CoinW研究院

摘要

近期,Lighter 成为 Perp DEX 赛道讨论的焦点。Lighter 交易活跃,积分体系运行稳定,且 Coinbase 已将其纳入上币路线图;但代币发行时间和具体细节尚未明确,导致市场预期提前,而关键信息滞后,引发争议。与单纯依赖激励推动的项目不同,Lighter 通过高效的撮合机制和良好的交易体验,吸引了大量长期用户,已经展现出较强的产品价值。这使市场开始提前用成熟资产的标准进行估值,分歧因此放大。整个 Perp DEX 赛道正处于从“激励驱动”向“价值内生”过渡的关键阶段。如何设计代币,使其既能有效激励用户,又能合理承接平台的真实价值,成为行业普遍面临的挑战。以往项目的回购和激励策略各有侧重,但普遍体现出谨慎和平衡。Lighter 当前对代币节奏与功能的克制,某种程度上正体现了赛道对代币定位的重新思考。代币是否必需、以及如何在激励和价值承载间找到合理定位,仍是亟待解决的核心问题。观察 Lighter 的发展路径,有助于理解整个 Perp DEX 生态未来的代币设计逻辑和可持续发展方向。

1.Lighter 的争议从何而来:预期前置与信息滞后的错位

近期,关于 Lighter 的讨论热度显著上升。一方面,项目层面的进展持续释放积极信号:12 月 13 日,Coinbase 宣布将 Lighter 添加至上币路线图;与此同时,平台交易规模与积分相关数据同步放大,使其迅速成为 Perp DEX 赛道中关注度最高的项目之一。

但与数据和曝光同步上升的,是围绕 TGE 与空投节奏的不确定性。当前市场对 Lighter 的争议核心,并不在于它“会不会发币”,而在于市场预期已经明显前置,但决定估值的关键信息仍未被确认。社区中长期存在 Lighter 或将在今年 12 月进行 TGE 的预期,但官方始终未对具体时间、规则或代币分配方式作出明确说明。

从机制层面看,Lighter 的积分体系已经进入稳定运行阶段。用户可以通过向 LLP(Lighter Liquidity Provider)公共资金池存入资金并参与合约交易来获得积分。目前 Season 2 正在进行中,官方设定了相对固定的积分发放节奏,并根据交易行为进行分配,同时保留对规则进行动态调整的权利。然而,截至目前,官方尚未公布积分将如何与未来代币或 TGE 挂钩,包括兑换比例、分配结构或完整的 Tokenomics 设计。

