CoinW研究院

关键要点

全球加密货币总市值为3.22万亿美元,较上周3.15万亿美元,本周内加密货币总市值上升2.2%。截止至发稿,美国比特币现货ETF累计总净流入约579.0亿美元,本周净流入2.86亿美元;美国以太坊现货ETF累计总净流入约130.9亿美元,本周净流入2.08亿美元。

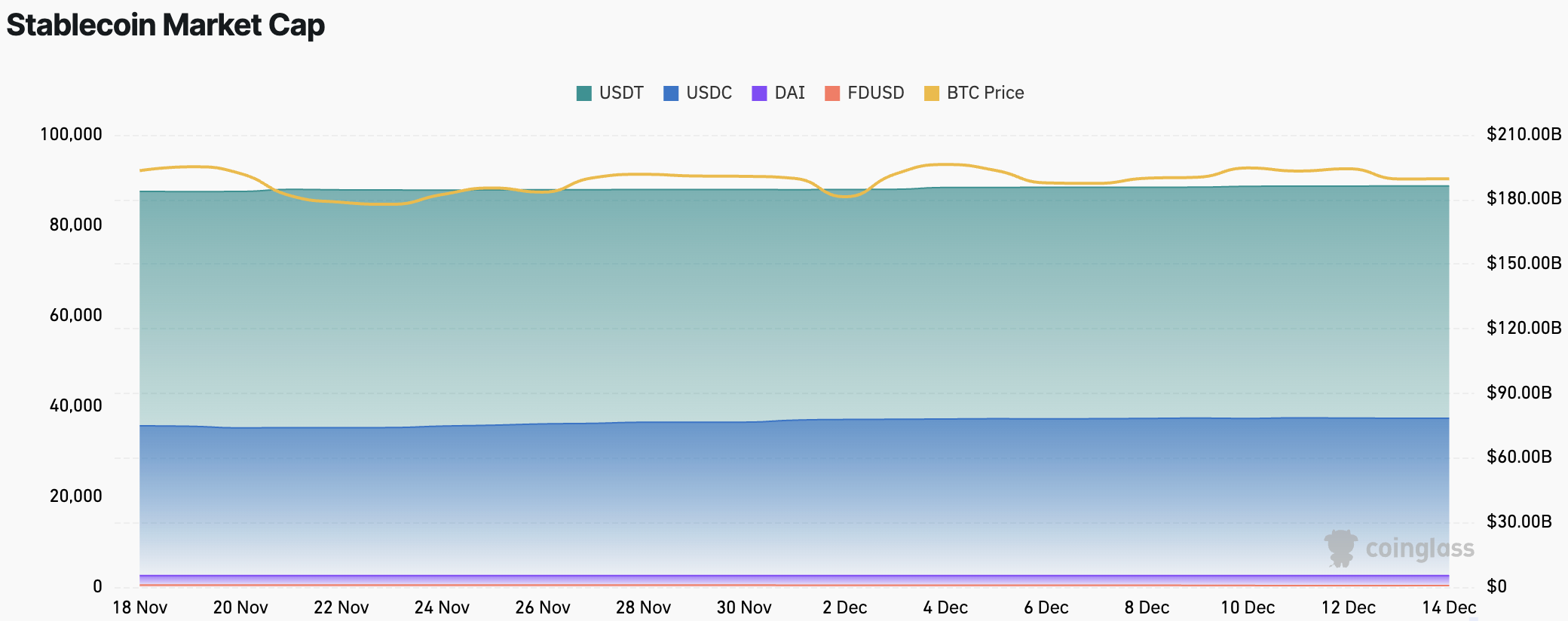

稳定币总市值为3,100亿美元,其中USDT市值为1,862亿美元,占稳定币总市值的60.06%;其次是USDC市值为784亿美元,占稳定币总市值的25.29%;DAI市值为53.6亿美元,占稳定币总市值的1.73%。

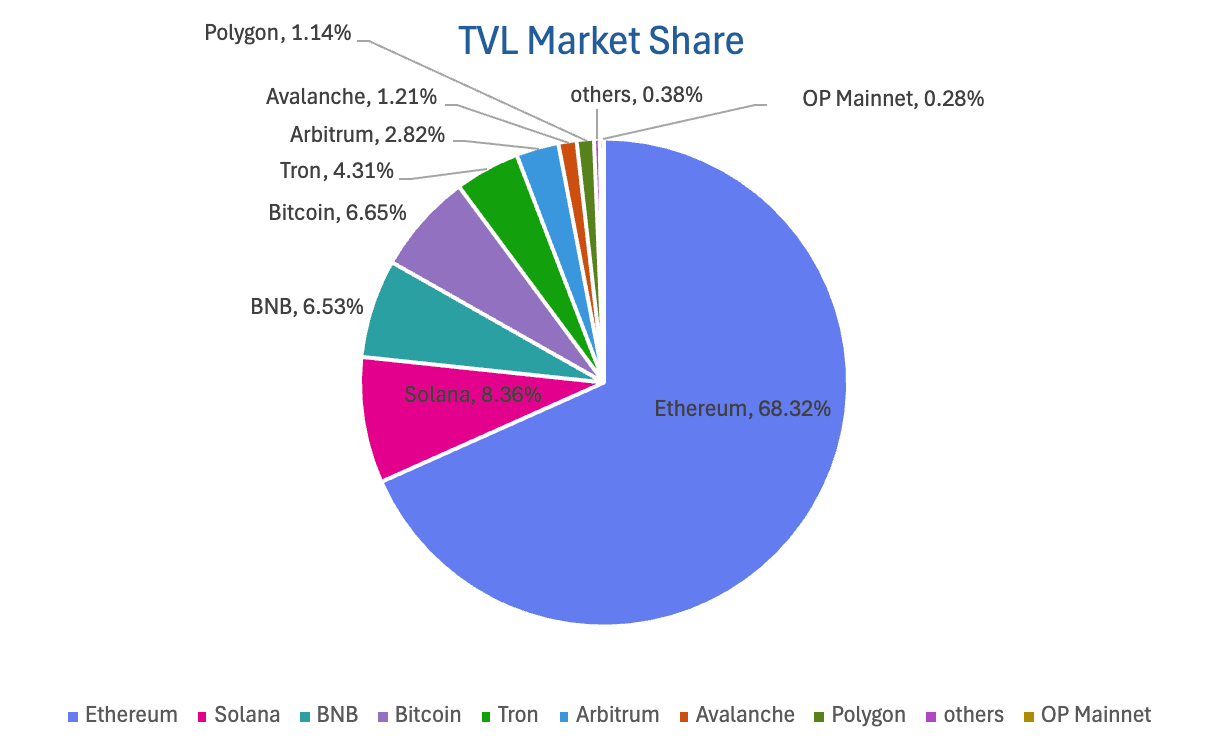

据DeFiLlama的数据,本周DeFi总TVL为$1,214亿,较上周1,208亿,上升约0.49%。按公链进行划分,其中TVL最高的三条公链分别是Ethereum,占比68.32%;Solana链,占比8.36%;BNB Chain,占比6.53%

