Original | Odaily Planet Daily (@OdailyChina)

Yesterday, Kain Warwick, the founder of Infinex, posted on X platform stating that due to high pricing feedback, the valuation of the Sonar token sale conducted by Infinex on Echo has been adjusted from the initially set $300 million to $99.99 million, with the lock-up period remaining unchanged at one year to better adapt to the current market environment.

As a result of the FDV adjustment, the overall allocation for the Sonar sale has decreased, making it impossible to ensure the original priority allocation arrangement for Patron NFT holders. The floor price of Infinex Patrons NFT has dropped nearly 10% in the last 24 hours, currently reported at 1.387 ETH.

Below, Odaily Planet Daily brings you insights into the Infinex project, new token sale regulations, and community sentiment.

Infinex: Full-Stack DeFi Services

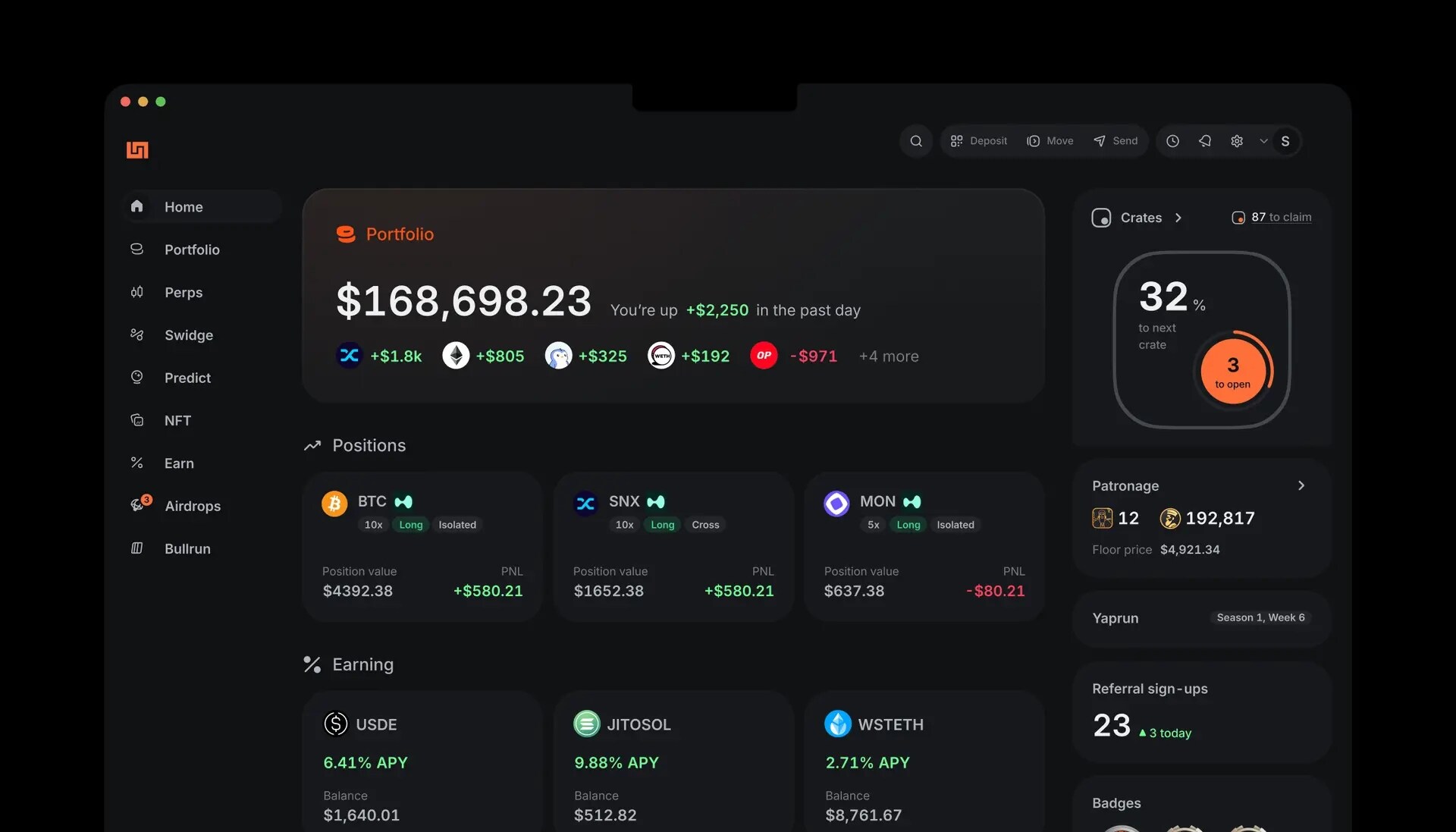

Infinex is a decentralized finance platform launched by Kain Warwick, the founder of Synthetix, in April 2024. Its goal is to provide products that offer an experience close to centralized exchanges while maintaining decentralization, thereby narrowing the usability gap between CeFi and DeFi. The platform optimizes interaction processes and user experience while ensuring asset non-custodianship and on-chain security.

From a product positioning perspective, Infinex is not a single-function application but rather a full-stack DeFi service entry point. Its core capabilities include: serving as a non-custodial wallet covering multiple chains to hold user assets; acting as a unified interface that aggregates and connects various on-chain DeFi protocols and services; and through highly abstracted interaction design, hiding complex concepts such as address management, cross-chain bridging, mnemonic phrases, and gas fees in the background, allowing users to interact with DeFi applications without needing to understand the underlying mechanisms, thus providing an overall user experience closer to CeFi products.

As of now, Infinex supports 15 blockchain networks, including Ethereum, Solana, and Base, with integrated DeFi functionalities covering cross-chain trading (Swidge), perpetual contracts (Perp), liquid staking, and other yield-generating services (Earn).

New Rules for Infinex Token Sale

According to Infinex's official documentation, the updated details for the Infinex token sale are as follows:

- INX token sale account registration date: Starting December 27;

- Official sale date for INX tokens: January 3 to January 6, 2026;

- Infinex TGE date: Planned for late January 2026;

- Sale quantity: 5% of the total token supply;

- FDV: Valuation adjusted from the initially set $300 million to $99.99 million;

- Lock-up situation: One-year lock-up;