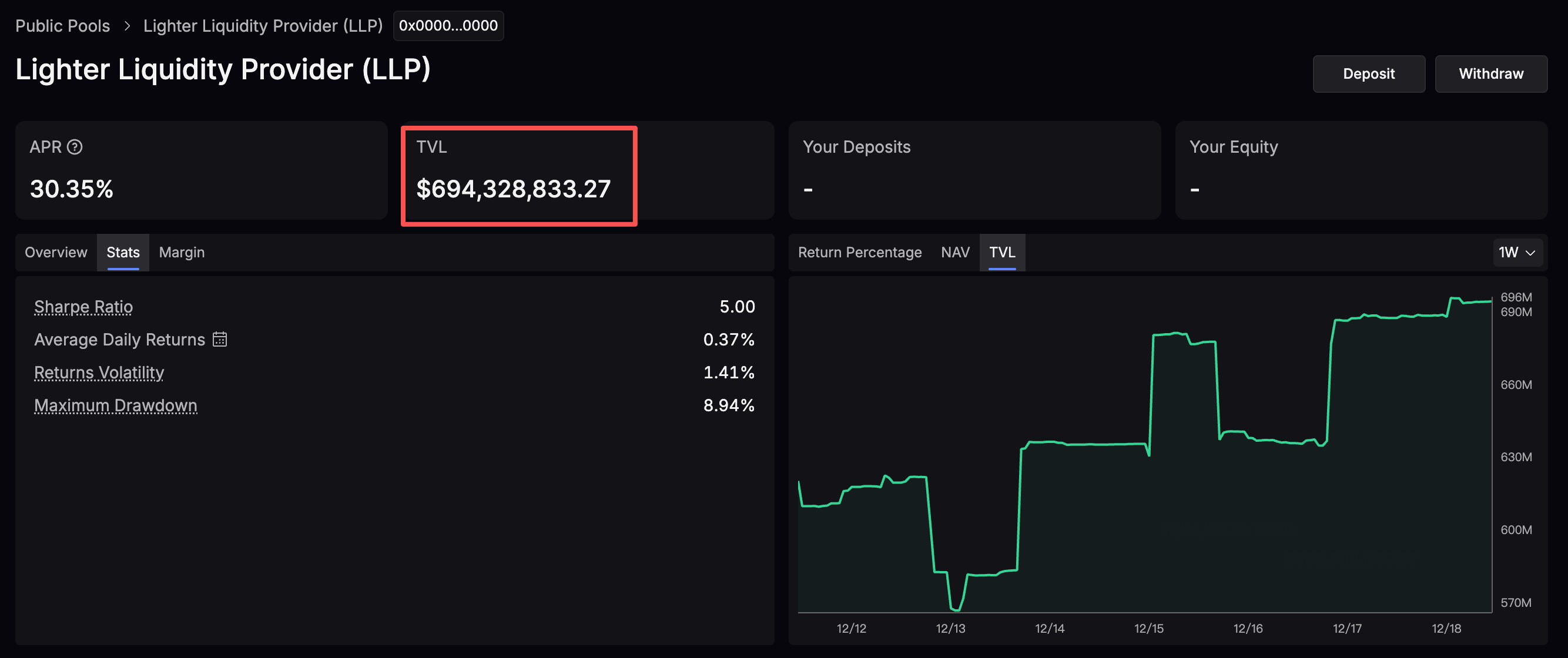

在实际参与过程中,尽管官方并未给出最终答案,但用户已经普遍将积分视作未来潜在收益的重要参考指标。随着参与规模扩大,这种预期被进一步强化。根据官网数据显示,目前 Lighter 积分池对应的 TVL 已达到约 6.9 亿美元,意味着这一体系已经承载了相当规模的真实资金与交易行为。在这一背景下,发币时间与规则层面的不确定性,很容易被放大为对潜在收益的不确定判断,并直接反映在预测市场的定价分歧以及参与者情绪的明显分化之中。

Figure 1. Lighter points system. Source: https://app.lighter.xyz/public-pools/281474976710654

