The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts, rejecting any market smoke screens, and welcoming the attention and likes from all crypto friends!

Through yesterday's article, I made a slight comparison between AI and blockchain paths; most friends have a basic understanding, and the vast majority hope that Lao Cui will focus on trends and points in the articles, wishing that Lao Cui's articles will be published daily with entry points, profit-taking points, and stop-loss points. Lao Cui also really wants to do this, but the current situation in the country does not allow it. The format of the article cannot contain guiding elements, and this approach is not very advisable. Lao Cui's views are merely to provide everyone with a basis for judgment and do not constitute investment advice; I hope everyone can be more objective. What Lao Cui can do is infer possible future events from what has already happened, which will lead to changes in the cryptocurrency market trends. If one can have a reasonable logic for such inferences, then there is the ability to profit from investments.

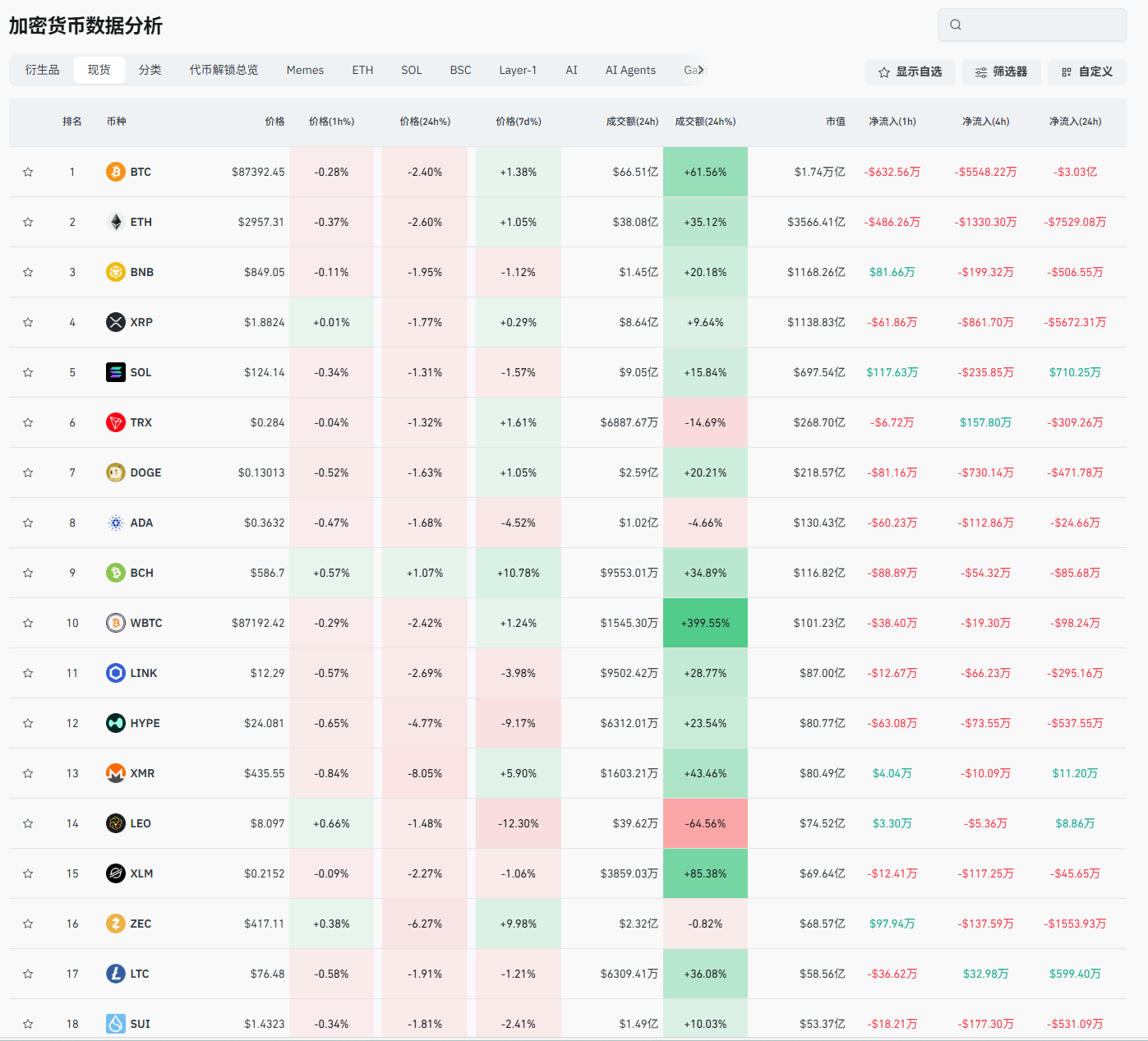

Recently, the movement of funds shows that both BlackRock and others have taken synchronized actions, shifting Bitcoin and Ethereum to the Coinbase platform. Many friends are worried about whether there will be another round of dumping through the platform? There is this possibility; within just two days, a total of 3,000 BTC and 30,000 Ethereum have been transported. The amount is quite large, and Lao Cui tends to believe it is more about staking and private agreements with the platform. The competition between platforms, as Lao Cui mentioned in 2024, will definitely be influenced by Trump's presidency, which will suppress BN to support local platforms. This includes the competition between USDT and USDC; opinions vary, and it is not necessarily the case that USDC is superior to USDT, after all, USDT is backed by over 100 tons of gold. However, the assets are not transparent, and excessive issuance is unregulated, all of which are used to purchase US debt, which may not be a wise move.

