I. Top Ten Predictions for 2026

1. Institutional Regulation and Trillions in Capital Entering the Market

With the implementation of the U.S. "GENIUS" and "CLARITY" acts, the crypto industry will shift from a law enforcement-led phase to a rules-based golden era. This transition will unleash over a trillion dollars in institutional capital, driving banks to issue compliant stablecoins and RWA on public chains at scale, resulting in a 100% explosive growth in crypto asset custody compared to 2025.

2. Bitcoin Becomes a Global Strategic Reserve Asset

Bitcoin will officially shed its speculative label, with volatility dropping to the level of the S&P 500, evolving into a global non-sovereign reserve asset. At least five sovereign nations are expected to include it in their treasuries, with institutional holdings accounting for over 15% of circulating supply, making it an indispensable digital safe-haven anchor in global corporate balance sheets.

3. Stablecoins Dominate the Global Digital Cash Layer

The annual settlement volume of stablecoins is expected to surpass Visa's annual processing amount, becoming the largest 24/7 clearing network globally. Under regulatory benefits, interest-bearing stablecoins will be highly integrated with tokenized deposits, serving as the fiat interface of the Web3 era and providing global users with inclusive financial channels linked to U.S. Treasury yields.

4. Leapfrog Growth of RWA and All-Asset Trading

The market size of tokenized real-world assets (RWA) will surpass $500 billion, with 2% of global U.S. Treasuries circulating on public chains. Crypto exchanges will evolve into all-asset centers, allowing users to seamlessly switch between cryptocurrencies, stocks, and bonds within a unified liquidity pool, achieving instantaneous cross-market allocation of assets and liquidity.

5. Birth of One-Stop "Financial Super Apps"

The market will see multiple Web3 super apps with over 100 million users, integrating spot, meme, RWA, and traditional securities under a unified compliant account. Such applications will completely bridge the gap between on-chain and off-chain, allowing users to operate without understanding private keys or gas fees, with the Web3 user base expected to surpass 20% of the global internet population, achieving large-scale seamless applications.

6. Capital Revaluation in the Era of DATs 2.0

Digital Asset Financial Companies (DATs) will evolve from passive coin hoarding to active on-chain banking, capturing excess returns through staking and restaking. The valuation of such companies will shift from net asset value to cash flow discount models, with annualized cash flow returns expected to stabilize above 8%.

7. Diversification of ETFs and the Disappearance of Investment Barriers

Spot ETFs will explode from single-coin products to strategy-enhanced and thematic index types, with over 50 products covering altcoin portfolios, AI + DePIN themes, and more. The share of cryptocurrency ETFs in the total assets of global exchange-traded funds will exceed 5%, completely removing the last barriers for traditional pensions and retail investors to participate in emerging sectors.

8. Prediction Markets Upgrade to Risk Pricing Centers

Prediction markets will leap from native gaming tools to global risk pricing infrastructure. Through probability pricing and capital gaming mechanisms, they will become more accurate collective expectation indicators than traditional polls, with their predictive accuracy for macro events consistently surpassing that of traditional institutions.

9. AI Agent Economy Materializes

Leveraging protocols like x402, AI agents will possess independent wallets and autonomously initiate transactions, with over 30% of on-chain interactions completed by AI. This machine-to-machine model will support settlements as low as $0.001, completely resolving real-time payment challenges for computing power leasing and data procurement, marking the synchronization of on-chain value flow with information flow.

10. Vertical Utility Differentiation in Public Chain Tracks

Public chain competition will shift from a single performance game to a demand-driven professional landscape. Ethereum will dominate over 40% of institutional-level settlement and security layers; high-performance chains like Solana will support social and payment interactions; other specialized chains will focus on AI computing power and DePIN tracks, forming a differentiated competitive closed loop.

II. Macroeconomic Review and Forecast

The global macroeconomic landscape in 2025 is characterized by high complexity and interwoven variables, with the core theme revolving around the dynamic balance between inflation stickiness, economic growth resilience, and financial stability in a high-interest-rate environment.

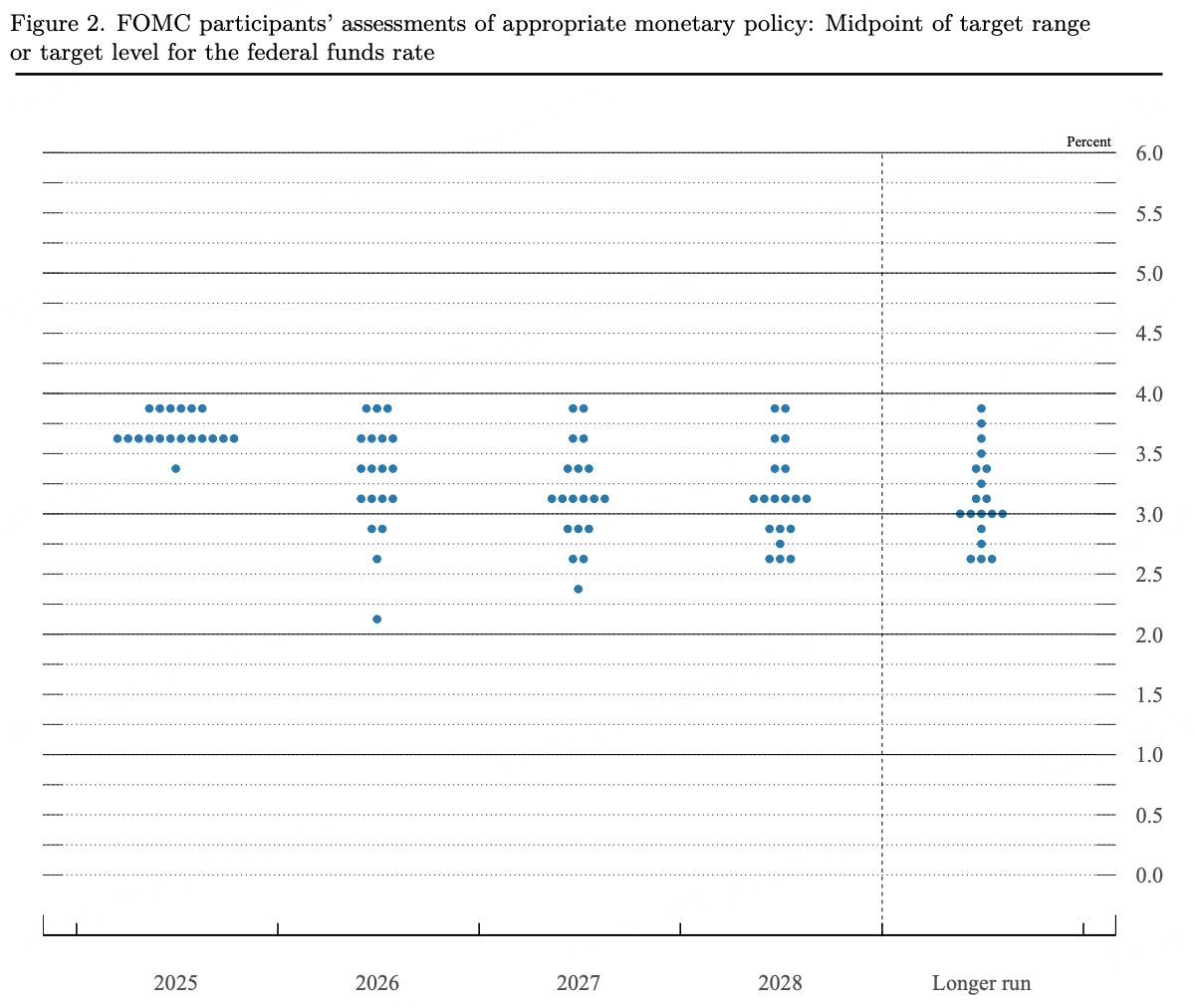

The Federal Reserve's policy tone is situated in a rate-cutting cycle but remains extremely restrained. Although it supports the economy through slight rate cuts and a slowdown in balance sheet reduction (dovish), the pace of rate cuts is slower than market expectations due to factors such as a shift in the composition of voting committee members towards hawkishness, a rebound in inflation expectations, and disruptions from tariff policies. The Fed maintains a strong cautious stance, ready to pause rate cuts to curb inflation. It consistently emphasizes a data-dependent principle in its meetings and communications, particularly focusing on core PCE, service inflation, and the tightness of the labor market.

At the beginning of the year, the federal funds target rate remained in a restrictive range, with the Fed repeatedly stating that it would not easily loosen policy until inflation is "sustainably suppressed." As the second half of the year approaches, with the labor market gap narrowing and structural slowdown in economic growth momentum, the Fed's policy focus shifts from a singular anti-inflation stance to a dual-mandate balance. Although core inflation remains sticky due to global trade policy disruptions, the Fed has initiated a gradual rate-cutting process to prevent an unexpected economic slowdown against a backdrop of relatively high real interest rates. This move does not signal a return to a low-interest-rate era but rather a tactical adjustment to ensure inflation does not rebound while correcting excessive tightening, with the overall tone still maintaining a slightly tight "restrictive range."

In 2025, the U.S. inflation process fell into a "asymmetric decline" stalemate. On one hand, core goods inflation continued to deflate under the combined effects of supply chain redundancy and global demand slowdown, effectively offsetting some price pressures; on the other hand, service inflation remained resilient due to the slow transmission of housing rents and the structural cost rigidity of labor-intensive sectors. As the second half of the year progresses, market expectations for a new round of trade tariffs and expansionary fiscal policies heat up, significantly raising the tail risks of secondary inflation. This inflation pattern leads to a plateau around 2.7% for core CPI, forcing the Fed to maintain a slow and steady rate-cutting path, ensuring that inflation expectations are not anchored by maintaining a restrictive interest rate range.

Compared to the slow decline in inflation, the labor market released clearer signs of weakening in the second half of 2025. The unemployment rate has steadily climbed from a low at the beginning of the year to 4.6%, reaching the highest threshold since 2021, marking a substantial easing of the tight labor supply situation in the post-pandemic era. Although non-farm data continues to show positive growth, the internal structure has severely diverged, with hiring momentum in interest-sensitive manufacturing and finance sectors nearly stagnating. Defensive pressures on the employment front are replacing anti-inflation demands, becoming the decisive marginal variable driving the Fed to initiate a gradual rate-cutting process by the end of the year.

Data Source: U.S. Bureau of Economic Analysis; U.S. Bureau of Labor Statistics; U.S. Census Bureau via FRED®

Looking ahead to 2026, the U.S. economy is expected to enter a recovery phase. Although high-interest rate pressures will still constrain the extent of consumer expansion, the structural robustness of the labor market and the repair of household balance sheets will create a solid buffer against recession. Monetary policy will maintain a neutral but cautious tone, rather than returning to an extremely low-interest-rate era. Meanwhile, rising sovereign debt pressures will compel fiscal policy to shift towards precision targeting. Against the backdrop of global liquidity rebalancing, the stabilization of real interest rates will drive capital back from speculative premiums to certainty-driven growth, and the fragmented reorganization of geopolitical economics will also lead to significant defensive differentiation in growth performance among nations.

Data Source: Federal Reserve Board, Summary of Economic Projections, December 10, 2025.

In this macro context, the external environment for the crypto market is expected to improve compared to previous cycles, but more as a structural improvement rather than a mere liquidity-driven one. With the end of the rate hike cycle, expectations for real interest rates are stabilizing and declining, alleviating long-term valuation pressures on risk assets. Additionally, progress in stablecoin regulation and crypto ETFs in the U.S. in 2025 has gradually brought crypto assets into a clearer regulatory framework. As we enter 2026, the policy focus will shift from institutional establishment to execution and coordination, further influencing the allocation of institutional capital. Overall, the impact of macro factors on the crypto market in 2026 will be more reflected through policies, capital structures, and institutional behaviors, as the crypto market transitions from a cyclical, narrative-driven speculative market to an alternative asset class deeply linked with the global macro cycle.

III. Development Status of Major Public Chains

1. BTC

1.1 Market Performance

Data Source: BitMart API

In 2025, Bitcoin's price exhibited a high-level oscillation trend. At the beginning of the year, Bitcoin briefly surged to $109,000 but quickly retraced to $74,000 due to market uncertainties triggered by U.S. tariff policies. Subsequently, market narratives shifted towards expectations of Fed rate cuts, driving Bitcoin to experience a strong upward trend from March to July, with prices climbing from around $80,000 to approximately $125,000.

However, the turning point in the second half of the year was more dramatic. Following the historic liquidation event in the crypto market on October 11 and the U.S. government shutdown, Bitcoin's price continued to decline. By December, its price closed at around $85,000, down nearly 33% from its peak during the year. The annual trend clearly indicates that Bitcoin's price volatility has become deeply anchored to global liquidity expectations and macroeconomic data, highlighting its attributes as a macro-sensitive asset.

1.2 On-Chain Data

Data Source: CoinGecko, DeFiLlama

In terms of on-chain data, Bitcoin's market capitalization rapidly expanded and maintained high levels in the first half of the year, oscillating at high levels in the third quarter, and significantly declining in the fourth quarter due to systemic risk shocks, indicating that while the price center has risen, volatility has significantly increased. Trading volume was primarily concentrated at trend inflection points and during periods of sharp volatility, especially highlighted during rapid declines, reflecting Bitcoin's status as the core liquidity carrier in the crypto market.