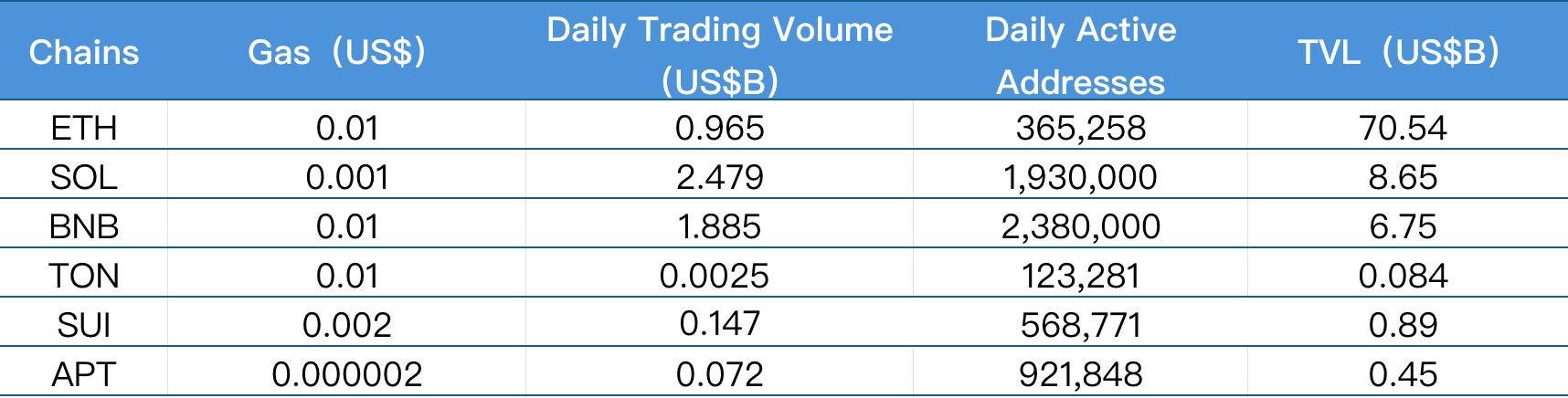

本周公链核心指标表现分化明显:日成交量方面,Ethereum 和 Solana 分别下跌 3.5% 和 19.25%,而 Sui 大幅增长 47% 表现最为突出,其次是 Ton上涨 25%;BNB Chain 与 Aptos 小幅上涨 3.01% 和 2.86%;交易费用整体走弱,Ethereum、BNB Chain 与 Ton 基本持平,Solana、Sui、Aptos 分别下降 42.94%、17.63% 和 13.38%。日活跃地址方面,仅 Aptos 下跌 22.81%,其余公链均实现增长,其中 Sui 增幅最高达 49.28%,Ethereum、BNB Chain、Ton 分别上涨 7.7%、9.68% 和 12.17%。TVL 表现偏弱,仅 Ethereum 小幅增长 0.75%,Ton 下跌 6.67%,其余公链均出现 1%–4% 左右的回落。

新项目关注:AllScale 是一家稳定币“自我托管” neobank/支付基础设施平台,目标是帮助全球创作者、小微企业 (SMB)、自由职业者,以及跨境团队,实现“无银行账户也能快速接收、发出付款”的稳定币支付、开票 、社交电商和跨国工资发放。Goblin Finance 是一个专为 Aptos 生态打造的 DeFi “收益基础设施”平台,它通过自动化的流动性管理(ALM)、跨市场策略、delta-neutral 与 LST-增强产品,将用户资金自动导入表现最优的链上或跨链策略,从而最大化收益并为 Aptos 提供深度流动性支持。Magma Finance 是一个建立在 Sui/Move 生态上的下一代去中心化交易所(DEX)和流动性基础设施平台。

目录

关键要点

一.市场概览

1.加密货币总市值/比特币市值占比

2.恐慌指数

3.ETF流入流出数据

4.ETH/BTC和ETH/USD兑换比例

5.Decentralized Finance (DeFi)

