The market holds its breath awaiting the last interest rate decision of the year, while the internal divisions within the Federal Reserve and the power struggle over the future chairperson are pushing this globally influential central bank toward a crossroads filled with uncertainty.

Tonight, the Federal Reserve is set to announce its December interest rate decision, with the market widely expecting a 25 basis point cut. This could represent another "dovish" victory, albeit a difficult one for current Chair Jerome Powell, amid the sharp divide between "hawks" and "doves."

At the same time, a power struggle that will determine the direction of the Federal Reserve for the coming years has entered its final stage. President Trump has canceled the previously scheduled final interviews, suggesting he has a candidate in mind. The most popular candidate, Kevin Hassett, publicly stated on the eve of the meeting that there is "ample room" for future rate cuts, potentially exceeding 25 basis points.

1. A "Divided" Rate Cut

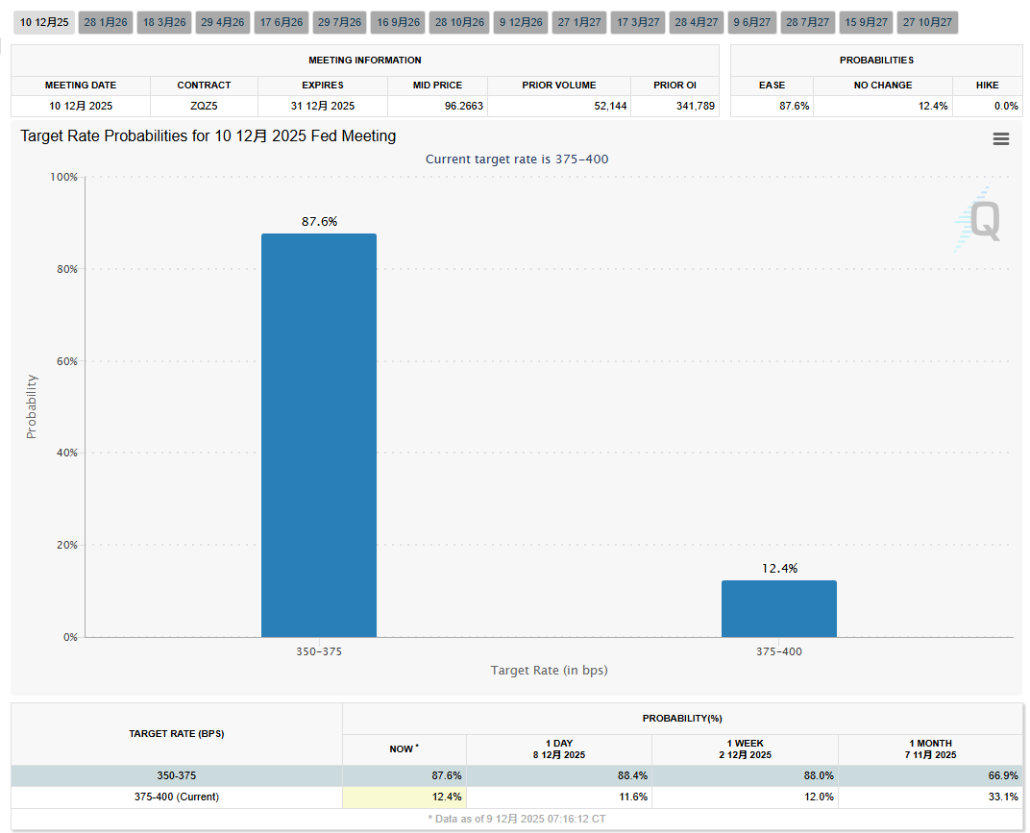

● The last Federal Reserve meeting of 2025 opens in an atmosphere of high division and uncertainty. The market almost unanimously expects the Federal Reserve to announce its third rate cut of the year, lowering the federal funds rate target range to 3.50%-3.75%. However, this rate cut is far from a consensus decision. The divisions within the Federal Open Market Committee have reached their most severe level in years.

● Among the 12 voting members, as many as 5 have publicly expressed opposition or skepticism toward further rate cuts. ING expects that tonight's decision may see four dissenting votes. This division is rooted in the direct conflict between the Federal Reserve's two core objectives—"2% inflation" and "full employment"—in the current economic environment.

● The "dovish" viewpoint supporting the rate cut argues that the labor market has sent warning signals. Recent weak private sector employment data and the Federal Reserve's Beige Book assessment of the economy lean toward pessimism. New York Fed President John Williams believes that cutting rates without jeopardizing the inflation target can help mitigate the risk of a downturn in the labor market.

● Meanwhile, the "hawkish" camp remains focused on persistently high inflation. Kansas City Fed President Esther George pointed out that inflation remains broad-based and above target levels, while economic growth momentum is strong, warning that premature rate cuts could lead to a loss of control over inflation expectations.

2. An Open War

The potential dissenting votes tonight are not isolated incidents but rather the result of long-accumulated and publicized internal conflicts within the Federal Reserve. This "civil war" reached its peak in July of this year.

● On July 30 of this year, the Federal Reserve decided to keep interest rates unchanged for the fifth consecutive time. However, two governors appointed by Trump—Michelle Bowman and Christopher Waller—rarely cast dissenting votes, calling for an immediate 25 basis point cut. This marked the first time since 1992 that two governors simultaneously opposed an interest rate decision in 32 years, highlighting the internal policy dispute.

● Powell struggled to maintain balance during the press conference. On one hand, he stated that "the current monetary policy stance puts the Federal Reserve in a favorable position," while on the other hand, he acknowledged that economic growth had "slowed somewhat" in the first half of the year, which could provide a basis for future rate cuts if the trend continues.