TVL and the number of active addresses rebound during the rising phase and contract during the pullback phase, indicating that on-chain participation is highly sensitive to price changes. Overall, trading and speculative demand remain dominant, with limited long-term capital accumulation. In summary, Bitcoin has entered a new phase characterized by "high market capitalization, high liquidity, and strong volatility." Structural funds such as ETFs and DATs mainly serve to reinforce trends and provide temporary support, with limited impact on on-chain activity and real usage demand. In the future, Bitcoin's core position in the global risk asset system will be further solidified, but the market is more likely to exhibit structural fluctuations within a high range rather than a unilateral trend.

1.3 BTC Spot ETF

Data Source: SoSoValue

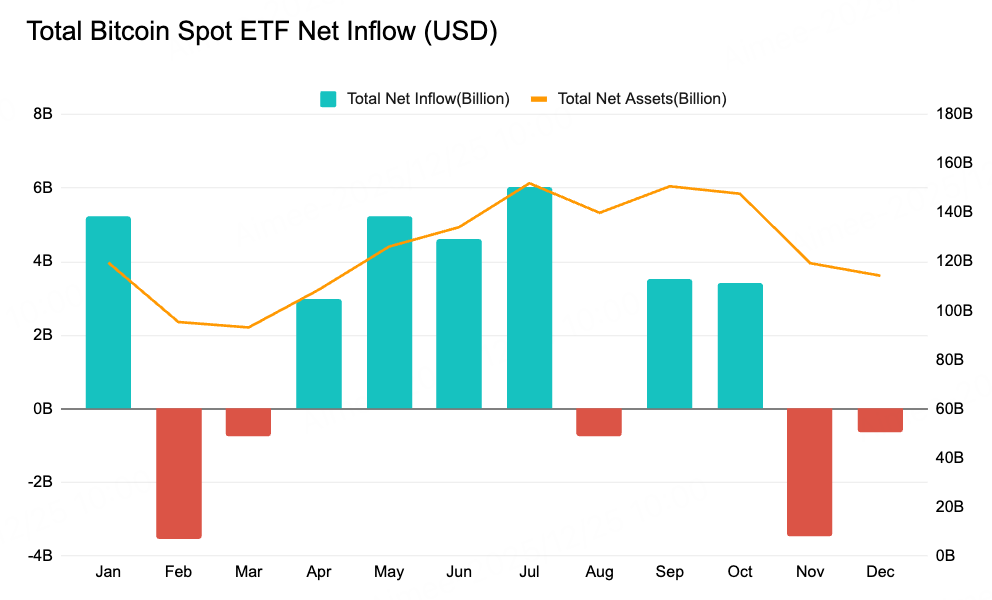

From the data for the entire year of 2025, the capital flow of the BTC spot ETF is highly correlated with tariff policies, interest rate cut expectations, fiscal uncertainties, and systemic volatility in the crypto market, reflecting the sensitivity of institutional capital to macro variables. At the beginning of the year, under the influence of soft landing and interest rate cut expectations, the BTC ETF saw significant inflows, driving prices upward simultaneously. However, from February to March, repeated tariff expectations put pressure on risk assets, leading to outflows from the ETF, which took on more of a risk-off and position adjustment role.

In the second quarter, the macro environment improved temporarily, with a repricing of the interest rate cut path and marginal easing of financial conditions. The BTC ETF saw continued inflows from April to July, pushing Bitcoin prices to new historical highs. However, the black swan event in the market on October 11, combined with the U.S. government shutdown, significantly increased the ETF's sensitivity to volatility, resulting in sustained rapid outflows.

Overall, the changes in the circulation of the BTC spot ETF in 2025 were primarily driven by the U.S. macro cycle and market volatility: interest rate cut expectations determined the medium-term direction, tariffs and fiscal risks amplified volatility, while extreme events accelerated risk-off behavior, indicating that although Bitcoin has entered the institutional allocation system, it is still in a transitional phase from high-volatility assets to stable macro allocation assets.

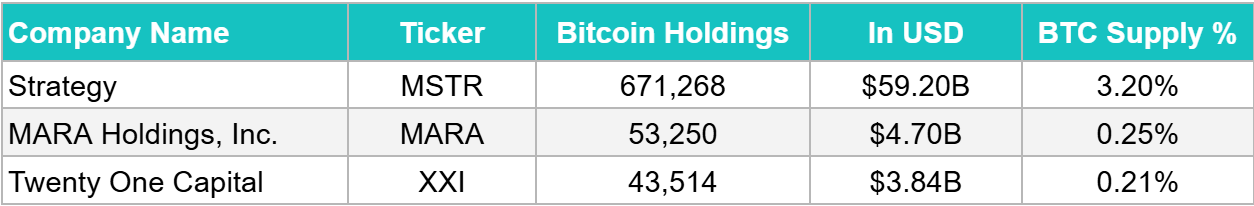

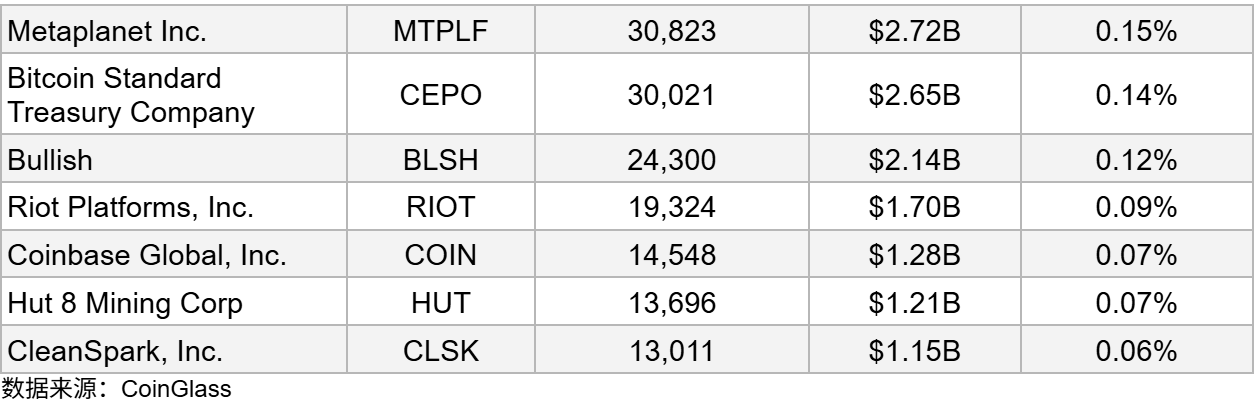

1.4 DATs Company Holdings Value

The BTC DATs reserve data for 2025 shows a clear stratification in the allocation of Bitcoin among listed companies. Strategy ranks first with approximately 671,268 BTC, accounting for about 3.20% of the circulating supply. Despite a significant market correction, it continues to increase its holdings to solidify its market position. However, the valuation of its stock relative to Bitcoin holdings has significantly compressed, with mNAV dropping to about 1.08 times, at a near-low level in recent years, reflecting a decline in market confidence in its "Bitcoin proxy stock" attributes. Overall, leading BTC DATs companies have strategic advantages but also face high valuation volatility risks. A model that relies solely on BTC reserves exhibits high beta characteristics, amplifying gains during upward cycles while magnifying losses and valuation discount pressures during turbulent or downward phases. In contrast, companies with diversified businesses (such as Coinbase) demonstrate stronger risk-buffering capabilities.

1.5 Outlook for 2026

The year 2026 will mark the official end of Bitcoin's "four-year cycle" theory, with prices expected to reach new historical highs in the first half of 2026. With the full opening of spot ETFs in mainstream wealth management channels (such as Morgan Stanley and Merrill Lynch) and the unlocking of digital asset allocations in 401(k) retirement plans, Bitcoin will transition from a retail-driven speculative asset to an institutional-level macro hedging tool. Against the backdrop of rising credit risks in fiat currencies, Bitcoin's status as a scarce digital commodity will be further solidified, and its volatility will structurally decline as the options market matures, gradually aligning with the pricing models of traditional macro assets.

In terms of capital structure, Digital Asset Financial Companies (DATs) will enter the 2.0 era, with Bitcoin becoming an important component of corporate balance sheets, but this also brings potential forced liquidation risks. If market prices experience a deep pullback, highly leveraged institutional positions may face margin pressure, triggering a more severe sell-off chain reaction than that of retail investors. However, from a medium- to long-term perspective, with the implementation of regulatory frameworks such as the Clarity Act, Bitcoin will no longer be merely a speculative tool but will be deeply embedded in the core financial infrastructure of the U.S. and even the global financial system.

2. ETH

2.1 Market Performance

Data Source: BitMart API

Data Source: BitMart API

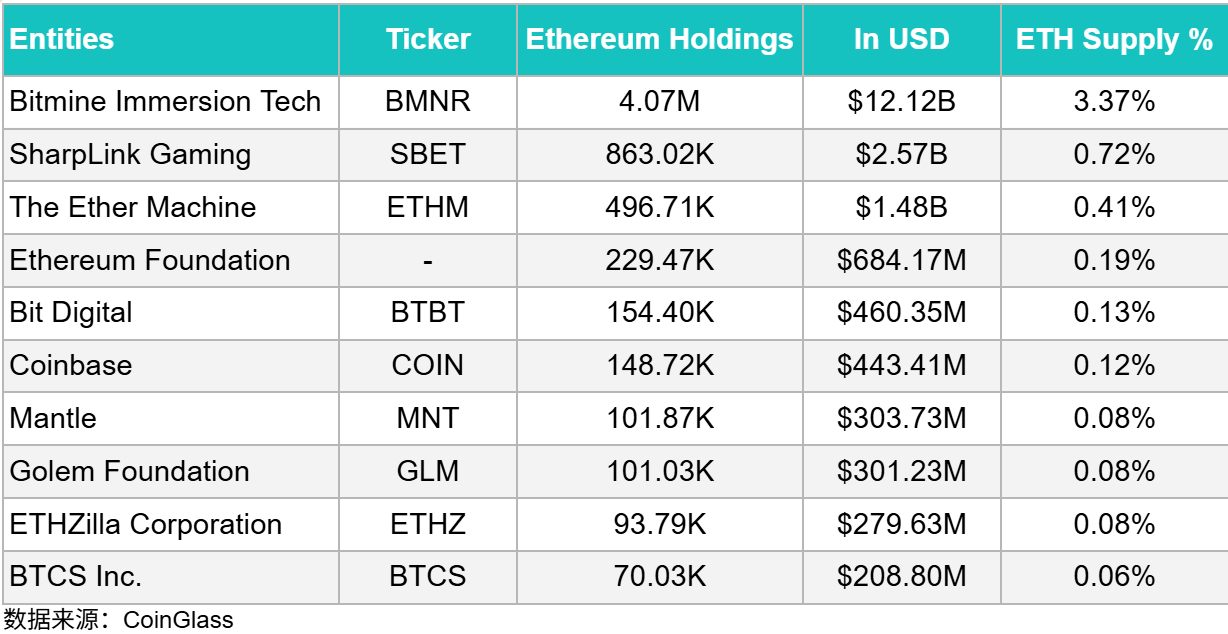

Compared to Bitcoin, Ethereum's price trajectory in 2025 exhibited higher volatility. The annual market can be divided into three phases: deep pullback, strong recovery, and high-level retreat. At the beginning of the year, influenced by a collective downturn in the crypto market, it fell from a 2024 high of $4,040 to a 2025 low of $1,447, with a decline exceeding 65%. Entering the second quarter, as expectations for Fed interest rate cuts warmed, capital began to flow back. Meanwhile, Ethereum DATs companies led by Bitmine and SharpLink began to accumulate ETH significantly. Driven by dual favorable factors, Ethereum became the main force behind the mid-year rise in 2025, with its price climbing from the April low to a relative high of about $4,950, an increase of 242%. However, as macro uncertainties intensified in the second half of the year, the market experienced a deep pullback, and Ethereum's price quickly fell. By December, it had dropped to $2,828 from the August high, a decline of over 43%.