6.链上数据

7.稳定币市值与增发情况

二.本周热钱动向

1.本周涨幅前五的VC币和Meme币

2.新项目洞察

三.行业新动态

1.本周行业大事件

2.下周即将发生的大事件

3.上周重要投融资

四.参考链接

一.市场概览

1.加密货币总市值/比特币市值占比

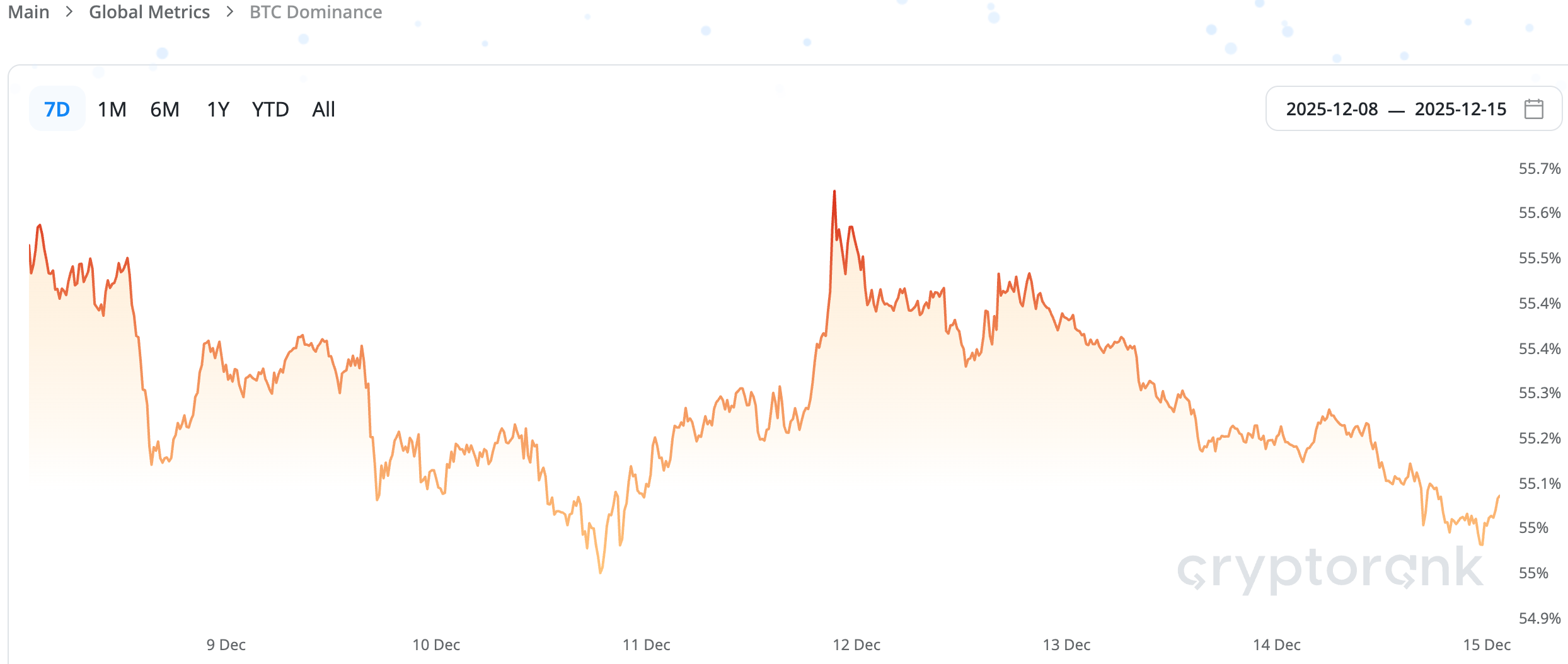

全球加密货币总市值为3.22万亿美元,较上周3.15万亿美元,本周内加密货币总市值上升2.2%。

数据来源:cryptorank, https://cryptorank.io/charts/btc-dominance

数据截止至2025年12月14日

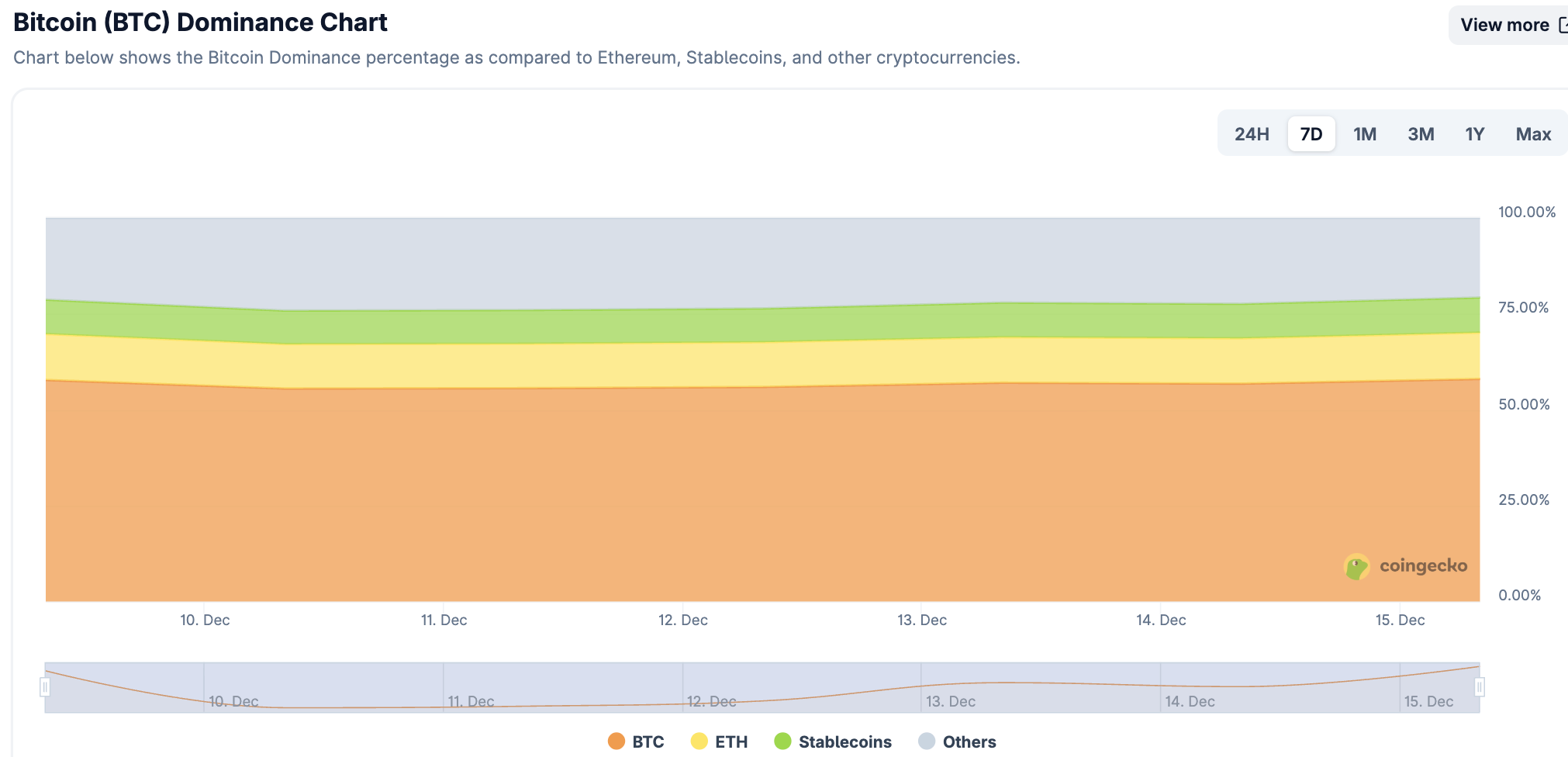

截止至发稿,比特币的市值为1.76万亿美元,占加密货币总市值的54.6%。与此同时,稳定币的市值为3,100亿美元,占加密货币总市值的9.63%。

数据来源:coingeck, https://www.coingecko.com/en/charts

数据截止至2025年12月14日

2.恐慌指数

