每个周末都担心会有幺蛾子,虽然今天没有什么明显的利空,但 $BTC 的价格还是跌破了 89,000 美元,不知道是不是因为对下周开始日本加息的担心,下周除了日本加息还有美国非农和通胀的数据,都可能会引发市场的变动,不过重点还是看明天美股开盘后的走势,毕竟加密货币并没有自己的叙事,仍然是和科技股高度同步的。

周末的价格只要不是太夸张我是不太在意的,毕竟周末是流动性最差的时候,目前市场的重点再次回到了数据上,尤其是非农的数据会更加重要一些,这也是下周最需要注意的,而日本加息已经是确定的事情了,市场应该有了足够的预期。

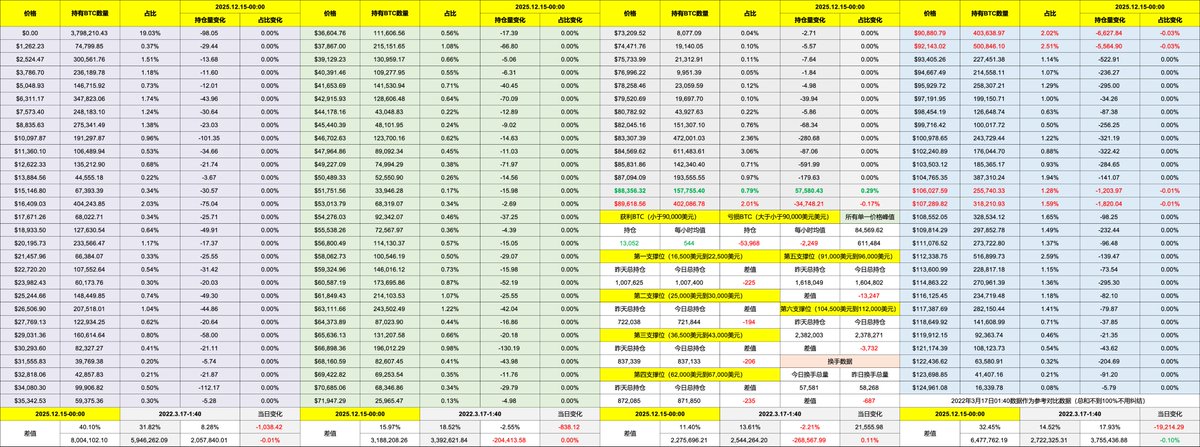

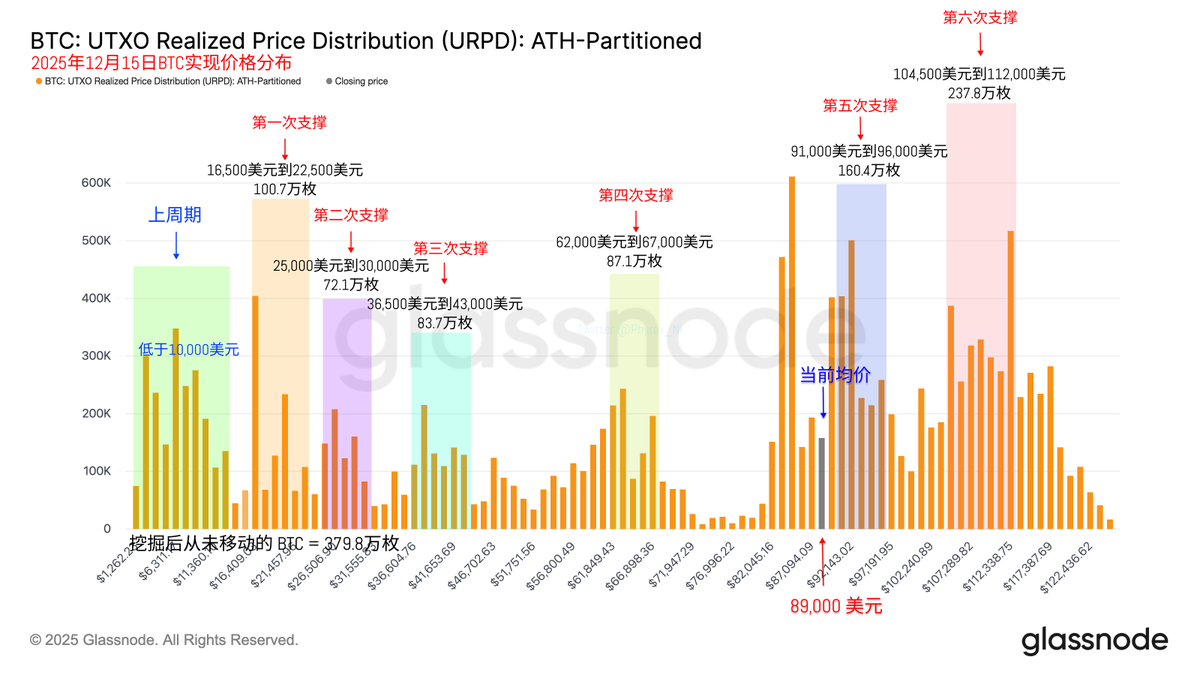

回到 Bitcoin 的数据来看,虽然价格有下跌,但换手率并没有增加,相比周六还略微减少了,所以并不是投资者恐慌或者是狗庄砸盘,应该就是流动性低下的情况下出现的购买力不足,等周一美股开盘后再看是否会被修复吧。

因为换手率不高,所以筹码分布也没有什么问题,投资者也没有出现因为恐慌和抛售的迹象,情绪都很正常,尤其是高位亏损的投资者还非常镇定。

Bitget VIP,费率更低,福利更狠

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。