Written by: Frank, MSX Research Institute

The introduction of the "23-hour system" by this node is not merely to cater to Asian traders, but rather to pave the way for seizing the global liquidity high ground.

In the past, trading U.S. stocks meant sleepless nights, but will it soon mean sleepless days as well?

As the Crypto market has long adapted to a 7×24 rhythm of never sleeping, Nasdaq, standing at the core of TradFi, can no longer sit idle.

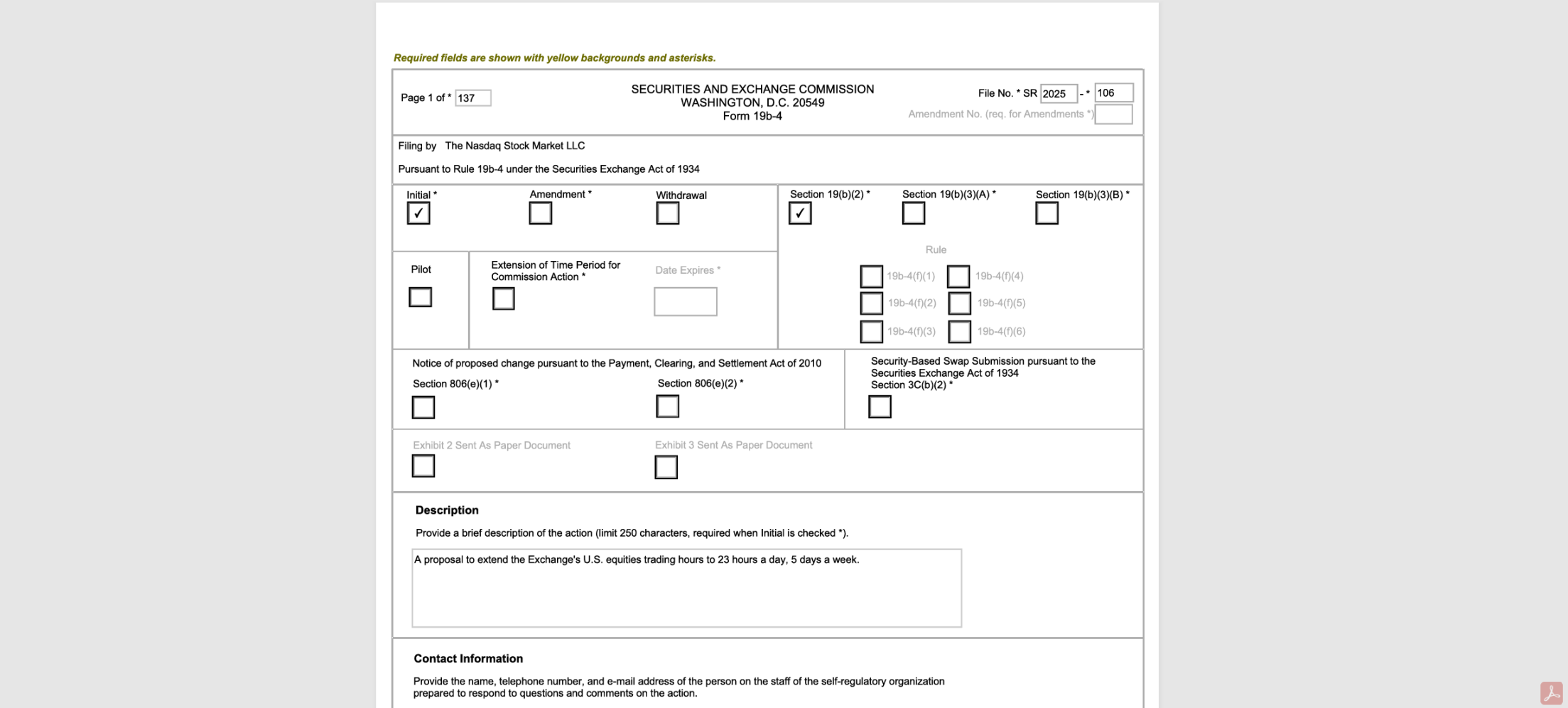

On December 15, Nasdaq officially submitted documents to the U.S. Securities and Exchange Commission (SEC), planning to extend trading hours from the current 5 days a week, 16 hours a day (pre-market / market hours / after-hours) to 5 days a week, 23 hours a day (daytime / nighttime).