加密货币恐慌指数为17,显示为极度恐慌。

数据来源:coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

数据截止至2025年12月14日

3.ETF流入流出数据

截止至发稿,美国比特币现货ETF累计总净流入约579.0亿美元,本周净流入2.86亿美元;美国以太坊现货ETF累计总净流入约130.9亿美元,本周净流入2.08亿美元。

数据来源:sosovalue, https://sosovalue.com/zh/assets/etf

数据截止至2025年12月14日

4.ETH/BTC和ETH/USD兑换比例

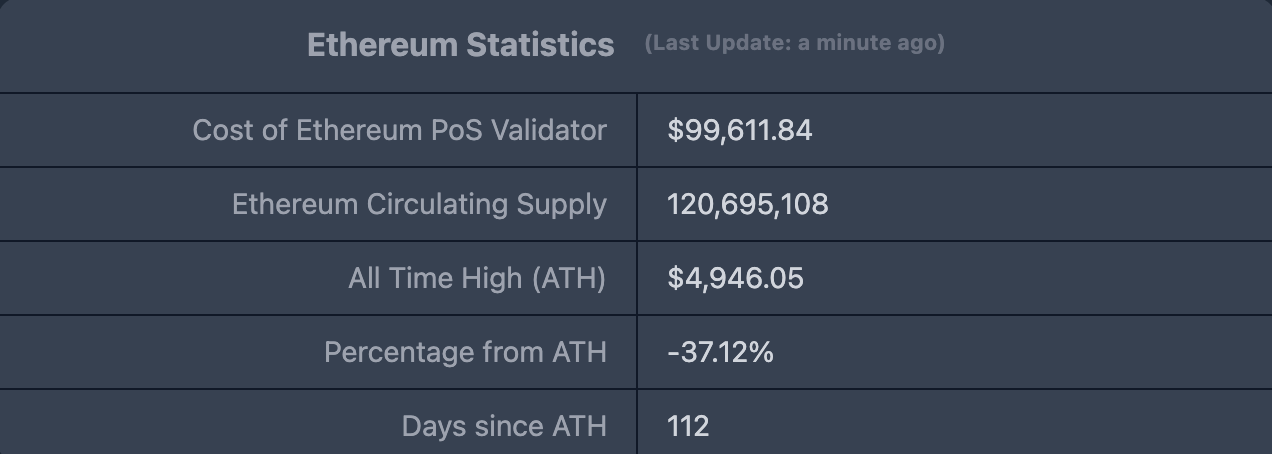

ETHUSD :现价$3,114.30,历史最高价$4,878.26,距最高价跌幅约37.12%

ETHBTC :目前为0.034881,历史最高为0.1238

数据来源:ratiogang, https://ratiogang.com/

数据截止至2025年12月14日

5.Decentralized Finance (DeFi)

