Coinbax is positioned as a stablecoin payment infrastructure provider, offering secure and reliable stablecoin and tokenized deposit payment channels for banks, fintech companies, and corporate clients by introducing programmable risk control rules and automated clearing and settlement logic, focusing on addressing the core pain points of compliance, controllability, and settlement efficiency in institutional-level stablecoin payments. (December 22, 2025)

Architect has completed a $35 million Series A financing round, with investors including Coinbase Ventures, VanEck, Galaxy Ventures, Tioga Capital, CMT Digital, ARK Invest, Miami International Holdings, Geneva Trading, and other crypto-native funds and traditional financial institutions. Architect is a digital asset trading software provider aimed at professional traders and institutional investors, with the core goal of providing a unified, efficient, and scalable global digital asset trading access solution by bridging centralized exchanges and decentralized markets through highly customizable trading infrastructure. (December 24, 2025)

easy.fun has completed a seed round financing of $2 million, led by Mirana Ventures. easy.fun is positioned as an open on-chain trading platform built on Hyperliquid, combining on-chain trading with competitive mechanisms to create trading scenarios where users engage in games around rankings, earnings, and honors. (December 24, 2025)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Railne: https://x.com/railnet_org

Predictir: https://x.com/Predictir

Yusan: https://x.com/yusandotfi

Coinbax: https://x.com/CoinbaxHQ

Architect: https://x.com/Architect_Fi

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。