最近一段时间,有很多朋友在问我一个问题:

比特币这一次,会不会再次复刻过去的四年周期?

这个问题,其实我在很早之前就已经给出过答案。

一、为什么10月初就判断进入回调周期

在10月初,当时比特币价格还在124,000附近,我就明确提出,比特币已经进入大周期回调阶段。

当时我也同步给出了一个判断,比特币未来的底部区间,大致会落在70,000到50,000之间。

之后我们也反复强调过一点:

至少要看到5字头或6字头的价格,才有资格考虑中长期买入。

二、上涨周期的时间规律

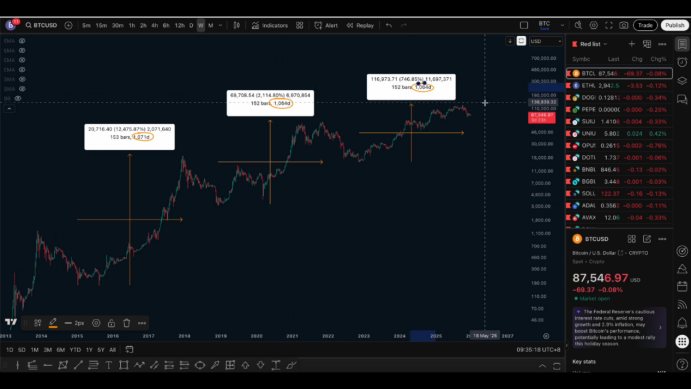

从周线级别来看,过去三轮主要上涨行情的持续时间分别是:

第一轮:约1,070天

第二轮:约1,070天

第三轮(2022年至今年10月):约1,060天

可以看到一个非常清晰的规律:

上涨周期基本都集中在1,000天到1,100天之间。

这正是比特币典型的四年上涨周期。

也正因为如此,再结合当时价格行为上已经出现了多个高点、顶部突破失败的结构,我才会在10月初判断,这一轮上涨大概率已经结束。

目前来看,这个判断是成立的。

三、下跌周期的时间与幅度

再来看下跌周期。

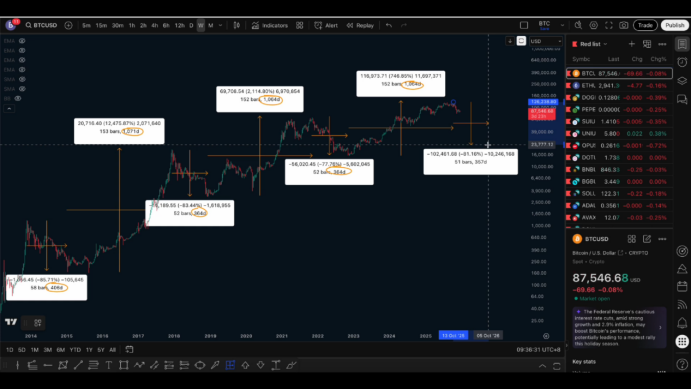

过去几轮下降行情中:

下跌持续时间多在365天左右

有的接近400天,但整体集中在一年上下

如果按照这个节奏推算,本轮下跌从今年10月初开始,

比特币见底的时间,大概率会落在明年的第三季度之后。

从跌幅来看:

早期周期下跌85%到83%

上一轮约77%

跌幅整体呈现逐步收敛趋势

在我看来,这一轮未必会再出现70%以上的跌幅,

但至少50%以上的回撤,是非常有可能出现的。

四、关键价格区间的判断

如果按50%的跌幅来计算,比特币价格大致在65,000附近;

如果达到60%的跌幅,价格则会跌破50,000。

是否一定会到更低的位置,目前无法确定,

但50%左右的下跌幅度,我认为概率较大。

从周线结构来看,本轮上涨过程中经历了三段明显的宽幅震荡。

这些区间,本质上都是筹码密集交换区,

一旦价格回到这些区域,往往会形成一定支撑。

再结合上一轮牛市顶部69,000这一重要价格区域,

综合判断,65,000到60,000之间,是一个相对合理、具备观察价值的区间。

但还是那句话:

价格到了再看,走一步看一步。

目前可以明确的是:

现在这个位置,并不适合参与现货。

原因很简单:

没有止跌

没有多周期反转信号

下跌结构尚未走完

五、四年周期的本质原因

很多人把四年周期当成一种“市场魔咒”,

但在我看来,它本质上是一个流动性问题。

随着机构参与度不断提升,比特币正在快速机构化,

它不再是一个完全独立运行的品种,而是深度受到宏观环境影响。

例如:

流动性紧缩,价格承压

黄金、贵金属上涨,会分流部分资金

避险需求上升,风险资产流动性被抽走

正因为如此,比特币才会反复呈现出

4年上涨 + 1年回调的节奏

六、短线结构与交易思路

回到短线,今天是圣诞节,美股休市,整体波动预期偏低。

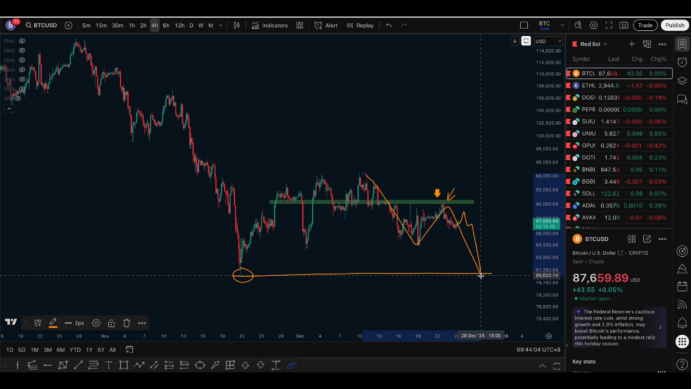

从结构上来看:

上方关键压力位仍在91,000到90,500之间

该位置未被有效突破

周线、日线、小时级别仍然是空头结构

因此当前思路不变:

反弹以高空为主

防守位放在91,000到90,500上方

短期目标,依然关注8万一带是否形成有效下破

我们在会员群中,昨天也参与了以太坊的一笔短空交易,

整体仍然是顺结构、以空头为主。

关注我,加入社区,一起进步。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。