2.2 On-Chain Indicators

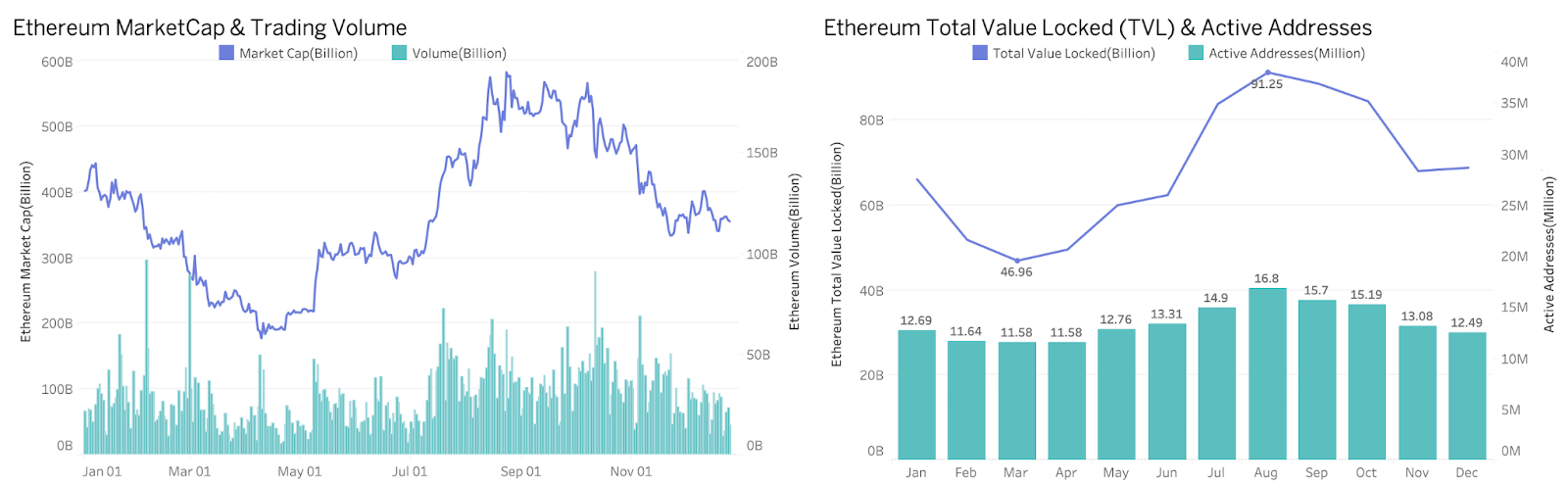

Data Source: CoinGecko, DeFiLlama

At the beginning of the year, Ethereum's market capitalization continued to decline from a high of $444 billion, reaching an annual low of about $177.4 billion in April. During the same period, on-chain TVL and the number of active addresses also declined, indicating insufficient market confidence and a significant cooling of ecosystem activity. Starting in July, companies like BitMine and SharpLink began to include Ethereum in their corporate-level strategic reserves, while Ethereum ETF funds saw significant inflows, with a net inflow of $5.43 billion in July, directly pushing ETH prices to an annual high of about $4,953 in August. The concentrated influx of funds brought significant wealth and siphoning effects, with market capitalization and TVL rising rapidly, reaching an annual peak of $91.2 billion in TVL in August, and the number of active addresses climbing to 16.8 million, indicating that price increases had transmitted to the on-chain application layer, temporarily activating ecosystem vitality. As the second half of the year progressed, the market shifted from a previous unilateral rise to high-level oscillation and evolved into a deep pullback. Following the historic black swan event in the crypto market on October 11, Ethereum's price experienced a noticeable decline. By December, ETH's market capitalization had fallen to about $340 billion, with prices already below the main accumulation cost range of leading DATs companies, while Ethereum ETFs experienced net outflows for two consecutive months. The dual weakening of price and capital further transmitted to the on-chain level, with the number of monthly active addresses quickly declining to 8.34 million, nearly halving from the August peak, reflecting a significant contraction in market risk appetite, with speculative funds and some active users temporarily withdrawing, leading to noticeable deleveraging and cooling pressures on the Ethereum ecosystem in the short term.

2.3 ETH Spot ETF

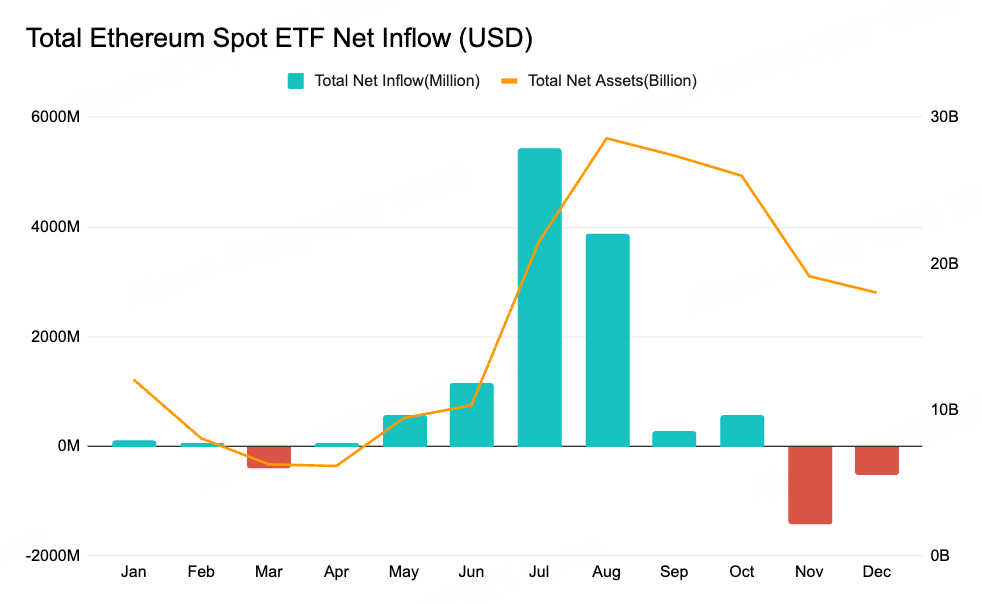

Data Source: SoSoValue

In 2025, the capital flow of the ETH spot ETF exhibited clear phases and high volatility characteristics. After a slight inflow at the beginning of the year, there was a significant outflow in March against a backdrop of rising market uncertainty, reflecting a cautious attitude from early capital. Entering the second quarter, inflows significantly increased in May and June, especially with a net inflow of about $1.16 billion in June, bringing the total net assets of New York ETFs back above $10 billion, indicating that institutions and long-term capital were re-adding positions during price stabilization or rebound phases. In July and August, explosive net inflows occurred, reaching approximately $5.43 billion and $3.87 billion, respectively, driving the total net assets of ETH ETFs to an annual high of about $28.58 billion, showing a significant increase in institutional allocation demand after ETH prices rebounded. However, following the impact of October 11, the ETF experienced significant outflows, particularly with a net outflow of about $1.42 billion in November, lowering total net assets to about $19.15 billion.

2.4 DATs Company Holdings Value

The significant rise in ETH prices in 2025 is closely related to the large-scale accumulation of Ethereum reserves by companies such as BitMine and SharpLink. These companies adopted a strategy similar to the previous asset-liability accumulation strategy of Strategy for BTC, continuously buying ETH through targeted issuance, private placements, and other financing methods. Among them, BitMine has continuously expanded its ETH reserves to about 4.07 million ETH, accounting for about 3.37% of the total ETH supply, with a holding value of up to $12.12 billion, far exceeding other companies. Following closely are SharpLink Gaming and The Ether Machine, holding approximately 863,000 and 496,700 ETH, respectively, to support their liquidity layout and ecosystem participation; Coinbase's ETH holdings largely serve the operational needs of the exchange and network services rather than purely asset appreciation strategies. Overall, the ETH holdings of listed companies include both strategic players betting on the growth of the Ethereum ecosystem and participants based on operational needs or diversified asset allocations. This differentiated layout indicates that ETH is increasingly being integrated into corporate asset-liability management frameworks, no longer merely a trading or speculative target, but a core digital asset with strategic value and ecological synergy.

This corporate-level accumulation behavior has produced a significant supply-demand shock effect: large-scale corporate buying not only raises market expectations for ETH demand but also enhances institutional confidence in Ethereum as a core digital asset, leading to strong rebounds in ETH prices after multiple phases of pullback, with prices even breaking historical highs in August. This upward momentum partly reflects the market's positive response to these companies' accumulation strategies and the linkage effect between ETF capital inflows. Therefore, it can be concluded that a key driver of the ETH price increase in 2025 is the accumulation pace of institutional ETH reserves represented by companies like BitMine and SharpLink—they not only directly boost demand through their own buying but also indirectly amplify price upward momentum through improved market sentiment and institutional participation willingness.

2.5 Stablecoin Circulation

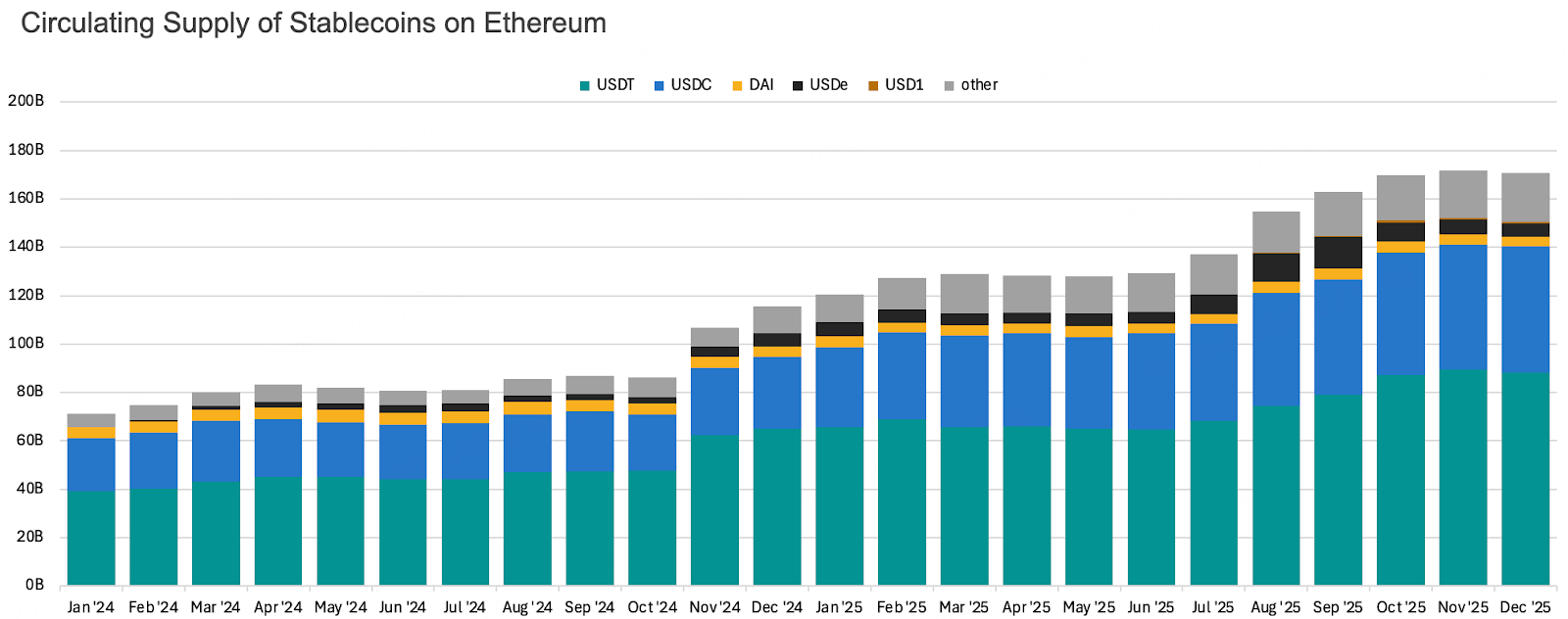

Data Source: Artemis

Compared to 2024, the circulation of stablecoins on the Ethereum chain saw a significant increase in 2025. The total circulation broke historical highs in the second half of the year and continued to expand, injecting unprecedented liquidity depth into the entire DeFi and trading ecosystem, directly reflecting the trend of ETF capital inflows and market recovery during the same period. Structurally, a more robust dual-giant + diversified pattern emerged: USDC, with its solid compliance foundation, rebounded strongly, significantly increasing its circulation and reshaping the competitive balance with USDT; while USDT maintained its dominant share due to its unparalleled network effect and cross-chain penetration, together forming the core pillars of ecosystem liquidity.

In terms of mechanism innovation, yield-bearing stablecoins represented by USDe, based on cash arbitrage and other new structural designs, achieved a breakthrough from non-existence to existence, with circulation rapidly growing from zero to several billion dollars, briefly becoming the third-largest stablecoin in the Ethereum ecosystem. However, following the price decoupling triggered by the black swan event on October 11, the stability of its underlying mechanism and risk exposure were questioned by the market, significantly weakening the trust foundation, leading to a substantial contraction in circulation. Overall, Ethereum remains the most mature and liquidity-concentrated network among all public chains for the DeFi ecosystem, with stablecoins primarily issued and circulated on Ethereum. As the regulatory environment in 2025 becomes marginally more lenient and stablecoin-related legislation gradually takes shape, the path for compliant capital to enter is further clarified, and it is expected that stablecoins will continue to thrive on the Ethereum network.