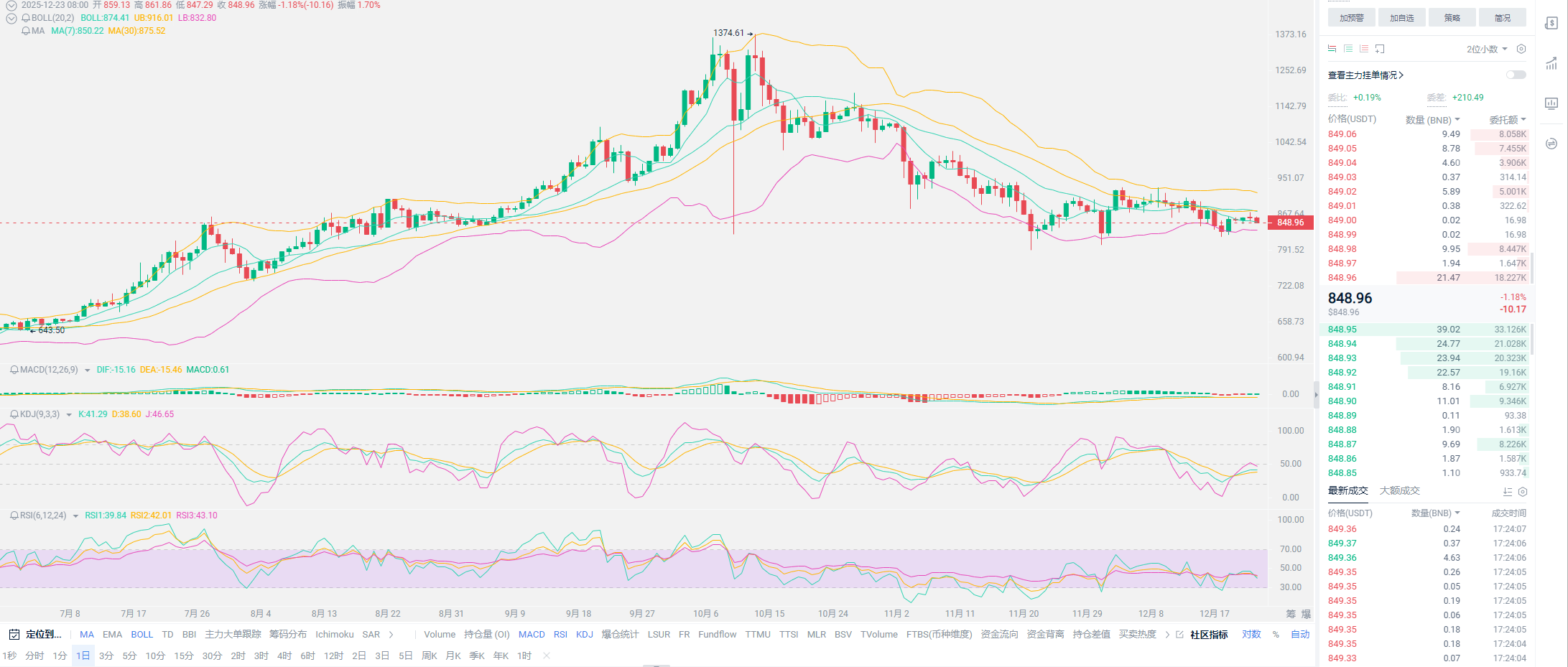

Competition will definitely continue; BN has obtained licenses in multiple regions this year, and most importantly, it has received endorsement from Hong Kong, which indicates many issues. The growth of BNB can be said to have become the first generation token of the platform, and the downward trend is not obvious, showing signs of a potential rise. In this form of competition, do not speculate too much; the deep binding between USDT and BN is a strong alliance, and concerns are somewhat excessive. Including the selling by MicroStrategy, many friends firmly believe that the withdrawal of giants ignores the inflow of funds. SOL and XRP were almost listed at the same time, and there have been no signs of outflow from the ETF; instead, buying has increased. The market is not rising more due to human factors; if emotions do not rise, there is little chance of an explosion. Looking at the current market, it is in a volatile range; if it were before the listing or before Trump's presidency, the entire cryptocurrency market would have already entered a bear market. Isn't the so-called four-year cycle just like this?

Stabilizing the current market is not easy. True giants do not have data outflows. A recent example is the turnover between BlackRock and Grayscale; currently, there is not even a single piece of information. If Lao Cui's memory serves correctly, the trading between these two reached over 100,000 BTC and 500,000 in turnover daily, continuing for six months; at the same time, Bitcoin's price rose from around 20,000 to 60,000, and after that, it exploded into last year's bull market, growing all the way to 110,000. The data shown to everyone cannot explain the problem, especially the outflow of such super giants is mostly a smoke screen. The inflow and outflow of a few thousand Bitcoins are not sufficient to discern trends for investment teams of the level of BlackRock and MicroStrategy. Everyone needs to have the ability to distinguish between smoke screens and actual information, and not be overly influenced by the giants; the current four-year cycle theory is already outdated, and the mainstream is the movement of funds.

You may find this section a bit convoluted because the movement of funds should not just focus on the giants. For example, BlackRock, which holds over 500,000 Bitcoins, if it flows out over 10,000 Bitcoins, it could potentially cause a trend change; at least one-tenth of the assets would need to represent the actions of the giants, not just a few thousand. The circulation of a few thousand Bitcoins by such investment institutions may just be for shareholder dividends and the use of funds for institutional circulation. Even after outflows, they may still proceed to repurchase; large-scale inflows and outflows at the institutional level will not