原文标题:《Twenty One 上线首日暴跌近 20%,第三大 BTC DAT 的估值之谜》

原文作者:叮当,Odaily 星球日报

由稳定币巨头 Tether 和日本财团 SoftBank Group 共同押注的「比特币资产储备公司」Twenty One Capital(NYSE: XXI),于 12 月 9 日正式登陆纽约证券交易平台。然而,与其「重资产」「强背书」的资源优势形成强烈反差的是,首日开盘后股价即下挫,盘中跌幅接近 20%,资本市场给出的第一份答卷并不友好。

Twenty One 成立于 2025 年初,由 Strike 创始人兼 CEO Jack Mallers 领导,定位是一家以比特币为核心资产配置的公司。其背后获得稳定币发行商 Tether、日本软银集团以及华尔街投行 Cantor Fitzgerald 的强力支持。

要注意的是,Twenty One 并未采用传统 IPO,而是通过与 Cantor Equity Partners(SPAC)合并完成借壳上市,并于 12 月 9 日正式在纽交所挂牌,而 Cantor Equity Partners 正是 Cantor Fitzgerald 旗下的重要平台。该公司由美国商务部长之子 Brandon Lutnick 执掌,此次合并亦由他亲自领导。他在公告中强调,Cantor 的合作伙伴关系是促成 Tether 和 SoftBank 等创新参与者的关键。这一关系为 Twenty One Capital 增添了「制度维度的声望」,特别是在特朗普政府承诺的加密友好政策环境下。

但资本市场的情绪显然更为复杂。公司初期仍以 CEP 代码进行交易,在公告发出后,股价曾从 10.2 美元最高冲至 59.6 美元,涨幅接近 6 倍,市场最初对「比特币储备公司」叙事的热情几乎写在 K 线上。但随着投机情绪退潮,股价迅速回落,目前已徘徊在 11.4 美元附近,几乎抹去绝大部分溢价。

这与其庞大的比特币资产形成了极为强烈的反差。截至上市时,Twenty One 共持有 43,514 枚 BTC,市值约 40.3 亿美元,在全球企业持币排行榜中位列第三,仅次于 Strategy 与 MARA Holdings。

估值谜题:极端折价背后的成因

真正令市场困惑的,是其估值结构。在当前股价水平下,Twenty One 的整体市值仅约 1.86 亿美元,市场倍数(mNAV)低至 0.046。也就是说,资本市场只愿意给予其比特币资产账面价值约 4.6% 的定价。为什么会出现如此极端的折价?

深入剖析其资产获取方式,我们发现 Twenty One 的比特币储备并非主要通过公开市场长期买入形成,而是高度依赖「股东输血」模式:其初始储备约 42,000 枚 BTC,是来自 Tether 的直接注资。随后在 2025 年 5 月 14 日,公司又通过 Tether 加仓 4,812 枚 BTC,当时耗资约 4.587 亿美元,对应单枚成本约 9.53 万美元;并在上市前,通过 PIPE 融资与可转换债券机制,完成了额外约 5,800 枚 BTC 的增持计划。

这种模式的优势在于极高的效率,无需经历漫长的二级市场建仓过程,可以在短时间内完成规模化储备;但代价也同样明显:资产高度集中来源于少数关联方,投资者很难完全穿透其内部交易结构、托管形态与潜在的协议约束,透明度与可持续性自然成为市场定价的重要折价因子。