2.6 Layer 2 Ecosystem

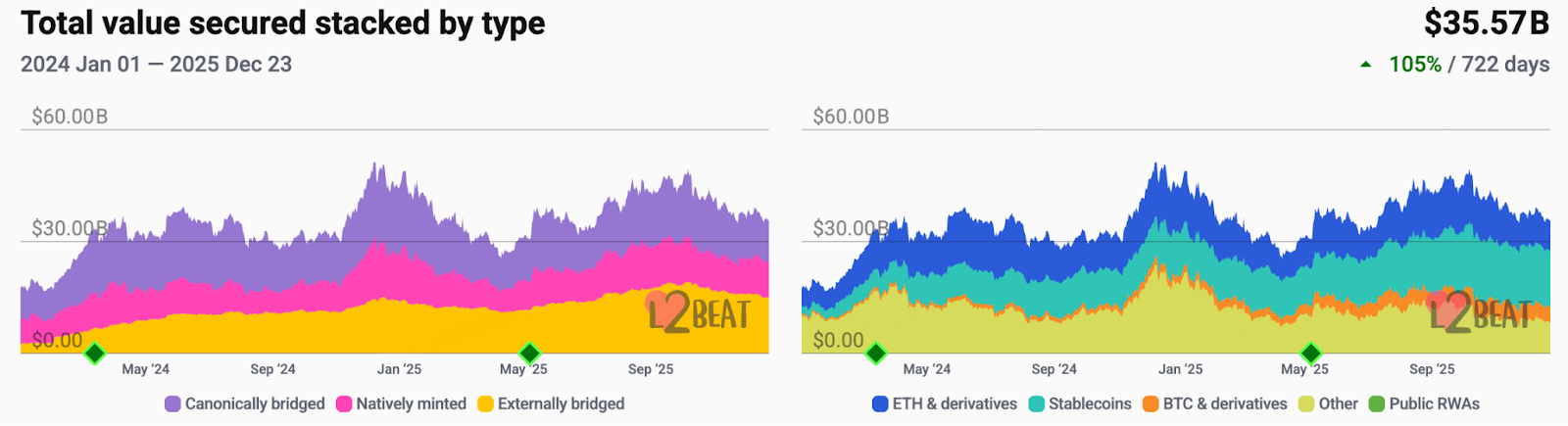

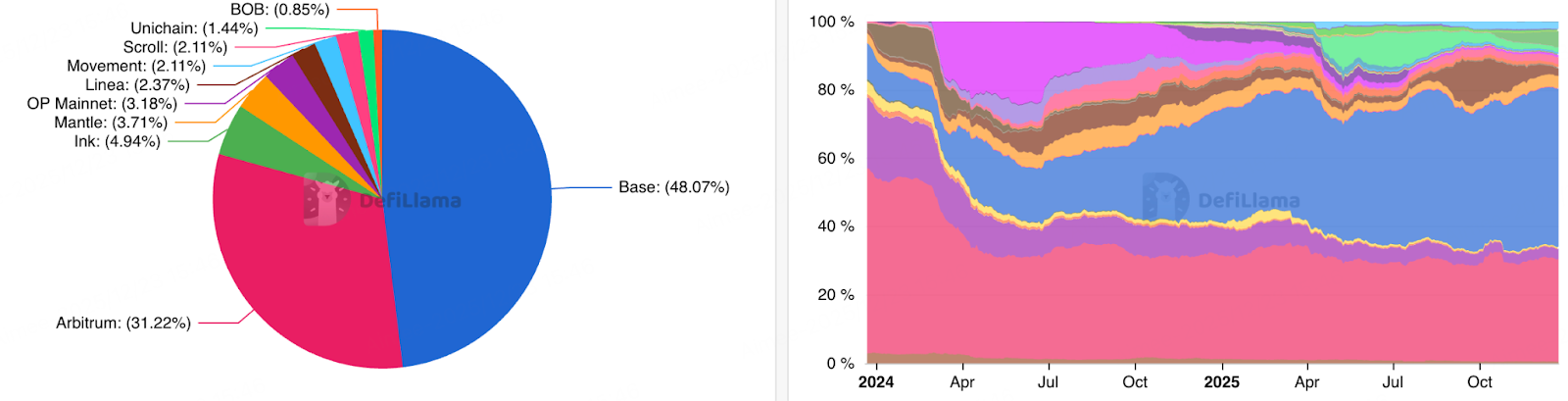

Data Source: L2BEAT

Although Layer 2 remains one of the most important tracks in the Ethereum ecosystem in 2025, the TVL of Ethereum Layer 2 decreased by approximately 24.6% over the past year, indicating a continued weakening of ecosystem vitality. The long-term lack of new narrative support has led to a certain degree of regression in the entire Layer 2 ecosystem compared to 2024. While some established projects like Linea officially launched tokens and went live this year, the lack of market confidence prevented widespread attention to the track, resulting in a significant price drop shortly after launch. As of December, three months after Linea's launch, the price had cumulatively dropped by over 80%, reflecting that the Layer 2 market still faces challenges of insufficient liquidity and concentrated investor wait-and-see sentiment in the short term.

Data Source: DeFiLlama

Despite the overall underperformance of Layer 2, the development of Base in 2025 remains noteworthy, as it successfully completed a leading layout in Layer 2 market share. Base is undoubtedly one of the most active Layer 2 projects this year. At the beginning of the year, with the explosion of projects like Virtual and Zora, Base attracted a large amount of attention and new users, continuously expanding its ecosystem. Mid-year, Base launched the Perp Dex project Avantis and the prediction market project Litmitsless in response to market enthusiasm, and subsequently, the CEO of Base hinted at token issuance expectations, further boosting market confidence. In 2025, Base remained a focal point in the crypto market, with its ecosystem development and user growth leading to a TVL share of 47.16%. Looking ahead, the anticipated token issuance of Base is expected to bring significant benefits to the ecosystem, users, and developers. With Coinbase's compliance advantages and mature ecosystem, Base is likely to continue attracting market focus back to the Layer 2 track.

2.7 Outlook for 2026

In 2026, Ethereum will complete its transformation into an institutional-level financial infrastructure. With the implementation of the Fusaka and Glamsterdam upgrades, and the subsequent Hegota upgrade optimizing execution layer performance, the collaborative efficiency between the Ethereum mainnet and Layer 2 will be significantly enhanced, with L2 throughput reaching new levels. At the same time, the L2 market will enter a period of consolidation and reshuffling, with chains like Base, Arbitrum, and Optimism, which have strong ecological accumulation or exchange backgrounds, occupying monopolistic positions, while L2s lacking practical utility may be eliminated by the market.

In terms of value capture, Ethereum will become the preferred settlement layer for real-world assets (RWA) and institutional-level DeFi. Projects like BlackRock's BUIDL fund and JPMorgan's JPMD have already demonstrated their composability advantages in a compliant environment. The surge in tokenized government bonds and credit scales in 2026 will bring robust demand for block space on Ethereum. Additionally, as regulations clarify that liquid staking does not constitute securities trading, staking yields will become the default configuration model for institutions holding ETH, further compressing circulating supply and raising the long-term value center of the asset.

3. Solana

3.1 Market Performance

Data Source: BitMart API

Data Source: BitMart API

In 2025, Solana's price performance was less than expected compared to the other two major assets. At the beginning of the year, the SOL price fell from a high of $294 and failed to return to previous highs. Unlike BTC and ETH, which benefited from new capital liquidity brought by ETFs and DATs during this cycle, Solana's ETF did not officially launch until October, resulting in a lack of stable buying support throughout the year. Additionally, the ongoing token unlocks for Solana increased market selling pressure, exacerbating the price slump. Even in August, when both BTC and ETH reached new highs, SOL lingered around $253 and quickly fell afterward. Furthermore, Solana's ecosystem primarily relied on the shrinking market capitalization of meme-related projects, and its market share was partially eroded by competitors like BNB and Base, further suppressing SOL's price performance. Overall, Solana's price lacked external capital support, and internal ecosystem growth was limited, making its performance significantly weaker than BTC and ETH throughout the year.

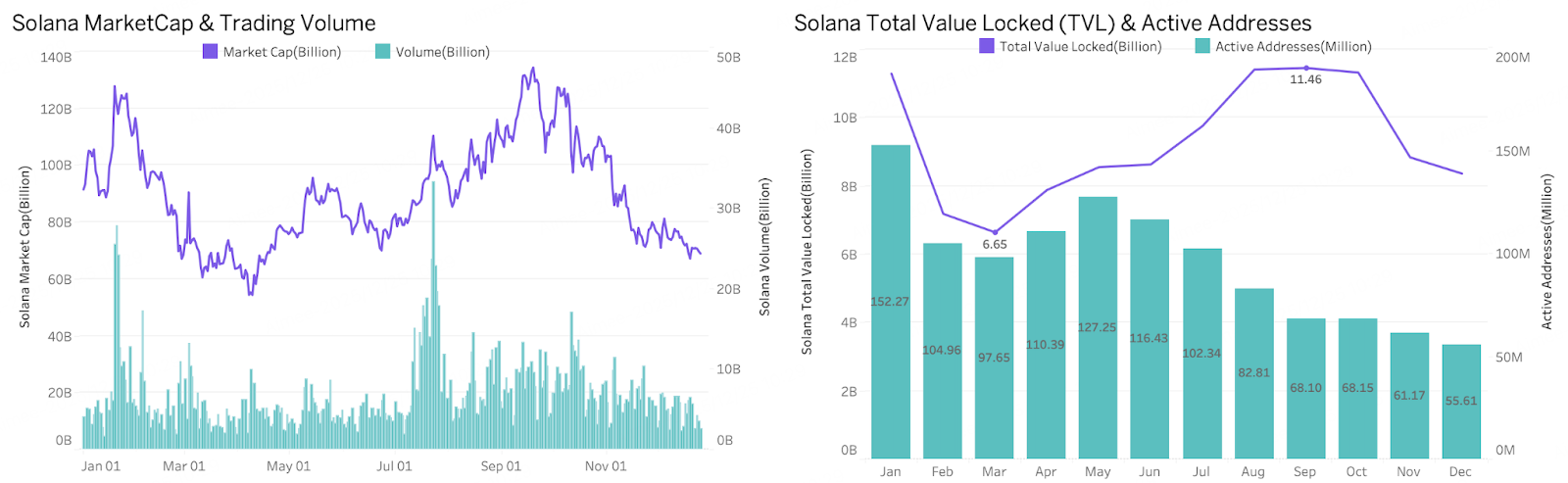

3.2 On-Chain Indicators

Data Source: CoinGecko, DeFiLlama

At the beginning of 2025, SOL entered a correction phase based on high market capitalization and high activity, with market capitalization rapidly declining, trading volume contracting, and TVL and active addresses significantly decreasing, indicating insufficient on-chain funds and user retention after the decline in Ai Agent Meme popularity. From the second quarter to the mid-third quarter, SOL experienced a recovery, with market capitalization and price rebounding, reaching annual highs from July to September, with trading volume significantly increasing and TVL recovering to peak levels, indicating a reflow of funds into DeFi and on-chain applications. However, the number of active addresses continued to decline, mainly due to the diversion of meme popularity to the BNB Chain. In the fourth quarter, SOL entered a downtrend and deleveraging phase, with market capitalization, trading volume, and TVL falling, and the number of active addresses dropping to an annual low, indicating weakened on-chain participation.

In summary, Solana's market in 2025 was essentially driven by a high-elasticity cycle influenced by price and meme narratives. Its advantages lie in strong trading activity and the ability to quickly attract risk capital, but its shortcomings include user retention, long-term TVL accumulation, and insufficient support from non-speculative applications for price stability. SOL exhibits significant amplification effects during upward phases, while also experiencing severe pullbacks during risk contraction phases. In conclusion, Solana remains one of the most trading-active and sentiment-sensitive public chains in the crypto market, but its ecosystem stability and sustainability still heavily depend on market risk appetite and the cyclical inflow of meme capital.

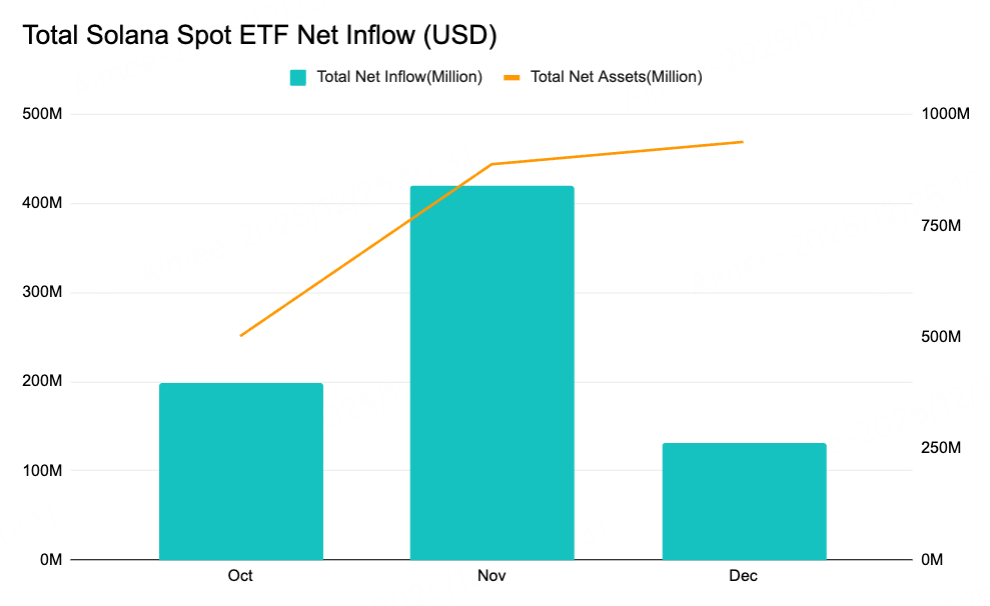

3.3 ETF Circulation

Data Source: SoSoValue

The first batch of Solana spot ETFs officially launched on October 28, and by December, their managed asset scale had reached approximately $920 million. Due to the short time since launch, the Solana ETF had not yet formed a sufficiently large and sustained buying pressure in 2025, thus having a relatively limited impact on SOL's price performance for the year. However, from the perspective of capital flow structure, the Solana ETF still shows some positive signals: despite SOL's price weakening in the post-launch phase, ETF funds exhibited a counter-trend net inflow, indicating that some medium- to long-term capital is gradually positioning itself in Solana at lower levels, laying a potential foundation for subsequent price recovery and ecosystem valuation reconstruction.