go through platforms, and the traceability of hot wallets is not a concern; private and discreet trading has always been Wall Street's style. The most noteworthy information is that Trump Media under Trump has increased its holdings by 300 Bitcoins, bringing its total holdings to 11,542 Bitcoins, of which nearly 10,000 Bitcoins were held during this decline; he is a firm holder of the bullish position, and I am just watching Trump's actions.

As we approach the end of December, everyone needs to refocus on the foreign trade and foreign exchange markets, as the overall data will concentrate on outflows in January. Expected data is also very important; most well-known investment institutions' predictions are generally accurate and will not differ much from actual data. Once the data from various countries flows out, it could very likely set the economic policy for 2026; before that, it may lead to decisions on whether everyone can still hold cryptocurrency assets. If directional issues arise, everyone should be prepared to exit at any time. Lao Cui's prediction for 2026 leans towards a bull market phase because my holdings are primarily long, and I have never believed that a bear market would break out in the near future. Will the monetary easing policy continue? Is the exchange rate between CNY and USD stable? And are tariffs stable? Even, will military tensions end or escalate? These factors will all be answered in January 2026, and the data from December is a crucial link.

Lao Cui's summary: At this stage in the cryptocurrency market, there is no stimulus from news, nor support from large funds. So if you hold the same cryptocurrencies as Lao Cui, you need to be patient; this market does not belong to spot users, and the happiest are the contract users, as the support and pressure are very clear. What you need to do is to trade back and forth for profit. On the other hand, spot users can only average down and stake while waiting for signals next year. Especially for those firmly holding small cryptocurrencies, if Bitcoin does not move, do not expect other cryptocurrencies to have independent trends; what small cryptocurrencies hope to see is for their own coins to surge; only independent trends can bring a spring for altcoins. According to convention, this market is just the charge of the altcoin season; it has not appeared yet, and the diversion from other markets is quite serious. This issue does not need to worry us; it is something the giants need to address. If anyone has specific questions they do not understand, they can directly ask Lao Cui, especially regarding the handling of contract users; if you are still in a loss state, then the problem must be with yourself. For spot users, if the trend is fine, you can also ask Lao Cui about entry points.

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。