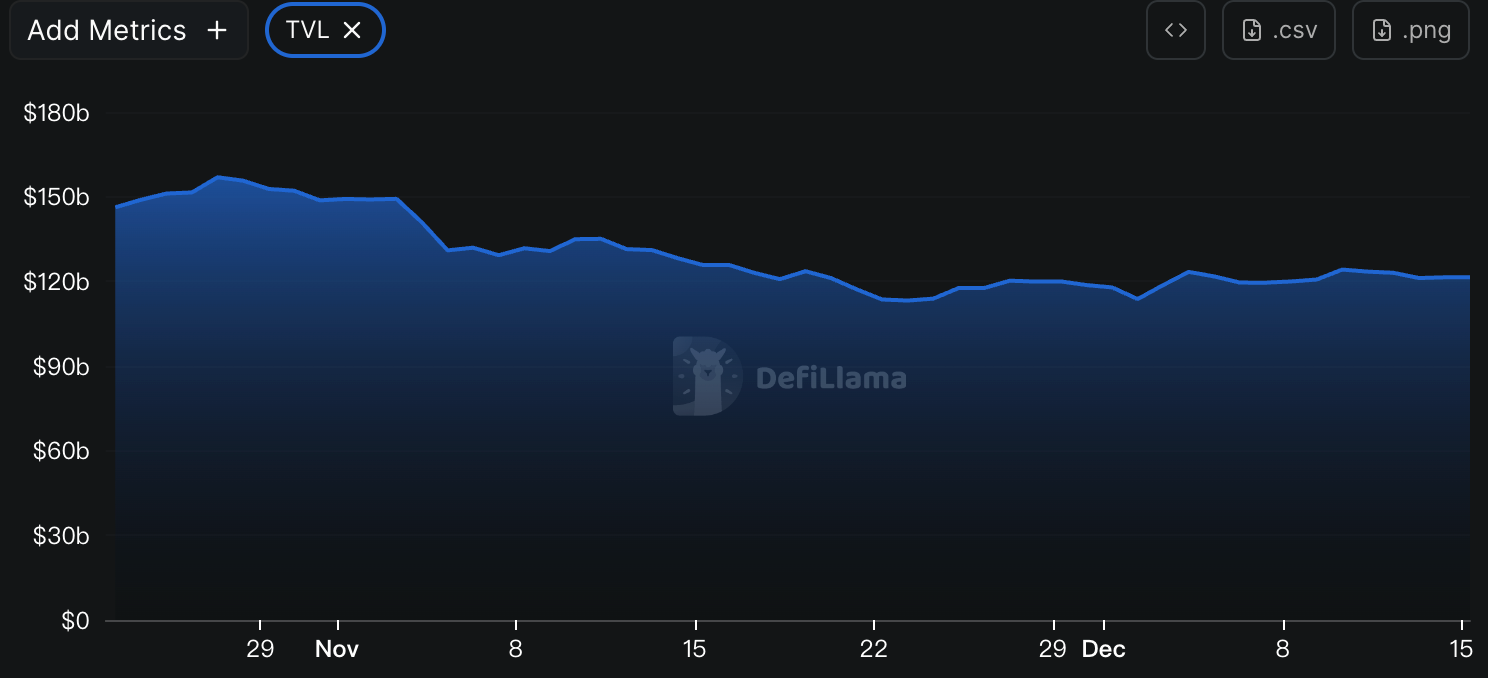

据DeFiLlama的数据,本周DeFi总TVL为$1,214亿,较上周1,208亿,上升约0.49%。

数据来源:defillama, https://defillama.com

数据截止至2025年12月14日

按公链进行划分,其中TVL最高的三条公链分别是Ethereum链,占比68.32%;Solana链,占比8.36%;BNB Chain,占比6.53%。

数据来源:CoinW研究院,defillama, https://defillama.com

数据截止至2025年12月14日

6.链上数据

Layer 1相关数据

主要从日交易量、日活跃地址、交易费用分析目前主要Layer1含ETH、SOL、BNB、TON、SUI以及APTOS的相关数据。

数据来源:CoinW研究院,defillama, https://defillama.com

数据截止至2025年12月14日

日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。日成交量方面,本周Ethereum和Solana分别下跌3.5%和19.25%;Sui链增幅最大为47%,其次是Ton上涨25%;BNB Chain和Aptos小幅上涨3.01%和2.86%。在交易费用方面,本周Ethereum、BNB链和Ton链较上周持平;Solana、Sui和Aptos分别下降42.94%、17.63%和13.38%。

日活跃地址与TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL反应了用户对平台的信任程度。在日活跃地址方面,本周仅Aptos下降22.81%,其余链均实现上涨。Sui链增幅最大为49.28%;Ethereum、BNB Chain和Ton分别上涨7.7%、9.68%和12.17%;Solana链相对轻微上涨0.52%。在 TVL 方面,本周仅Ethereum实现小幅上升0.75%;其余链均小幅下跌,分别为 Ton(-6.67%),Solana(-1.77%)、BNB Chain(-2.19%)、Sui(-3.98%)和Aptos(-4.26%)。