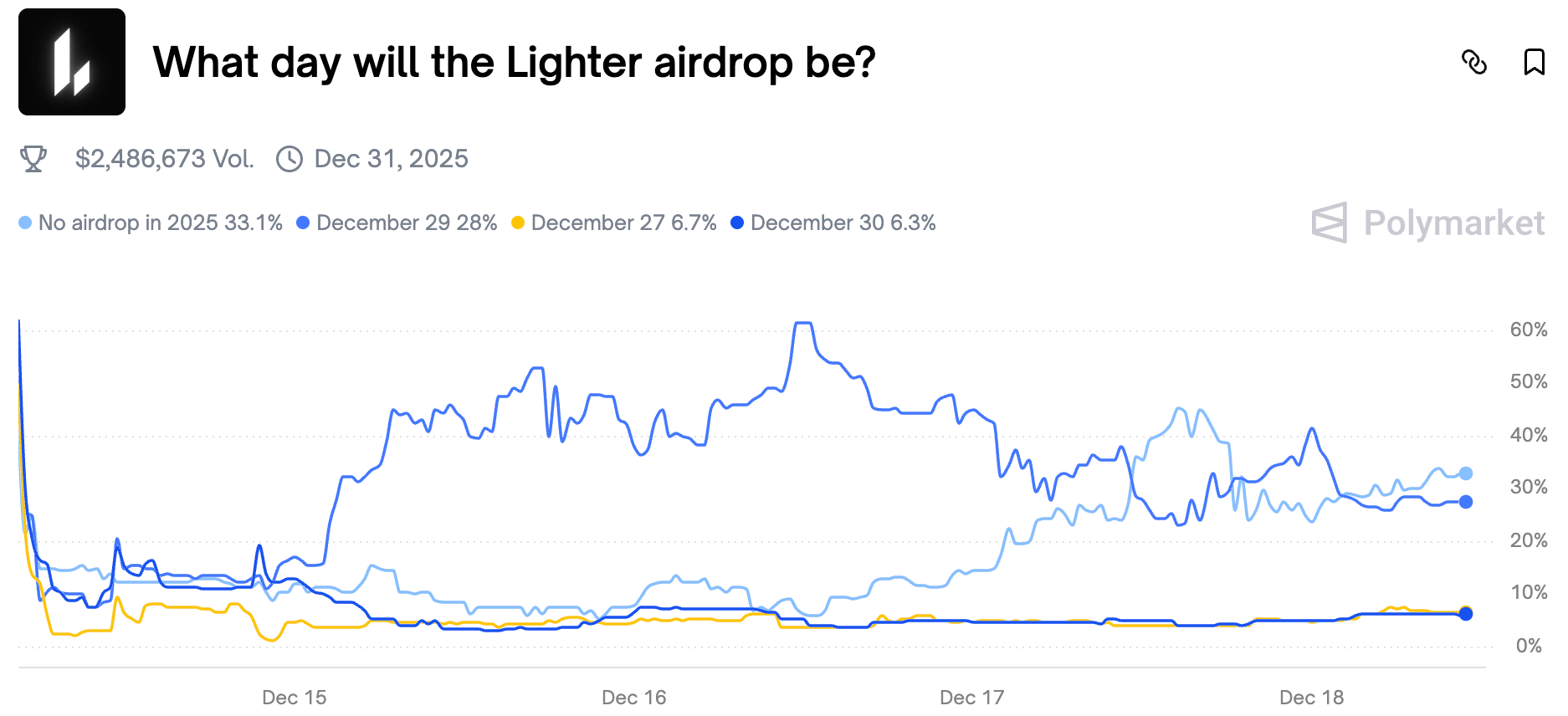

从预测市场 Polymarket 的数据来看,市场并未对 Lighter 的空投时间形成高度一致的判断。例如,“Lighter 在 12 月 29 日空投”的概率约为 28%,而“2025 年不空投”的概率约为 33%,其余日期的概率则相对分散。这种结构表明,市场并未将空投视为确定事件,而是在对多种可能情景进行并行定价。

Figure 2. The prediction on Polymarket for when the Lighter airdrop will be. Source: https://polymarket.com/event/what-day-will-the-lighter-airdrop-be?tid=1766026269827