Once approved, U.S. stocks will trade from Sunday evening at 21:00 until Friday evening at 20:00, leaving only a 1-hour (20:00-21:00) market closure window each day. The official reason is quite respectable: "to meet the growing demand from Asian and European investors, allowing them to trade during non-traditional hours."

However, peeling back the layers reveals that the logic behind this is far more complex. Nasdaq is clearly conducting extreme stress tests for the future of stock tokenization. We are gradually piecing together a continuous timeline:

Nasdaq and the U.S. financial market are preparing for a "financial system that never closes."

I. From 5×16 to 5×23: Approaching the "Last Hour" of TradFi Limits

On the surface, this is merely an extension of trading hours, but from the perspective of various participants in TradFi, this step nearly pushes the technical capacity and collaborative ability of the existing financial infrastructure to its physical limits.

It is well known that stock trading within the TradFi system is a precisely meshed gear system, and besides Nasdaq, stakeholders include brokers, clearing institutions, regulators, and even the listed companies themselves. This means that to support a 23-hour trading system, all market participants must communicate thoroughly and undergo deep transformations around all aspects such as clearing, settlement, and collaboration systems:

- Brokers and dealers must extend customer service, risk control, and trading maintenance systems to operate around the clock, leading to a sharp increase in operational and labor costs;

- Clearing institutions (DTCC) must simultaneously upgrade trading coverage time and clearing and settlement systems, extending service hours to 4 AM to match the new rules of "overnight settlement for nighttime trades" (trades from 21:00 to 24:00 count for the next day);

- Listed companies must also recalibrate the timing of financial reports or major announcements, and investor relations and market participants must gradually adapt to the new reality of "significant information being priced in the market during non-traditional hours."

Of course, for those of us in the UTC+8 time zone, the previous U.S. stock trading was mostly concentrated in the late night or early morning. The future model of 5 days × 23 hours means we can participate in real-time without staying up late, which is a significant benefit. However, it raises a profound question—if a reform has already been decided, why not implement a full 7×24 system instead of leaving this awkward 1-hour gap?

According to Nasdaq's public disclosures, the 1-hour gap is primarily for system maintenance, testing, and trade settlement, which exposes the "Achilles' heel" of traditional financial architecture. Under the existing centralized clearing system (based on DTCC and broker/bank systems), there must be a period of physical downtime for data batch processing, end-of-day reconciliation, and margin settlement.

Just like bank branches must reconcile accounts after closing each day, this 1-hour window can also be seen as a "tolerance window" in the real world. Although it requires significant human resource and system maintenance costs, it provides a necessary buffer for system upgrades, synchronized clearing and settlement, fault isolation, and risk management under the current financial infrastructure.

However, compared to the past, the remaining 1 hour in the future will impose nearly harsh requirements on the cross-role collaborative capabilities of the entire TradFi industry, akin to an extreme stress test.

In contrast, blockchain-based Crypto and tokenized assets rely on distributed ledgers and smart contracts for atomic settlement, inherently possessing the gene for 7×24×365 trading. There are no market closures, no need for breaks, and no need to squeeze critical processes into a fixed end-of-day window.

This explains why Nasdaq is challenging limits, not out of a sudden realization to "care" for Asian users, but because of the circumstances— as the boundaries between the 7×24 Crypto market and traditional financial markets become increasingly blurred, the incremental trading demand for traditional exchanges increasingly comes from global funds across time zones and longer periods of liquidity coverage.