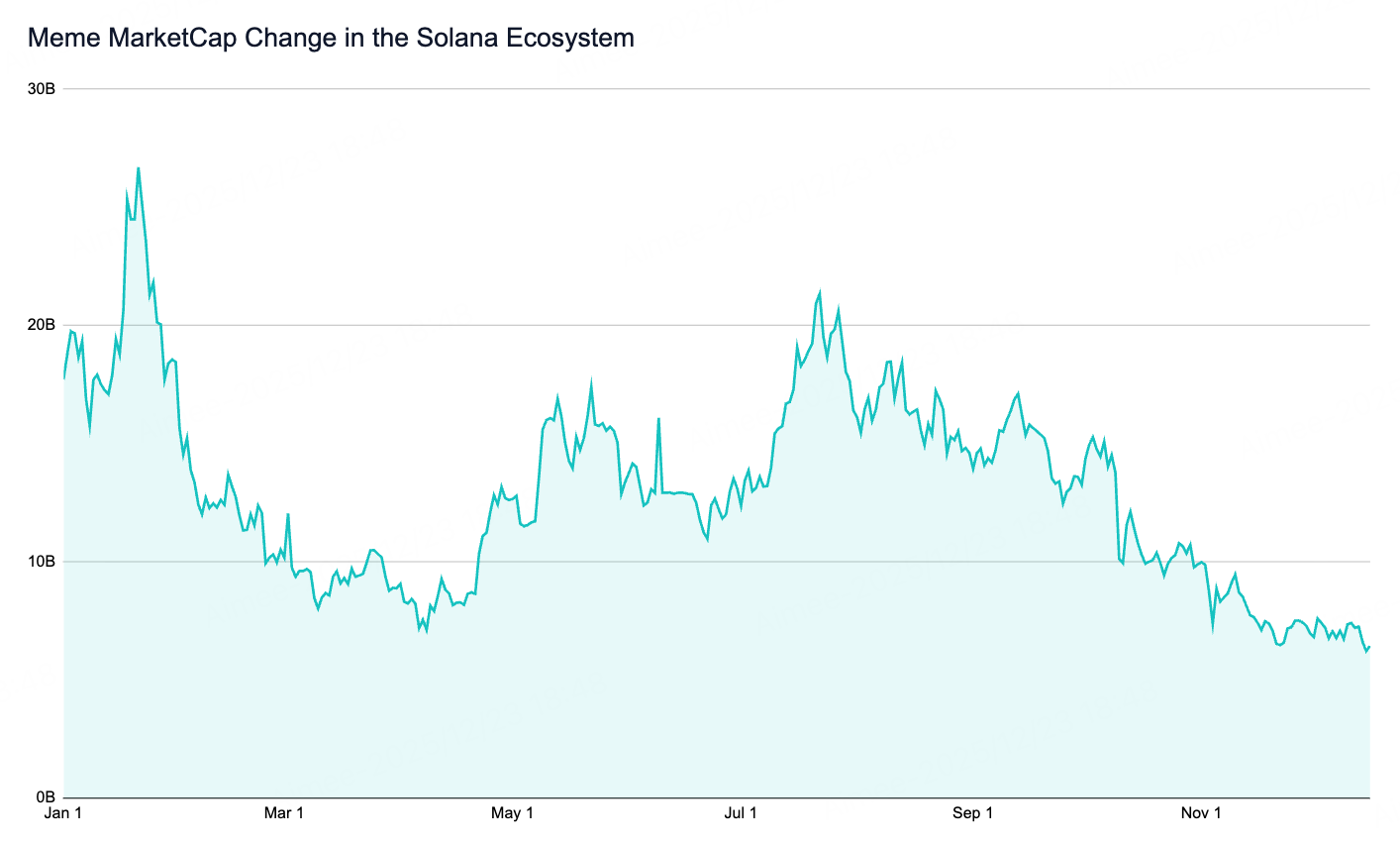

3.4 Changes in Memes within the Ecosystem

Data Source: CoinMarketCap

In 2025, the meme track within the Solana ecosystem gradually cooled down after experiencing explosive growth at the beginning of the year. This phenomenon was primarily caused by changes in the competitive landscape, insufficient internal ecosystem dynamics, and a lack of new meme narrative cycles. Initially, the AI Agent brought significant attention and market capitalization growth to the Solana meme track, but as the overall crypto market corrected, the market capitalization of related meme assets rapidly declined, causing Solana's meme market capitalization to drop by over 50% from its peak. Later in the year, the Solana ecosystem briefly regained some heat due to the launch of Pumpfun and the rise of Bonkfun, driving a temporary increase in on-chain meme trading volume and participation, but this wave of enthusiasm lacked sustainability.

At the same time, significant changes occurred in the external competitive landscape. For example, the BNB Chain, through the influence of founders CZ and He Yi, continuously created popular topics, such as Chinese memes and Binance-themed memes, successfully attracting a large amount of attention and capital. The diversity and high topicality of these tracks allowed the BNB Chain to form multiple breakout hits in the meme sector, diverting meme users and hot money that might have originally flowed to Solana, further contributing to the decline in Solana's meme market capitalization.

3.5 Outlook for 2026

In 2026, Solana will establish its leadership in consumer applications and the agent economy through a high-performance paradigm. With the full adoption of the Firedancer validator client and the completion of the Alpenglow upgrade, the network will achieve sub-second transaction confirmations (around 100 milliseconds) and the potential for millions of TPS, eliminating throughput bottlenecks for high-frequency applications. Solana will no longer rely solely on meme-driven narratives but will shift towards a diversified on-chain economy composed of high-performance decentralized exchanges, cross-border payments, and DePIN projects. In the payment sector, Solana is rapidly penetrating traditional financial tracks, with the involvement of giants like PayPal and Western Union positioning it as a global settlement hub for dollar stablecoins. Particularly, developments based on protocols like x402 will support a vast machine-native financial system, allowing low-cost, instant micropayments between AI agents. Although the inflation proposal (SIMD-0411) may face withdrawal risks, its strong network effects and increasingly mature market microstructure will attract more professional market makers to migrate from centralized exchanges to Solana DEX.

4. BNB

4.1 Market Performance

Data Source: BitMart API

Data Source: BitMart API

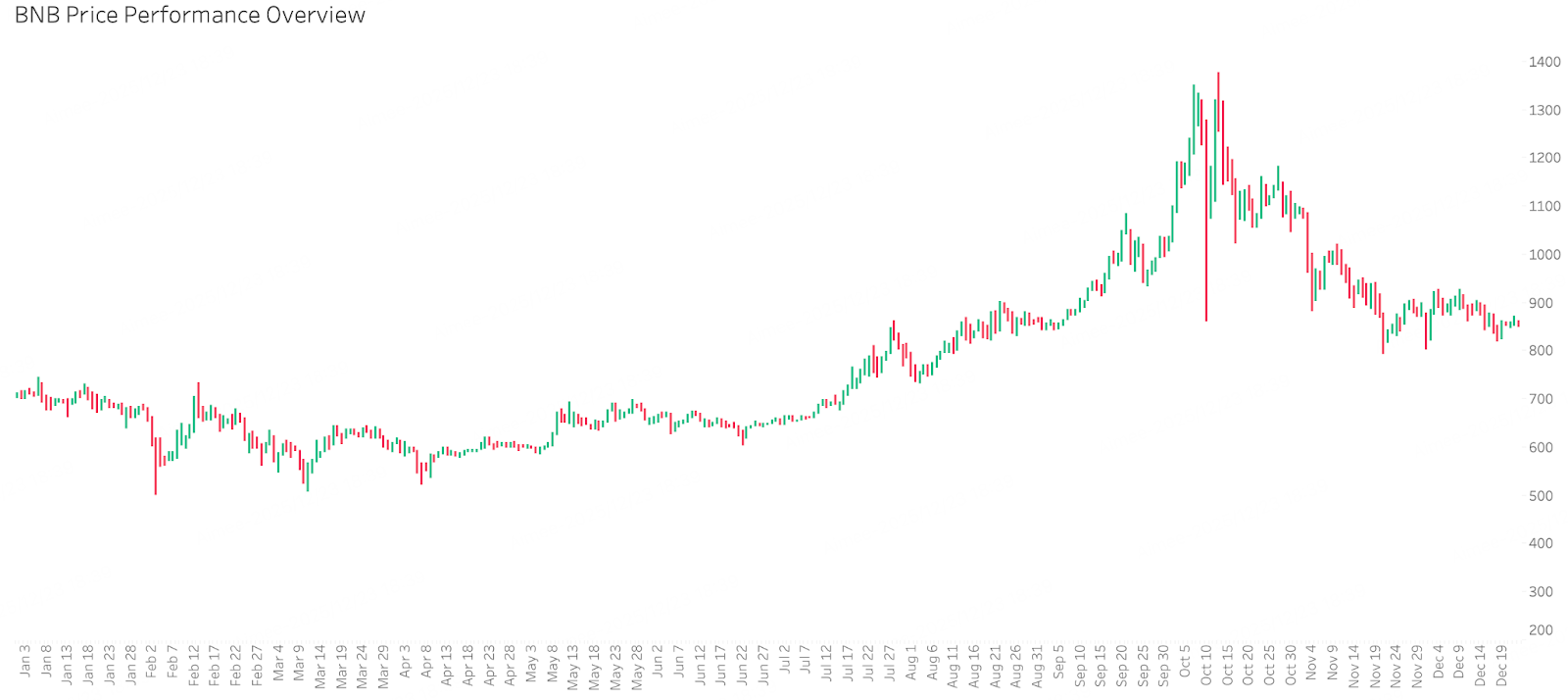

2025 was a strong year for BNB. Its price rose sharply after hitting a low of about $509 in April, breaking historical highs on October 13, reaching $1370, with a phase increase of over 169%. This surge was primarily driven by the continuous development of the Binance ecosystem and effective market operations: the launch of Binance Alpha attracted a large number of users, while founder CZ and co-founder He Yi actively created topics on Twitter, successfully boosting the activity of the meme sector on the BNB Chain—such as the emergence of "Chinese memes" and "Binance-themed memes," significantly enhancing the chain's market attention and capital participation willingness.

Although BNB's price subsequently retreated due to an overall correction in the crypto market, the adjustment was relatively limited, and the current price remains stable near the level at the start of the upward cycle in August, demonstrating strong resilience and ecological support.

4.2 On-Chain Indicators

Data Source: CoinGecko, DeFiLlama

The growth of the BNB Chain in 2025 was not driven by short-term sentiment or speculation but by a positive feedback loop consisting of "increased user activity—amplified trading volume—expansion of TVL and market capitalization." Although there was a phase correction after October, the user base, trading frequency, and fundamental liquidity center have clearly shifted upward, laying a higher starting point for subsequent ecosystem and capital inflows.

From a market performance perspective, BNB's market capitalization exhibited a structure of "initial fluctuation, followed by acceleration, then retreat": it hovered around $100 billion at the beginning of the year, fell to the $80-90 billion range from February to April; starting in June, as on-chain activity increased, it entered an upward channel, surging to about $180 billion in early October against a backdrop of significantly increased trading volume, before retreating to around $120 billion. Trading volume and meme activity, along with on-chain interactions, expanded simultaneously, indicating that the rise was driven by genuine trading demand.

On the on-chain fundamental side, TVL peaked at about $8.36 billion in October before retreating, while the number of active addresses reached a high of about 82.85 million during the same period, significantly higher than Solana's. Although TVL fell to about $6.5 billion in December and activity cooled somewhat, it remained significantly above mid-year levels, indicating that the BNB Chain has completed an overall uplift of its user and liquidity base.