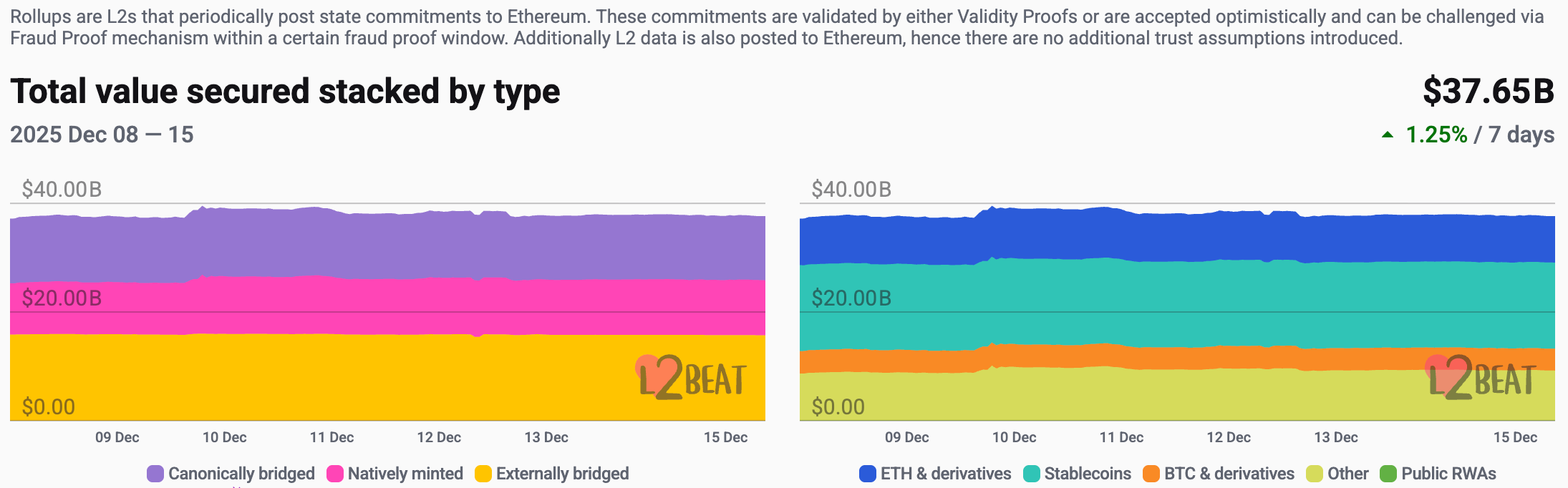

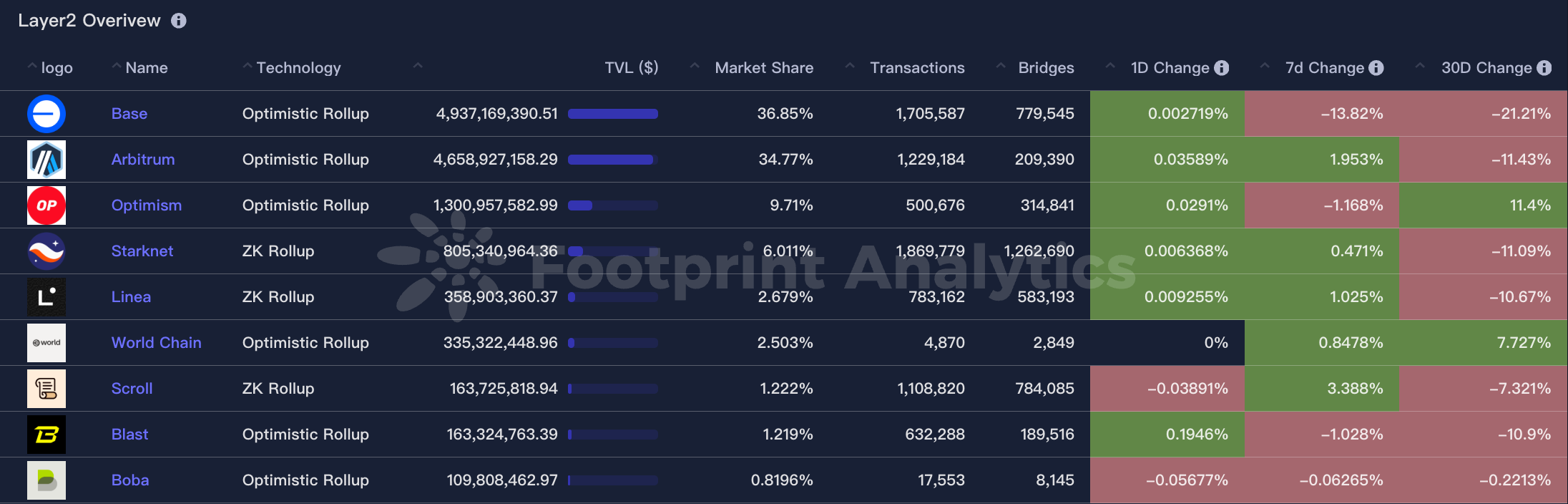

Layer 2相关数据

据L2Beat数据显示,以太坊 Layer 2总TVL为376.5亿美元,本周较上周($371.7亿)整体涨幅为1.4%。

数据来源:L2Beat, https://l2beat.com/scaling/tvs

数据截止至2025年12月14日

Base 和 Arbitrum 分别以 36.85% 和 34.77% 的市场份额占据前排,Base链过去一周市场份额有所下降,Arbitrum轻微上升。

数据来源:footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

数据截止至2025年12月14日

7.稳定币市值与增发情况

据Coinglass数据,稳定币总市值为3,100亿美元,其中USDT市值为1,862亿美元,占稳定币总市值的60.06%;其次是USDC市值为784亿美元,占稳定币总市值的25.29%;DAI市值为53.6亿美元,占稳定币总市值的1.73%。

数据来源:CoinW研究院, Coinglass, https://www.coinglass.com/pro/stablecoin

数据截止至2025年12月14日

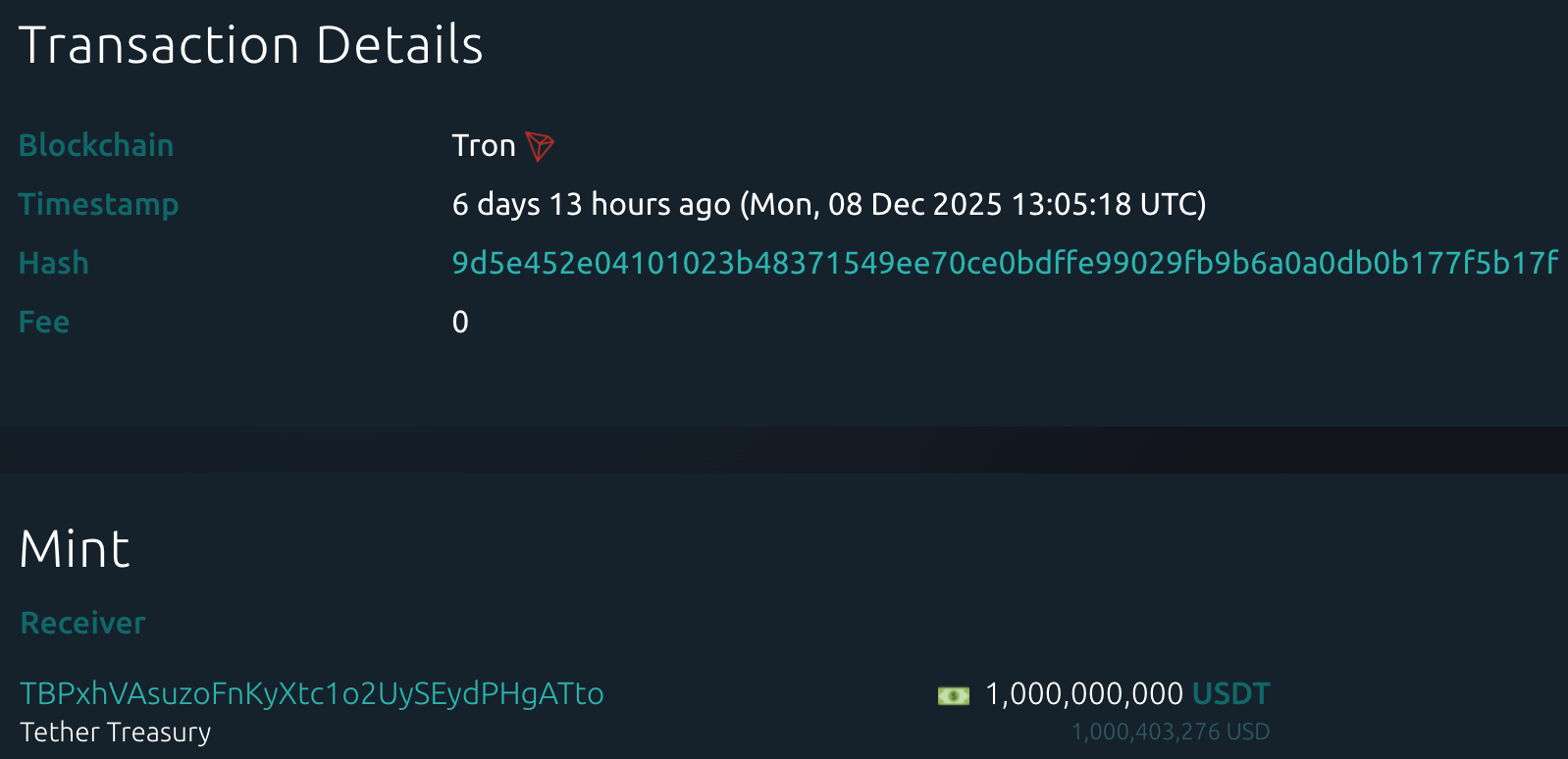

据Whale Alert数据显示,本周USDC Treasury总计增发26.67亿枚USDC,Tether Treasury本周总计增发10亿枚USDT。本周稳定币增发总量为36.67亿枚,较上周稳定币增发总量(39.55亿枚)下降7.28%。