It can be said that as we enter 2025, tokenization is already on the horizon, and players like Nasdaq have long been laying the groundwork behind the scenes (see further reading: "Nasdaq Hits the Gas: From 'Drinking Soup' to 'Eating Meat', Is U.S. Stock Tokenization Entering the Decisive Stage?"). Therefore, from this perspective, the 23-hour trading system is not an isolated change in rules to "open a few more hours," but rather a systematic transitional phase paving the way for stock tokenization, on-chain clearing, and a 7×24 global asset network:

Without overturning existing securities laws and the National Market System (NMS), the trading system, infrastructure, and participant behavior are being pulled toward a rhythm that is "approaching on-chain"—testing the waters and laying the groundwork for more aggressive goals (more continuous trading, shorter settlement cycles, and even on-chain clearing and tokenized delivery).

Imagine, once the SEC approval is granted, and the 23-hour trading system begins to operate and gradually becomes the norm, the market's patience threshold and reliance on "trading anytime, instant pricing" will be raised. How far will we be from that true 7×24 endpoint?

At that time, with the official launch of tokenized U.S. stocks, the global financial system will smoothly transition to that truly "never closing" future.

II. What Profound Impacts Will This Have on the Market?

Objectively speaking, the "5×23" model may trigger a structural shock affecting the global TradFi ecosystem.

In terms of time breadth, it significantly expands the boundaries of trading time, which is undoubtedly a substantial benefit for cross-time-zone investors, especially in the Asian market. However, from the perspective of market microstructure, it also introduces new uncertainties in liquidity distribution, risk transmission, and pricing power, easily leading to a "sustainable depletion" of global liquidity.

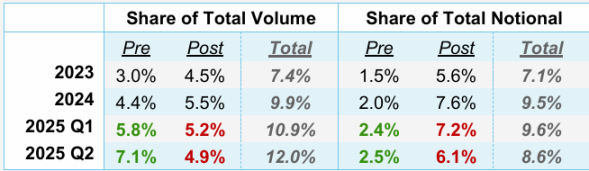

In fact, in recent years, the activity in non-traditional trading hours (pre-market, after-hours) for U.S. stocks has indeed shown explosive growth.

Data from the New York Stock Exchange indicates that in the second quarter of 2025, trading volume during non-trading hours exceeded 2 billion shares, with a transaction value of $62 billion, accounting for 11.5% of U.S. stock trading that quarter, setting a historical high. Meanwhile, trading platforms like Blue Ocean and OTC Moon have also seen continuous increases in transaction volume, and night trading is no longer a marginal phenomenon but a new battleground that mainstream funds cannot ignore.

Source: New York Stock Exchange

Behind this is essentially the concentrated release of the genuine demand from global traders, especially Asian retail investors, "to trade U.S. stocks in their own time zone." From this perspective, what Nasdaq is attempting to do is not to create demand but to re-integrate the night trading that was originally scattered in off-market, low-transparency environments back into a centralized, regulated exchange system with compliance identity, reclaiming the pricing power that had been lost in the shadows.

However, the problem is that "5×23" trading does not necessarily lead to higher quality price discovery; it may present a paradoxical double-edged sword state:

- First is the risk of liquidity "fragmentation" and "dilution": Although extending trading hours theoretically can attract more cross-time-zone funds, in reality, it also means that limited trading demand is fragmented and diluted over a longer time frame. Especially during the "nighttime" period under the "5×23" model, the corresponding trading volume for U.S. stocks is already lower than during regular hours, and extending it may lead to wider spreads, insufficient liquidity, increased trading costs and volatility, and even make it easier to manipulate prices during thin liquidity periods;

- Secondly, there is the potential change in the structure of pricing power: As mentioned earlier, Nasdaq's "5×23" model is expected to absorb scattered orders that have been diverted to off-market platforms like Blue Ocean and OTC Moon. However, for institutions, liquidity fragmentation has not disappeared; it has merely shifted from "off-market dispersion" to "on-market time-sharing," raising higher demands for risk control and execution models. This fragmented liquidity environment also significantly increases the execution costs of large orders;

- Finally, the possibility of black swan risks being amplified due to "0 latency": Under the 23-hour trading framework, significant unexpected events (whether earnings disasters, regulatory statements, or geopolitical conflicts) can be instantly converted into trading instructions. The market no longer has the buffer period of "sleeping overnight to digest," and in the relatively thin liquidity environment of night trading, such immediate reactions are more likely to trigger gaps, severe volatility, and even irrational chain liquidation reactions, exponentially amplifying the destructive power of black swans in the absence of counterparties.