He attributed part of the contradiction to external factors, pointing out that tariff policies have driven up prices for certain goods, with about 30% to 40% of the impact on core inflation potentially stemming from this.

● This public division has unsettled the market. Following the July meeting, traders' expectations for a rate cut in September plummeted from 68% before the meeting to 45%. Now, a similar dramatic scene is likely to replay at the December meeting.

3. Who Will Be the Next Helmsman?

● As the current management finds itself in a decision-making deadlock, a personnel change that will determine the future direction has quietly entered its final stages. The most significant event occurred in early December: the Trump administration suddenly canceled the final interviews for the Federal Reserve chair candidates that were scheduled to begin this week.

● This move is widely interpreted as Trump having "a candidate in mind." He confirmed in a White House meeting that he has narrowed the candidate list down to one. Subsequently, he specifically pointed out that Kevin Hassett, the director of the White House National Economic Council present at the meeting, is a "potential candidate for Federal Reserve chair."

● Hassett's leading position is evident, but he is not without competition. Recent information indicates that Trump and Treasury Secretary Mnuchin plan to interview former Federal Reserve governor Kevin Warsh this Wednesday (December 10). This suggests that the final decision remains uncertain. Other competitors on the shortlist include current Federal Reserve governor Christopher Waller, governor Michelle Bowman, and BlackRock executive Rick Rieder.

● Treasury Secretary Mnuchin is the core leader of this selection process. He has submitted a brief list to the White House. Although Trump has publicly expressed a desire for Mnuchin to take on the role himself, Mnuchin has made it clear that he has no intention of stepping in.

4. A "Politicized" Economist?

● Among all candidates, Kevin Hassett undoubtedly generates the most attention and controversy. This long-time economic advisor to Trump and former chair of the White House Council of Economic Advisers, if he were to lead the Federal Reserve, would signify a fundamental change in the relationship between the monetary decision-making center and executive power.

Hassett's recent statements reflect his policy inclinations. He openly stated that if he were to lead the Federal Reserve, he would "immediately cut rates," because "the data shows we should do so."

● At a Wall Street Journal CEO Council event, he further declared that the Federal Reserve "has ample room" for significant rate cuts. When asked if this means the rate cut could exceed the market expectation of 25 basis points, he directly replied, "That's right." These remarks align closely with Trump's demands. Trump has long criticized Powell for hesitating to cut rates and has publicly stated that he hopes the next Federal Reserve chair will focus on lowering interest rates. He has even suggested reducing U.S. borrowing costs to 1%.

● However, Hassett attempts to balance his radical stance with the independence of the central bank. When faced with sharp questions about whether he would be subservient to Trump, he responded, "You just have to do the right thing." He cited an example that if inflation rises from 2.5% to 4%, then rates cannot be cut.

● The market is filled with doubts about this. Some bond investors have warned that Hassett, closely tied to the president, might "indiscriminately cut rates," thereby shaking the $30 trillion U.S. Treasury market.

5. Future Path: Different Candidates, Different Directions

Who the next Federal Reserve chair will be will determine the monetary policy path for the U.S. and the world for the coming years. The policy blueprints of different candidates are starkly different.

● If Hassett takes office, the market expects a shift toward a faster and more significant rate-cutting cycle. His recent argument that "artificial intelligence will significantly boost productivity" may provide a new theoretical framework for maintaining a low-interest-rate environment.

● Another major competitor, Kevin Warsh, represents a different direction. He has previously sharply criticized Powell and advocated for "thorough, top-down reform" of the Federal Reserve. His policy inclinations may lean more toward traditional and cautious approaches.

● If current governor Christopher Waller is elected, it may signify the greatest policy continuity. Although he has recently expressed support for rate cuts, he emphasized the need to "proceed with caution," reflecting the mainstream, data-dependent middle path within the current Federal Reserve.

● Notably, a special arrangement regarding Hassett's term is under discussion. Some government officials have suggested that Hassett might serve a shorter term than the normal four years. This is seen as potentially paving the way for Treasury Secretary Mnuchin to take over the Federal Reserve at some point in the future.

6. More Than Just Interest Rates

● Regardless of tonight's decision or who the next chair will be, changes in the Federal Reserve's decision-making body will have far-reaching implications. In the short term, if Hassett's dovish stance prevails, it may boost the stock market, especially interest-sensitive tech growth stocks, but it could also raise long-term inflation expectations and suppress the dollar's exchange rate.

● In the long term, the Federal Reserve's independence and credibility are facing the most severe test in decades. If the market forms a widespread perception that the Federal Reserve's decisions are politicized, its role as the "anchor" of the global financial system will be weakened, potentially triggering broader asset price volatility.

● Additionally, the balance sheet policy, which is as important as interest rates, also faces uncertainties. The Federal Reserve halted its balance sheet reduction process on December 1. In the future, whether the Federal Reserve maintains a stable balance sheet size or begins to expand it again will become a key question that the new chair must address.

On Wall Street, the rate futures bets are constantly fluctuating, showing that the probability of a rate cut is nearing 90%. But in Washington, the power game has just reached its climax. Trump holds the nomination power to rewrite the history of the Federal Reserve, while Kevin Hassett's remarks about "ample room for rate cuts" have already laid the groundwork for a potential policy shift in the future.

Whether or not there is a rate cut tonight, the Federal Reserve's giant ship is heading toward unknown waters shaped by political games and internal rifts. The global market can only hold its breath and wait.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。