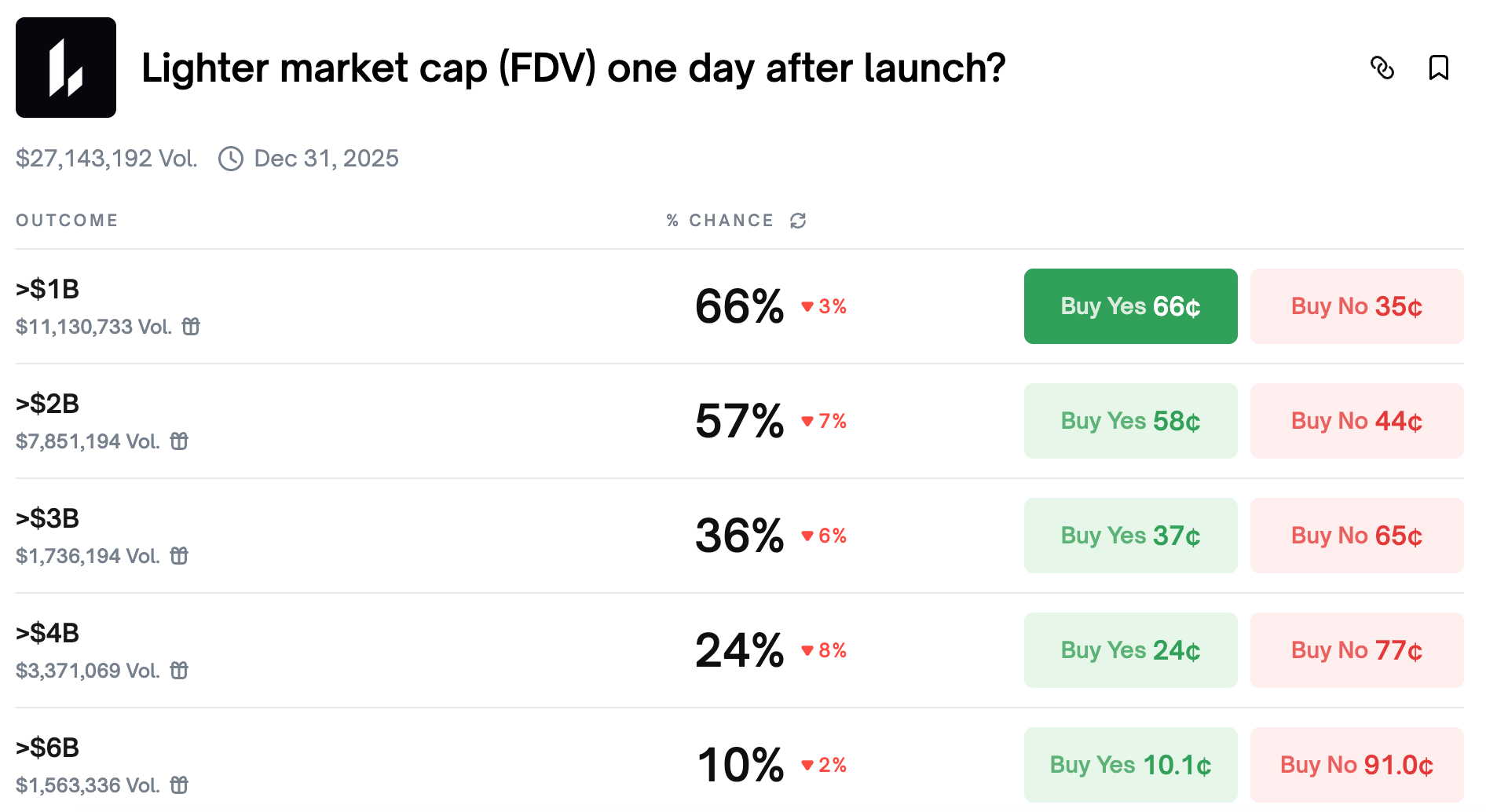

在关于代币上线后估值的预测中,市场对“上线次日 FDV 超过 10 亿美元”的判断偏向肯定,但对更高估值区间的概率预期则明显收敛。整体来看,市场对 Lighter 的态度并非盲目乐观,而是在不确定性尚未消除的前提下,提前进行了风险分散式定价。

Figure 3. The prediction on Polymarket for Lighter’s market cap (FDV) one day after launch. Source: https://polymarket.com/event/lighter-market-cap-fdv-one-day-after-launch?tid=1766026452011

在更长期层面,围绕 Lighter 的业务模型与代币设计,社区也逐渐出现不同看法。部分观点认为,Lighter 当前更聚焦于交易产品本身,在质押、治理或更丰富的生态层级设计上仍十分有限,若未来代币功能未能与平台交易行为形成清晰的价值闭环,TGE 与空投完成后用户活跃度将会面临较大回落压力。这类讨论并非是对项目进展的否定,而是在 Perp DEX 赛道逐步成熟的背景下,市场对长期可持续性的关注正在显著上升。

2.高曝光下的提前定价:Lighter 为什么被当成“准资产”

过去一年,链上 Perp DEX 项目并不少,但真正能够持续进入市场视野的并不多。与依赖高强度激励机制维持数据的项目不同,Lighter 从一开始就被置于一个高曝光的位置。Coinbase推出的超级应用Base app中集成了Lighter的官网页面,用户可以在 Coinbase 场景中直接发现并使用该产品。这使其被放在潜在主流交易场景下进行审视,也意味着市场对它的评判标准,迅速从“能否跑通机制”,升级为“是否值得被长期定价”。