数据来源:Whale Alert, https://x.com/whale_alert

数据截止至2025年12月14日

二.本周热钱动向

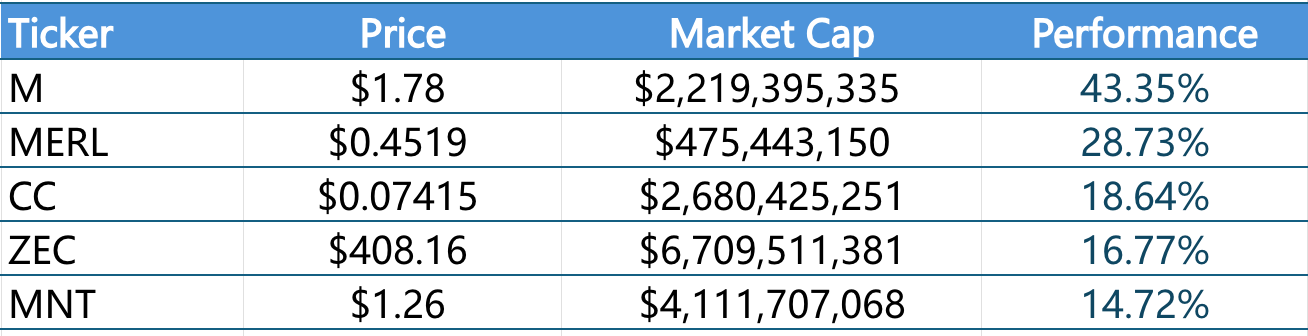

1.本周涨幅前五的VC币和Meme币

过去一周内涨幅前五的VC币

数据来源:CoinW研究院,coinmarketcap, https://coinmarketcap.com/

数据截止至2025年12月14日

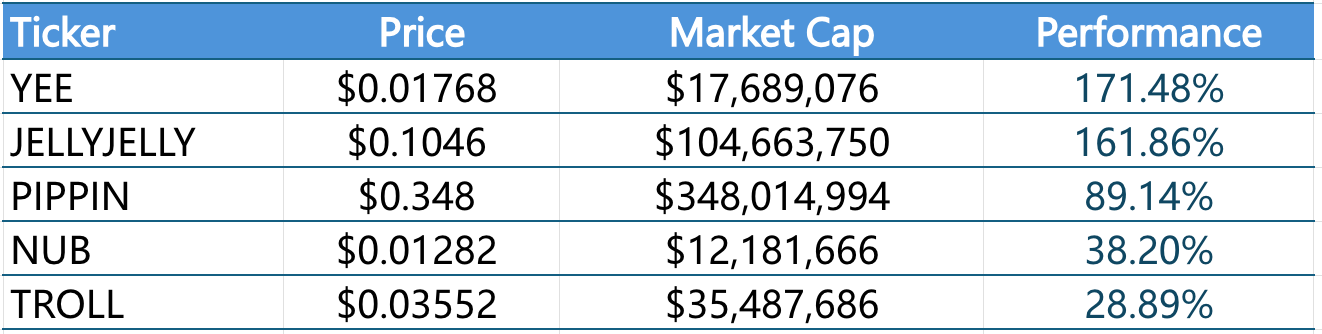

过去一周内涨幅前五的Meme币

数据来源:CoinW研究院,coinmarketcap, https://coinmarketcap.com/

数据截止至2025年12月14日

2.新项目洞察

AllScale 是一家稳定币“自我托管” neobank/支付基础设施平台,目标是帮助全球创作者、小微企业 (SMB)、自由职业者,以及跨境团队,实现“无银行账户也能快速接收、发出付款”的稳定币支付、开票 (invoicing)、社交电商 (social commerce) 和跨国工资发放(payroll)。在 2025 年 12 月 08 日,AllScale 宣布完成一轮 500 万美元种子融资,该轮融资由 YZi Labs 领投,参与方包括 Informed Ventures 和 Generative Ventures,并获得多家加密 / 风投机构支持,同时它也是 BNB Chain 的生态合作伙伴。

Goblin Finance 是一个专为 Aptos 生态打造的 DeFi “收益基础设施”平台,它通过自动化的流动性管理(ALM)、跨市场策略、delta-neutral 与 LST-增强产品,将用户资金自动导入表现最优的链上或跨链策略,从而最大化收益并为 Aptos 提供深度流动性支持。Goblin Finance 的目标是让普通用户也能像机构一样,用“一键存入”方式参与专业级资产管理,把闲置资产变为高效“收益机器”,同时推动 Aptos 生态的去中心化流动性基础设施建设。

Magma Finance 是一个建立在 Sui/Move 生态上的下一代去中心化交易所(DEX)和流动性基础设施平台。它结合集中流动性 AMM (CLMM) 和自适应流动性机制 (Adaptive Liquidity / ALMM),通过锁仓 + ve-tokenomics 的方式,让用户既能提供高效率的流动性,也能参与治理、获得手续费与激励。

三.行业新动态

1.本周行业大事件

Stable 于 2025 年 12 月 8 日正式上线主网并完成 STABLE 代币 TGE,同步启动空投计划,面向早期用户、开发者与流动性贡献者发放奖励。官方已开放领取通道,所有符合条件的用户都可在 2026 年 3 月 2 日(UTC) 前完成申领。Stable 是一个以 USDT 作为原生 gas 的新型区块链,目标是构建高稳定性、高吞吐、面向大规模应用的金融基础设施。其核心理念是将稳定币直接作为链的底层结算资产,让交易、支付与应用交互都以“原生稳定币”进行,从而减少波动、提升可用性。

HumidiFi 代币 WET 的代币公开发售最初安排在 2025 年 12 月 3 日 于 Jupiter DTF 平台启动,但因防刷机器人问题被调整并于 2025 年 12 月 8 日重新发售,随后 在 2025 年 12 月 9 日正式触发 TGE(代币生成事件)并开放代币领取与流动性池上线。HumidiFi 是构建在 Solana 上的高性能「Prop AMM + DEX」去中心化交易协议,旨在通过专业做市和深度流动性解决链上交易的滑点与碎片化问题。其代币 WET 总供应量为 10 亿枚,主要用于治理、质押激励和手续费返现。