Thus, I pointed out earlier that trading under the "5×23" model is by no means as simple as "just opening a few more hours," nor is it merely a question of "risk being smaller or larger." It is a systematic extreme stress test of the price discovery mechanism, liquidity structure, and distribution of pricing power in TradFi.

Everything is preparing for that "never closing" tokenized future.

III. Nasdaq's Entire Strategy: All Preparations Pointing to On-Chain

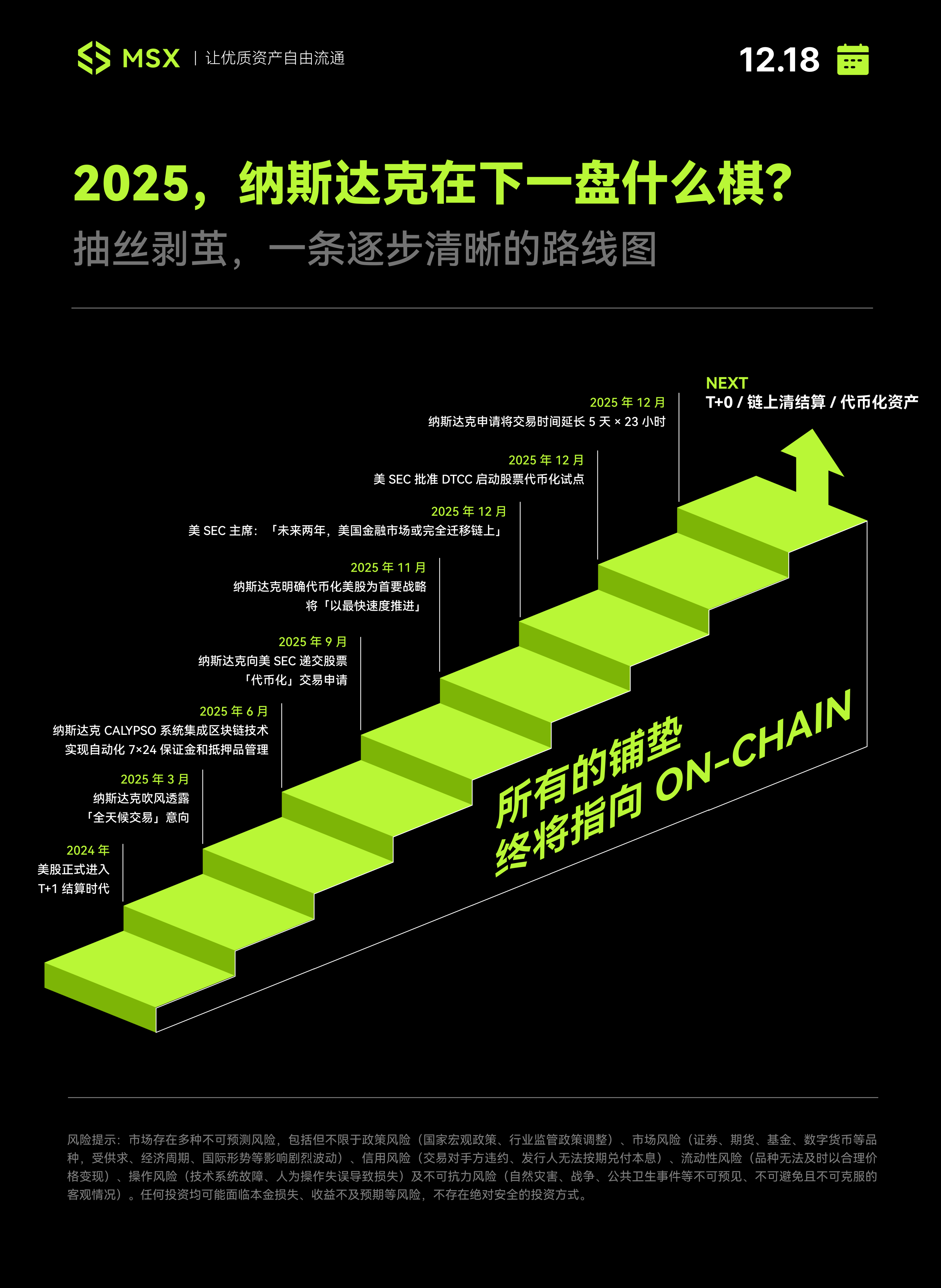

If we extend our view and connect Nasdaq's recent intensive actions, we will be more convinced that this is a strategic puzzle with a hidden agenda, aiming to ultimately enable stocks to possess the ability to circulate, settle, and price like tokens.

To achieve this, Nasdaq has chosen a path of gentle reform with a strong traditional financial style, and the evolution logic of the roadmap is extremely clear, advancing step by step.

The first step occurred in May 2024, when the U.S. stock settlement system was officially shortened from T+2 to T+1, a seemingly conservative yet crucial infrastructure upgrade. Following that, at the beginning of 2025, Nasdaq began to signal its intention for "around-the-clock trading," hinting at plans to launch uninterrupted trading services five days a week in the second half of 2026.

Subsequently, Nasdaq shifted its reform focus to a more concealed yet critical backend system—the Calypso system, integrating blockchain technology to achieve 7×24 hours of automated margin and collateral management. This step hardly created any visible changes for ordinary investors, but it sent a very clear signal to institutions.