在这一过程中,Lighter 并未先行给出完整的代币叙事,但其交易数据与参与度却在短时间内同步放大。这种组合,使得市场在尚未获得全部关键信息的情况下,已经开始将其纳入估值与横向比较的讨论框架之中。

更重要的是,Lighter 出现的时间点,恰好踩在 Perp DEX 赛道整体叙事发生转向的阶段。行业关注点正从早期强调机制与架构创新,逐步转向一个更现实的问题:是否已经出现可持续、非激励驱动的真实交易需求。在这一背景下,只要项目率先证明“确实有人在用”,即便其商业模式与代币价值捕获尚未完成全部叙事闭环,也往往会被市场提前视作一种“准资产”进行审视。

因此,当前围绕 Lighter 的争议,并不完全源自项目自身的节奏选择,而更像是市场预期与项目所处阶段之间的一次结构性错位:当市场开始用对待成熟资产的方式,去衡量一个仍处于构建期的产品时,分歧自然会被放大。

3.不看TGE,Lighter是否真的跑出了产品价值?

如果暂时把 TGE 与空投预期拿掉,Lighter 是否仍然具备被持续讨论的价值,是判断这一项目是否值得关注的关键。

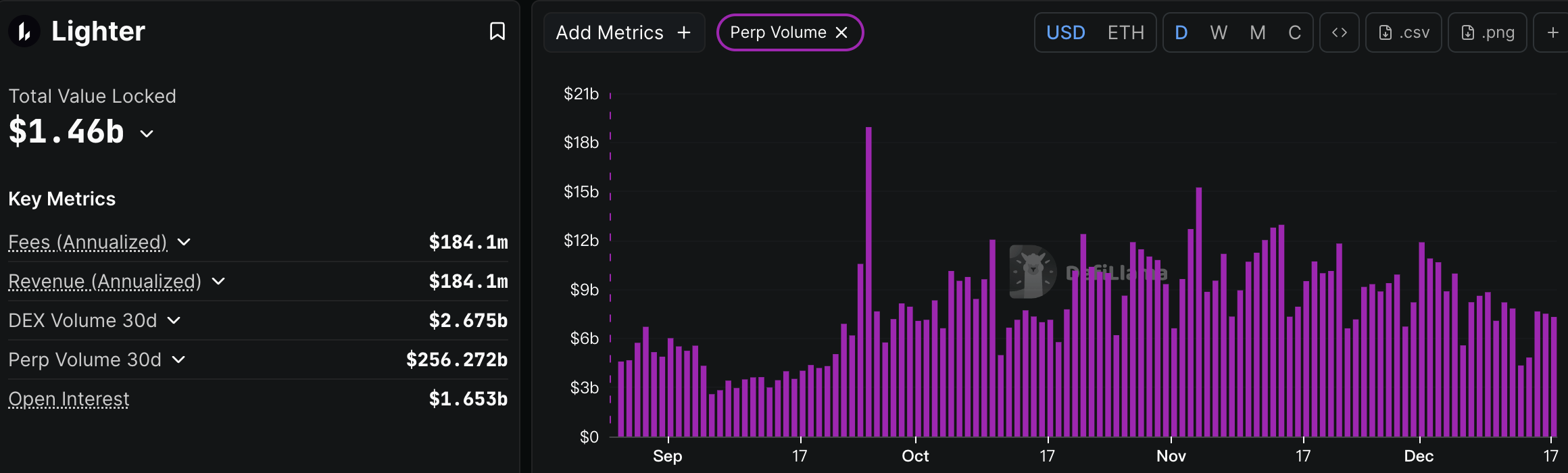

从已披露的数据与实际交易行为来看,Lighter 至少展现出几项并不容易出现的关键信号。首先,在永续合约交易层面,Lighter 已承接了相当规模的市场交易活动。根据 DefiLlama 数据,截至 12 月 18 日,Lighter 在过去 30 天内的永续合约交易量约为 2562.7 亿美元,平台 TVL 为 14.57 亿美元,对应的交易量 / TVL(等价资本占用)约为 175.88。作为对比,Hyperliquid 与 Aster 在同期的交易量 / TVL 分别约为 49.16(2038.4 亿美元 / 41.46 亿美元)和 169.6(2210.0 亿美元 / 13.03 亿美元)。交易量 / TVL 本质上反映的是单位锁定资本在一定周期内的周转强度。在永续合约场景下,该指标越高,通常意味着资金被更频繁地滚动使用,交易行为更偏向高频和激励驱动。从这一指标来看,Lighter 与 Aster 当前均呈现出明显的高周转特征,显示出较强的交易活跃度,但其中可能包含了一定由激励机制放大的交易需求;相比之下,Hyperliquid 的交易结构则更偏向资本沉淀与相对稳定的风险敞口。

在这一时间窗口,Lighter 的永续合约交易规模已处于 Perp DEX 赛道的高位区间,显示其在交易撮合效率与系统承载能力方面具备较强的竞争力。需要指出的是,当前阶段 Lighter 的交易活跃度仍可能受到激励机制与市场预期的影响,而非完全由自然需求主导。但即便如此,能够在高频、高杠杆的交易环境中持续承接如此体量的交易,本身已构成一道不低的技术与产品门槛,也为后续检验真实交易需求的可持续性奠定了基础。