Cysic 原生代币 CYS 于 12 月 9 日 TGE,创世流通量约 1.608 亿枚(总量 10 亿)。项目为早期用户推出官方空投计划,空投注册时间为 12 月 1 日 13:00 UTC 至 12 月 7 日 13:00 UTC,面向社区贡献者、CUBE 节点持有者、测试网参与者、开发者与合作伙伴等群体按资格分配 CYS。Cysic是一个以去中心化算力与 ZK 计算为核心的 ComputeFi 基础设施项目,其整体代币机制旨在激励算力贡献者、支持 ZK/AI 工作负载,并推动网络治理与生态发展。

RaveDAO 原生代币 RAVE(总量 10 亿枚)于12 月 12 日进行 TGE 并开始部分解锁流通。项目预留 3% 代币作为空投奖励早期贡献者与活动参与者,用户需在 PLVR 平台提交 Base 地址领取,空投分三批处理:12.10–12.11、12.11–12.18、12.18–2026.1.11,对应在最晚 12.12、12.19、2026.1.12 前到账。空投发放后会从用户积分中扣除相应数量,后续还将推出 Genesis Rewards 等激励计划。RaveDAO是一个结合音乐、文化与 Web3 的去中心化社区。

2.下周即将发生的大事件

Rainbow Wallet 于 2025 年 12 月 11 日至 12 月 18 日通过 CoinList 进行 RNBW 代币公售(价格 $0.10、占总量3%)。公售代币将在 TGE(时间待定)时一次性解锁,而团队与投资者代币将按 2–4 年线性归属。项目还计划在 2025 年 Q4 以空投形式将旧的 Rainbow Points 忠诚度积分兑换为 RNBW,完成从积分到代币奖励的转换。RNBW 是 Rainbow Wallet 的原生代币,用于激励用户与强化其多链非托管钱包生态。

GrantiX 代币 GRANT 于 2025 年 12 月 15–17 日 进行 IDO,价格 $0.088,具体 TGE 时间将在此后公布。项目在代币经济中预留了约 3% 作为社区/空投奖励。GrantiX是一个面向社会影响投资的 SocialFi 平台,利用区块链和 AI 搭建透明可追踪的公益与可持续发展资助体系。

Helios Blockchain 宣布将在 Spores Network 启动 IDO,时间定于 2025 年 12 月 16 日–18 日,公开售价为 0.02 USD/HLS,总出售量为 2,500 万枚 HLS,占总量的约 0.5%,TGE时间将在此后公布。Helios Blockchain (代号HLS) 是一个面向多链资产与 on-chain ETF 的 EVM-兼容 Layer-1 区块链,采用独特的 I-PoSR 共识机制,并通过“Hyperion + Chronos”模块实现跨链资产组合与自动化资产管理。

Aztec 完成 AZTEC 代币公募,共募得 19,476 ETH、吸引 16,741 名用户参与,其中一半资金来自社区。持有 20 万枚以上代币的用户已开始获得区块奖励。TGE 将由链上治理投票触发,官方表示最早可能在 2026 年 2 月 11 日进行,届时公募获得的 100% 代币将全部解锁并可自由转移。项目未采用传统空投,而是通过公募与区块奖励的方式完成代币分发。

3.上周重要投融资

Surf 宣布完成 1500 万美元融资,由 Pantera Capital 领投,Coinbase Ventures 和 Digital Currency Group(DCG)参投。Surf(访问域名 ask.surf / asksurf.ai)是一款专为加密货币领域打造的 AI 驱动“研究 + 行动”平台,它通过整合链上数据、市场情绪、社交趋势等,提供加密资产分析、市场洞察与投资决策支持。(2025年12月10日)

Real Finance 完成一轮 $2900万 私募融资,由 Nimbus Capital 领投(约 $25M),参投方包括 Magnus Capital 和 Frekaz Group。融资将用于扩展其合规、托管、结算与运营基础设施,推动其全栈 RWA 平台发展。Real Finance 是一家专注「现实世界资产(RWA, real-world assets)代币化 + 合规链上基础设施」的 Layer-1 区块链/金融基础设施项目,致力于帮助机构将传统资产(例如债券、信贷、基金、另类资产等)转为链上 token,并提供合规、托管、风险评估、保险等机构级服务。(2025年12月10日)

Cascade 宣布获得 1500 万美元种子轮融资,领投方包括 Polychain Capital、 Variant,并有 Coinbase Ventures 和 Archetype Ventures 等参与。Cascade 是一家 “neo-brokerage / perpetual-markets” 平台,目标是打造一个 24/7 全天候、统一保证金账户(unified margin account)的交易系统,允许用户通过同一个账户交易加密资产、证券、甚至私有公司pre-IPO 股权等资产。(2025年12月9日)

TenX Protocols 是一家面向高性能公链(如 Solana、Sui、Sei 等)提供验证人与节点基础设施支持的区块链基础设施公司,并通过购买及参与这些网络的 staking 来构建收益型资产组合。2025 年,TenX 共完成超过 C$33M 融资,其中包括 C$29.9M 的认购收据融资以及年初的约 C$3.5M 种子轮,并于 2025 年 12 月 10 日正式在 TSX Venture Exchange 上市(代码 TNX)。资金将用于扩展其在高吞吐区块链上的节点与基础设施部署、资产收购及运营能力,从而进一步为这些网络提供底层支持。(2025年12月10日)

四.参考链接

1.Coingeck:https://www.coingecko.com/en/charts

2.Coinglass:https://www.coinglass.com/pro/i/FearGreedIndex

3.Sosovalue:https://sosovalue.com/zh/assets/etf

4.Ratiogang:https://ratiogang.com/

5.Defillama:https://defillama.com

6.L2Beat:https://l2beat.com/scaling/tvs

7.Footprint:https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

8.Coinglass:https://www.coinglass.com/pro/stablecoin

9.Whale Alert:https://x.com/whale_alert

10.Coinmarketcap:https://coinmarketcap.com/

11.Surf: https://www.ask.surf/

12.Real FInance: https://www.real.finance/

13.Cascade: https://cascade.xyz/

14.ALLScale: http://allscale.io/

15.Goblin Finance: https://goblin.fi/

16.Magma Finance: https://magmafinance.io/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。