- Purchase amount: Minimum of $200, maximum of $2,500. If the token sale is oversubscribed, participants can increase their chances of obtaining an allocation by sharing their participation on X. Regular users can receive a 3x bonus for sharing on X, while Patreon NFT holders can receive a 10x bonus.

Additionally, the INX tokens in this token sale offer an early unlock option. If the early unlock is chosen, the corresponding valuation at TGE will be $300 million FDV, with a single token price of $0.03. Subsequently, this valuation will be gradually adjusted downwards over the next year on a linear basis, ultimately settling at $99.99 million FDV, corresponding to a single token price of $0.0099.

Community Sentiment: Negative Voices Dominate, Patron NFT Holders Particularly Dissatisfied

“If the $300 million valuation allows for full unlock at TGE, then what does my purchase of the Patron NFT at a $500 million valuation count for?” This is the most direct question from many Patron NFT holders following the announcement of the new regulations. According to previous sales expectations, participants could engage in the token sale at a $300 million FDV, and if they wished to unlock at TGE, they would need to meet a higher valuation threshold, approximately $1 billion FDV. Under this expectation, some users chose to purchase Patron NFTs at a higher implied valuation in exchange for more certain allocation rights and earlier liquidity.

However, after the adjustment of the new plan, the valuation threshold for early unlock has been significantly lowered to $300 million FDV, which has clearly weakened the Patron mechanism that originally relied on high valuations for unlock rights and priority. This means that the premium that Patron NFT holders previously paid for "certainty" and "early unlock" is no longer valid, and some holders have turned to a negative yield state both on paper and in expectations.

In response to this controversy, Kain Warwick stated that the purpose of the new plan is to promote a broader distribution of tokens and to enhance overall participation and market enthusiasm before TGE. However, for some Patron holders, this explanation fails to cover their core loss points and does not adequately address the expectation gap experienced by early supporters due to the changes in the mechanism, thus not fully calming the controversy.

Moreover, the unchanged one-year lock-up period remains the biggest pain point in community discussions. Although the significant reduction in FDV has somewhat alleviated market criticism of high valuations, it has not changed the strong dissatisfaction among most community members regarding the "one-year lock-up period," which they believe is almost equivalent to a "premature death sentence" in the current market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。