4.3 Comparison of BNB Meme and Solana Meme

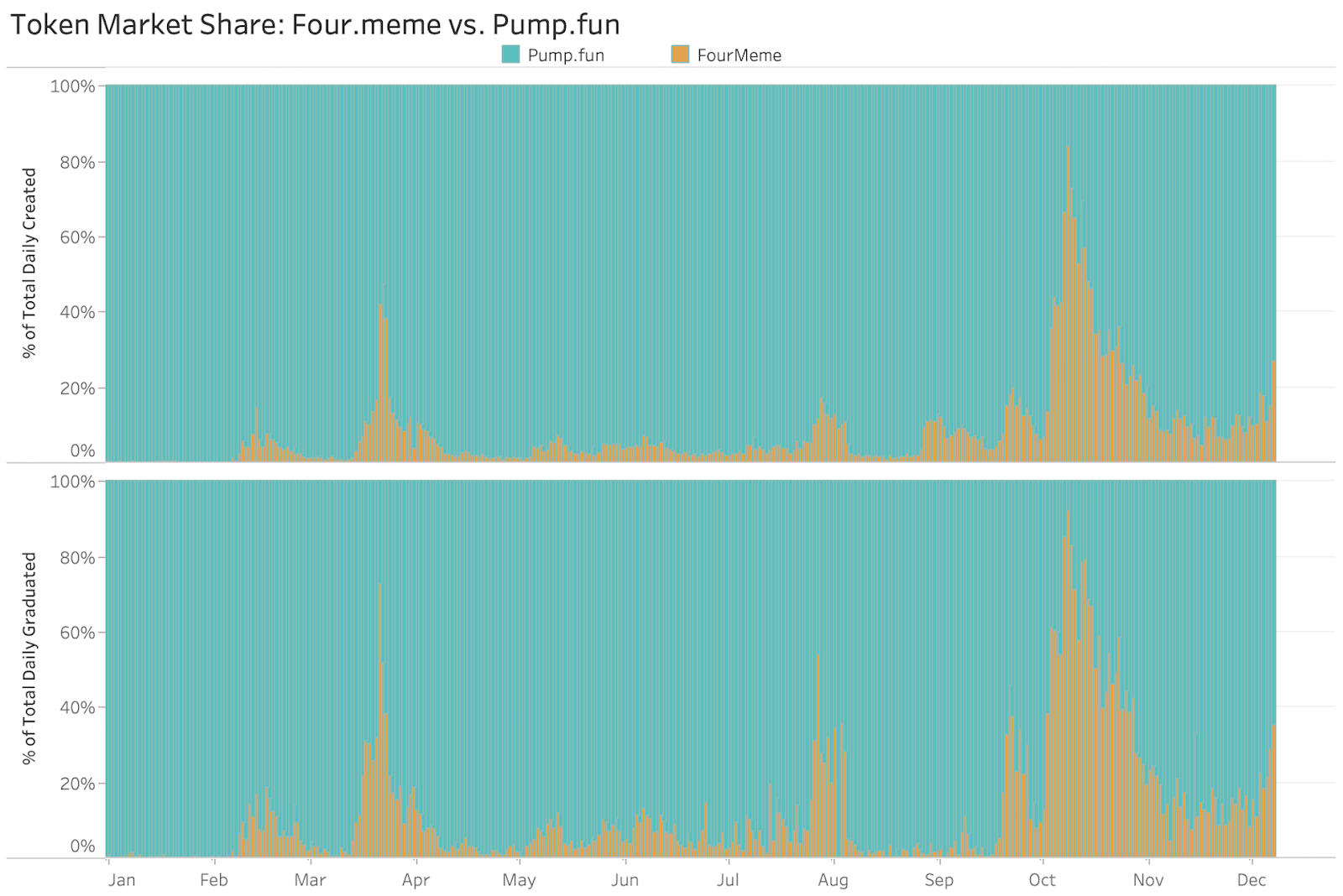

Data Source: Dune

At the beginning of the year, Pump.fun on the Solana chain dominated, but starting in the second quarter, the share of the FourMeme platform within the BNB Chain ecosystem steadily increased, surpassing Solana in the second half of the year and establishing a lead. This change directly corresponds to the intertwined fates of Solana and BNB Chain in 2025: after the decline in the popularity of Ai Agent memes, Solana exposed issues of insufficient on-chain real funds and user retention, with the number of active addresses continuously declining and capital and attention being captured by BNB Chain; meanwhile, BNB Chain successfully attracted a large number of new users and trading volume through various Binance-themed memes, achieving a historic leap in on-chain activity.

4.4 BNB Ecosystem

The BNB Chain has built a highly collaborative composite ecosystem around DeFi, AI, RWA, and memes, forming a positive feedback growth flywheel through the mutual reinforcement of capital, users, and narratives, transitioning from phase-based explosions to more sustainable long-term growth.

Among these, memes have become the core growth engine in 2025. The meme trading activity on the BNB Chain in the first half of the year surpassed that of Solana and Ethereum, becoming an important on-chain traffic entry point. Projects like "Binance Life" exemplify the power of co-creation and social virality within the Chinese community, and their success is not incidental but a concentrated reflection of a low-barrier trading environment and content dissemination mechanisms. The BNB Chain further facilitated the issuance, trading, and liquidity migration paths of memes through tools like Four.Meme and Binance Wallet Meme Rush, establishing a standardized mechanism for meme incubation and amplification. In terms of liquidity and project supply, Binance provides comprehensive support for ecological projects through the Alpha program, forming a strong liquidity closed-loop system that allows quality projects to gain considerable trading depth and user exposure early on. In Binance Wallet activities, the Alpha program reached 396 projects, including 46 exclusive TGE tokens and 14 Booster projects, creating a highly dense asset supply pool. The Alpha program has established a clear asset growth channel: from on-chain testing, DEX trading to futures and mainboard spot, significantly reducing the friction costs for new assets entering the mainstream market and strengthening the BNB Chain's advantages in new asset discovery and pricing efficiency.

Additionally, the BNB Chain's focus is also expanding towards institutional-level tracks such as RWA and derivatives. It has currently attracted institutions like BUIDL, Ondo, and CMB International, gradually forming a one-stop tokenization solution; at the same time, perpetual contract protocols represented by Aster are rapidly scaling, making derivatives the third core narrative after memes and stablecoins.

4.5 Outlook for 2026

Looking ahead to 2026, the BNB Chain will drive its critical transition from a single high-performance trading chain to a "comprehensive on-chain asset platform." Leveraging deep synergy with the Binance ecosystem, its closed-loop advantages in traffic, capital, and application scenarios will be further strengthened, enabling the network to efficiently accommodate meme assets, mature DeFi applications, and the continuously expanding real-world asset (RWA) sector simultaneously. As one of the important infrastructures for the distributed RWA market, the BNB Chain is expected to attract higher-grade, scaled assets onto the chain due to its solid liquidity foundation.

At the same time, as the integration of AI and crypto technology accelerates, the BNB Chain will increase its layout for agent-friendly infrastructure, focusing on building low-cost payment and settlement networks suitable for AI applications. With its cost advantages and high compatibility, it will grasp key traffic and settlement entry points in the AI-driven on-chain economy. By 2026, the ecological focus of the BNB Chain is expected to further extend towards RWA tokenization and institutional-level services, gradually establishing its important hub position connecting traditional financial assets and the crypto world.

IV. Review and Forecast of Popular Tracks

1. Meme: From P/E to P/A: Reshaping the Valuation Model of Memes

Entering 2025, the meme track completed a historic transformation, evolving from a speculative symbol at the end of the bull market to a core investment line throughout the year. The fundamental reason lies in the migration of capital structure and asset pricing logic—under the general overvaluation of VC tokens and unlocking pressures, capital systematically flowed towards meme assets with strong dissemination attributes and fair launch mechanisms, forming a new consensus that "attention equals liquidity." At the beginning of the year, breakthroughs in AI Agent technology propelled meme projects like ai16z to combine technical narratives with viral dissemination, leading to a collective explosion of on-chain AI themes; mid-year, cultural assets represented by Binance Life and other Chinese community memes experienced concentrated explosions, indicating that Eastern communities regained some pricing power. By the end of the year, the x402 protocol, aimed at building a self-payment network for the AI Agent economy, saw its concept-related meme coins (like PING) gain market favor. The valuation model of the meme track also completed a paradigm shift, transitioning from the traditional P/E logic to the P/A (Price/Attention) model, with attention becoming the core value carrier.

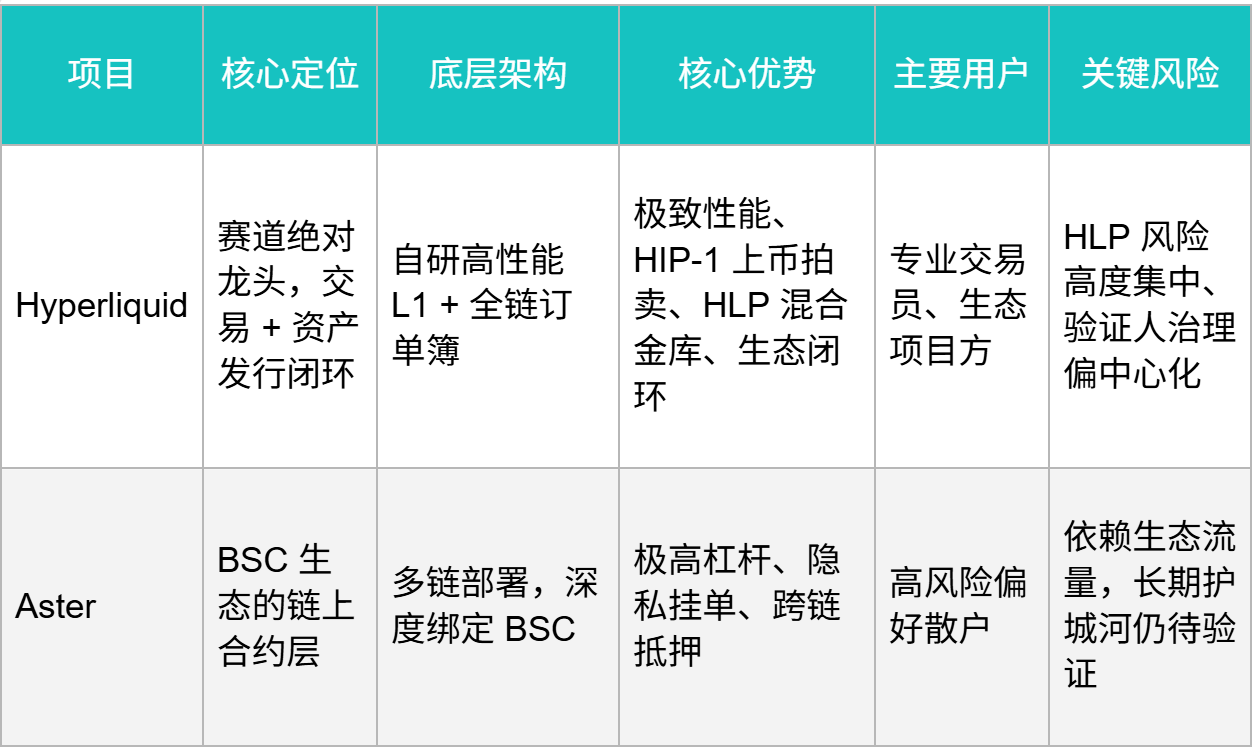

2. Perp DEX: From Application Optimization to Infrastructure Competition

In 2025, the Perp DEX track completed a return to valuation and competition logic. The market gradually downplayed "passive liquidity" indicators like TVL, shifting focus to OI (open interest) and fee income to genuinely reflect trading activity and commercialization capability. High OI represents sustained gaming demand, while stable fee income indicates the protocol's long-term survival capability in a weak incentive environment. This indicates that Perp DEX has transitioned from a narrative-driven phase to a mature competitive stage centered on trading depth, execution quality, and commercial closed loops.

On-chain transparency further productized in 2025, giving rise to advantages distinct from CEX—whale monitoring and copy trading. Leading DEXs integrated "smart money tracking" and "one-click copy trading" into their interfaces, enhancing user stickiness and trading frequency, forming a long-term moat against centralized exchanges. The differentiation of projects within the track is no longer about "whether it is a DEX," but rather reflected in the underlying execution architecture, target user groups, and ecological closed-loop capabilities.

Hyperliquid, with its self-developed high-performance L1, full-chain order book, asset issuance closed loop, and HLP mechanism, remains the strongest project in the track, suitable for professional users seeking depth and efficiency, though its structural concentration brings systemic risks. Aster relies on the BSC ecosystem's dividends, showing strong short- to medium-term explosive potential, but has limited long-term independent competitiveness. Lighter represents a technology ceiling route, with outstanding fairness and anti-MEV capabilities, but its business model is still under validation. EdgeX leans towards optimizing underlying infrastructure, providing performance potential for high-frequency and professional trading, but market acceptance and ecosystem development will require time.

Overall, the competition in Perp DEX in 2025 has shifted from optimizing application functions to a full-scale arms race in underlying infrastructure. Future core variables include the maturity of sovereign underlying layers, the construction of global liquidity networks, adaptation to institutional and professional traders, and contributor economic design. The era of simple DeFi protocols has ended, and Perp DEX is accelerating towards vertically integrated on-chain financial infrastructure, with the RWA track expected to become an important source of asset increment for these high-performance platforms.