By the second half of 2025, Nasdaq began to advance on institutional and regulatory fronts.

First, in September, it formally submitted a "tokenization" trading application for stocks to the SEC, and in November, it clearly stated that tokenizing U.S. stocks was a primary strategy, aiming to "push forward as quickly as possible."

Almost simultaneously, SEC Chairman Paul Atkins stated in an interview with Fox Business that tokenization is the future direction of capital markets. By putting securities assets on-chain, clearer ownership rights can be established. He predicted that "within about 2 years, all U.S. markets will migrate to on-chain operations, achieving on-chain settlement."

Against this backdrop, Nasdaq submitted its application for the 5×23 hour trading system to the SEC in December 2025.

From this perspective, Nasdaq's extension of trading hours to the "23-hour trading system" is not a standalone reform but a necessary step in its stock tokenization roadmap. This is because future tokenized assets will inevitably pursue 7×24 hours of liquidity, and the current 23 hours is the closest "transitional state" to on-chain rhythm.

What is particularly noteworthy is that the regulatory body (SEC), infrastructure (DTCC), and trading venue (Nasdaq) demonstrated a highly coordinated rhythm in 2025:

- SEC Deregulation and Positioning: While continuously easing regulations, it consistently released expectations for "full on-chain" through high-level interviews, injecting certainty into the market;