Figure 4. Lighter data. Source: https://defillama.com/protocol/lighter?perpVolume=true&tvl=false

其次,从产品结构看,Lighter 所采用的订单簿混合撮合模型,在执行效率、滑点控制与交易反馈上,已经能够支撑用户的连续使用。这决定了它不只是试一次就走的产品,而是被部分交易者纳入了长期交易路径之中。此外,接入 base app 官方页面所带来的入口级曝光,并未停留在被看见的阶段。从当前可观察到的交易与活跃数据来看,至少已有一部分流量完成了从“曝光”到“行为”的转化。这一点,使 Lighter 与大量仍停留在叙事与预期层面的 Perp DEX 项目拉开了差距。

正是因为已经跑通了这些关键环节,Lighter 才会被市场提出更高要求。当一个项目已经被证明具备真实使用价值时,问题就不再只是“有没有代币”,而是代币是否能够合理承接并放大这些已经存在的价值。

4.当Perp DEX跑通后,Token还能怎么设计?

在 Hyperliquid、Aster 等项目之后,Perp DEX 赛道正整体走到一个相似的阶段性节点:当交易产品本身已经被验证可行,代币究竟还应以何种方式“合理存在”?

过往项目的实践已经给出了不同方向的尝试。以 Hyperliquid 为例,其代币设计并未停留在治理或激励层面,而是围绕如何承接协议真实收入展开。根据官方披露与第三方统计数据,平台将永续合约等业务产生的大部分手续费(超90%)收入持续用于在二级市场回购 HYPE 代币,并通过销毁或移出流通的方式,对代币供给侧形成支撑。随着交易量与手续费规模增长,回购强度也会同步扩大,从而将协议经营成果传导至代币层面,形成相对清晰的价值闭环。这一路径对基本面的要求也极为直接:只有在平台能够长期、稳定地产生足够规模的真实交易收入时,回购机制才能持续发挥作用。一旦交易活跃度下降,代币价值的支撑也会随之承压。

相比之下,Aster 在早期通过大规模空投和多阶段激励,快速扩大用户规模和交易活跃度。官方 Tokenomics 显示,约 53.5% 的 ASTER 总供应量用于空投、交易激励和社区奖励,助力启动阶段聚集流动性。长期价值设计中,Aster 引入了阶段性的回购与销毁机制,已公开回购代币中约一半被永久销毁,其余锁定用于后续激励。回购资金主要来自协议手续费和项目国库,并非完全依赖协议收入。与 Hyperliquid 持续将大部分手续费用于回购不同,Aster 的回购更多用于稳定预期和调节供需,规模和节奏不会随手续费收入自动扩大。这样的策略有助于早期提升关注和参与度,但中长期若激励减弱,交易需求难以承接,代币可能面临抛压。