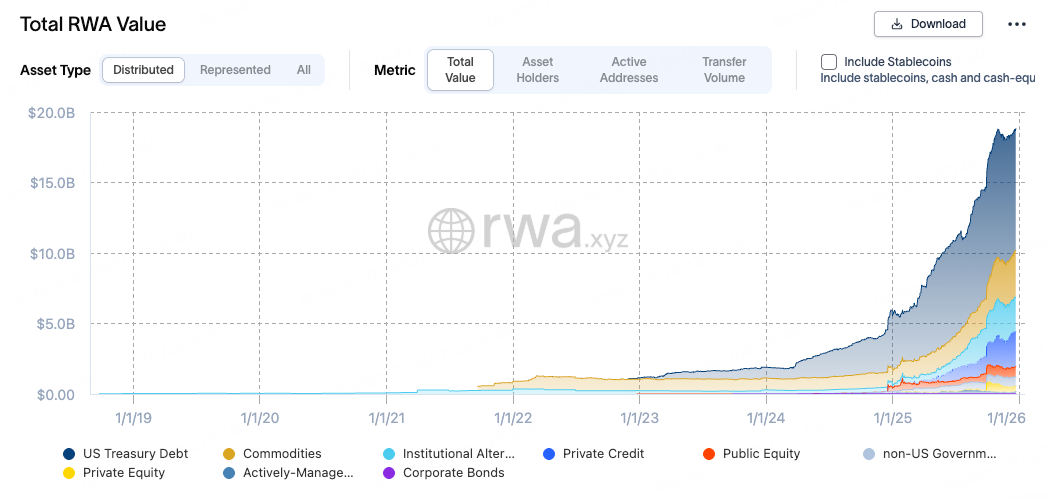

3. Real World Assets (RWA): Evolution from Asset Tokenization to Financial Composability

Data Source: RWA.xyz

In 2025, the RWA track completed a critical leap from narrative to scaled implementation, becoming the most certain growth engine in the Web3 space. Data shows that its total market value has achieved exponential growth, marking the industry's complete departure from the proof-of-concept stage and entering an explosive period driven by institutional capital and clear regulation. This explosion essentially stems from RWA's unique positioning: in the global growth narrative, it has become a rare value consensus intersection between traditional capital (Old Money) and crypto capital (New Money), with both forming a synergy under clear regulatory pilots and revenue demands, driving rapid market expansion.

The market's asset structure presents a diversified healthy pattern of "one leader and many strong players." Among them, the tokenization of U.S. Treasury bonds (approximately $8.7 billion) serves as the absolute leader, acting as the on-chain "risk-free interest rate" anchor and the core entry point for institutional participation. Meanwhile, private credit, institutional alternative funds (each around $2.5-2.6 billion), and commodities (approximately $3.3 billion) also show significant scale, indicating that RWA is successfully penetrating the non-standard and alternative investment fields that address liquidity pain points, proving the universality of its technology. More importantly, the surge in on-chain active addresses and holders signifies that RWA assets have transformed from static allocations to active financial elements frequently combined and traded in DeFi, achieving a paradigm shift from "asset tokenization" to "asset utilization."

The core driving force behind this transformation is the investment logic of "yield stacking." Market focus has shifted from "can it be tokenized?" to "how to efficiently combine it after tokenization." By combining RWA assets (such as the inherent yield of U.S. Treasury bonds) with DeFi protocols (like lending and staking), a dual-driven model of "real-world native yield + on-chain financial yield" has been realized, greatly enhancing capital efficiency. Under this logic, the track has evolved two complementary core players: asset providers represented by Ondo Finance, focusing on offering compliant and secure standardized yield assets (like tokenized government bonds), acting as traditional liquidity entry points; and infrastructure providers represented by Plume Network, dedicated to building a dedicated execution environment for RWA, solving liquidity and composability issues for non-standard assets through integrated issuance, trading, and DeFi combinations. Together, they are driving RWA towards a "Web3 Wall Street" that combines institutional-grade quality with on-chain programmability. Looking ahead, as regulatory frameworks mature further, the RWA track is expected to deeply integrate with high-performance DeFi platforms, becoming their most important source of assets and nurturing more complex on-chain derivatives and structured products.

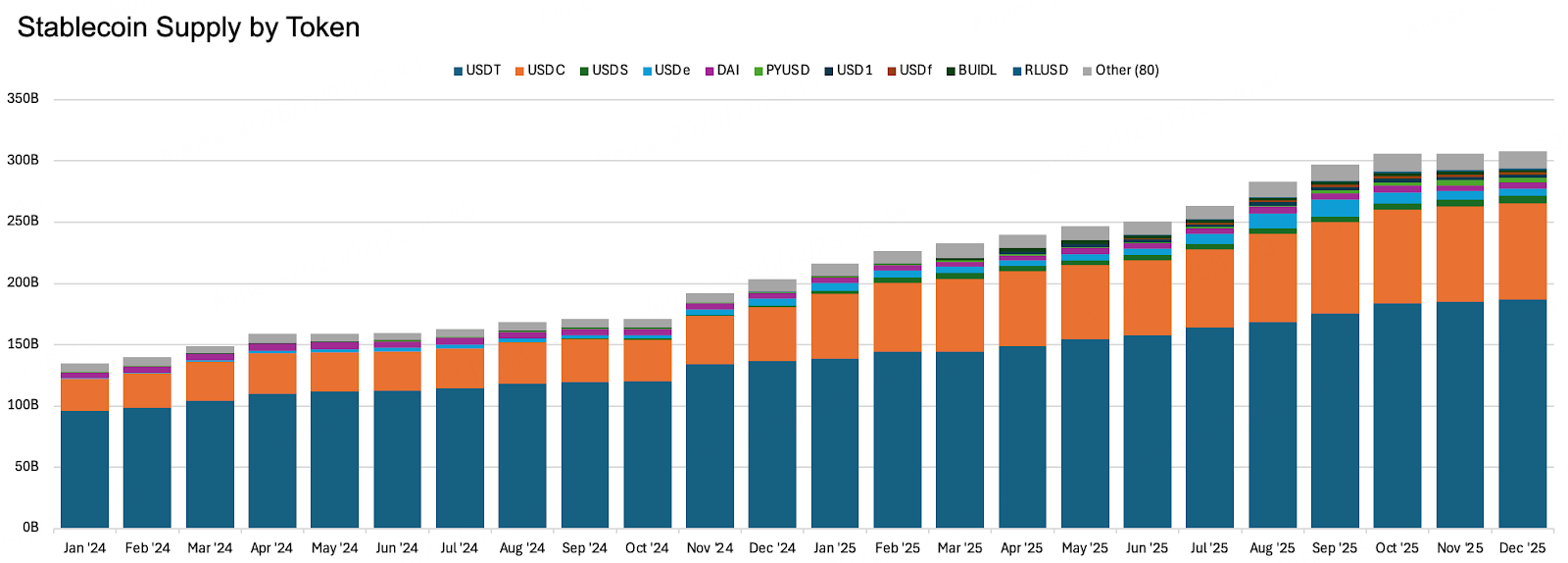

4. Stablecoin Track: Differentiation and Functional Evolution Under Compliance

Data Source: Artemis

2025 marks a historic watershed for the stablecoin track. With the implementation of key regulatory frameworks such as the U.S. GENIUS Act and the EU MiCA, stablecoins have completely bid farewell to their identity as "gray financial tools," entering a new era of highly compliant and institutionalized competition. Their role has also fundamentally evolved: from a trading medium within the crypto market to the foundational currency layer of the entire on-chain financial system. Against this backdrop, the stablecoin market in 2025 exhibits dual characteristics of total volume leap and structural reshaping. In terms of total volume, circulation has significantly increased compared to 2024. This is certainly aided by the global monetary policy shift towards easing, but the most direct driving force is the regulatory thaw. Clear legal frameworks have eliminated compliance concerns for traditional financial institutions, attracting large-scale institutional capital.

Structurally, the market competition logic has clearly differentiated into three paths, forming a complete picture of competition:

- Compliance Trust: Represented by Circle (USDC). Its core is to build institutional trust, serving as a compliant bridge for traditional capital to enter the chain. The strong recovery of USDC in 2025 and the completion of its IPO mark its rise as a financial infrastructure priced by traditional capital markets. Its planned Arc chain further highlights the ambition to build "currency-grade cloud services."

- Yield-Driven: Represented by Ethena (USDe). Its essence is to tokenize strategies like basis trading, providing on-chain yields far exceeding traditional government bonds in bull markets and high-volatility environments, making it a "engine asset" of DeFi. However, its model is highly sensitive to market conditions, exhibiting volatility characterized by "initial rise followed by suppression," making it a highly elastic cyclical tool.

- Application Experience: Represented by payment infrastructures like Plasma and Stable Protocol. They do not attempt to redefine currency but focus on solving "last-mile" user experience issues, such as promoting the penetration of stablecoins in emerging market payments and daily scenarios through extremely low costs or gas abstraction.

In summary, the core logic of stablecoin growth in 2025 has shifted from serving crypto trading to meeting the "institutional demand" for compliant settlement tools in the traditional world. The market has evolved from a competition of "who can issue dollar tokens" to a long-term war of "who can define the ultimate form of the dollar on-chain." Compliance assets determine the entry of funds, yield assets determine liquidity vitality, and application facilities determine user retention. The outcome of this war may not be a single winner but rather an ecosystem that achieves a dynamic balance between compliance, yield, and experience. This lays a solid capital and institutional foundation for stablecoins to embed deeper into global trade, payments, and DeFi in 2026.

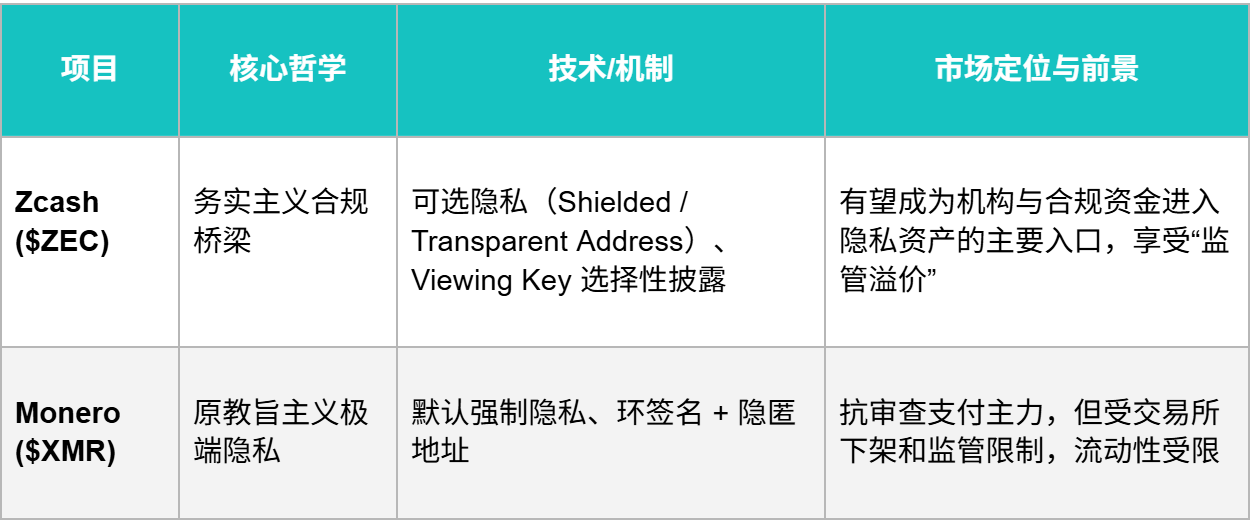

5. Privacy Track: Revaluation of Defensive Assets in the Era of Transparency

In the fourth quarter of 2025, the privacy track experienced a historic awakening. Marked by Zcash ($ZEC) rising from a low of about $35 to nearly $750 in November (an increase of over 2200%), the market has completed a thorough revaluation of privacy assets. In a context where on-chain monitoring, address profiling, and fund tracing have become highly industrialized, privacy is no longer a "tool for evasion" in the black and gray industries but is redefined as a scarce defensive foundational asset in the Web3 system, used to hedge against regulatory, censorship, and information exposure risks. The essence of this market movement is not merely a simple rebound but a gradual realization that fully transparent blockchains are not suitable for all financial and commercial scenarios, and privacy is becoming a necessary patch for on-chain pathways to the "real economy."

Core Game: Differentiation of Privacy Coin Paths

In 2025, clear route differentiation emerged within the privacy track, with two major privacy coins represented by Zcash and Monero moving towards completely different ecological niches. Zcash's advantage lies in its "auditable understanding," sacrificing some purity for survival space within the system; Monero's advantage is its "untraceability," but the compliant market is almost closed, and liquidity is highly restricted. The competition among privacy coins has evolved from a technical contest to a struggle for survival strategies.

Rise of ZK Privacy Infrastructure

If privacy coins primarily address "personal transaction privacy," the real breakthrough in 2025 is the ZK-driven privacy infrastructure track. This branch does not emphasize complete anonymity but focuses on "verifiable but invisible," making it more suitable for institutional, RWA, and enterprise-level financial scenarios. The core advantage of the ZK privacy route is that it does not directly conflict with regulation, serving RWA, corporate settlements, and privacy DeFi, making it more easily accepted by TradFi, institutions, and government systems. However, its disadvantages include high technical complexity, significant development costs, and user experience still lagging behind traditional chains, with token value capture paths still in their early stages.