「数字资产储备公司」模式的集体困境

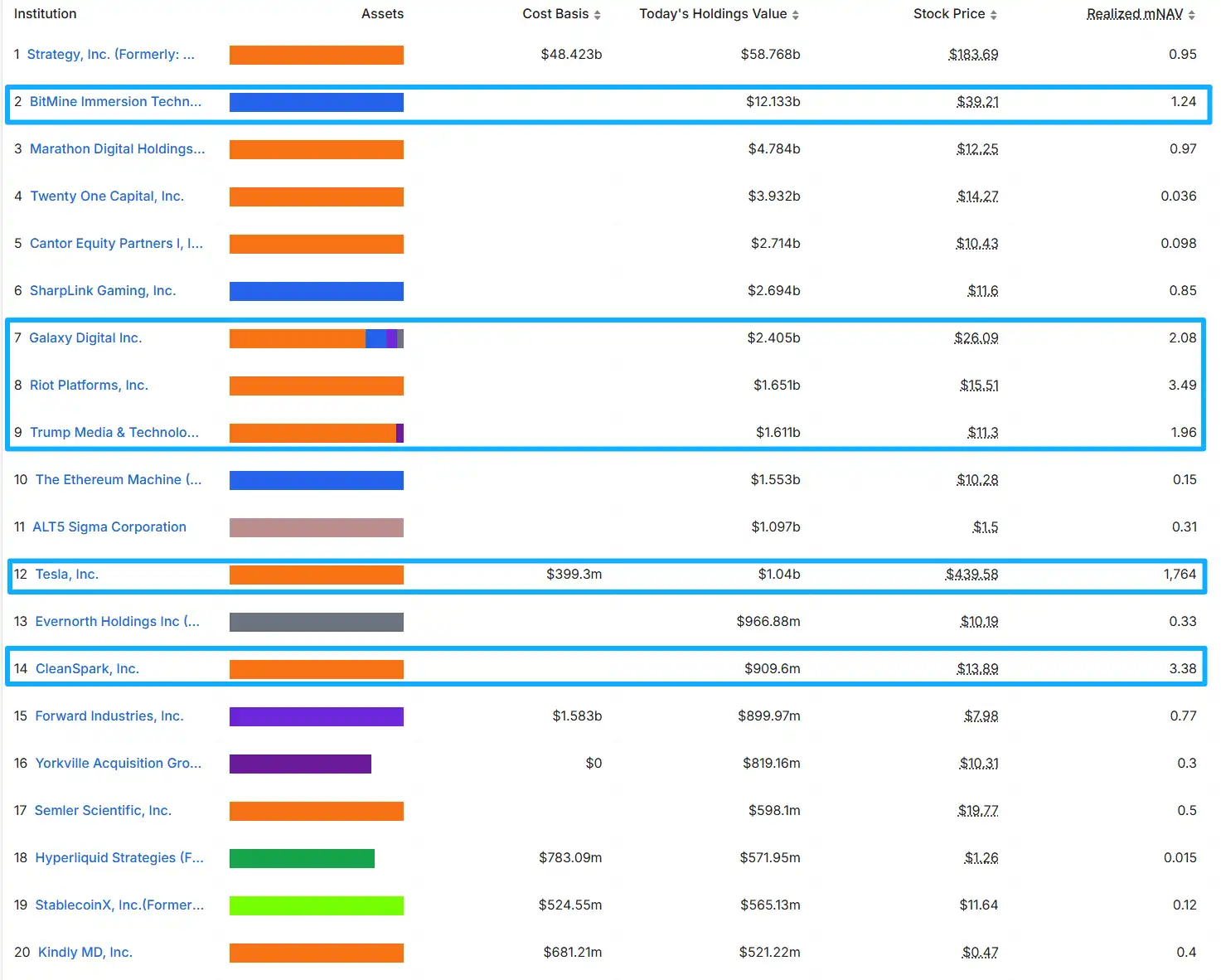

从行业层面看,Twenty One 的问题已经并非个案。据 defillama.com 数据,目前全球已有超过 70 家「币股公司」(即持有加密资产的上市公司)。在前 20 大持有者中,大多数公司的 mNAV 已跌破 1,包括开创该模式先河的 Strategy。

随着当前加密市场的整体回撤,使得这些「币股公司」从曾经的叙事核心,逐渐退回到风控模型中的边缘资产,当前市场对这些加密资产储备企业的估值已经普遍转向谨慎。

然而,Strategy 与 Twenty One 存在量级差异。Strategy 当前持有约 66.06 万枚比特币,约占比特币总供应量的 3%,这一规模是 Twenty One 的 15 倍以上。这种体量不仅赋予其更强的市场话语权,也赋予其某种「系统性锚定」的象征意义。当 Strategy 的 mNAV 跌破 1 时,市场自然会产生更深层的疑问:它会不会被迫卖币?债务结构是否会形成踩踏?DAT 模式是否在宏观周期面前失去了逻辑基础?

事实上,随着 2025 年加密市场大幅回撤,DAT 模式面临严峻考验。该模式的核心是通过债务和股权融资积累比特币,将其视为「终极资产」以对冲通胀和货币贬值。但当比特币的价格波动显著放大,这一模型的稳定性便开始动摇。部分公司虽持有大量 BTC,却因运营成本和市场情绪而估值承压。Twenty One 的极端折价虽然与其资产获取方式有关,但也是市场对整个 DAT 模式风险定价的一次集中体现。

结语:叙事仍在,但市场需要时间

在 12 月 4 日的币安区块链周上,Michael Saylor 提供了一个更广阔的视角。他以《为什么比特币仍是终极资产:比特币的下一章》为题,再次重申了他对比特币未来十年的核心判断:比特币正在从一种投资品,跃迁为全球数字经济的「基础资本」,而数字信贷体系的崛起将重塑传统 300 万亿美元的信贷市场。从政策转向、银行态度变化,到 ETF 的制度化吸纳,再到数字信贷工具的爆发式增长,Saylor 描绘的是一个正在加速到来的新金融秩序:数字资本提供能量,数字信贷提供结构,而比特币将成为支撑这一切的底层资产。

从这个角度看,Twenty One 这类公司,的确具备一种「远期正确」的潜力——如果比特币最终完成由高风险资产向「数字黄金」的身份迁移,那么这些企业可能将成为这一迁移过程中的核心载体。

但问题在于,「远期正确」并不自动等于「当下合理定价」。市场仍需要时间去验证比特币在宏观体系中的真实角色,也需要时间去重新评估 DAT 模式在不同周期环境下的抗压能力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。