在现实约束下,Perp DEX 项目的代币设计普遍呈现出一种“有意识的克制”:它们既清楚单纯激励型代币的不可持续性,又对收入分配型代币所带来的结构复杂度与合规成本保持警惕。在缺乏一条已被充分验证、可规模化复制的标准路径之前,延后承诺、保留弹性,反而成为更理性的选择。

5.回到Lighter:它的“犹豫”,或许正是问题的一部分答案

如果跳出“会不会 TGE”、“什么时候空投”这类情绪化讨论,用一个相对冷静的视角来看,Lighter 目前呈现出的状态其实非常清晰:它并不是一个只依赖 TGE 拉估值的项目,但同时,也尚未给出一个足够令人信服、可被市场定价的 Token 终局叙事。

从产品策略上看,Lighter 并未通过高频、显性的补贴来快速堆积短期数据,而是借助积分机制,将激励与真实交易行为绑定。这种激励被延后兑现,其作用更多体现在对交易行为的持续引导,而非一次性冲量。Lighter 正在用已经跑通的交易量、活跃用户与持续增长的数据,去换取市场的时间与耐心。在一个高度习惯以 TGE 作为阶段性锚点的市场环境中,这种克制必然会引发不适。

也正因如此,围绕 Lighter 的分歧开始逐渐显性化。对短线参与者而言,缺乏明确的代币时间表与收益预期,会直接削弱参与动机,质疑情绪自然上升;而对长期交易用户来说,只要产品深度、撮合效率与交易体验仍然具备优势,是否立即发币并不会影响其使用决策。两类人群关注点的错位,使得同一个项目在不同视角下呈现出截然不同的评价,也让市场分歧不断放大。

从行业视角来看,Lighter所体现的争议已经超越“是否发币”本身,而是触及了去中心化永续交易平台代币设计的核心命题:在Perp DEX已证明具备真实用户和交易需求的背景下,代币究竟是否必需?其核心功能应当聚焦于激励、治理,还是更重要的价值捕获和长期生态建设?

这反映出整个赛道正处于从“快速增长+激励驱动”向“可持续价值创造”的转型期。Lighteru作为被市场放大审视的项目,其表现和代币策略将对整个Perp DEX生态的代币经济模型起到重要的示范效应。无论其最终代币设计和发行节奏如何,这场围绕代币定位的探讨都将持续影响未来项目的设计思路和市场预期。对投资者和研究者来说,观察Lighter的路径,有助于洞察这一赛道如何实现从“激励引流”向“价值内生”的关键跃迁。

参考

1.Hyperliquid Diligence Report. Source: https://messari.io/research/deep-research-reports/hyperliquid-diligence-report-fdf9486f-d978-4a6f-980e-ccadc697b120

2.10 Projects Account for 92% of Token Buyback Spend in 2025: https://www.coingecko.com/research/publications/token-buybacks

3.Lighter points system: https://app.lighter.xyz/public-pools/281474976710654

4.The prediction on Polymarket for when the Lighter airdrop will be: https://polymarket.com/event/what-day-will-the-lighter-airdrop-be?tid=1766026269827

5.The prediction on Polymarket for Lighter’s market cap (FDV) one day after launch: https://polymarket.com/event/lighter-market-cap-fdv-one-day-after-launch?tid=1766026452011

6.Lighter data on Defillama. Source: https://defillama.com/protocol/lighter?perpVolume=true&tvl=false

7.Aster DEX burns 80 million tokens and unveils 2026 roadmap: Key insights and analysis: https://investx.fr/en/crypto-news/aster-dex-burns-80-million-tokens-unveils-2026-roadmap-key-insights-analysis/

8.Aster PERP-DEX Investment Memo: https://insights.blockbase.co/aster-perp-dex-investment-memo

9.Aster Updates ASTER Token Buyback and Airdrop to Boost Token Value: https://www.mexc.co/en-IN/news/149436

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。