The future of the privacy track will be defined by both regulation and real financial demand. The EU's Anti-Money Laundering Regulation (AMLR) in 2027 will pose a severe challenge to strong anonymity coins like Monero, while auditable Zcash and "verifiable but invisible" ZK (zero-knowledge proof) infrastructure are expected to become compliance standards. Therefore, the core value of this track will no longer be anonymous transactions but rather providing privacy protection for real-world assets (RWA) and enterprise-level finance. ZK technology can verify transactions without disclosing commercial secrets, thus becoming the "productive layer" supporting the development of on-chain finance, while traditional privacy coins may play more of a value storage role in specific scenarios.

2026 Hot Track Predictions

1. Real World Assets (RWA)

By 2026, the tokenization of U.S. Treasury bonds and money market funds will establish their core position as the "low-risk anchor" and "on-chain cash" of the on-chain financial system, becoming the preferred tools for institutions to compliantly obtain on-chain yields and connect traditional finance with DeFi, driving RWA into a phase of scaling and mainstreaming.

On this basis, the structure of RWA assets will expand from single government bonds to private credit, tokenized stocks, and alternative assets, technically shifting from "off-chain packaging" to native on-chain issuance and automated settlement. At the same time, synthetic perpetual contracts will accelerate development, providing higher liquidity and leveraged exposure for assets such as stocks, interest rates, and commodities. The integration of stocks and crypto-native derivatives will give rise to a new track of stock perpetual contracts. With 24/7 trading, high leverage, and greater liquidity, it is gradually evolving from a niche product in DeFi to a mainstream trading tool for institutions and retail investors. However, due to its high dependence on funding rate mechanisms and price oracles, there remain potential risks of cost control and centralized clearing in extreme market conditions.

Additionally, as regulations such as the CLARITY Act become clearer, banks and asset management institutions will systematically issue and use RWA on public chains. Ethereum will leverage its compliance and liquidity advantages to become the core settlement layer for institutional-level transactions, while high-performance chains like Solana will accelerate their catch-up in stock tokenization and high-frequency trading. RWA assets will be widely integrated into DeFi and exchange margin systems, pushing on-chain finance towards a more complete global asset market.

2. Prediction Markets

In 2026, prediction markets will surpass information aggregation, evolving into a real-time, investable "social consensus sensor," with its core shifting from betting on events to pricing risks for any uncertainty. AI Agents will become direct participants, automatically creating and trading micro-narrative markets by scanning multi-source data, while their integration with Perp DEX may give rise to "prediction perpetual contracts," achieving continuous and efficient capital utilization. The outputs will profoundly impact traditional sectors: businesses can use them as "decentralized advisors" to optimize decision-making, while the predicted probabilities generated by the market will transform into high-value "alternative data assets," purchased by hedge funds, insurance companies, and others, expanding the industry's revenue sources from trading fees to data value capture. Of course, how regulators define their attributes (as information platforms, data services, or derivatives) will be a key challenge. Ultimately, prediction markets are expected to become on-chain infrastructure connecting uncertainty, collective intelligence, and financial capital, blurring the traditional boundaries between investment, insurance, and research.

3. Perp DEX

By 2026, decentralized perpetual contract exchanges (Perp DEX) will complete their transformation from auxiliary tools for CEX to the main battleground for derivatives trading and the core of global asset pricing. As execution efficiency, liquidity depth, and certainty in extreme market conditions continue to approach or even partially exceed leading CEXs, perpetual contract trading volume will continue to migrate on-chain. The competitive landscape will exhibit characteristics of "head concentration and multi-dimensional games": platforms represented by Hyperliquid will occupy the minds of professional traders with dedicated execution environments and deep liquidity, while new entrants will compete for users through capital, fees, and ecosystem integration. Protocols in high-performance ecosystems like Solana will differentiate themselves in speed and specific scenarios. More critically, as traditional assets like stock indices and commodities become perpetual contracts, Perp DEX will begin to possess pricing advantages in continuous trading and high capital efficiency, gradually challenging the price discovery position of traditional exchanges.

On the product and structural level, the Perp DEX of 2026 will become the fastest channel for RWA and synthetic assets to go on-chain, igniting a wave of "perpetualization of everything"—from macro indicators, commodities, and stocks to private equity, all can achieve 24/7 global liquidity through synthetic perpetual contracts. At the same time, Perp DEX will deeply integrate with lending protocols and margin systems, significantly enhancing capital efficiency; AI agents will also become important trading entities, undertaking tasks such as high-frequency arbitrage, market making, and risk hedging.

4. Artificial Intelligence

As autonomous intelligent agent (AI Agent) technology matures, AI is evolving from a passive tool into an economic entity capable of setting goals, making independent decisions, and taking continuous actions, while crypto networks will become the underlying infrastructure supporting this "agent economy." A large number of AI agents will directly participate in on-chain activities, creating a rigid demand for decentralized identities, permissionless micropayments, verifiable execution environments, and trusted settlement systems, upgrading blockchain from a value transfer tool to an operating system for agent collaboration and settlement. The market focus will also shift from "AI-enabled crypto applications" to "crypto infrastructure designed for AI," including public chains and L2s that adapt to high-concurrency agents, decentralized computing and data markets, and certification mechanisms that ensure AI decision-making is traceable and trustworthy. On this basis, AI will deeply integrate with mainstream tracks such as RWA, prediction markets, and DeFi, promoting the implementation of new models like intelligent asset management and automated trading. Overall, the core of the crypto AI track in 2026 will not lie in the model's capabilities themselves, but in whether it can build rules and networks that allow AI to safely, efficiently, and reliably participate in the decentralized economy, thus evolving cryptographic technology into the trust and coordination hub of the future intelligent digital economy.

5. Stablecoins

Stablecoins will further break through the category of crypto trading mediums in 2026, evolving into a global "digital cash layer." Driven by the implementation of regulatory frameworks such as the U.S. GENIUS Act and the EU MiCA, compliant stablecoins (like USDC) will become the preferred channel for large-scale compliant settlements between traditional financial systems and the on-chain world, deeply embedding themselves in cross-border payments, corporate treasury management, and supply chain finance. Yield-bearing stablecoins (like Ethena/USDe) will continue to serve as "yield engines" in volatile markets, but the tests of stability will become more severe. Payment-specific chains (like Plasma) and experience optimization protocols (like Stable) will focus on solving the "last mile" of stablecoin applications in everyday scenarios. At the same time, the trend of stablecoin issuers building their own public chains to control the entire stack of infrastructure will become more pronounced, forming a "track war" around the definition of currency forms.

6. Meme

The meme track will passively evolve in 2026, showing trends of "institutionalization, practicality, and cultural diversification." In terms of financial productization, more meme ETFs may emerge after the Doge ETF, opening doors for institutional funds. In terms of value practicality, the market tends to favor meme projects that combine with large ecosystems or payment scenarios, rather than purely cultural symbols. In terms of cultural diversification, various public chains will continue to incubate meme projects with local characteristics, vying for market attention and traffic, resulting in a more decentralized and diverse cultural landscape in the track. The P/A (Price/Attention) logic will continue to dominate valuation models, but meme assets will gradually be incorporated into structured investment products and portfolio strategies.

5. Entry of Traditional Financial Institutions

2025 marks a structural turning point in the relationship between traditional finance and crypto finance. Compared to the previous phase dominated by small-scale allocations, peripheral services, or policy observation, traditional financial institutions are beginning to enter crypto assets and their underlying infrastructure in a more systematic, long-term, and institutionalized manner, resulting in a clear acceleration of financialization and institutionalization in the crypto market. This change is not driven by a single policy or product breakthrough, but is a phased result of the maturation of capital return logic, financial product forms, and global regulatory frameworks.

In terms of participation methods, traditional finance in 2025 has clearly broken through the single logic of buying coins, gradually forming a multi-layered participation structure covering financial products, balance sheets, on-chain infrastructure, and tokenization of real-world assets. On the product level, after completing market education in 2024, Bitcoin spot ETFs entered a phase of structural deepening in 2025, with products continuously launched around enhancing returns on crypto assets, options coverage, and derivative-linked products, making them no longer just high-volatility risk assets, but integrated into institutions' return management, volatility management, and portfolio allocation frameworks.

More significantly, the banking system and large asset management institutions are beginning to directly participate in on-chain activities under a compliant framework. Regulatory agencies have clarified that banks can pay on-chain network fees and hold related crypto assets within reasonable business needs, gradually incorporating blockchain into usable financial infrastructure. On this basis, asset tokenization entered a substantial advancement phase in 2025, with low-risk assets such as money market funds, government bonds, and commercial paper beginning to be issued in native on-chain forms, used for collateral management, trading margins, and cross-platform settlement scenarios, marking the first large-scale coupling of on-chain finance and traditional finance's operational mechanisms.

Alongside the entry of capital, global regulation concentrated on implementation in 2025: the institutionalization of U.S. stablecoin regulation, the comprehensive implementation of the EU MiCA, and Hong Kong's completion of the stablecoin licensing system transition, with the regulatory focus shifting from "whether to allow" to "how to regulate operations." Looking ahead to 2026, traditional finance's participation in crypto is expected to deepen further, with the core issue no longer being whether to enter, but rather the depth of participation and regulatory boundaries. Asset tokenization is expected to expand into repurchase agreements, structured notes, and some private assets, while banks and large financial intermediaries may also participate more systematically in on-chain clearing and settlement, compliant stablecoin channels, and institutional-level DeFi interface construction. Regulatory attention will shift towards execution, auditing, and cross-market systemic risk prevention, laying a foundational institutional basis for the long-term integration of crypto and traditional finance.

6. Conclusion

From 2025 to 2026, the global crypto market will undergo a profound structural transformation, with the core storyline evolving from a high-volatility speculative market driven by cyclical narratives and retail sentiment to an "institutionalized" and "regulated" market deeply participated in and dominated by traditional financial institutions under a clear regulatory framework.

2025 is a key turning point and foundational year. In a complex macro environment characterized by high interest rates and sticky inflation, the market has experienced a process of retracement from the bull market peak, seeking a new balance amid volatility. The fundamental change of this year lies in the switch of driving forces: marked by the massive inflow of capital into Bitcoin and Ethereum spot ETFs, institutional capital has officially replaced retail investors as the dominant force in the market. This shift is accompanied by a historic turning point in global regulatory thinking, particularly as the U.S. begins to shift from "enforcement regulation" to "legislative construction," with key legislation such as the GENIUS Act providing initial compliance pathways for activities like stablecoins, clearing obstacles for traditional finance's large-scale entry. Therefore, traditional financial institutions are no longer merely testing the waters but are making multi-dimensional, systematic layouts: not only allocating assets through products like ETFs but also directly holding Bitcoin and Ethereum by forming "Digital Asset Treasuries" (DATs) through publicly listed companies, with giants like BlackRock even beginning to explore the tokenization of RWA assets as the next generation of financial infrastructure. The internal market is also undergoing intense evolution, with public chain tracks initially showing positioning differentiation, and the competitive logic of tracks like RWA and Perp DEX shifting from superficial functions to underlying performance and compliance.

As we enter 2026, the seeds sown in 2025 will fully grow, and the market will usher in a new phase of "regulatory implementation" and "deep integration." The core feature will be a deterministic institutional environment fostering specialized competition. With the full effectiveness of regulatory frameworks such as the U.S. GENIUS Act and the anticipated passage of the CLARITY Act, the boundaries between digital asset securities and commodities will be clarified, and a clearly defined federal regulatory system will officially operate, providing unprecedented stability to the market.

In this context, the market will undergo a brutal process of transition from explosion to reshuffling: crypto spot ETF products will experience a diversified explosion stemming from the regulatory "fast track," but will soon face fierce rate wars and tail-end eliminations; DATs companies will upgrade from simple "holders" to professional operating institutions that actively capture value through staking, credit, and other means. More importantly, the entire crypto ecosystem will undergo vertical integration and construction around clear positioning: the public chain track will completely bid farewell to the fantasy of a "universal chain," entering an era of "specialized survival" where Ethereum focuses on DeFi and RWA, stablecoin-specific chains optimize global payments, Solana becomes the center of high-frequency consumption and meme culture, and AI chains serve the agent economy.

At the same time, RWA will experience an explosion of asset classes and financial models under a compliant framework, shifting from static tokenization to composable and derivable "financial primitives"; stablecoins will further integrate into the global payment network, becoming a true "digital cash layer." Additionally, the integration of artificial intelligence and crypto technology will move from concept to substance, with blockchain-based payment, identity, and data protocols becoming an indispensable trust and settlement foundation for the "AI agent economy."

Overall, the crypto market in 2026 will be a new ecosystem characterized by sound regulation, institutional dominance, and clearly defined roles across various tracks. The overall volatility of the market may ease due to institutionalization, but the inherent competition will become more intense, with the key to success lying in building real commercial value and ecological barriers in specific vertical fields within a compliant framework.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。