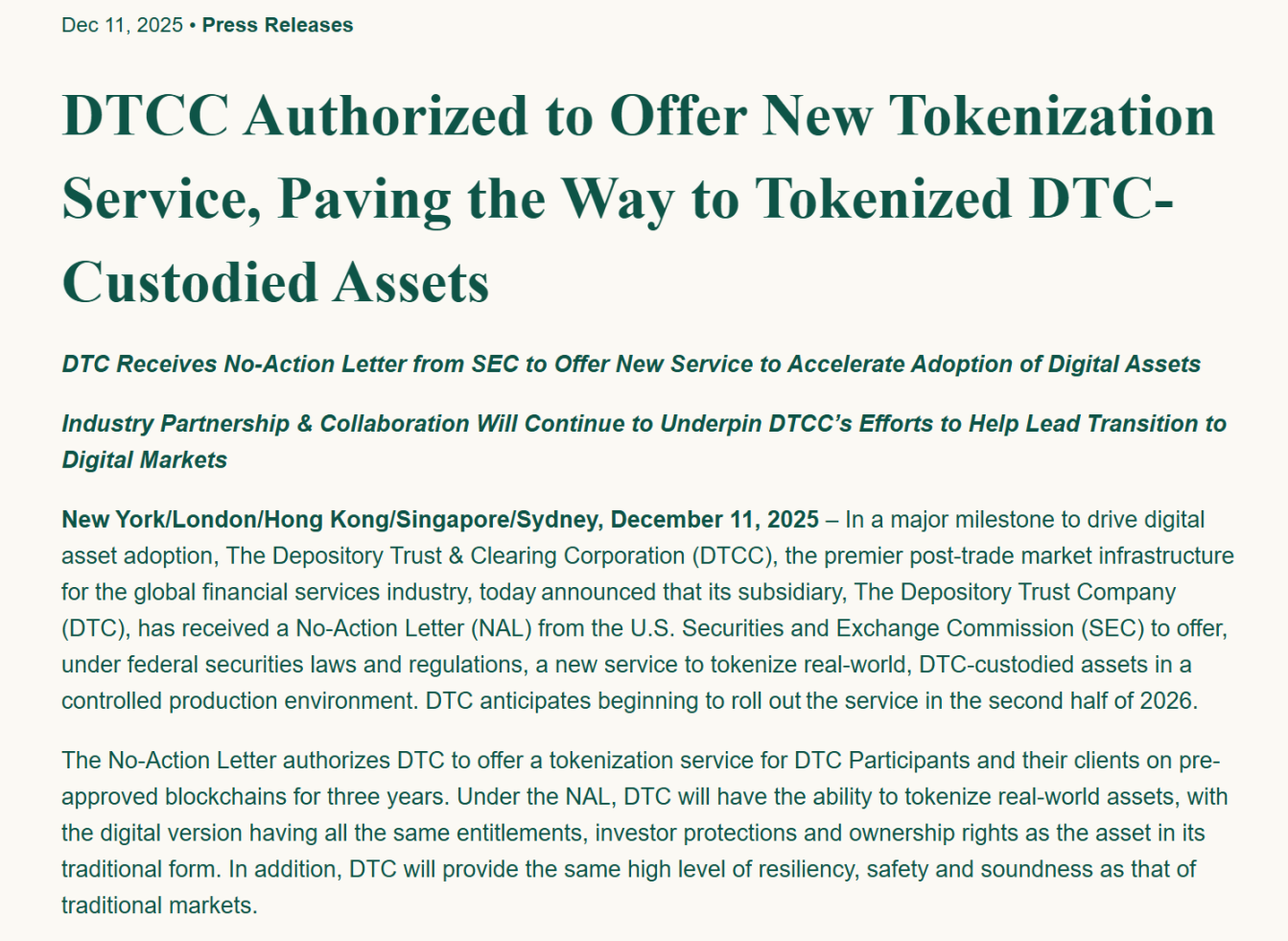

- DTCC Foundation: On December 12, DTCC's subsidiary, the Depository Trust Company (DTC), received a no-objection letter from the SEC, approving its provision of real-world asset tokenization services in a controlled production environment, with plans to officially launch in the second half of 2026, addressing the core compliance issues of clearing and custody;

- Nasdaq's Charge: Officially announcing its tokenized stock plan, prioritizing it, and submitting the 23-hour trading application to attract global liquidity;

Source: DTCC Official Website

When these three lines are placed on the same timeline, the tacit understanding of this collaborative effort makes it hard not to draw a conclusion:

This is not a coincidence or a sudden idea from Nasdaq, but a highly coordinated, continuously advancing institutional project. Nasdaq and the U.S. financial market are making the final push for a "financial system that never closes."

In Conclusion

Of course, once Pandora's box is opened, the "5×23 hours" is just the first step.

After all, once human needs are unleashed, they become irreversible. So, since U.S. stocks can be traded at midnight, users will inevitably ask: Why should I still endure that 1-hour interruption? Why can't I trade on weekends? Why can't I settle in real-time using U?

When global investors' appetites are thoroughly whetted by the "5×23 hours," the existing incomplete structure of TradFi will face its final reckoning, and only 7×24 native tokenized assets can fill that last hour's gap. This is why, besides Nasdaq, players like Coinbase, Ondo, Robinhood, and MSX are all racing madly—those who run slowly are destined to be swallowed by the on-chain tide.

The future is still far off, but the time left for the "old clock" is running out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。